Summary

The VanEck Semiconductor ETF (NASDAQ:SMH) looks like a poor option in the semiconductor ETF space. One may be better off simply owning Nvidia (NVDA) given the 20% stake, while the remaining portfolio is concentrated in more mature or even problem stocks such as Intel (INTC). My bottom-up analysis, using consensus estimates for all 25 stocks in the portfolio, indicates that SMH has 22% potential upside. However, excluding Nvidia (41% upside) the potential declines to 13%. This discrepancy extends to EPS growth and valuation.

The VanEck Semiconductor ETF is highly concentrated with a 20% weight in Nvidia followed by 12% in TSM and with the top 5 positions equal to 50% of the portfolio. The ETF was formed in December 2011 and has performed in line with other larger Semi ETFs such as (SOXX) which I covered here.

SOXX: AI Driven Demand May Be Relegated To A Select Few

XSD: A Chip ETF With Strong Potential Upside

Semiconductor Sector in Cyclical Downturn

As many investors may be aware, semiconductors are key building blocks in the digital age. However, demand is cyclical, generally ebbing and increasing with global GDP. There are many chip applications from PC and smartphones, blockchain data crunchers, graphics chipsets to more simplistic sensors that have impacted the automakers and now AI data processing. Most companies are application-focused, a few companies, such as Nvidia have been able to weave into new applications. Then there are the manufacturers such as TSM that build chips for everyone else and finally the equipment suppliers such as [ASML] and [LRCX].

This cyclicality is evident in YE23, with many stocks posting earnings declines or losses such as Micron (MU) and Intel that focus on memory and PC chips. The SMH portfolio has an EPS decline of 8% estimated for YE23, excluding NVDA. Some companies appear to rebound rapidly in YE24, and others look quite weak for longer, which I delve into in greater detail in the EPS Growth section of this article.

Bottom Up Analysis

I conducted a bottom-up analysis of each of the 25 stocks in the ETF portfolio using consensus estimates to derive potential upside, EPS growth and valuation. This data set I then weighted according to the ETF exposure and striped out Nvidia’s impact to get a better idea as to this mega cap stock’s impact on the entire ETF.

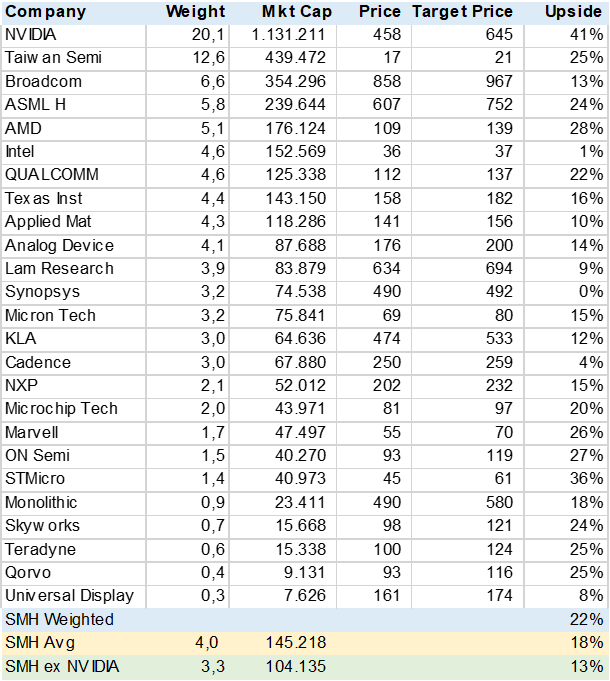

In the table below, using consensus price targets for YE24, I calculated that SMH has 22% upside potential. However, without the NVDA position this upside potential declines to 13%.

SMH Consensus Price Target Upside (Created by author with data from Capital IQ)

EPS Growth

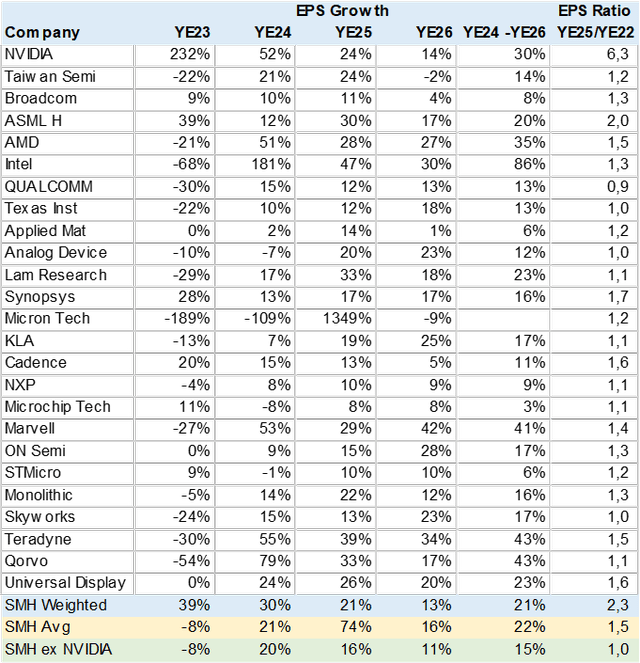

As seen in other semiconductor ETFs, the industry is experiencing a downturn post-COVID with many companies seeing declining EPS or even losses. Using consensus estimates I calculated that SMH has a 39% EPS gain in YE23, thanks almost exclusively to Nvidia’s 232% expected growth. Without Nvidia EPS growth is a negative 8%.

Looking at YE24 to YE26 we see significant EPS growth of over 20%. However, this is an optical illusion given the low or negative EPS base in YE23. To get a better idea of absolute growth I calculated an EPS ratio using YE22 base vs. YE25 estimates. If the ratio is 1 or less this means that the company has not yet reached YE22 EPS levels, not a good sign. In the table below one can see that this ratio, excluding Nvidia is 1x, which means the ETF portfolio is barely expected to recover to YE22 levels by YE25.

SMH Consensus EPS Growth (Created by author with data from Capital IQ)

Valuation

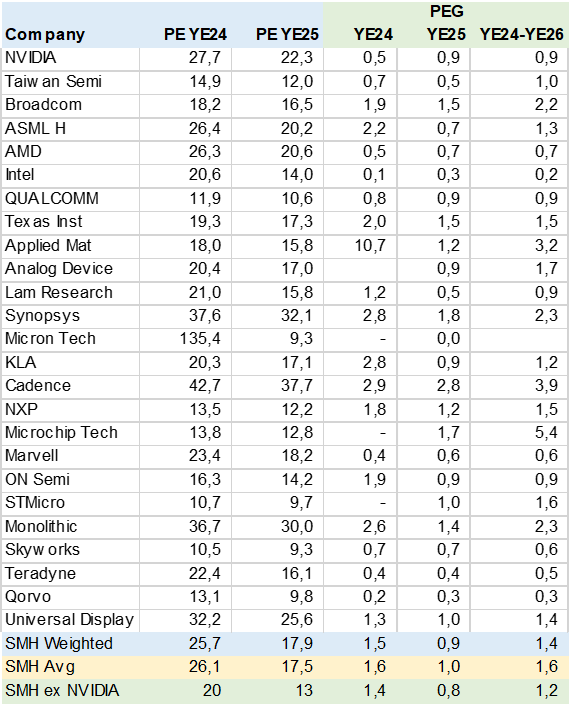

Using the same consensus database, I calculated each stock’s PE and PEG (PE to Growth) and then weighted accordingly. SMH looks to have a low PEG i.e., reasonably valued vs. expected growth at 1.4x for the YE24-YE26 period. Stripping out Nvidia the PEG declines to 1.2x suggesting that valuations have factored in some sectors’ weakness. However, Nvidia’s stand-alone PEG is .9x, better than the ETF.

SMH Consensus Valuation (Created by author with data from Capital IQ)

Conclusion

I would sell SMH and replace it with a smaller position in Nvidia. The ETF’s performance is very dependent on Nvidia, while the rest of the portfolio appears to offer poor diversification that may not mitigate risk given the broader sectors recuperating growth and profitability outlook. The primary risk to this rating is if the semiconductor sector as a whole sees far stronger and faster recuperation of demand, i.e., higher global growth.

Read the full article here

Leave a Reply