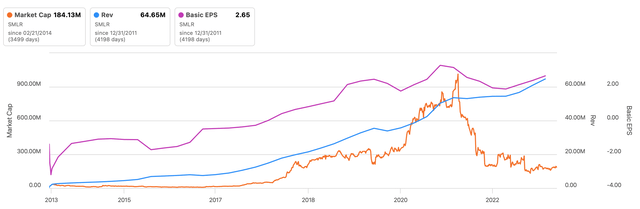

I first stumbled across Semler Scientific (NASDAQ:SMLR) in early 2020, when it was still trading over-the-counter. It struck me as a fast-growing business with a sensible product that had software-like margins–and it was very profitable for its size. Semler looked like a successful turnaround story: after the company lost Nasdaq compliance in 2016 or so, it successfully commercialized its QuantaFlo product and was growing both its top and bottom line by 30%+ annually.

But the stock was priced to perfection when I started researching it. At around $50 per share and a FY2019 EPS of $2.34, it was trading 21x TTM earnings: it wasn’t dirt cheap, it wasn’t absurdly expensive. Then the company uplisted to the Nasdaq, and investor enthusiasm piled in. At the end of October 2021, the stock was bid up to nearly $150 per share!

In hindsight, the 2020-2021 rally didn’t have legs and the market got ahead of itself. The stock was slammed in 2022 when growth came up against tough comps and management cited a new “seasonality” in testing.

When the Centers for Medicare & Medicaid Services (CMS) released the updated 2024 Hierarchical Condition Categories (HCC) codes earlier this Spring, the stock got slammed again. Now, Semler’s stock is trading below where it was during the depths of the pandemic–yet the business is in better shape in nearly all aspects.

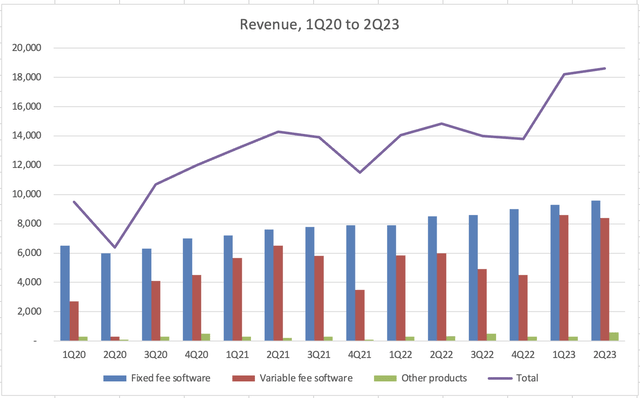

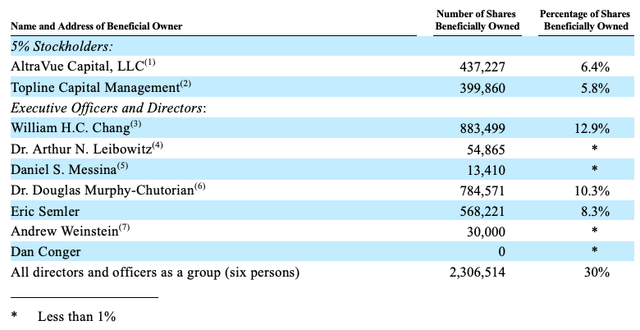

The numbers simply speak for themselves. Semler’s fixed-fee software revenues have grown by 10% YoY for at least the previous 10 quarters and variable-fee revenues have rebounded strongly in the first half of this year. In addition, the company’s strong equipment sales in the first half of this year are a leading indicator of solid future sales growth and should provide reassurance to investors that the HCC code change will not impact Semler’s business as much as previously thought. Last but not least, insider ownership of Semler’s stock is an astonishingly high 30%—and one of its new directors, Eric Semler, disclosed a recent purchase of $2.1 million of stock, around 1.1% of all common shares.

As I will discuss later, there are several yellow flags that may make investors uneasy. However, I am willing to overlook them given the wonderful business and management’s character and track record. I believe an investment in Semler presents a hefty amount of risk, but can provide investors with a commensurate amount of capital appreciation. I am very bullish on the name, and I believe you should be, too.

Seeking Alpha

The Business

Semler Scientific’s business is surprisingly straightforward from a financial point of view. At the moment, nearly the entirety of Semler’s revenue is derived from selling one product: QuantaFlo, which is either sold in a fixed-fee form (where the buyer pays an up-front fee for uncapped uses) or variable-fee form (where a buyer pays per use).

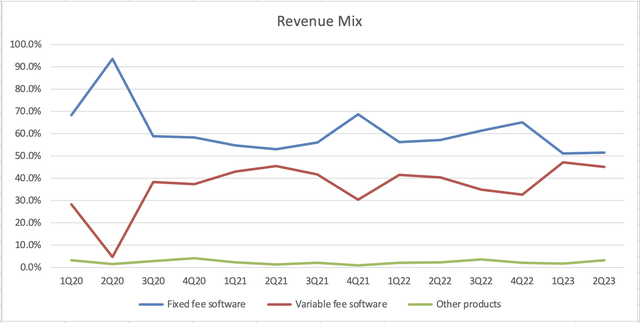

But not every dollar is made the same. From an “earnings quality” perspective, revenue from fixed-fee software sales is more valuable than revenue from variable-fee sales.

SaaS investors like to see the annual recurring revenue (or ARR) figure tick up quarter after quarter. While Semler’s management doesn’t use “ARR” as a term, that’s what the fixed-fee software revenue essentially is. Except Q2 2020 (the depths of the pandemic), fixed-fee revenue has increased every quarter by at least a 10% clip YoY. This is an impressive feat that demonstrates QuantaFlo’s stickiness. Investors should feel relatively safe that fixed-fee revenues are likely to hold, if not continue to increase, in the future.

Author’s Calculations

Sales have been up on an overall upward trajectory since the company went public, but variable-fee revenues have added a lot of noise recently. In the latter half of 2021, Semler began to observe “seasonality” in its variable-fee revenues. Now that more time has passed, it’s evident that in 2021 and 2021, variable-fee revenues in the 2nd half was softer than the 1st half.

The first half of 2023 was excellent: fixed-fee revenues continued to tick to record highs and variable-fee revenue of approximately $8 million per quarter also hit a record high. I would not be surprised if the seasonality trend continues this year and variable-fee revenues in Q3 and Q4 are lower than in Q1 and Q2.

Of course, it’s challenging to predict buyer patterns and habits. Even management was caught off guard when it saw a new trend in seasonality in 2021. This is why I emphasize the importance of the fixed-fee revenues: Semler’s renewal rates are high, so a subscription landed this quarter will likely be there next quarter. In short, variable-fee revenues will be bumpy but keep a close watch on fixed-fee revenues.

Author’s Calculations

Yellow Flag #1: 2024 HCC Codes

Although the company’s financial statements are pristine, I have encountered several yellow flags that have made me take a step back.

First, the 2024 Hierarchical Condition Categories (HCC) codes that were released by the Centers for Medicare & Medicaid Services (CMS) have created uncertainty around to what extent QuantaFlo will be eligible for insurance reimbursement.

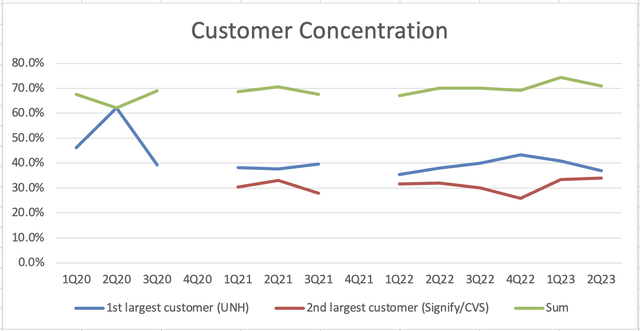

For context, Semler’s two largest customers are UnitedHealth (UNH) and Signify Health (now (CVS)), both of whom operate Medicare Advantage insurance plans. Medicare Advantage is an insurance plan that’s a public-private partnership where the US government pays private insurers to provide coverage to individuals (premiums vary based on pre-existing conditions and other risk factors).

Medicare Advantage providers can bargain for higher premiums if it’s determined that a patient has underlying medical conditions (PAD in Semler’s case). In addition, operators of Medicare Advantage plans have a strong incentive to proactively catch underlying medical conditions before they manifest themselves. The government provides Medicare Advantage operators with a fixed premium; if a patient needs treatment, the bill is placed on the Medicare Advantage provider.

Insurers using QuantaFlo had been using HCC code 108 (“Vascular Disease”) up until now, but the 2024 HCC codes have effectively eliminated HCC code 108. It’s unclear (to me at least) what HCC codes QuantaFlo will be eligible under starting in 2024, but QuantaFlo will likely be eligible for reimbursement under a different HCC code or through some alternative arrangement.

I have conviction in what I said above because Semler’s equipment sales have been very strong in 1H23. On their own, equipment sales make up a minuscule percent of revenue, but they are a forward-looking indicator gauge for demand. This makes sense because the equipment can only be paired with the QuantaFlo software: if you weren’t going to use QuantaFlo (either with a subscription or pay-per-use) then there’s no reason to buy the equipment.

After the equipment is purchased, it becomes a sunk cost. If a buyer doesn’t subsequently use the purchased equipment, it looks like they “wasted” it. Semler’s business model thus plays into human psychology.

Here’s a quote from management in the Q2 2023 earnings call:

“We continue to see strong demand from our home risk assessment customers using QuantaFlo for PAD during in-home examinations. Equipment and other revenues were $600,000, an increase of 128% year-over-year. Because the majority of equipment sales are to variable fee customers, we believe it is a sign of strength in the fee per test market.”

I don’t have an equation that predicts revenue growth given equipment sales, but total equipment sales in 2020 were 1.2 million and revenue grew by 37% in 2021. In 2021, equipment sales were lower, at 900 million, and revenue only grew by 7% in 2022. Equipment sales in 2022 were $1.4 million, and there was start revenue in both Q1 (30% YoY) and Q2 (25% YoY). As mentioned earlier, the first half of 2023 is off to a promising start, with $900 million in equipment sales already.

When the proposed HCC codes were released by the CMS in February, the stock was cut by nearly 50% in one day. The finalized version of the 2024 HCC code was released in April, and affirmed the February proposal. In hindsight, I think the drop in stock price was a massive overreaction—Semler’s value proposition is the same with or without HCC 108.

Yellow Flag #2: Patent Cliff

Medtech and biotech investors know that patents provide the strongest source of IP protection—until they expire. Back in 2020, it seemed like QuantaFlo’s patent cliff (December 11, 2027) was a long way out. But now that we’re nearing the end of 2023, the patent cliff feels imminent.

In the past, Semler has also funded/profiled in several large-scale peer-reviewed studies (including two this year) that showed its efficacy. I did not touch on it here, but QuantaFlo’s usage is extremely simple and convenient for patients. A medical staff simply needs to attach a clip to a patient’s finger(s) and toe(s) for 5 mins and wait for the results.

Given that QuantaFlo has been proven to be effective and is logistically simple to administer, I believe its installed base with UnitedHealth and Signify Health is likely to remain even after the patent cliff in 2026.

Meanwhile, Semler is trying to grow out of being a one-trick pony. In the Annual Reports, the company states its mission is to create products that “assist our customers in evaluating and treating chronic diseases”—its mission statement is much broader than simply developing a product for early diagnosis of PAD.

To this point, in the Q2 earnings call, Semler announced it would be leveraging the QuantaFlo technology that was originally designed for peripheral arterial disease (PAD) for heart dysfunction (HD) as well. Collectively, it looks like management has rebranded QuantaFlo as a tool that can be used to evaluate a

“patient’s risk of mortality and major adverse cardiovascular events (MACE)”. I’m under the impression that moving forward, QuantaFlo will be used as an umbrella term for both QuantaFlo HD and QuantaFlo PAD.

What Semler is doing with QuantaFlo HD reminds me of the playbook used by (VRTX). The simplified version of the VRTX story is they originally got FDA approval in 2012 for Kalydeco (ivacaftor is the generic name) to treat the underlying cause of cystic fibrosis. Then, VRTX created various modifications of ivacaftor which provided better outcomes for specific groups of cystic fibrosis patients. Notably, Kaftrio and Symkevi are both treatments that are Kalydeco (ivacaftor) in combination with another drug. VRTX piggybacked on the success of one revolutionary drug (Kalydeco) and turned it into a family of blockbuster treatments.

Of course, it’s still early days for QuantaFlo HD and it will take time for the product to ramp up. Management in the Q2 earnings call said QuantaFlo HD is “generating cash now, but it’s not as meaningful revenue as we hoped to have.” Nonetheless, the QuantaFlo HD development is positive.

Also, let’s not forget about Semler Scientific’s agreement with Mellitus Health and Monarch Medical Technologies. With Mellitus, Semler has an exclusive agreement to market and distribute the FDA-cleared Insulin Insights™ software product that “recommends optimal insulin dosing for diabetic patients”. Semler invested in Monarch, whose EndoTool® product focuses on inpatient glycemic management.

In sum, QuantaFlo has the potential to follow in the shadow of VRTX but management also has other irons in the fire with Mellitus and Monarch. I’m personally in the “wait and see” camp vis-a-vis QuantaFlo’s patent cliff.

High Insider Ownership and a Recent Buy

Semler has extremely high insider ownership. Executive officers and directors own 30% of Semler’s common stock. It is increasingly rare to see such high insider ownership, especially in medtech companies because they often require large capital raises to fund ongoing expenses. The high level of insider ownership, in addition to the 12% owned by two “smart money” institutional investors, should give investors relief that they are investing alongside people who have better insights into the company.

Definitive Proxy Statement (DEF 14A)

What’s more, Eric Semler and Will Chang both joined Semler’s Board of Directors in Q2 2023. Eric Semler is far from a no-name though. Eric Semler is the founder and president of TCS Capital Management, a long/short investment fund that he founded in 2001 and converted into a family office in 2017. Many stock market watchers probably know famous activist funds such as Third Point, Elliott Management, or Trian Partners. TCS Capital Management may not be as well known, but has been around the activism block. Most recently, TCS Capital Management has pushed (YELP) to sell itself or seek a merger with (ANGI) (fka Angie’s List).

It is unclear (at least to me) if there’s a connection between Eric Semler and Herbert Semler (founder and the Chairman when Semler first went public). Given the age gap, it’s plausible Eric is Herbert’s son, but Eric may also be the nephew or cousin. To be honest, I prefer not to see family members appointed for management positions, but it’s more acceptable for board positions. Nonetheless, Eric Semler’s expertise in capital allocation and corporate governance means him joining is a major plus for the company.

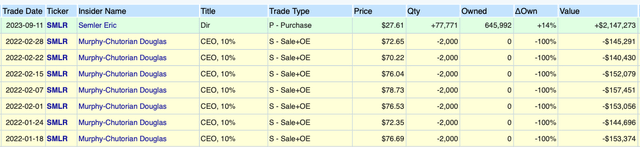

Open Insider

I would be remiss not to mention Eric Semler purchased $2.1 million of shares in a SEC filing disclosed on September 11, 2023.

This is the first insider activity since early 2022. (It should be noted that CEO Doug Murphy-Chutorian’s sales in early 2022 were customary options exercises followed by sales. His beneficial ownership didn’t change because he simply exercised options issued by Semler at the strike price, sold at the market price, and pocketed the spread. Still, CEO Doug Murphy-Chutorian’s ownership is nearly 800k shares; he still has a very large long position in the stock.)

Peter Lynch has this famous quote: “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.” Of course, $2.1 million for Eric Semler is probably not a substantial portion of his net worth, but it’s a positive sign anyway.

Conclusion

After several years of following the company, I have noticed management tends to “say less, do more.” Typically, they will only announce what they did and not provide insights on future moves. For example, I was surprised when the partnership and investment in Mellitus and Monarch, respectively, were announced. I personally did not remember management discussing venturing into non-QuantaFlo segments.

While I would prefer management be more transparent about future plans, I also have faith that management’s moves are correct. Not only do they have strong economic incentives, but management and the Board of Directors are stacked with medical professionals and subject matter experts. I have high conviction that Semler is in good hands, especially considering they commercialized QuantaFlo from scratch.

Investors should expect the current management team to run Semler for the foreseeable future. It’s unlikely the company will be sold, as management seems eager to continue running the ship. There’s also no chance of activist investors stepping in. From the outside, it is conceivable an activist investor may be interested in Semler given the stock now trading at prices below its pandemic lows and the business is in good shape. However, with Eric Semler’s background and knowledge in activism, and the generally closely held nature of Semler’s stock, it is unlikely activists will want to enter an uphill battle.

That said, it will be interesting to monitor the outcome of Semler Scientific’s 2023 Annual Meeting that’s scheduled for October 19, 2023. Both the business landscape and the stock price have changed quite a bit in this past year.

Before we close, I want to be clear that risks abound with an investment in Semler. Customer concentration is still very high and that’s unlikely to change. The new HCC codes provide an uncertain backdrop for reimbursement next year, but at least strong equipment sales provide a counterbalance.

Author’s Calculations

All in all, though, I would urge investors to compare the business performance and the stock’s market cap over time (see the beginning of the article). There’s a disconnect. If Semler can continue to grow QuantaFlo sales (and secondarily introduce new products), the valuation gap will close to the benefit of investors who are patient.

For investors who have an above-average risk tolerance, Semler Scientific presents an attractive opportunity to earn above-average returns.

Read the full article here

Leave a Reply