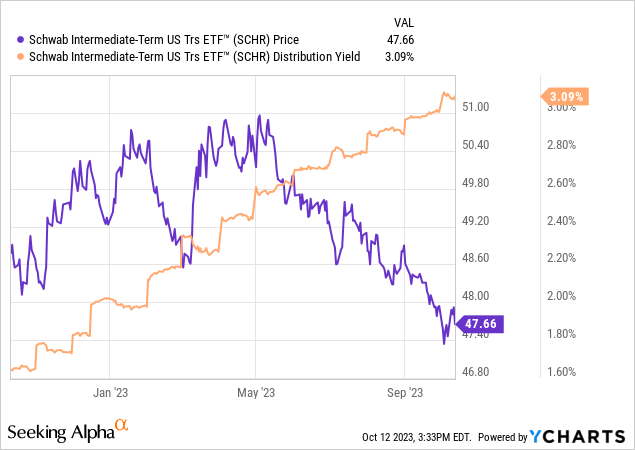

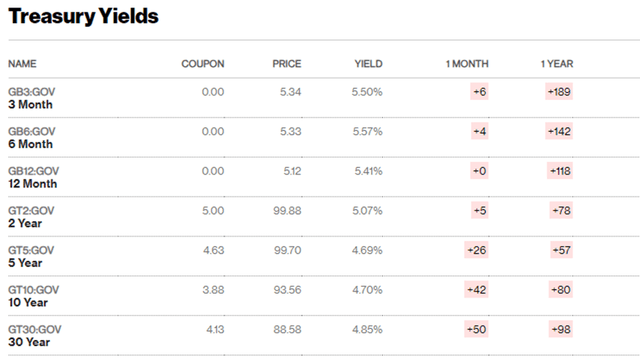

Borrowing costs in the US are now at their highest levels since the pre-financial crisis. However, rates don’t seem all that stretched given the current backdrop of persistently higher deficits and ‘sticky’ core inflation. Plus, the curve still builds in some rather optimistic rate cut assumptions next year. Thus, picking your spots in the yield curve is essential; the still inverted (but rapidly normalizing) curve means the front end (i.e., Treasury bills) remains the best vehicle to park excess cash, in my view (see recent coverage of the SPDR Bloomberg 3-12 Month T-Bill ETF (BILS) here). Going beyond the 12-month bill entails less compensation for more duration exposure, which is hardly an ideal risk/reward. Ahead of the Q4 refunding (more supply) and November’s policy meeting (more tightening), ETFs targeting the belly of the curve, including the low-cost Schwab Intermediate-Term U.S. Treasury ETF (NYSEARCA:SCHR), remain exposed to more downside.

Lowest Cost Exposure to the Belly of the Treasury Curve

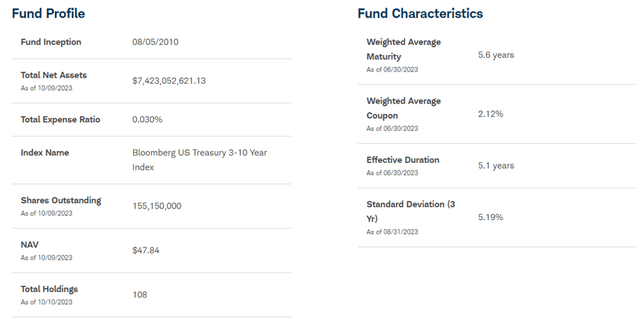

The Schwab Intermediate-Term U.S. Treasury ETF seeks to track, before fees and expenses, the performance of the Bloomberg US Treasury 3-10 Year Index, a basket of USD-denominated Treasury securities within the three to ten-year maturity range. The ETF had ~$7.4bn of assets under management at the time of writing and charged a 0.03% expense ratio, below comparable passive ETFs like the Vanguard Intermediate-Term Treasury ETF (VGIT) (0.04%) and the JPMorgan BetaBuilders U.S. Treasury Bond 3-10 Year ETF (BBIB) (0.07%).

Schwab

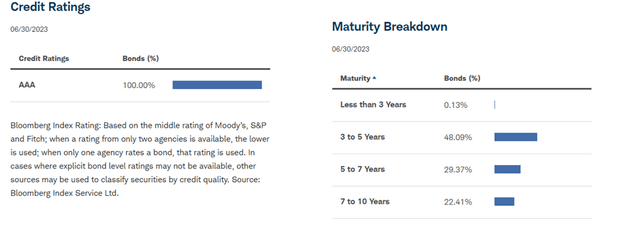

The fund is spread across 108 Treasury holdings, with a weighted average portfolio maturity of 5.6 years and an average yield to maturity of 4.1%. Per its latest disclosures, the specific maturity profile skews toward the three to five-year range (48.1%), followed by five to seven years (29.4%) and seven to ten years (22.4%). VGIT and BBIB offer slightly higher yields at 4.3% and 4.2% for a similar duration profile, respectively. As the fund targets the curve belly (effective duration of 5.1 years), SCHR sits between Treasury bills and longer-duration Treasury bond funds in terms of its sensitivity to interest rate fluctuations.

Schwab

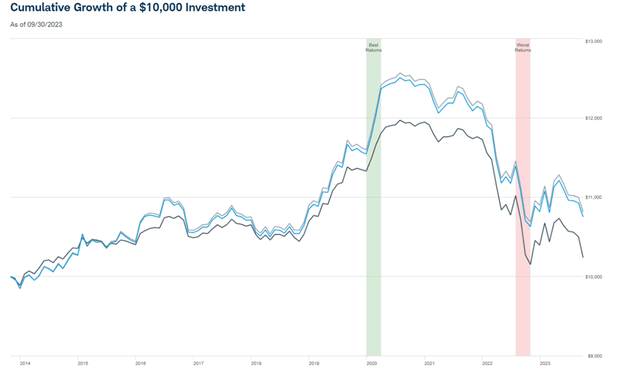

In line with other intermediate-term Treasury bond funds, SCHR has suffered a slight drawdown at -0.6% (NAV and market price terms) this year. Zooming out, the fund’s return profile hasn’t been great either, at -4.8% and +0.4% over the last three and five years due to the Fed’s steep rate hikes post-COVID. In general, SCHR sits between the ‘wings’ of the curve, which means it lags both the front and long end in terms of upside/downside. While the currently inverted yield curve skews the risk/reward in favor of the front end, the two and five-year yield premium to the ten-year means investors are better compensated for duration in the belly (vs. the long end); in essence, SCHR makes a lot of sense as a vehicle for directional rate bets here.

Schwab

Economic Data Points to More Tightening

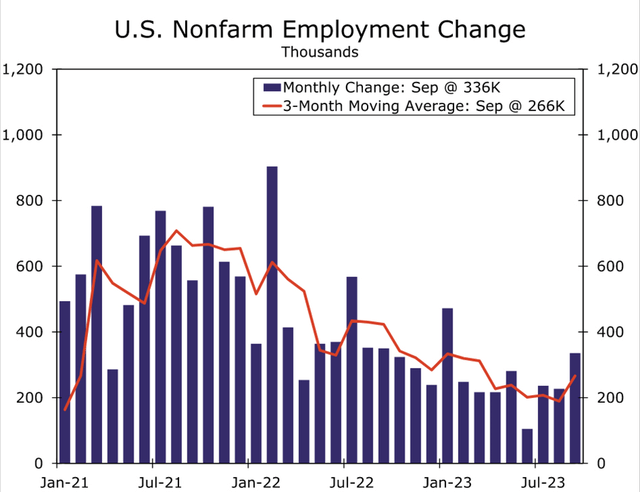

Recent jobs data has reignited fears of more hikes on the horizon – alongside the blowout non-farm payrolls this month (+336k and well ahead of consensus), prior months’ jobs numbers were also revised higher.

Doves will point to average hourly earnings decelerating to 4.2% YoY (well below the ~6% peak last year) and the higher unemployment rate as evidence of labor supply tailwinds. Yet, headline consumer inflation just printed higher than estimates at +3.7% YoY, while core inflation remains at an elevated +4.1% YoY.

Wells Fargo

Growth isn’t slowing either – GDP could well hit +5% in Q3, helped by a resilient consumer, accommodative fiscal policy, and termed-out debt funding (particularly mortgage rates). Higher oil prices could weigh on growth somewhat, but the bigger impact will likely be higher near-term inflation. Hence, the Fed holding firm on its hawkish bias (“current inflation remained unacceptably high” per the latest FOMC minutes) likely means another hike may still be on the cards this year. This will, in turn, take terminal rates higher and punish longer-duration bonds.

Curve Belly isn’t Immune from Higher Term Premia

Term premia has risen across the Treasury curve in recent weeks. But I’d argue the move is nowhere near fully played out – at ~4.7% for the five and ten-year maturities vs. a 5.25%-5.5% range for the Fed Funds rate, markets are still pricing in excessive cuts from here. Even if inflation normalizes to the 2% target at a relatively benign 2% real policy rate, adding an in-line 50-100bps term premium would imply terminal yields running in line to slightly ahead of current levels. This doesn’t yet account for the unique circumstances we see today around sustained mid to high-single-digit % budget deficits and a below triple-AAA credit rating (post-Fitch downgrade), both of which would entail investors demanding more compensation to hold US debt.

Bloomberg

Intermediate-term maturities may be relatively less exposed to these risks in the mid to long term, but we likely haven’t seen yields hit their ceiling at the current ~4.7% at the curve belly. And as the curve continues to normalize, intermediate-term Treasuries likely won’t be spared. Hence, investors looking for a balance of income, diversification, and capital preservation in the face of geopolitical uncertainty are better off at the front end, in my view, where yields are already running >5%.

Fade Intermediate-Term Treasuries

At least in the near term, as the FOMC minutes show, higher policy rates are here to stay. Growth hasn’t faltered either, while employment numbers remain too resilient for a pivot anytime soon – in contrast to implied market expectations for multiple Fed rate cuts next year. In the mid to long-term, concerns about government deficit funding and a pending normalization in the term premium haven’t been resolved either. The latter could add 50-100bps (based on pre-financial crisis precedent) of term premia, even if we revert to neutral policy rates and target inflation; hence, I wouldn’t underwrite a reversal for Treasury bonds just yet – even in lower duration/higher yielding curve belly ETFs like SCHR. Given the superior balance of principal protection and yields at the front end, I still see T-bill ETFs like BILS as the best risk/reward play at this juncture.

Read the full article here

Leave a Reply