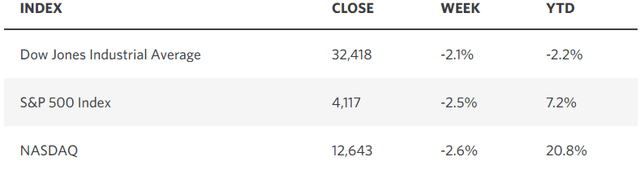

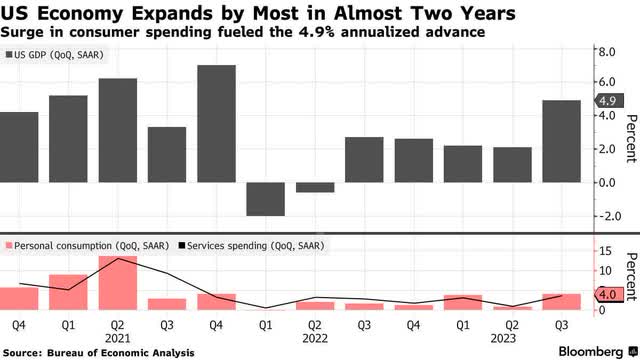

Defying the skeptics all year long, consumers continued to power the ongoing expansion, as economic growth in the third quarter soared at an annualized 4.9%. Yet that did not drive interest rates higher, as the consensus might have anticipated because inflation data in the report was better than expected. As a result, bond yields across the curve declined from their recent highs. Corporate earnings for the third quarter have also been better than expected so far this earnings season. Regardless, the major market averages were lower across the board last week with the S&P 500 and Nasdaq Composite entering correction territory with declines over the past three months of more than 10%. Countering economic resilience, the market has been digesting a higher interest-rate environment with the added headwinds of Washington’s disfunction, the United Auto Workers strike, and war in the Middle East. The issue now is when market prices more than accounted for higher interest rates and these near-term headwinds, setting the stage for the recovery.

Edward Jones

The economy expanded in the third quarter at the fastest pace since the fourth quarter of 2021. Growth was fueled primarily by a 4% increase in consumer spending, but the best news in the GDP report was on the inflation front, as the core personal consumption expenditures (PCE) price index rose at a rate of 2.4% during the quarter, which was below the 2.5% expectation and 3.7% rate in the second quarter. That was the slowest pace since 2020 and is rapidly approaching the Fed’s target of 2%.

Bloomberg

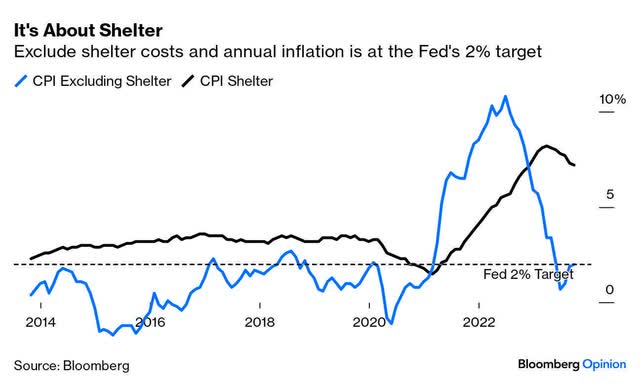

Confirming what we learned in the latest Consumer Price Index report, the core PCE rose at a rate of just 1.8% during the third quarter when we excluded housing. This is vitally important because we know that shelter costs are bound to decelerate rapidly in the coming months, which should bring the Fed’s preferred measure down to target during the first half of 2024.

Bloomberg

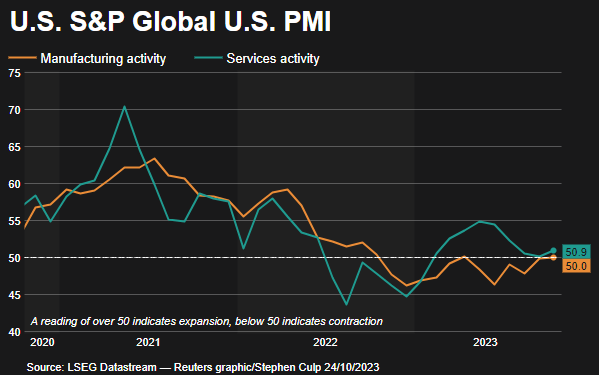

Despite recent economic strength, no one is expecting another rate hike from the Fed’s meeting this week. That is because it is well understood that economic activity will slow sharply in the current quarter under the weight of much tighter financial conditions that developed over the past three months. Still, last week’s measure of economic activity during October from S&P Global showed a decent start to the fourth quarter. The service sector index rose to a three-month high of 50.9, while the manufacturing sector is at a six-month high and on the cusp of growth at 50.0 after a year of contraction.

Reuters

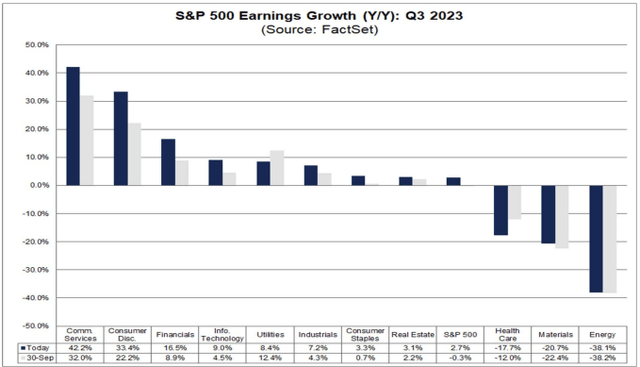

Disinflation combined with resilient growth has been a tailwind for corporate profits, which has resulted in a return to year-over-year earnings growth for the first time since the third quarter of last year. Halfway through the earnings season, profits are now growing 2.7%, which is better than the 0.3% decline expected at the beginning of October. Better yet, when the energy sector is excluded, profits have risen 8.4%.

FactSet

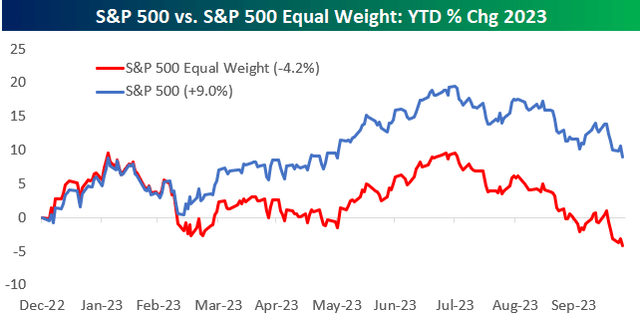

Despite the outperformance, the S&P 500 has declined approximately 3% so far this month and 10% from its peak this year, as the market digests the higher interest-rate environment. There is also the expectation for a deceleration in economic activity that is breeding caution from corporate management teams. This is why we have had a correction over the past three months, but I think we have largely priced in these developments with more reasonable valuations. The S&P 500 now trades at a forward price-to-earnings multiple of 17.1, which is below its 5- and 10-year averages. More importantly, the equal-weighted index multiple is down to 14 times, while the Russell 1000 Value index is down to 13 times. The S&P 500 index is still being heavily influenced by the Magnificent 7 (Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia, and Tesla), trading at an average of 30 times and accounting for more than 30% of the index value.

Bespoke

No one rings a bell at the tops and bottoms, as both are processes, but this feels like we are moving closer to the end of the correction process. There is now a lot of value in the average stock, especially where dividend yields are challenging the 5% offered by everything from money markets to longer-term bonds, which are yields that won’t last when the economy slows, and the Fed starts to reduce rates at some point next year. Furthermore, market technicals are deeply oversold and sentiment is approaching extremely bearish levels, both of which are good contrarian indicators pointing to a rebound during two of the best-performing months of the year in November and December.

Read the full article here

Leave a Reply