Southland Holdings (NYSE:SLND) works in the infrastructure construction business. SLND posted its Q2 FY23 results. I will review their Q2 FY23 results. I think SLND is overvalued, and the technical chart is bearish. Hence, I assign a hold rating on SLND.

Financial Analysis

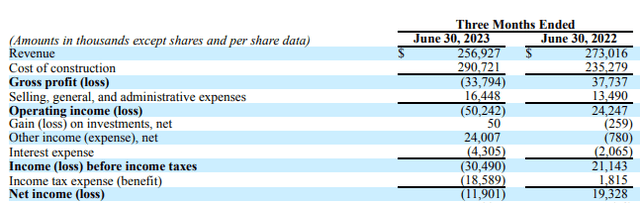

SLND posted its Q2 FY23 results. The revenue for Q2 FY23 was $256.9 million, a decline of 5.9% compared to Q2 FY22. The underperformance in both segments was the major reason behind the revenue decline. The revenue from the civil and transportation segments declined by 12.4% and 3.4% in Q2 FY23 compared to Q2 FY22. The gross loss for Q2 FY23 was $33.7 million compared to a gross profit of $37.7 million in Q2 FY22. The company decided to wind down its paving business, and it got rid of various assets that supported various paving projects. Hence, they had to incur several related charges, which I believe was the reason behind the loss.

Seeking Alpha

The net loss for Q2 FY23 was $11.9 million compared to an income of $19.3 million in Q2 FY22. The discontinuation of the paving business was the main reason behind the increased loss. Although their numbers were quite poor this quarter, I think they do not show the real picture. I believe the company is in an important transition phase as they have decided to quit the legacy material and paving business because these businesses were not proving beneficial for the company. Now, they want to focus on their core business, which can benefit them in the long run because it will allow the company to focus on more profitable businesses. But I think this decision to quit the business might affect their financials in the short term. So, investing in this company can be risky because we might see share price fluctuations.

Technical Analysis

Trading View

SLND is trading at $6.7. After trading in a small range of $9.8-$10.34 for about 13 months, the stock gave a breakdown and fell to the $7 level. The stock tried to form a base at $7 and took support from the $7 level two times, but recently, the stock broke the $7 level, which is not a good sign because it shows that the support zone has become weak and sellers have become active. Additionally, a retest has been done after the breakdown, so there is a high chance that the support zone might now act as a resistance zone. Hence, I am bearish on SLND and would advise to avoid it. Now, talking about the buying scenario. Since February 2023, the stock has tried to break 200 ema five times but failed each time. So, when the stock price breaks its 200 ema convincingly and sustains above it for at least a week, then we can see a trend reversal, but until then, it would be wise not to trade the stock.

Should One Invest In SLND?

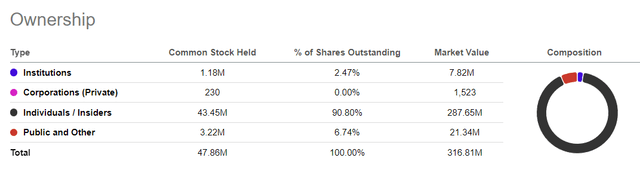

First, look at SLND’s valuation. SLND has an EV / EBIT [TTM] ratio of 28.55x, which is higher than the sector median of 16.07x, and has a Price / Cash Flow ratio of 62.40x compared to the sector ratio of 13.33x. It shows that SLND is overvalued. In addition, with a market capitalization of $316.8 million, the company has a total debt of $308.6 million, which is huge and a matter of concern.

Seeking Alpha

Institutions own just 2.47% shares of the company. So, the shareholding pattern of SLND is also quite concerning because the institution ownership in the company is low, and I believe wherever there is low institution investment, we see more volatility in the share price fluctuations.

As I told you earlier, the company’s financials might be adversely affected in the short term due to disposing of some of its business. So, investing in it right now can be risky; hence, looking at the bearish price action, high valuation, and high debt, I assign a hold rating on SLND.

Risk

They make use of several typical products whose prices can change significantly. They are exposed to various commodity price risks through transactions made in the ordinary course of business, including but not limited to those related to diesel fuel, natural gas, steel, and liquid asphalt. To power or lubricate their machinery as well as a large component of the asphaltic concrete they produce for sale to third parties and use in their asphalt paving construction projects, they use petroleum-based materials such as fuels, lubricants, and liquid asphalt. Additionally, they work with materials like steel and others that can see large price swings in their construction projects. They keep an eye on the prices of these commodities at the time of bid and adjust the prices in their contracts as necessary to manage or mitigate commodity price risk.

Additionally, some of their contracts can have provisions that guard them against price increases if commodity prices rise. They may sign supply contracts or buy commodities in advance to lock in prices and employ financial arrangements to further limit price risk. Large price swings could significantly harm financial position, results of operations, cash flows, and liquidity.

Bottom Line

I assign a hold rating on SLND due to various factors like high valuation, high debt, and the fact that the technical chart of the company is bearish. Hence, I think it can be quite risky to trade in the company for now.

Read the full article here

Leave a Reply