Thesis

This is my third article on Shimano (OTCPK:SHMDF)(OTCPK:SMNNY), following two previous articles (first, second) where I highlighted the attractiveness of Shimano’s stock, citing its secular growth potential and pristine balance sheet. Especially as its vast cash position is being put to better use for shareholders, with buybacks picking up. This article further builds on the thesis and updates it with recent financials. While the company is seeing growth rates picking up in its most recent quarter, the stock price has as well. The recent rally in the stock price might be getting ahead of itself, but Shimano remains a very solid company (recession-proof balance sheet) with secular tailwinds. I therefore give it a downgraded ‘Buy’ rating.

Recent results better than expected

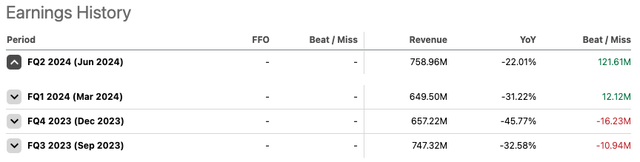

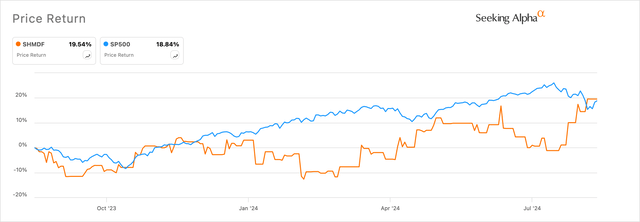

Shimano’s latest quarterly performance exceeded expectation, beating estimates by $122 million (see figure below), with total revenue reaching $723 million for the second quarter of 2024 (the discrepancy between the $759 million in the earnings history and the $723 million here is due to currency effects related to the Japanese Yen). Better recent financial performance has also led to the stock increasing in price. Since my first article on Shimano, it has kept up with the S&P 500’s performance and has gained momentum more recently.

Shimano: Earnings History (Seeking Alpha)

Shimano: Stock Price (Seeking Alpha)

Net income expected to increase in 2024, after a Q4 of 2023 low

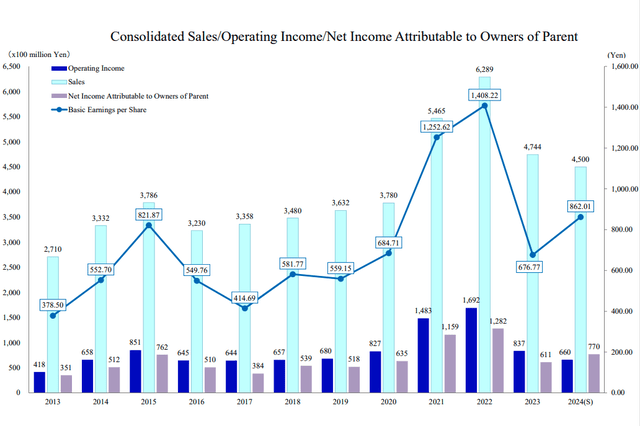

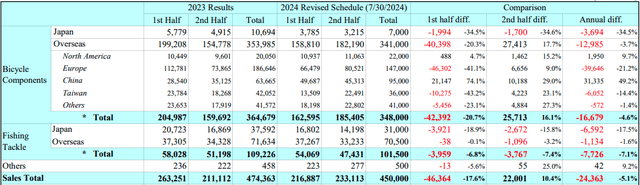

The company’s net income is recovering from its low in Q4 of 2023, though it remains well below pandemic highs, as can be seen in the figure below. Sales are up on a quarterly basis, though not annually from 2023, and EPS has increased significantly (on a quarterly basis) as well. I think this can be seen as the first signs for a reversal of the malaise in the market for bicycle components that Shimano operates in. Especially sales in China were strong, providing new growth potential. Sales in other markets seem to be picking up as well, after a severe downturn at the end of 2023, but it is to be seen if growth can be sustained in coming quarters. I think it will, however, as the market will become less saturated after the very high sales of the post-covid period. Bike sales were extremely high in this period, and it took some time for the demand of bicycle parts (for replacement) to pick up. New bike sales could also potentially pick up in the coming quarters, as they will normalize after oversupply and heightened demand in 2021 and 2022.

Shimano: Quarterly Results (Shimano)

Shimano: Results by Segment (Shimano)

Tailwinds and risks

Potential catalysts remain the same as in earlier articles, but are now beginning to show in the numbers as well:

- The market for bicycle components seems to be picking up after covid saturation, as can be seen in the figures above. Old bikes, bought in 2020 to 2023, will need new parts and this will boost short-term demand.

- Long-term growth for the bicycle market is unchanged. As shown in my previous articles, growth rates vary from 6.2% for the high-end market to 9.7% for the general market. This secular trend is the main tailwind that will benefit Shimano and its shareholders in the long term. Even when Shimano does not increase market share, they can be expected to beat general economic growth with these kinds of growth rates.

- Shimano’s business remains a duopoly with strong economies of scale, no real counter-positioning from new entrants, a strong brand and increasing network economies from building a network of Shimano service centers.

- Continued stock repurchases and its strong cash position make the company very recession-resilient.

There are also risks to take into account:

- While there are no real competitors to the duopoly right now, this does not mean that there is no innovation in the market. Shimano has arguably missed the boat in the mountain bike-market, in which SRAM dominates, and is kind of a slow mover. Innovation such as, for example, Classified’s shifting system might pose a long-term risk. Shimano’s derailleur systems are its bread-and-butter, and a company counter-positioned to this could be successful. However, this is not an immediate risk.

Valuation

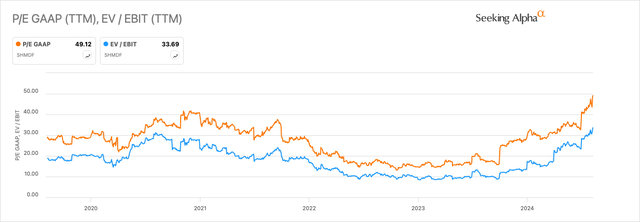

Shimano has become more expensive recently, as the stock price has picked up and EPS is still down from covid-highs. I expect the PE and EV/EBIT ratio to fall substantially in the coming months, as the extremely low EPS of Q4 2023 continues to weigh in now but EPS growth is expected to pick up in coming quarters. Due to this cyclicality, the stock appears to be more expensive than it actually is. However, my previous DCF analysis suggests that the stock price is above its intrinsic value at this moment. Shimano is a very solid company, with a pristine balance sheet and a strong market position, so a premium might be expected, but it does appear to be on the expensive side at this moment. I therefore downgrade it to a ‘Buy’ rating, as it remains a very solid company with growth picking up.

Shimano: PE and EV/EBIT (Seeking Alpha)

Takeaway

Growth seems to be picking up for Shimano recently, as the company beat estimates in its most recent quarter. The company remains a duopoly with strong economies of scale, a solid brand reputation and network economies due to its service centers. Secular tailwinds also provide fertile ground for future growth. The company also has an extremely strong balance sheet and appears recession proof because of this. The stock price might be getting ahead of itself, however, as the market recognizes the regained growth potential. I therefore assign it a cautious ‘Buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply