Summary of prior coverage

This is an update of my previous coverage of Seres Therapeutics (NASDAQ:MCRB). To sum up my prior coverage, VOWST (MCRB’s flagship and only approved product) represents the first commercial FDA-approved orally administered microbiome-based therapy in capsule form for prevention of recurrent C. difficile infection [CDI]. VOWST is approved for 1st CDI recurrence (i.e. ≥2 CDI episodes). VOWST is self-administered orally by the patients which is a big advantage over competition (need for office-visit/admission and rectal/ colonoscopy-guided/ intravenous administration). Taking cost out of the equation and considering very high efficacy, safety and being logistically an easier treatment option I am confident that most physicians would recommend VOWST as a 1st-line option for treatment of recurrent CDI and patients would be more satisfied with this option. However, considering the very high cost, much higher compared to competitors (reviewed in my prior coverage), insurance reimbursement policies may be unfavorable, leaving VOWST as a 2nd/3rd-line option after failure of other options, which would result in a much smaller target market.

Thesis update

Since my prior coverage MCRB stock price has declined significantly, resulting at the time of writing in a market cap of just $130M. MCRB has recently announced Q3 financial results (increasing VOWST sales with high percentage of insurance coverage) and strategic restructuring that is expected to extend cash runaway into Q4 2024. Considering these news and current stock price the risk-reward has improved considerably. However, pending more updates on commercial uptake of VOWST, especially in 1st CDI recurrence patients, it remains a risky investment and there may be better entry points for buying the stock. Notably, MCRB remains a “Strong Sell” according to Seeking Alpha’s quant rating. Furthermore, whether and to what extent MCRB will achieve penetration in the 1st CDI recurrence market (the larger market share among CDI recurrence patients) remains uncertain.

Business and pipeline update

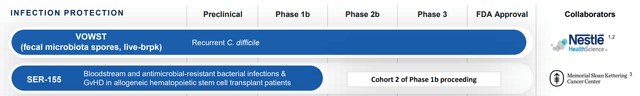

MCRB has announced “a strategic restructuring to focus its business operations to prioritize the commercialization of VOWST and the completion of the SER-155 Phase 1b study”. The restructuring includes the following;

- reduction in the current workforce by 41%

- significantly scaling back all non-partnered R&D programs and activities other than the completion of the SER-155 Phase 1b study

Considering the company’s financial hurdles, the commercial potential of VOWST and urgency in improving VOWST sales, I believe above restructuring was necessary and a good decision.

Results of the ongoing SER-155 Phase 1b study are anticipated in Q3 2024. As discussed in my prior coverage, and considering the emerging threat of antimicrobial resistance, use of microbiome-based therapies (like SER-155) to reduce colonization by antibiotic-resistant bacteria, as well as to reduce risk for infections by antibiotic-resistant bacteria, has immense potential. However, SER-155 is still too early in its clinical development and MCRB’s medium-term future will depend on commercial success of VOWST. Furthermore, I believe MCRB will likely have to seek for a partner to further advance the program (assuming positive results from the ongoing Phase 1b study) unless VOWST sales improve considerably.

MCRB’s remaining pipeline following the strategic restructuring (Image cut from latest company presentation)

Update on VOWST sales

VOWST was launched in early June. Net sales in Q2 was $1.2M. Net sales in Q3, the 1st full quarter after launch, have increased to $7.6M based on 506 units (i.e. $15K per unit). Total VOWST loss was $12.9M. I remind here that costs and profits from VOWST commercialization are shared 50-50 between Seres Therapeutics and Nestlé Health Science.

Details on the progress of VOWST sales are summarized in the table below. Notable are the following;

- Increasing VOWST sales “exceeding the Company’s forecasted expectations”

- Increasing percentage of patient enrollment forms resulting in new patient starts.

- Increasing percentage of patients starts being reimbursed (vs dispensed by a free drug program). “The use of free drug was mostly due to patient affordability challenges with co-pays or other cost-sharing requirement after the prescription was approved by their insurer”. “The vast majority of patients were able to gain access to VOWST through their insurer”.

| Launch (early June) to July 27 | Q3 | Total (launch to Sep 30) | |

| Prescription enrollment forms | 610 | 1215 | 1513 |

| % of enrollment forms resulting in new patient starts | 46% | 69% | 62% |

| % of new starts reimbursed by health plans | 57% | 61% | 52% |

Of note Seres believes that VOWST can achieve even the highest sales-based milestone threshold which is $750M of sales and would results in milestone payment to MCRB of up to $225M. This, as discussed in my prior coverage, is reasonable assuming insurance coverage of VOWST as an option for 1st CDI recurrence, but overoptimistic in other scenarios (health plans covering VOWST only after failure of cheaper options or for ≥2 CDI recurrences). Notably, so far “majority of utilization for VOWST in the early launch period has been in the multiply recurrent patient group” (percentage of VOWST sales in first vs multiple recurrences was not reported). Thus, sales results so far do not support MCRB’s ambitions. Nevertheless, this is only the 1st full quarter after launch and a major goal of Seres’ and Nestle’s commercialization efforts is to increase utilization of VOWST in 1st CDI recurrences.

On the insurance coverage front

As is obvious from my prior coverage and above paragraph the outlook for MCRB will depend on market penetration of 1st CDI recurrences, which will depend on health insurance plans.

Below are the main info on VOWST coverage from the Q3 conference call;

- “As of September 30, we had received coverage for VOWST across approximately 50% of commercial and 35% of Medicare Part D lives and estimate that the remaining plans will issue coverage policies in the coming quarters”

- “Some coverage policies for VOWST that are quite broad for the approved indication and others with some utilization management restrictions”

- “the vast majority of patients who are prescribed VOWST are able to obtain approval for the product, either through the medical exception process prior to a policy being issued or via a prior authorization”

- “As the first recurrent demand for VOWST builds, we will continue to work with prominent payers to ensure that we preserve the broad patient access to VOWST that we are currently observing.”

To meaningfully sum up the above, it is still uncertain whether Seres and Nestle will achieve sufficient enough VOWST health plan coverage, including 1st CDI recurrences, to achieve target sales. Demand is there, but has to be backed up by favorable insurance policies. Currently, VOWST coverage requires prior authorization. Below are examples of VOWST prior authorization criteria from US health insurers;

- UnitedHealthcare; Requires at least 3 CDI episodes (i.e. at least 2 CDI recurrences)

- Blue Cross Blue Shield of Michigan; No restriction on the number of CDI recurrences or prior therapies.

- Kaiser Permanente; Requires at least 3 CDI episodes

- Centene corp; Requires at least 3 CDI episodes

- PacificSource Community Solutions; Requires at least 3 CDI episodes + documented failure with all other agents (including Rebyota) (a worst case-scenario)

- Various other health plans (1, 2, 3, 4, 5, 6) also currently require at least 3 CDI episodes.

- Some other health plans (1, 2) do not appear to have restrictions

As can be seen, vast majority of plans currently cover VOWST only after at least 3 CDI episodes (i.e. 2nd recurrence). Therefore, Seres and Nestle will have to work with payers to increase patient access to VOWST after 1st CDI recurrence.

Updated outlook for VOWST sales

In my prior coverage I described an extreme worst-case scenario where all first CDI episodes are treated with fidaxomicin (lower recurrence rate vs vancomycin) and VOWST is covered by health plans only as 2nd-line option (i.e. after failure of at least 1 alternative). Based on Q3 update this scenario does not seem to apply. MCRB has reported that majority of requests for VOWST were successfully re-imbursed. Furthermore, based on above-described coverage criteria it seems that VOWST may successfully penetrate multiple-recurrent CDI market as a 1st-line option (i.e. not requiring failure of alternative options).

As described in my prior coverage, at least 300K US patients have a first CDI episode per year. Depending on the treatment received (fidaxomicin vs vancomycin) about 10-25% will have a 1st recurrence (i.e. 30-75K 1st CDI recurrences per year). After a 1st recurrence up to 40-50% will have a 2nd recurrence (i.e. 13-34K 2nd CDI recurrences per year). Considering $15K per VOWST unit this would correspond to a market potential of $195M-$510M per year. Assuming 50% penetration (considering advantages of VOWST over competition) this would correspond to a peak sales potential of $100M-$250M. Seres would share this 50-50 with Nestle, i.e. peak revenue potential for Seres $50M-$125M.

Notably, above estimations only account for US market potential and only for 2nd-recurrences (i.e. not including market potential in patients with >2 recurrences). Obviously, market potential will be much higher if Seres and Nestle can achieve coverage of VOWST for 1st CDI recurrence.

Financial outlook

MCRB reported cash, cash equivalents and investments of $169.9M as of September 30, 2023. Total operating expenses were $47.7M (R&D $28.3M, G&A $20M, collaboration profit sharing $519K). The above-discussed restructuring is expected to result in annual cash savings of approximately $75-$85 million in 2024. Considering these savings and the expected receipt of the $45 million tranche under its existing debt facility, MCRB has guided a cash runaway into Q4 2024.

However, to gain access to the $45M tranche MCRB has to achieve trailing 6-months VOWST net sales of at least $35M no later than September 30, 2024. This is achievable in my opinion. MCRB and Nestle have already achieved net sales of $7.6M (corresponding to $15.2M per 6 months) in the first full quarter after launch. Still, unless VOWST sales improve considerably (which does not seem likely in the short term), it seems MCRB will need to raise cash in 2024.

Risks

Below are the main risks for MCRB;

- The main short/medium-term risk is underwhelming VOWST sales. This would have the following implications; Worst case scenario (which I think is unlikely based on current sales trajectory) VOWST may not reach necessary net sales to allow access to the next loan trance. In a more realistic scenario, VOWST sales may not be good enough to prevent need for dilutive cash raising (which at current prices would be bad for investors).

- Longer-term risks include approval of competing products for prevention of recurrent CDI or approval of new, better (lower recurrence) treatments for CDI. Of note, “in connection with the FDA approval of VOWST, we received seven years of orphan-drug exclusivity, which began on April 26, 2023. During that time, VOWST is entitled to a period of marketing exclusivity, which precludes the FDA or other regulatory authorities from approving another marketing application for the same drug or biologic for the same disease or condition during that time period, except under certain circumstances.”

Conclusion

Risk-reward has improved significantly at current MCRB stock price. However, the risk is still high. Specifically, there is still uncertainty about whether VOWST will be able to penetrate the 1st CDI recurrence market. Currently, majority of sales are in multiply recurrent CDI patients and vast majority of health plans currently cover VOWST only for ≥2 CDI recurrences (despite FDA label for ≥1 CDI recurrence). Recent restructuring has extended cash runaway into at least Q4 2024 (assuming sales increase enough to allow access to the $45M loan tranche) but MCRB will likely have to raise more cash in 2024. The main factor that would change my thesis on MCRB would be coverage of VOWST for 1st CDI recurrence.

Your feedback is appreciated

Please comment below if you have any feedback (negative or positive), if you spot any mistakes or if you believe I missed something important in the article.

Read the full article here

Leave a Reply