The way that I view performance might be different from the way that many others do in the market. Performance typically refers to absolute performance, as in upside or downside. If your portfolio is up 10% in a year, you would probably be quite happy. And if it’s down 10%, you would probably be very unhappy. I do look at investing in that light, but I also look at it relative to the broader market. If the market is down 1% for the day, and my portfolio is down half of that, I am quite happy with the results. If the market is up 20% for the year and I am up only 10%, I am unhappy because to continue to underperform the market means that I would be better off placing my money in an index fund and allocating my time elsewhere.

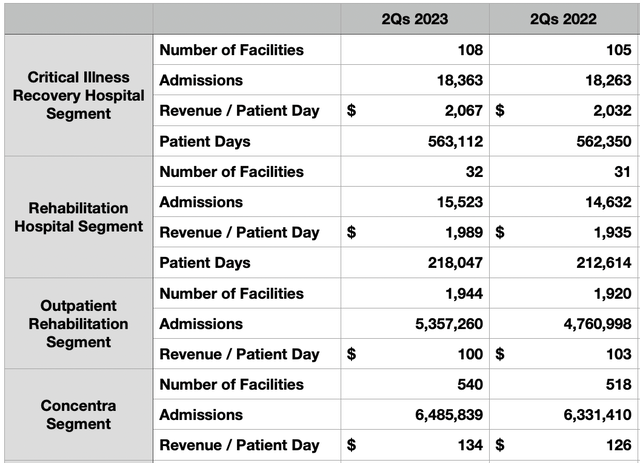

One company that has not done as well as I have hoped it would, but that is proving to be successful by my own view of what constitutes good performance, is Select Medical Holdings (NYSE:SEM). For those not aware of the company, it is one of the largest operators of critical illness recovery centers, rehabilitation hospitals, outpatient rehabilitation clinics, and occupational health centers in the nation. As of the end of the most recent quarter, the company has 108 critical illness recovery hospitals spread across 28 states, 32 rehabilitation hospitals in 12 states, 1,944 outpatient rehabilitation clinics in 39 states plus the District of Columbia, 540 occupational health centers spread across 41 states, and 141 onsite clinics at miscellaneous employer worksites. All in all, it operates in 46 States and the District of Columbia.

Well over a year ago now, in early April of 2022, I wrote a bullish article about the company. In that article, I called it a ‘great play on the medical space’. I found myself impressed with the company’s track record. I did acknowledge that it was likely to face margin pressures during that year but that shares were still cheap enough to warrant upside. As a result, I ended up rating the company a ‘buy’ to reflect my view at the time that shares should outperform the broader market for the foreseeable future. While I would have loved to see the stock actually increase since then, it has outperformed the market. Shares have seen downside of 1.4% at a time when the S&P 500 is down 7.1%. While the market has spoken so far, I am surprised that its fundamental performance has not pushed shares higher. But the good news is that, with earnings just around the corner, there is a chance that the market might finally wake up and see the high quality that this business offers for the low price that it’s trading for.

Strong performance should be rewarded

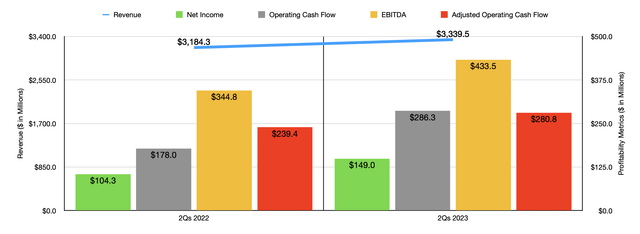

If we focus mostly on the financial performance achieved by Select Medical Holdings for this year, the picture looks very positive. Let’s take revenue as a starting point. During the first half of the year, sales for the company came in at $3.34 billion. That’s 4.9% higher than the $3.18 billion the company generated one year earlier. This strength was generated across the board. The largest part of the company is its Critical Illness Recovery Hospital operations which, in the first half of the year, generated $1.17 billion. That’s 1.9% above the $1.15 billion generated one year earlier. But this was actually the slowest growing part of the enterprise. The Rehabilitation Hospital segment outperforms this, growing by 5.1% year over year. Even more impressive was the 6.8% increase seen by Concentra. But the fastest growing of its four key operating segments was the Outpatient Rehabilitation unit. Sales there spiked 7.1%.

Author – SEC EDGAR Data

There are multiple data points for each of these segments that explains why revenue increased. But it really does boil down to three things. The first would be an increase in the number of facilities. The second involves higher revenue per patient per day (in three of the four segments). And the third centers around the number of visits made to its locations. So that we don’t need to go through every one of these line by line for four different segments, I would just refer you to the table below. In it, you can see all three of these metrics for each of the four operating segments.

Author – SEC EDGAR Data

With the increase in revenue for the company came higher profits as well. Net income shot up from $104.3 million to $149 million. In addition to benefiting from an increase in sales, the company also saw its cost of services, excluding depreciation and amortization, drop from 87.9% of revenue to 85.1%. Although this may not seem like much, when applied to the revenue generated during the first half of 2023, that’s an extra $93.5 million on the company’s bottom line on a pretax basis. Management attributed this improvement mostly to a decline in labor costs within its Critical Illness Recovery Hospital segment.

What’s really great here is that this is likely a permanent improvement for the company. I say this because management claimed that the lower labor costs resulted from the company’s decision, in 2022, to hire additional full-time nursing staff, work on improving employee retention, and decrease its reliance on contract labor. So in short, the company went from trying to use a lot of contract labor to using less of it in favor of utilizing full-time workers. This almost certainly stemmed from painful experiences seen during the height of the COVID-19 pandemic when many medical facilities were short-staffed. I personally know one doctor in the internal medicine space that worked contract labor during parts of the pandemic. And the effective hourly pay of many of these contracts was in excess of $300 per hour. That would be more than double that doctor’s pay as a full time, salaried employee.

If only it weren’t for other cost increases, such as interest expense climbing from $76.6 million to $97.6 million, and income tax expense growing from $37.8 million to $55 million, profits would have improved even further. Other profitability metrics followed a similar trajectory. Operating cash flow, for instance, increased from $178 million to $286.3 million. If we adjust for changes in working capital, we get a rise from $239.4 million to $280.8 million. And finally, EBITDA for the company grew from $344.8 million to $433.5 million.

When it comes to the 2023 fiscal year in its entirety, management is expecting revenue of between $6.55 billion and $6.70 billion. That would be a nice increase over the $6.33 billion generated in 2022. Adjusted earnings per share should range between $1.86 and $2.03, with a midpoint of guidance translating to net profits of $247.6 million. And EBITDA is expected to come in at between $795 million and $825 million. At the midpoint, that should result in an adjusted operating cash flow of approximately $556.4 million.

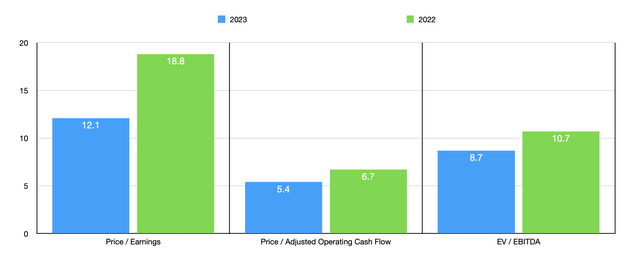

Author – SEC EDGAR Data

Using these figures, I was able to value the company on a forward basis and value it using data from 2022. The results can be seen in the chart above. The stock definitely looks fundamentally attractive on an absolute basis. And relative to similar firms, it is a bit on the cheap side. To see this, we need only look at the table below. On a price to earnings basis, only two of the five firms were cheaper than Select Medical Holdings. When it comes to the price to operating cash flow approach, this number drops to one, while using the EV to EBITDA approach, we see that three of the five are cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Select Medical Holdings Corporation | 12.1 | 5.4 | 8.7 |

| HCA Healthcare (HCA) | 11.9 | 7.0 | 7.8 |

| Tenet Healthcare (THC) | 12.0 | 3.3 | 7.3 |

| Acadia Healthcare (ACHC) | 25.3 | 18.9 | 14.6 |

| Universal Health Services (UHS) | 13.0 | 7.7 | 8.1 |

| The Ensign Group (ENSG) | 22.7 | 17.6 | 13.3 |

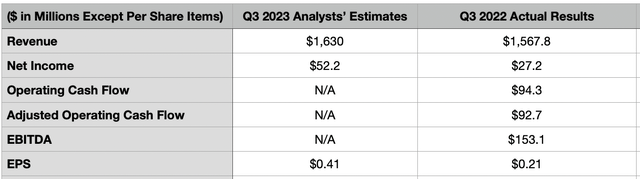

Of course, this picture can always change. On November 2nd, management is expected to announce financial results covering the third quarter of the company’s 2023 fiscal year. Leading up to that time, analysts anticipate revenue of $1.63 billion. If that comes to fruition, it would represent a 4% increase over the $1.57 billion generated one year earlier. Earnings per share, meanwhile, are expected to total $0.41, which would be nearly double the $0.21 in profits generated the same time in 2022. This would mean net income rising from $27.2 million to $52.2 million. Estimates were not given when it came to other profitability metrics. But investors should be aware of those as earnings approach. Operating cash flow in the third quarter of last year was $94.3 million. On an adjusted basis, it was a bit lower at $92.7 million. And finally, EBITDA for the company came in at $153.1 million.

Author – SEC EDGAR Data

Takeaway

From all the data I see today, I remain perplexed as to why the market continues to shortchange Select Medical Holdings. I am happy that shares are outperforming the broader market and I expect that trend to continue. But it would be nice to see the stock actually increased. We do know already that the company has a positive catalyst for next year. For instance, Medicare reimbursement for long-term hospital care is expected to see an increase of 3.6% while the fixed loss amount for high-cost outlier cases is expected to grow by 10.2%. And for inpatient rehabilitation facility services, Medicare reimbursement is also expected to grow by 3.6% year over year. Add on top of this how cheap shares already are and the favorable guidance for this year, and I have no reason to be anything other than bullish still.

Read the full article here

Leave a Reply