Investing in floating-rate senior loans tends not to get much attention in the analyst world, but this is a part of the marketplace that’s worth paying attention to, not their income potential and relative safety. One fund that, I think, does this well is the Virtus Seix Senior Loan ETF (NYSEARCA:SEIX).

SEIX is an actively managed exchange-traded fund (“ETF”) that primarily invests in senior-secured, floating-rate leveraged loans. These investments aim to generate high levels of current income. The fund’s investment strategy is based on fundamental research that targets the strongest and most undervalued credits in the market. This approach is designed to capture potential upside while limiting downside risk.

SEIX Holdings: A Closer Look

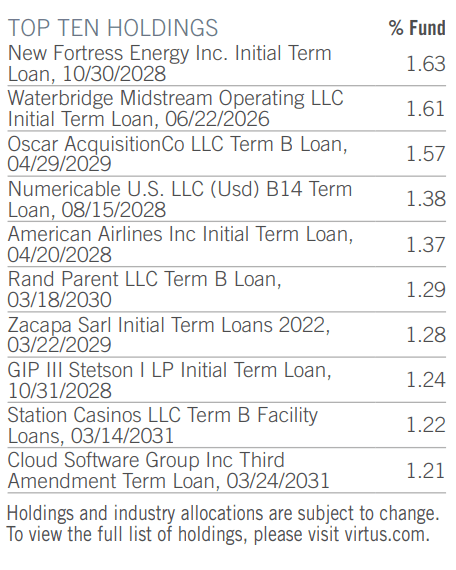

The SEIX portfolio is well-diversified, with investments spread across over 140 different loans and securities. No position makes up more than 1.62% of the fund, helping to spread out any credit risk from an individual issuer.

virtus.com

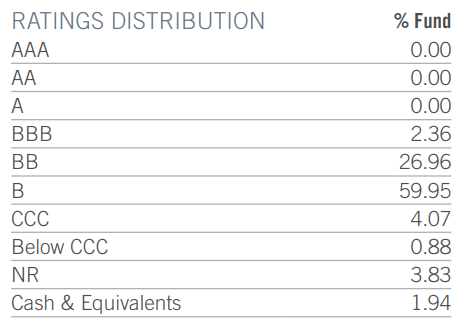

When we look at the ratings, this is primarily a BB and B fund, with B rated issues making up nearly 60% of the holdings. This could be a problem down the line should credit spreads widen and default risk get more aggressively priced in. Currently, it’s not an issue, but can certainly become one should a risk-off period take hold.

virtus.com

Sector Composition and Weightings

SEIX’s portfolio is spread across several sectors, with the largest exposure to information technology, financials, aerospace/defense/airlines, services/environmental/other, and telecom excluding wireless.

The sector weightings, as of the end of the first quarter of 2024, are as follows:

- Information Technology: 11.20%

- Financial: 10.12%

- Aerospace/Defense/Airlines: 8.77%

- Services/Environmental/Other: 8.13%

- Telecom Ex Wireless: 6.31%.

These weightings reflect the fund’s strategic approach to balancing risk and reward across different sectors, aiming to capture the most promising investment opportunities while keeping risk at manageable levels. I actually like that tech and financials have roughly the same overall weight, as these two parts of the marketplace tend to straddle the growth and value styles respectively.

Peer Comparison

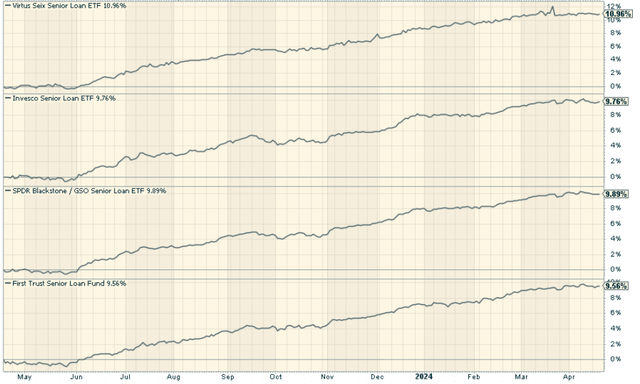

A comparison with other similar ETFs reveals that SEIX stands out due to its superior historical performance and higher yield. Compared to the Invesco Senior Loan ETF (BKLN), the SPDR Blackstone Senior Loan ETF (SRLN), and the First Trust Senior Loan Fund (FTSL), SEIX has consistently delivered better absolute returns with less volatility.

stockcharts.com

Additionally, SEIX’s net expense ratio of 0.62% is in line with the senior loan average and is considered reasonable compared to other senior loan funds. These factors make SEIX a compelling choice for investors looking for robust performance and reasonable costs.

The Pros and Cons of Investing in the Theme the ETF Tracks

Investing in senior loan ETFs like SEIX offers several advantages. First, such ETFs typically offer higher income potential due to the high-yield nature of leveraged loans. The current 30-day SEC Yield is a whopping 9.35%. Secondly, because these loans are senior and secured, they have a higher claim on the issuer’s assets in case of default, which provides a degree of protection to investors.

However, these advantages come with certain risks. The credit risk associated with leveraged loans is higher than with investment-grade bonds. Also, while senior loans provide potential protection in a rising interest rate environment, they can underperform in a falling or low-interest-rate environment.

Conclusion: Should You Invest in SEIX?

Investing in Virtus Seix Senior Loan ETF is worth considering so long as credit spreads stay contained. The fund’s strong historical performance, higher yield, and reasonable expense ratio, combined with the potential benefits of investing in senior loans, make it a compelling option.

However, as with any investment, it’s crucial to consider its inherent risks. The credit risk associated with leveraged loans, the potential underperformance in a low-interest-rate environment, and the fund’s sensitivity to economic and market conditions can impact its performance.

Overall, I view this as a good fund for those looking for income alternatives that can benefit from a higher for longer environment. Just be aware that things can change quickly if volatility in markets asserts.

Read the full article here

Leave a Reply