Introduction

SoFi (NASDAQ:SOFI) just posted a record quarter, with all three business segments producing record results as well. More notably, all three of them are now profitable.

Even more impressive, SoFi added the most number of new Members and Products in a single quarter. Ever.

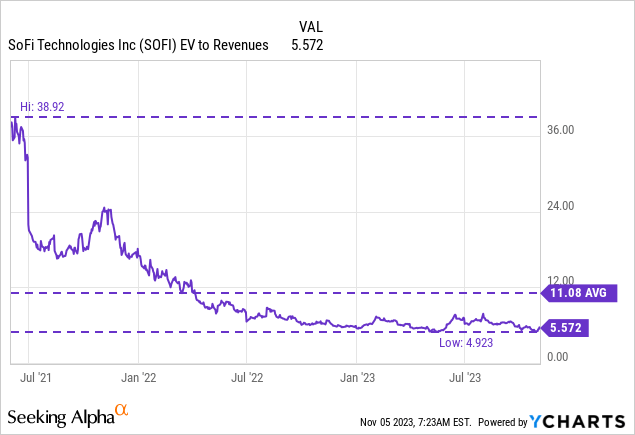

Despite the record-breaking performance, SoFi still trades at the lower range of its valuation multiple, which may mean that shares are still attractively valued.

Growth

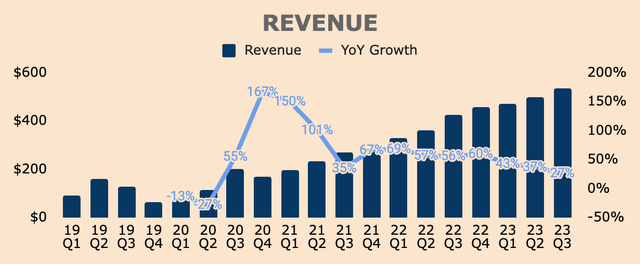

Looking at growth, Q3 Revenue and Adjusted Revenue both grew by 27% to $537M and $531M, respectively, setting new records for the 10th consecutive quarter.

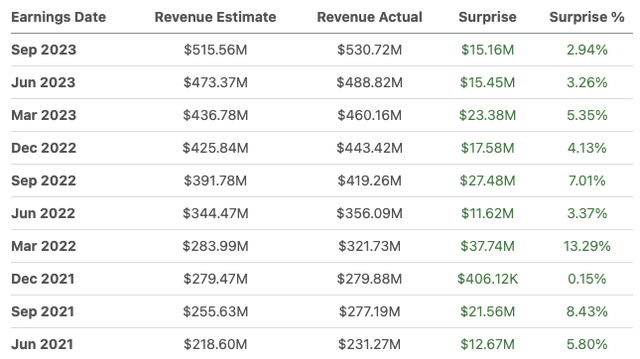

Q3 Revenue also beat analyst estimates by $22M, or 4%. Yes, growth is slowing down, but SoFi continues to defy expectations, which is a testament to the company’s unique value proposition and execution.

Nevertheless, SoFi’s incredible growth was driven by record Revenue across all three of SoFi’s operating segments.

Author’s Analysis

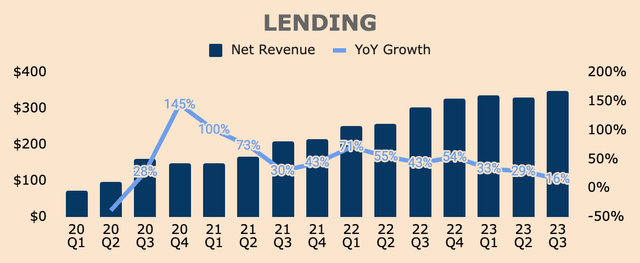

Its Lending segment grew 16% to $349M in Q3, driven by higher loan balances as well as higher net interest margins, which was 5.99% for the quarter, up from 5.86% a year ago and 5.74% a quarter ago.

Author’s Analysis

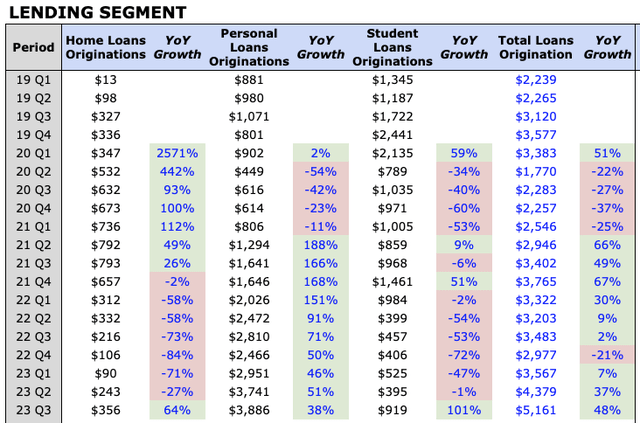

Looking at Loan Originations below, we can see that Q3 marks the first time in almost two years whereby all three of SoFi’s Lending segments grew YoY. Previously, Personal Loans drove all the growth in the Lending segment while Home Loans and Student Loans lag due to spiking mortgage rates and the student loan moratorium, respectively.

Author’s Analysis

However, things took a positive turn in Q3 with all three segments finally in the green.

- Home Loans grew 64% to $356M as the integration of Wyndham Capital Mortgage (acquired in April) increased fulfillment capacity.

- Personal Loans grew 38% to $3.9B, another record, as traction in the segment continues.

- Student Loans doubled YoY to $919M as borrowers prepared for the resumption of student loan payments in October.

On aggregate, Q3 Total Loan Originations grew 48% YoY to $5.2B, surpassing the $5B mark for the first time. This was made possible by the growth in Customer Deposits, which funded 65% of SoFi’s loans (more on deposits later).

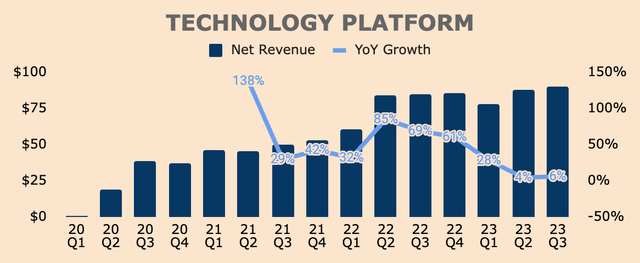

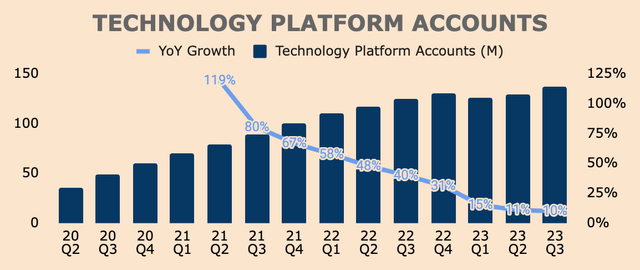

Moving on, SoFi’s Tech Platform posted $90M of Revenue in Q3, up 6% YoY, due to the additions of new clients and growth at existing clients. While growth for the segment seems underwhelming for a “high-growth” fintech company, management reiterated that Tech Platform Revenue should accelerate in Q4 as clients — both new and existing — continue to adopt products offered by Galileo and Technisys.

Author’s Analysis

It’s worth mentioning that SoFi is focusing on acquiring larger clients with established customer bases, stable revenue streams, and stronger growth potential — and this strategy is playing out well with Tech Platform Accounts growing 10% YoY to 137M, despite losing a major customer in Q1 this year.

Author’s Analysis

More importantly, the segment maintains a robust deal pipeline which should drive future growth — but do note that it may take some time for those deals to materialize.

The results of our strategic switch are really paying dividends. And right now, we’re in RFP status with a number of large financial institutions. We’ve actually won a regional bank deal, that’s one component of a larger piece of their business that will come on over the next 18 months to 24 months. But the pipeline is very strong in both financial institutions, incumbent banks and non-financial institutions as well as B2B.

(CEO Anthony Noto — SoFi FY2023 Q3 Earnings Call)

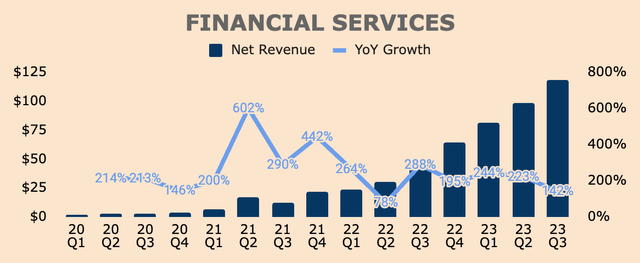

Turning to Financial Services, Q3 Revenue for the segment was $118M, which is up 142% YoY, its fifth consecutive quarter of triple-digit growth.

Author’s Analysis

Growth for the segment was primarily due to three main reasons: member growth, product growth, and improved monetization.

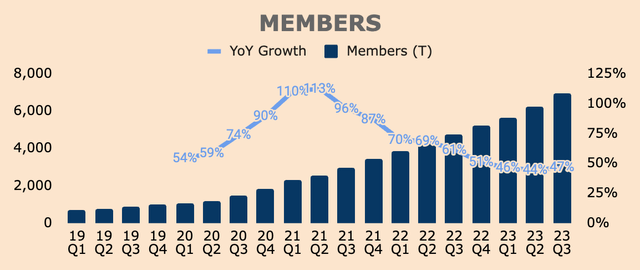

As you can see, SoFi grew Members by 47% in Q3 to 7.0M Members, which is an acceleration from Q2’s 44% growth. This is impressive considering tough YoY comps. But what’s more impressive is that SoFi added a record 717K Members in Q3, blowing past its previous record of 584K new Members added in Q2 this year.

I believe SoFi underwriting recent blockbuster IPOs like Instacart (CART) and Arm (ARM), and giving Members exclusive access to IPO prices, had a huge impact on new Member adds in the quarter. This is further proof of SoFi’s differentiated offering.

Author’s Analysis

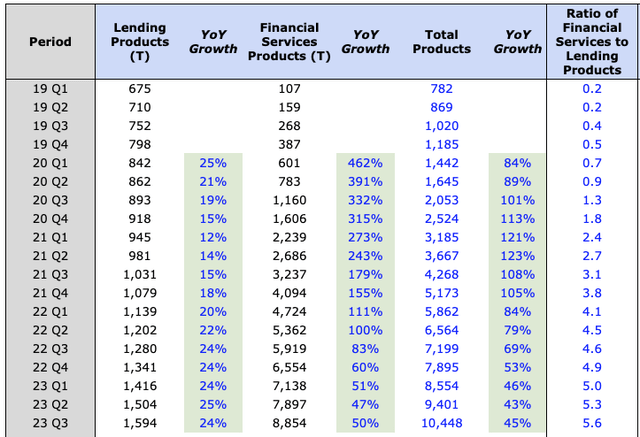

And with the ever-expanding Member base, SoFi grew Total Products by 45% in Q3, to 10.4M. On a QoQ basis, SoFi added over 1M new products which is, — surprise, surprise — a record as well.

- Financial Services Products grew 50% YoY, more than double the growth of Lending Products.

- The Ratio of Financial Services to Lending Products is also at an all-time high at 5.6x.

Here are some additional remarks by management, which indicate apparent stickiness and high engagement within the platform.

- More than 50% of newly funded SoFi Money accounts set up direct deposit within 30 days

- Point-of-sale debit spending was $1.2B+, up 3.2x YoY

- Cross-buy trends are really strong with Products Per Member remaining at 1.5x despite the rapid growth in Members.

Author’s Analysis

Adding record Members and Products are meaningless if SoFi fails to monetize them. Fortunately, overall monetization continues to improve as well with Revenue per Product up 61% YoY to $53.

Put simply, the combination of rapid member growth, growing product adoption, and better monetization is driving exponential growth within the Financial Services segment at lower relative cost, leading to superior unit economics.

This is the financial services productivity loop that management always talks about.

That said, SoFi is showing outstanding performance in the face of a challenging macro environment and tough YoY comps, and CEO Anthony Noto echoes this by categorizing SoFi as a “secular grower” rather than a “cyclical grower”, and that the company continues to steal market share from incumbents.

First, I’d like to caveat on my comments with the fact that we are relatively unique and that we’re a secular grower, not a cyclical grower at this point. Yes, there are cycles in some of our businesses with the vast majority of our growth is us taking market share from existing incumbents as opposed to an indication of the economy or the economic cycle. So secular growth to driving force. That said, we continue to see really strong demand for our products and really strong consumer trends.

(CEO Anthony Noto — SoFi FY2023 Q3 Earnings Call)

In other words, SoFi is set to grow rapidly regardless of the market environment. And with all three lending segments back in growth mode, there’s little doubt that SoFi’s record-breaking performance will continue in the next few quarters.

Profitability

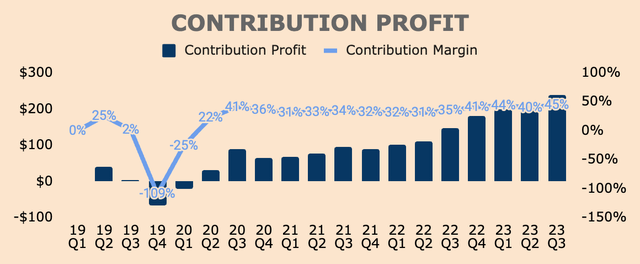

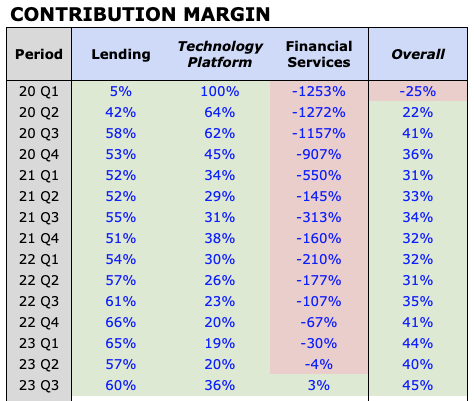

Turning to profitability, overall Contribution Profit, which is Net Revenue minus Direct Expenses, was $239M in Q3, representing a 45% Margin to Adjusted Revenue. This is the highest in both absolute and marginal terms, demonstrating economies of scale within the platform.

Author’s Analysis

If we break it by segment, you can see that Q3 represents the first quarter ever where all three segments have positive Contribution Margins, a major milestone for the SoFi team.

But let’s talk briefly about each segment.

Author’s Analysis

Q3 Lending Contribution Profit was $204M, which represents a 60% Contribution Margin. While this is lower YoY, it is an improvement from Q2’s 57% Contribution Margin. As the Wyndham Capital integration kicks in and as the student loan payments resume, I won’t be surprised if we see Lending Contribution Margins return to the mid-60s level.

Next, Q3 Tech Platform Contribution Profit was $32M. The surprise was that Contribution Margin for the segment came out to be 36%, a massive improvement YoY and QoQ. Per management, this was largely driven by:

- a few one-time items that reduced direct expenses by 12% YoY

- operating leverage from the Galileo-Technisys integration

Moving forward, management expects Contribution Margins to be in the “upper 20s to 30% in the near term” so expect Margins to come down a little in future quarters.

Lastly, Q3 Financial Services Contribution Profit was $3M, which is a 3% Contribution Margin, the first of many profitable quarters for the segment. This was primarily driven by better monetization and increased operating leverage.

Now, with the high-margin Lending business back in full force, the Tech Platform margin bottoming in Q2, and the Financial Services segment turning more profitable with each passing quarter, I see a clear path for SoFi to produce overall Contribution Margins of at least 50% in 2024 and possibly 60% by 2025.

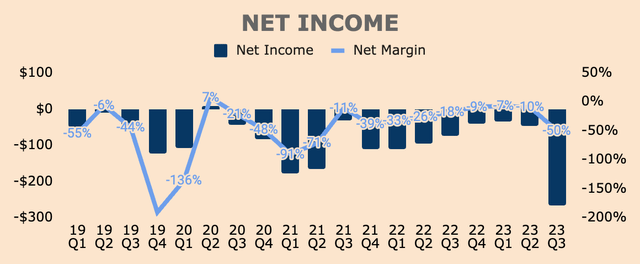

And that should reinforce the company’s path towards GAAP Net Income profitability as well. Below is SoFi’s Net Income profile and as you can see, Net Income worsened to $(267)M in Q3 — uninformed investors might just jump to the conclusion that SoFi is not faring well amidst a deteriorating macro situation.

However, this drop in Net Income was due to a one-time Goodwill Impairment Expense of $247M. Without this one-time charge, Net Income in Q3 would have been $(20)M, a sequential improvement from Q2’s figure of $(48)M.

That said, without Goodwill Impairment, SoFi’s Noninterest Expenses only grew 12% YoY, compared to Revenue growth of 27%. As a percentage of Revenue, Noninterest Expenses improved by 1,400 basis points, which is great to see.

Author’s Analysis

Whatever it is, Contribution Profit is at an all-time high, both in absolute and marginal terms, signifying economies of scale. And Net Income Ex-Goodwill Impairment is trending in the right direction, reflecting operating leveraging.

In addition, management reiterated that the company will be GAAP Net Income profitable by Q4 and in 2024, so that is great news for investors, and that should be a major catalyst for SoFi stock.

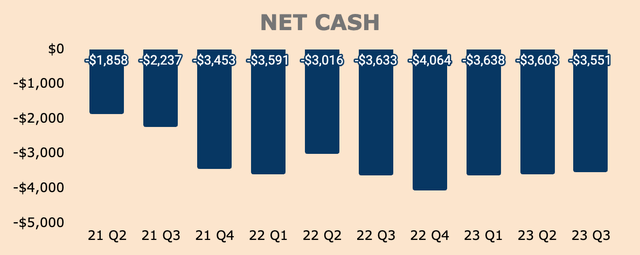

Health

Turning to the balance sheet, SoFi has Cash and Short-term Investments of about $2.8 with $6.4B of Total Debt, which puts its Net Cash position at about $(3.6)B. As you can see, Net Cash position has been relatively flat over the last few quarters.

Author’s Analysis

In Q3, SoFi added $2.9B of Deposits, much higher than its guidance of over $2B and a record in terms of sequential deposit growth.

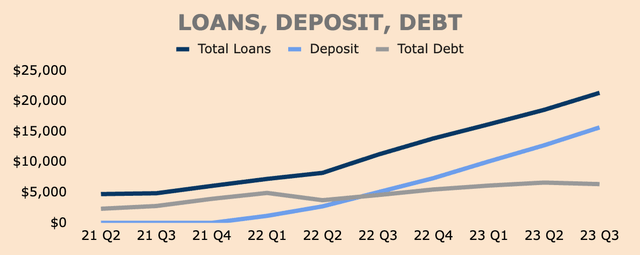

As Deposits grew, SoFi could fund its loans at a relatively lower cost than using Debt, leading to improved unit economics in the form of higher Net Interest Margin. As you can see below, Total Loans and Deposits on its balance sheet continue to expand while Total Debt dipped slightly QoQ — this is what we want to see.

As of Q3, SoFi had $21.4B of Total Loans on its balance sheet with $15.7B of Deposits.

Author’s Analysis

SoFi’s loan portfolio is high quality as well, as highlighted by management:

Our personal loan borrowers’ weighted average income is $167,000 with a weighted average FICO score of 744. Our student loan borrowers weighted average income is $180,000 with a weighted average FICO of 781. Our on-balance sheet delinquency rates and charge-off rates remain healthy and are still below pre-COVID levels.

(CFO Christopher Lapointe — SoFi FY2023 Q3 Earnings Call)

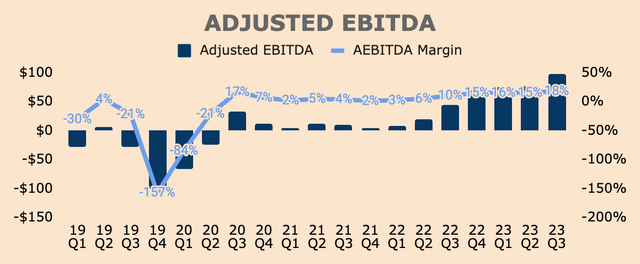

In terms of cash flow, it wouldn’t be helpful to look at Free Cash Flow since banks typically have negative Operating Cash Flow due to increased lending. As such, we can look at SoFi’s Adjusted EBITDA as a proxy for cash flow.

In Q3, SoFi produced a record Adjusted EBITDA of $98M, representing an Adjusted EBITDA Margin of 18%.

Q3 Incremental Adjusted EBITDA Margin — which is the change in Adjusted EBITDA divided by the change in Revenue — was 48%, meaning for every additional $100M of Revenue that SoFi generates, the company subsequently produces $48M of Adjusted EBITDA. This means that SoFi could produce Adjusted EBITDA Margins as high as 40%+ in the future. That’s huge.

Author’s Analysis

All things considered, SoFi’s balance sheet continues to expand and the company is essentially cash flow positive, which is great to see.

Outlook

Turning to the outlook, management provided the following guidance. Keep in mind that I will only be looking at the high-end of its guidance.

As usual, management raised guidance once again.

- FY2023 Adjusted Net Revenue: $2.065B (raised by $29M), up 34% YoY.

- FY2023 Adjusted EBITDA: $396M (raised by $53M) at a 19% Adjusted EBITDA Margin and a 48% Incremental Adjusted EBITDA Margin.

- GAAP Net Income profitable in Q4.

Assuming the numbers above, we can expect the following numbers in Q4:

- Q4 Adjusted Net Revenue: $585M, up 32% YoY.

- Q4 Adjusted EBITDA: $145M at a 25% Adjusted EBITDA Margin.

If you haven’t noticed, management expects Q4 Adjusted Net Revenue growth to accelerate relative to Q3’s growth of 27%, and Adjusted EBITDA Margin is expected to expand ~700 basis points relative to Q3’s figure of 18%.

Put it differently, expect very strong results in Q4. I have no doubt that management will beat expectations once again, as they have always done ever since the company went public.

Seeking Alpha

On another note, CEO Anthony Noto also mentioned 500K+ New Member adds per quarter, up from its average of around 400K, reflecting strong demand for SoFi products.

In terms of the outlook for member growth and product growth, what I’d say is, we have largely been averaging in the 400,000 range for members. I wouldn’t start assuming we’re going to average over 600,000 or 700,000 today. I think you could start to focus on 500,000 plus members in a quarter and keep it with a five-handle on it, and we’ll see how the quarter goes and how we’re doing overall.

(CEO Anthony Noto — SoFi FY2023 Q3 Earnings Call)

In short, the outlook looks bright as digital banking continues to gain traction and SoFi continues to take market share from legacy banks.

Valuation

Moving on to valuation, SoFi trades at an EV/Revenue multiple of just 5.6x, which is a significant discount from its highs of 38.9x and nearly half its average of 11.1x. On a historical basis, SoFi looks cheap, although this is justified given the macro environment today and its slowing topline growth.

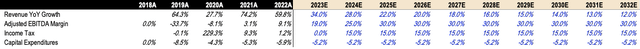

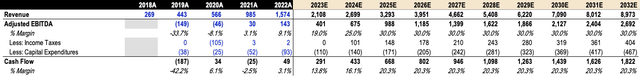

I’ve done a DCF analysis on SoFi as well — my model is oversimplified and does not include traditional DCF elements so take it with a grain of salt.

That said, I’ve used Adjusted EBITDA as a proxy for Cash Flow from Operations. I will then subtract Income Tax and Capital Expenditures to obtain a somewhat close estimate of Free Cash Flow.

With that out of the way, here are my key assumptions:

- Revenue: I will assign a 34% growth in FY2023, as guided by management, and then drop growth rates to 28% in FY2024, 22% in FY2025, and eventually down to 12% by 2032.

- Adjusted EBITDA: I will assign an Adjusted EBITDA Margin of 19% in FY2023, as guided by management. I expect margins to improve to 30% by 2025 and beyond as management is confident in achieving Incremental Adjusted EBITDA Margins of 30%+. Remember that SoFi currently has an Incremental Adjusted EBITDA Margin of 48%, which makes my assumptions fairly conservative.

- Income Tax: set at 15% of Adjusted EBITDA once SoFi turns GAAP Net Income profitable, which will be in FY2024.

- Capital Expenditures: set at 5.2% of Revenue, which is its 3-year average.

Author’s Analysis

Based on the above assumptions, I expect SoFi to generate $9B of Revenue by 2032, at a 20.3% Cash Flow Margin.

Author’s Analysis

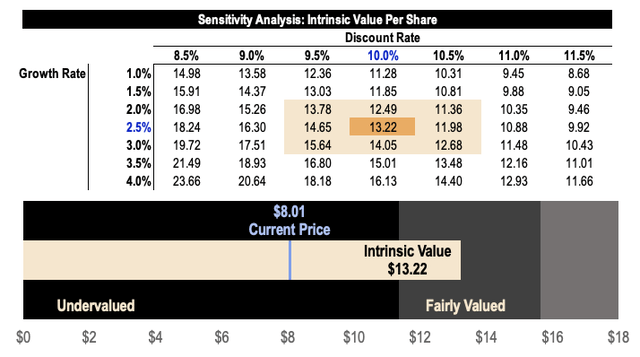

Based on a discount rate of 10% and a perpetual growth rate of 2.5%, I arrive at a fair value estimate of $13.22 for SoFi stock, which represents an upside potential of about 65% based on the current price of $8.01. Again, my model is oversimplified, and thus, may not be reliable (unfortunately).

Regardless, my fair value estimate is much higher than the average analyst price target of $9.81.

Author’s Analysis

Whatever it is, SoFi has what it takes to be a top 10 bank, which could lead to monumental share price appreciation for years to come.

That aside, GAAP Net Income profitability and S&P 500 inclusion could be major catalysts for the stock — as it has been for other growth stocks such as Palantir (PLTR).

Risks

- Politically-driven: SoFi is largely driven by politics and regulations, which is unpredictable. Any policies that hinder SoFi’s growth (such as another student loan moratorium) could be negative for the stock.

- Missing Estimates: SoFi has a perfect track record of beating sales estimates and guidance — investors have high expectations and are probably too complacent with respect to SoFi’s financial performance. They are now programmed to expect beat-and-raise quarters for all eternity. If the streak ends, we could see a huge drop in the stock.

Thesis

To wrap it all up, Q3 was a massive win for SoFi — it was another record-breaking quarter for the company.

The company posted record Revenue in all three of its business segments, record new Member and Product adds, record Adjusted EBITDA, record Deposit, and more, which is a testament to the company’s value proposition and strong execution.

Growth is set to reaccelerate with all lending segments in the green after a long time and the company is set to turn profitable by Q4 this year — growth and profitability are going into high gear, and that may eventually push the stock higher.

It bears repeating: the road to being a top 10 financial institution is well underway — SoFi’s record-breaking quarter says it all.

Read the full article here

Leave a Reply