Though many small and mid-cap tech stocks have enjoyed a massive YTD rally in spite of recent interest-rate fears, Smartsheet (NYSE:SMAR) is a major holdout. This collaboration software vendor has retraced back most of its gains this year owing to slower billings growth rates. The company has blamed all of this on macro conditions that have slowed down sales cycles (the same commentary as other software companies are offering), but prudent investors are taking this as a sign of increased competition in a very competitive workflow software arena.

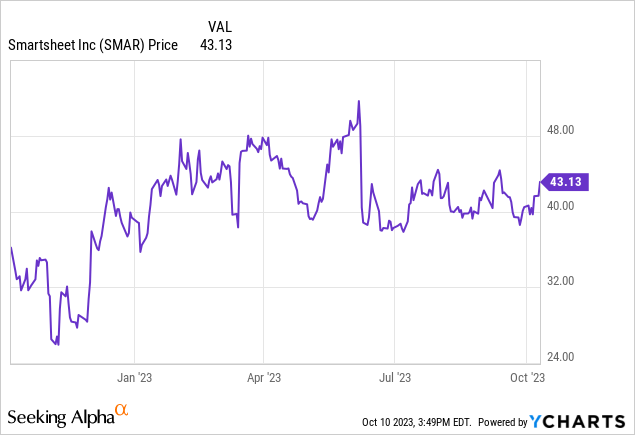

Year to date, Smartsheet is underperforming the S&P 500 at just a ~7% gain:

I last wrote an article on Smartsheet in July, rating it at a strong buy. Since then, a number of factors have transpired:

- At a macro level, interest rates have continued to march upward and more pessimism has been injected into the equity markets

- Smartsheet released Q2 results, showcasing continued deceleration in billings and revenue growth

- However, at the same time, the company has ratcheted up profit margins

In light of all of the new information here, and also weaving in my macro strategy of shifting away from equities and putting more into cash, I’m downgrading Smartsheet to buy, from strong buy.

I’m still a believer in the long-term bull case for this stock: but I just don’t think the gains will be as substantial or come as quickly as I did previously, especially in a 5%+ interest rate environment.

As a reminder for investors who are newer to this stock, here are the core elements of the bull thesis for Smartsheet:

- Remote work is going to continue being the “new normal”. Now realizing that productivity doesn’t suffer as much as originally thought when teams go remote, some companies are relaxing their expectations for employees to be fully back in the office even after the pandemic subsides. Some companies have even let their employees know it’s okay to work remotely indefinitely. But remote teams need a workspace to collaborate in, and tools like Smartsheet are perfect complements for that. This is especially true for distributed teams, where people are in different locations and some are in-person while others are remote: tools like Smartsheet help to rein in the geographic distance.

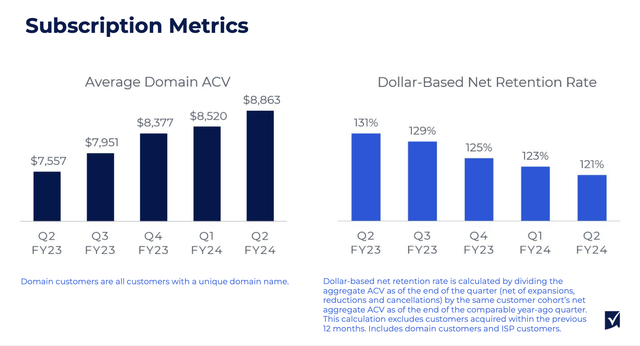

- Smartsheet is moving to bigger and bigger deals, and expansion rates remain high. As Smartsheet has proven its utility and flexed its muscles as a more prominent public company, the company has been able to sign larger deals. In its most recent quarter, its count of >$100k ACV customers grew 55% y/y to more than 1k such customers. The average customer is also upgrading their relationship with Smartsheet: net revenue retention rates are clocking in around 130%, which exceeds most other SaaS stocks.

- Horizontal software and broad use cases. Smartsheet is broadly applicable to virtually any industry and virtually any team or function within a company, making its addressable market wide.

- High gross margins. Smartsheet’s 80%+ pro forma gross margins are among the highest in the software industry, and enable the company to achieve significant operating leverage as it scales.

From a valuation perspective, the stock remains attractive – which is why I do still remain partial to it. At current share prices near $43, Smartsheet trades at a market cap of $5.82 billion. After netting off the $549.0 million of cash off Smartsheet’s most recent balance sheet, the company’s resulting enterprise value is $5.27 billion.

Meanwhile, for next fiscal year FY24, Wall Street analysts are projecting Smartsheet to generate $1.14 billion in revenue, representing 20% y/y growth (data from Yahoo Finance). Note that this consensus estimate would rely on some contribution from a macro rebound, as it represents acceleration from Smartsheet’s current 18% y/y billings growth rate. Nevertheless, taking estimates at face value, Smartsheet trades at 4.6x EV/FY24 revenue.

In my view, for a company that is currently seeing mid-20s revenue growth and high single-digit pro forma operating margins, I think Smartsheet should be able to flex up to a ~5.5x FY24 revenue multiple by mid-next year, representing a price target of $52 and ~21% upside from current levels.

The bottom line here: Smartsheet is still an attractive long-term investment, but it’s not a “bet the farm” type of play. Take a conservative position here and be patient for a more complete rebound.

Q2 download

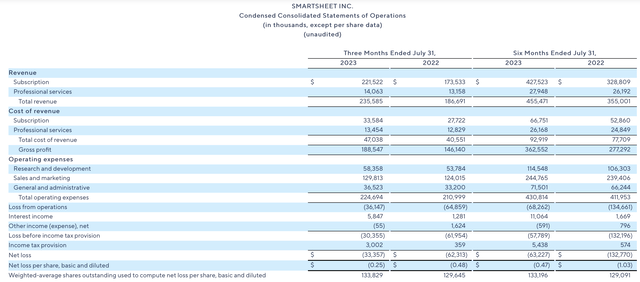

Let’s now go through Smartsheet’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Smartsheet Q2 results (Smartsheet Q2 earnings materials)

Smartsheet’s revenue grew 26% y/y to $235.6 million, slightly ahead of Wall Street’s expectations of $229.6 million (+23% y/y). Revenue growth slowed considerably from a 33% y/y growth rate in Q1, which was foreshadowed by billings rates coming down last quarter as well.

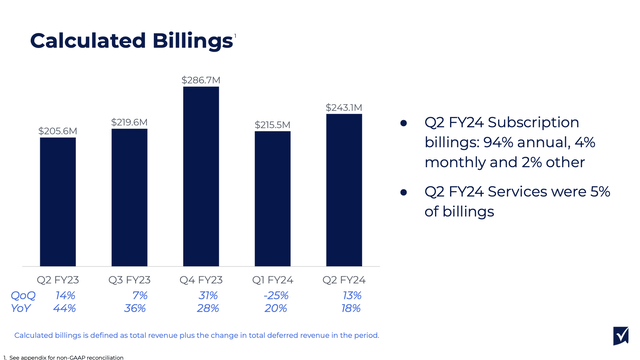

As a reminder: billings is one of the best indicators of a subscription company’s growth trajectory going forward, as it captures deals signed in the quarter that will be recognized as revenue in future quarters. And speaking of which, billings continued to decelerate in Q2, down to 18% y/y (from 20% y/y in Q1).

Smartsheet billings growth rates (Smartsheet Q2 earnings materials)

The slowdown in billings is due, in part, to slowing net retention rates. This, in turn, is a function of both IT budget cuts as well as headcount compression at Smartsheet’s customers, as the product is priced on a per-seat basis. That being said, dollar-based net retention still remained healthy at 121% in the quarter (indexing well above most SaaS companies that tend to report net retention in the ~110% range), but this metric is down a full ten points versus the prior year.

Smartsheet net retention trends (Smartsheet Q2 earnings materials)

Importantly, however – and one of the main cruxes of my continued optimism for Smartsheet – in this time of slowing growth, the company has turned its focus to profit optimization, leveraging its rich gross margins to cut down on discretionary spend and flex its muscle as a profitable company.

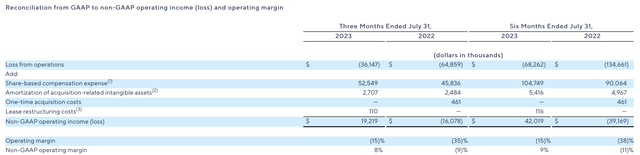

Smartsheet operating margins (Smartsheet Q2 earnings materials)

As shown in the chart above, Smartsheet notched an 8% pro forma operating margin in Q2: a full 17 points better than the year-ago quarter. The company’s total pro forma opex excluding stock-based comp was $173.2 million in the quarter, up only 5% y/y despite double-digit revenue and billings growth.

Key takeaways

Smartsheet continues to grow, albeit at a more moderate pace. I view the company’s ~4x FY24 revenue multiple as lean and having opportunity, while keeping various risks in mind: competition (the company has a number of higher-profile rivals, including Atlassian (TEAM)) and macro compression that is leading to slippage of net retention rates and billings growth. Maintain your position here, but don’t be too greedy either.

Read the full article here

Leave a Reply