Investment thesis

In August 2020, I wrote an article on BIC (OTCPK:BICEF) (OTCPK:BICEY) when the share price declined by 70% as the company has caused a lot of frustration among shareholders since 2016, and I decided to review the company as I believe the management has recently performed the movements that the company needed to move the needle in the long run. The lack of (true) innovation and significant acquisitions, as well as concerns about worldwide declining smoking rates and the digitalization of classrooms and office tasks, have raised concerns about the long-term viability of the company in recent years. Declining net sales in 2018 and 2019 (as well as 2020 due to the coronavirus pandemic crisis) began to suggest that the company had to adapt its products to new generations and acquire companies that offered long-term acceptable growth prospects, and although investors were frustrated for quite some time by the lack of significant changes in its product offerings, the company has begun, after the coronavirus pandemic in 2020, to make these changes by performing key acquisitions and launching products adapted to new generations, as well as through the digitization of its stationary segment and its expansion through the addition of human expression (temporary tattoo) products, which seeks to capitalize on increasingly high demand for products that allow highly daring tattoos without compromising the body skin forever.

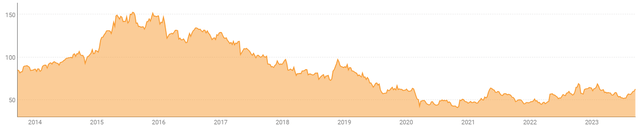

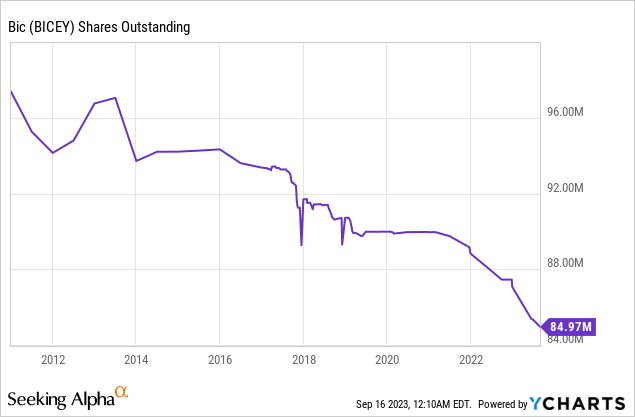

In the meanwhile, the company has maintained a very strong balance sheet and has taken advantage of the declining share prices to carry out relatively aggressive share buybacks with which to reduce the total number of shares outstanding. Nevertheless, recent strong share buybacks and key acquisitions have had a negative impact on the dividend, which was cut in 2019 and 2020 in order to preserve as much cash as possible during the coronavirus pandemic crisis, and the subsequent headwinds, and perform these acquisitions, although the dividend has partially recovered in 2021 and 2022 boosted by improving operations. For these reasons, I believe that the current share price decline of 60% from all-time highs reached in 2015 represents a good opportunity for long-term dividend investors interested in geographically diversifying their investments as the company keeps expanding its operations into markets with long-term faster growth rates.

A brief overview of the company

BIC is a French-based global manufacturer of stationery, lighters, and shavers. The company sells its products to over 160 countries and, since 2019, it also offers temporary tattoo pens under its BodyMark brand, and the company has expanded temporary tattoo offerings through the acquisition of INKBOX in January 2022. As for stationery products, the company is currently positioning the business for an acceptable capitalization of the digitization of education worldwide. The company was founded in 1945 and its market cap currently stands at €2.72 billion.

Bic Products (Kenyanwallstreet.com/kirubis-haco-industries-transfers-bic-brand-to-parent-company)

For many years, investors were concerned about the lack of diversification and adaptation to new consumer needs as the demand for stationery products is increasingly threatened by digital transformation, and the same is true for lighters as the world is becoming more aware of the dangers related to smoking, but in November 2020, the company launched its Horizon strategic plan, which is based on acquisitions of faster-growing companies to expand the company’s offerings. In this regard, BIC recently renamed its business segments from Stationary to Human Expression, from Lighters to Flame for Life, and from Shavers to Blade Excellence. In the Human Expression segment, which provided 38% of the company’s total net sales in 2022, the company plans to reach a total addressable market of €80 billion euros by 2025, and the company has begun to do so by introducing temporary tattoo markers and digital writing products. In the Flame for Life segment, which provided 39% of the company’s total net sales in 2022, BIC plans to expand pocket lighter offerings with the introduction of products with more attractive designs, and in the Blade Excellence segment, which provided 22% of the company’s net sales in 2022, the company launched BIC Soleil Escale, a new brand of women’s Disposable Razors with 4 blades, in 2022, and in 2023, it launched BIC EasyRinse shaver for a smoother shave with less irritation for the most sensitive skin.

BIC share price (Investors.bic.com/en-us/calendar-and-share/stock-market-prices)

Currently, shares are trading at €62.85, which represents a 60.43% decline from all-time highs of €158.84 reached in August 2015. This decline, although very significant, has taken place gradually since 2015 as it is directly related to the apparent lack of interest on the part of the management in modernizing the company’s products, although the apparently needed movements have accelerated recently as can be seen by reviewing recent acquisitions.

Recent acquisitions

In July 2019, the company acquired Lucky Stationery Nigeria, Nigeria’s leading writing instruments manufacturer with around 30% of the country’s market share as the company keeps expanding in developing markets. A year later, in July 2020, the company acquired Djeep, one of the main manufacturers of quality lighters with most of its sales taking place in Europe (although it also sells its products in the U.S., Latin America, Middle East, Africa, and Asia), for €40 million.

In December 2020, the company acquired Rocketbook, the leading smart and reusable notebook brand in the U.S., for $40 million (€33 million), and later, in February 2021, the company sold PIMACO, its Brazilian adhesive label business, for €6.5 million as the company plans to expand in creative expression and digital writing markets, which are expected to experience faster growth rates in the long term.

In this regard, in January 2022, the company acquired INKBOX, a leading Canadian semi-permanent tattoo manufacturer that sells its products in over 150 countries, for $65 million. The company’s tattoos last around 1-2 weeks and BIC is determined to capitalize on the do-it-yourself skin creative market, which is expected to reach $1.5 billion in value by 2031. During the first half of 2023, the acquired company achieved low double-digit year-on-year sales increases.

Finally, the latest acquisition took place in August 2022 when the company acquired AMI (Advanced Magnetic Interaction), a small French company that sells ISKN Reaper, a tablet that electronically reproduces the design that is drawn on paper using an electronic ring that is placed on any pencil.

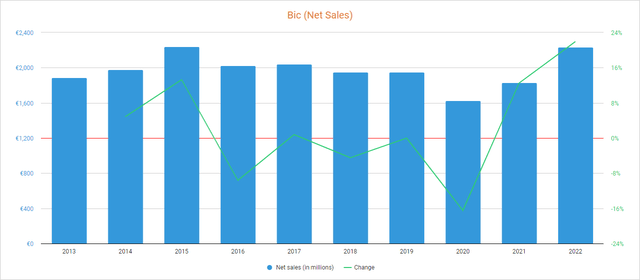

Net sales are reaching record highs boosted by price raises

As can be seen, the company’s sales have steadily declined in the 2016-2020 period, and although they declined by 16.49% in 2020 caused by disruptions stemming from the coronavirus pandemic worldwide, sales recovered the levels of 2015 as they increased by 12.53% in 2021 and by a further 21.94% in 2022 boosted by the reopening of the world economy and product price increases to offset inflationary pressures. Using the first half of 2023 as a reference, 40% of the company’s net sales are generated in North America, whereas 30% take place in Europe, 18% in Latin America, 7% in the Middle East and Africa, and 4% in Asia and Oceania.

BIC Net sales (Annual Reports)

As for 2023, net sales increased by 4.46% year over year during the first quarter, and by 9.3% (also year over year) during the second quarter. During the first half of 2023, net sales increased by 9.1% compared to the same period of 2022 in the Human Expression segment boosted by a robust back-to-school in North America and Europe and double-digit growth in developing markets. In the same period, Blade Excellence grew by 14.7% thanks to added-value products in developed markets and double-digit growth in the Middle East and Africa. Furthermore, the new BIC EasyRinse shaver, which was recently launched during the first half of 2023, already achieved a market share of 1.7% in the United States. Nevertheless, Flame for Life showed a much modest growth rate of 0.6% as net sales were impacted by H1 2022 lighters phasing in the United States (without impacts related to phasing, net sales would have increased by 5.5% year over year in the segment at constant currency). Nevertheless, the total lighter market declined 5.6% in volume and 1.4% in value in the United States in the past 12 months, which was offset by increased market share and product price raises. Now, the company wants to find a niche in the market for recycled stationery products in the United States as it launched BIC ReVolution in 2021, the brand’s first full range of eco-friendly stationery items, and the company is also making strong efforts to expand in developing markets where it already has operations.

Overall, net sales are expected to grow by 5-7% in 2023 at constant currency rates boosted by price raises, which should mark a new all-time revenue high.

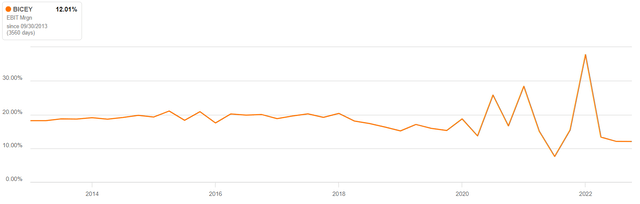

EBIT margins reached healthy levels again

The company enjoyed an EBIT margin of almost 20% before the outbreak of the coronavirus pandemic, but the company’s profitability profile worsened with the decrease in volumes prior to the coronavirus pandemic and, more recently, due to the restrictions to contain its spread, as well as the subsequent supply chain issues, inflationary pressures and increased transportation and labor costs.

BIC EBIT Margin (Seeking Alpha)

Now, higher raw material and electricity costs caused by inflationary pressures worldwide caused an EBIT margin decline to 13.3% during the first half of 2023 (compared to 19.0% during the same period in 2022), but it improved to 16.1% during the second quarter boosted by market share gains and easing inflationary pressures, and profit margins are expected to keep improving in the foreseeable future as temporary headwinds keep easing. Still, declining demand for lighters worldwide should keep investors alert as the adjusted EBIT margin was 35.3% in the Flame for Life division for the first half of 2023 (compared to 9.7% in Human Expression and 7.6% in Blade Excellence). In this regard, the global pocket lighter market size is expected to grow at a modest CAGR of ~3% from 2022 to 2030, which means that sales should continue to be contained in the long term as worldwide smoking rates are (always arguably) set to keep declining worldwide, although we must not forget that the company also sells kitchen lighters.

Finally, the second half of 2023 ended with a net cash position of €197.6 million (compared to €229.9 million in the same period of 2022) as the company spent €60.4 million in share buybacks in the first half of the year.

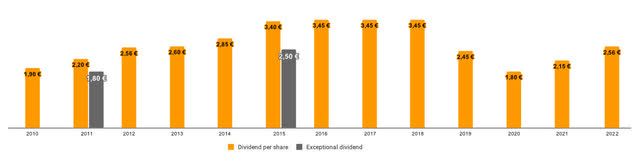

The dividend keeps improving and it looks safe

The company has a good track record of increasing its annual dividend and paying special dividends in favorable years, but it cut the proposed dividend for 2019 to €2.45 per share, from an initially proposed dividend of €3.45, in order to preserve as much cash as possible amidst the outbreak of the coronavirus pandemic worldwide. It also performed another cut in the 2020 dividend to €1.80 per share as the management is currently prioritizing share buybacks as the share price has declined significantly in recent years, which should eventually materialize in the form of capital gains, especially considering the company keeps repurchasing shares. Nevertheless, the annual dividend increased from €1.80 in 2020 to €2.15 in 2021, and to €2.56 in 2022.

Bic dividend per share (Investors.bic.com/en-us/strategy-and-governance/key-figures (adapted for 2022))

This dividend should represent an annual expense of around €110 million, which is significantly lower than the average cash from operations reported in recent years. In the following table, I have calculated the percentage of cash from operations that the company has allocated to the payment of the dividend each year (we must take into account that the dividend proposed for 2022 will appear in the 2023 results).

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Cash from operations (in millions) | €349.0 | €367.1 | €298.7 | €380.6 | €303.9 | €317.2 | €357.6 | €280.6 | €300.0 |

| Dividends paid (in millions) | €122.4 | €134.8 | €277.0 | €161.0 | €157.8 | €155.2 | €110.2 | €80.9 | €94.7 |

| Cash payout ratio | 35.07% | 36.72% | 92.74% | 42.30% | 51.92% | 48.93% | 30.82% | 28.83% | 31.57% |

As one can see, the company has historically allocated a fairly conservative percentage of cash from operations to cover the dividend, which has made it possible to maintain a strong cash position and carry out regular share buybacks and acquisitions. Considering that revenues are reaching record highs and the EBIT margin improved to a healthy 16.1% in the past quarter, the company should cover an annual dividend of around €110 million with relative ease if we consider the cash from operations reported in recent years, and the recent share price decline represents, in my opinion, a good opportunity for long-term dividend investors as an annual dividend of €2.56 represents slightly over 4% of the current share price of €62.85 while investors also benefit from periodic share buybacks. Furthermore, share buybacks should eventually give room for further dividend raises as dividends paid are divided into fewer and fewer shares as the years go by.

Share buybacks remain in force

Over the years, the company has carried out share buybacks with relative regularity, which has allowed for a 9.34% reduction in the total number of shares outstanding in the past 10 years, and the company spent €60.4 million in share repurchases during the first half of 2023, which means share buybacks remain in force.

This means that each share now represents a larger portion of the company, something that should continue to happen in the long term as the company’s net sales are reaching record-high levels and are poised to keep growing thanks to key acquisitions while EBIT margins are stabilizing at healthy levels boosted by price increases. This means that investors can expect their position to slowly keep expanding by holding the company’s shares, which should (more or less steadily) improve per-share metrics in the long run.

Risks worth mentioning

In the long term, I consider that BIC’s risk profile is relatively low as the company holds a strong cash position, its profit margins are stabilizing at healthy levels, sales are reaching record highs and recent acquisitions have been performed in businesses with higher growth prospects in the long-term. Still, there are certain risks that I would like to highlight, especially in the short and medium term.

- The global economy could face a recession as a result of recent interest rate hikes carried out in order to moderate high inflation rates. This could have a direct impact on the company’s sales, which would in turn have an impact on profit margins due to lower volumes.

- A further intensification of inflationary pressures worldwide could cause a further contraction in profit margins, which would add further strain to the dividend.

- The dividend could be cut again if inflationary pressures intensify or if a global recession finally materializes.

- Faced with either of the two scenarios mentioned (a potential recession or a further contraction of profit margins), the management could decide to pause share buybacks, which would have a direct impact on the buyback yield and limit potential capital gains in the short and medium term.

Conclusion

Without a doubt, recent years have not been easy for BIC shareholders, and that was the reason why I wrote an article on BIC in 2020. The perceived management’s inaction in recent years has raised doubts among investors about the company’s long-term viability as future demand for its products has been in question in recent years due to declining smoking rates and the digitalization of education worldwide. To this must be added the two dividend cuts that took place for the fiscal years 2019 and 2020 and the growing concerns of a potential recession due to recent interest rate hikes.

Even so, it seems that the company’s picture is beginning to improve significantly thanks to recent acquisitions and product launches, and despite a slight rebound in the share price, shares remain 60% below the all-time highs reached in 2015, which makes me believe that this represents a good opportunity for long-term dividend investors interested in geographically diversifying their portfolios while receiving acceptable dividend yields on cost as the share price is still depressed.

In short, EBIT margins are stabilizing at healthy levels, the dividend is recovering and appears to be sustainable in the long term, the cash position is very strong and the company’s sales are expected to keep improving thanks to recent acquisitions and product innovation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply