Since we wrote our previous analysis with a buy rating due to positive sign/momentum in Furoscix’s early sales ramp, several additional catalysts have emerged post-Q2 earnings that solidified our bullish view on the stock, which we will focus on during this article.

Furoscix’s Positive FDA Feedback for CKD Label Expansion

We believe the recent positive feedback from the FDA concerning scPharma’s Furoscix label expansion into chronic kidney disease (CKD) signals a propitious trajectory for the product. We highlight that the key findings from the Type D meeting with the FDA highlight that no additional clinical studies are necessary for the CKD label expansion. This decision is based on the adequate PK/PD bridge data to the reference drug. Considering that volume overload is common in both heart failure (HF) and CKD, Furoscix stands in an advantageous position to address the significant unmet medical need in the CKD realm. With an estimated 12-15 million CKD patients in the US, the market potential for Furoscix is vast, adding potential upside value beyond its ongoing heart failure applications.

Attractive Market Potential of Higher Concentration Auto-Injector Formulation

Following the Type C meeting with the FDA, scPharma is poised to introduce a higher concentration auto-injector formulation of Furoscix. FDA has provided insights from a Type C meeting about developing an 80mg/1mL auto-injector designed as an alternative to the on-body infusor, aiming to treat congestion from fluid overload in specific adult patients. Importantly, the FDA indicated that no extra clinical trials are needed, provided that an adequate bridge to the furosemide injection. We highlight that CKD often leads to fluid overload managed by loop diuretics, and the commercial synergy with the current indication is highly attractive.

Regarding the timeline, results from a crucial pharmacokinetic study are anticipated by the first half of 2024, and the company plans to submit a Supplemental New Drug Application by YE 2024. We believe this pivot in delivery could offer multiple benefits, from reducing manufacturing costs to enhancing patient convenience compared to the current on-body infusor device.

Net-net, the developments in the auto-injector segment, coupled with the potential rapidity of the approval process, amplify the promising horizon for Furoscix, and we believe the new auto-injector launch could be a meaningful catalyst that can drive further adoption of the product as we have seen with Repatha’s (PCSK9i MaB) launch trajectory (on-body infusor has helped its sales ramp meaningfully).

Positive Q2 Earnings: Momentum in Furoscix Sales

scPharma’s Q2 earnings results offer an encouraging snapshot of Furoscix’s market momentum. The financials align with consensus estimates, with net sales approximating $1.6 million. Furthermore, during the earnings call, the management highlighted continued demand for Furoscix, reinforced by physicians’ and patients’ positive feedback. Considerable growth is seen in total and unique prescribers, implying a widespread recognition of Furoscix’s potential in alleviating hospital admissions related to decompensated heart failure.

We find the company’s current cash holdings of USD104 million highly assuring, especially considering that the company’s quarterly cash burn of only ~USD11m). We expect the company to expand its sales force further, as emphasized by the management, and ramp to accelerate in 2H’23 and 2024. As FY2024 is anticipated to be an inflection year with improved market access and reimbursement, we believe the current trajectory of net sales growth suggests a bright future for Furoscix, especially with the recent sell-off in the company’s stock; any positive sales beat should lead to a meaningful jump in the stock price.

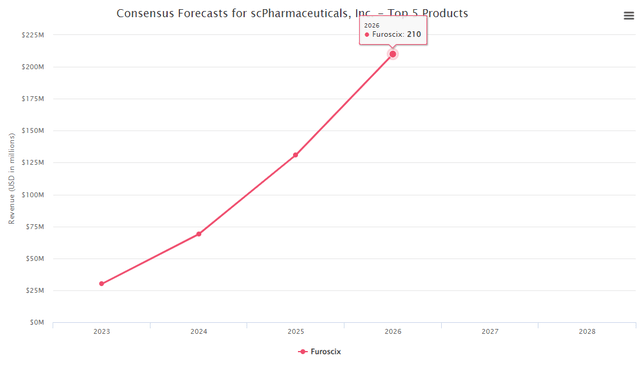

Furoscix consensus

BMed tracker database broker consensus (BMED tracker)

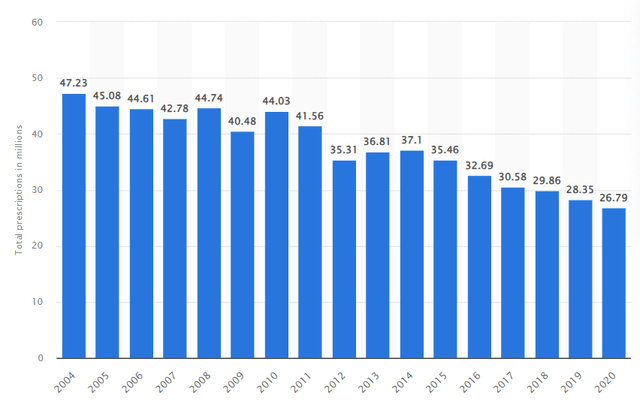

Just using Furosemide’s 2020 prescription numbers, which would be around $26M even if Furoscix captures 1% of it, it should be around 0.26M prescriptions. That should lead to close to $780m in sales using 3k per patient. We see Furoscix’s market opportunity as highly compelling and believe the consensus peak sales to be underestimating the drug’s potential.

Statista Furosemide prescription (Statista)

Risk

While the outlook is largely positive, potential investors should be cognizant of some risk factors associated with SCPH. Firstly, there’s inherent unpredictability in the pharmaceutical sector concerning regulatory approvals, which might affect the projected timelines. Secondly, while the uptake of Furoscix may increase, visibility into its prescription within integrated delivery networks (IDNs) could be limited. This could result in potential discrepancies between reported prescriptions and actual net sales. Lastly, competition within the CKD and HF markets is intense. Any advancements by competitors could impact SCPH’s market share.

Conclusion

In conclusion, we maintain a ‘buy’ rating on SCPH. SC Pharmaceutical’s lead product, Furoscix, with its promising label expansion into CKD and the anticipated release of a higher concentration auto-injector, is poised for significant market impact and a tailwind for its sales ramp moving into 2024-2025. Furthermore, the positive Q2 earnings results further substantiate this growth potential of the product, and we believe earnings beat next year with improved market access should add a positive tailwind for the company’s stock price. We see YE 2023 as an excellent time for long-term investors to establish a position on the stock.

Read the full article here

Leave a Reply