In a recent article, I updated my family’s target portfolio plan for our $2.5 million family charity hedge fund.

At the moment, I wouldn’t buy Schwab U.S. Large-Cap Growth ETF™ (SCHG) because big tech is still overvalued (by 13% historically).

I replaced Vanguard Dividend Appreciation Index Fund ETF Shares (NYSEARCA:VIG) with Schwab U.S. Dividend Equity ETF™ (NYSEARCA:SCHD) as my only core exchange-traded fund, or ETF, in that article.

Let me show you why I did that. Not because Vanguard Dividend Appreciation Index Fund ETF is a bad ETF. But simply because Schwab’s US Dividend Equity ETF is a hands down much better buy right now.

Reason One: SCHD’s Strategy Is Just Better

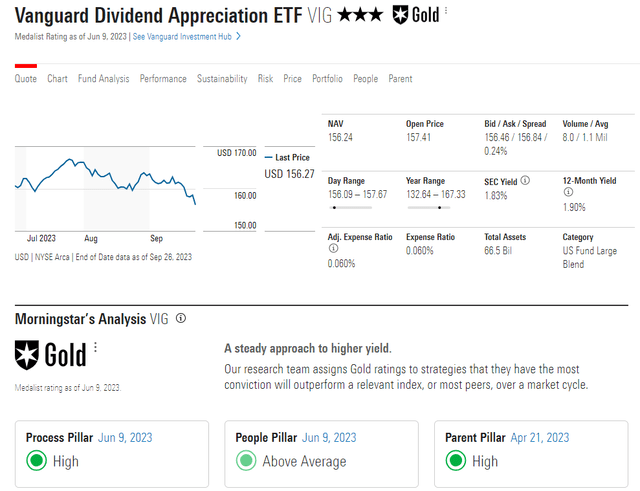

Morningstar

VIG is a gold-star-rated ETF, which means Morningstar’s analysts are extremely confident that it will outperform its peers in the future.

To be eligible for a Gold, Silver, or Bronze rating, we must expect an active strategy to have a high likelihood of generating positive alpha after fees. Of those, we award Gold ratings to the top 15% of active vehicles within their Morningstar Category, Silver ratings to the next 35%, and Bronze to the remaining 50%.” – Morningstar (emphasis added).

Morningstar considers VIG in the top 15% of large-cap funds. So why the 3-star rating?

Star ratings are assigned based on a weighted 3, 5, and 10-year return vs. peers.

-

Top 10% five stars (90th percentile or better)

-

Next 22.5% four stars (77.5% to 89.9th percentile)

-

Middle 35% three stars (65% to 77.4th percentile)

-

Next 22.5% two stars (22.5% to 64.9th percentile)

-

Bottom 10% one stars (10th percentile or worse).

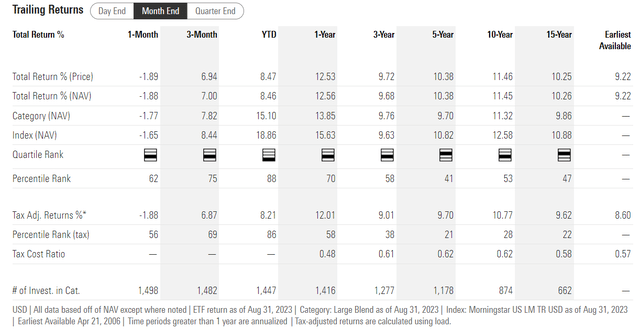

Morningstar

Over the last 3, 5, and 10 years, VIG has ranged from the bottom 42% of large-cap funds to the top 59%.

If you factor in taxes, which average 0.57% annually, VIG’s long-term percentile rank climbs to the top 22% of peers.

So if Morningstar used tax-adjusted returns, VIG would be 4-star rated and among the best dividend funds on earth.

Since its inception in 2006, VIG has delivered solid 9.2% annual returns, or 8.6% after taxes.

- 307% after-tax return over 17 years

- 197% after-tax inflation-adjusted return.

Vanguard charges just 0.06% per year for this ETF, or $6 per year per $10,000 investment.

Imagine owning $10,000 worth of the world’s premier Ultra Sleep Well At Night dividend blue-chips and paying just $0.50 monthly in management fees.

- $5 per month to manage $100K

- $50 per month to manage $1 million

- $50,000 per month to manage $1 billion.

But while VIG is impressive, SCHD is just outstanding.

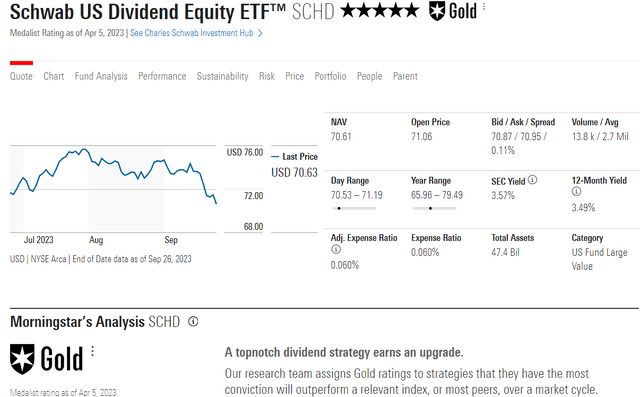

Morningstar

A 5-star gold rating means an ETF is kind of like Johnson & Johnson (JNJ) or Microsoft (MSFT), AAA-rated and as close to a risk-free long-term investment as exists on Wall Street.

- fundamental risk of going to zero is essentially zero.

SCHD has the same 0.06% expense ratio, meaning that $50 per month and Schwab will manage $1 million for you in the world’s premier high-yield blue-chips.

It’s a larger fund at $47 billion for good reason.

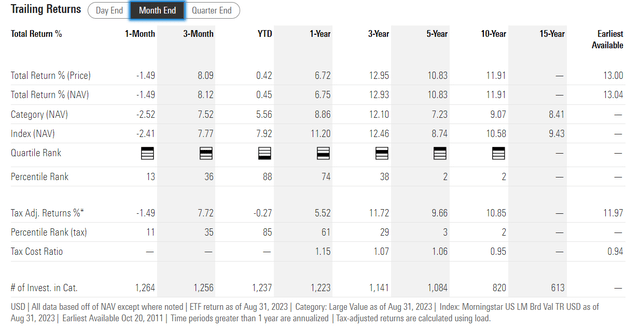

Morningstar

Over the last three years, SCHD has been in the top 62% of its peers; in the last five years, the top 3%, and the last ten years, the top 2%.

Those impressive percentiles hold even when adjusting for the relatively higher 0.94% long-term tax expense ratio.

But that means that since 2010, SCHD has still generated 12% post-tax returns.

- 336% post-tax total return

- 207% inflation-adjusted post-tax return.

Why is SCHD such a rockstar high-yield ETF? Why does it run circles around the best aristocrat/future aristocrat ETF?

The answer is strategy.

VIG Strategy: Based Around Dividend Growth Streaks

- 10+ year dividend growth streak

- eliminates highest yielding names

- weighted by market cap

- 4% risk caps per holding.

This is a fine strategy. It’s elegant and simple, and Ben Graham would approve.

Graham believed a 20-year streak without dividend cuts was an important sign of quality, and 20+ year dividend growth streaks are a sign of excellence.

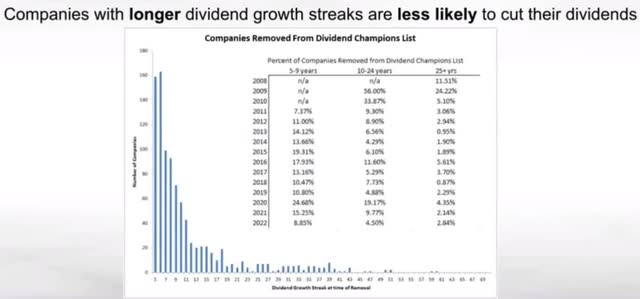

Justin Law

History confirms that 10+ years generally means a significantly lower risk of a dividend cut in recessions.

Pandemic Dividend Cuts: -30% GDP Growth

Justin Law

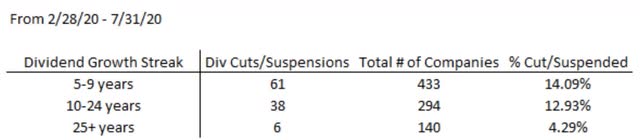

Now, let’s take a look at SCHD’s strategy.

SCHD Strategy: Dividend Streak Is Just The Beginning

- 10+ year dividend growth streak

- numerous quality screens

- weighted by market cap

- 4% risk caps per holding.

S&P

SCHD uses free cash flow to debt, return on equity, projected yield, and dividend growth rate to screen for what it considers the 100 best high-yield dividend growth blue-chips in America.

- quality is an alpha factor

- profitability is Wall Street’s favorite proxy for quality

- SCHD screens for balance sheet safety

- yield is an important metric for value.

So SCHD takes the same focus on income dependability that Ben Graham loved and then adds quality, safety, and value screens.

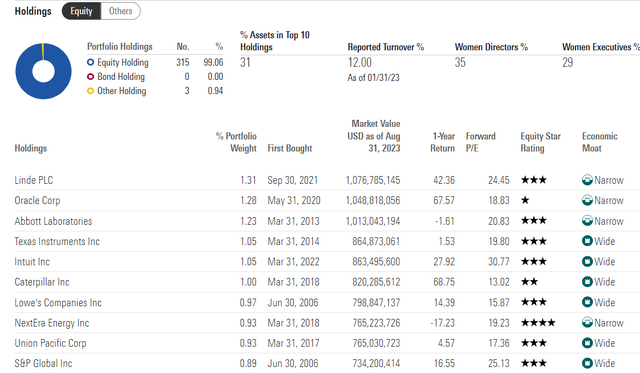

VIG Holdings

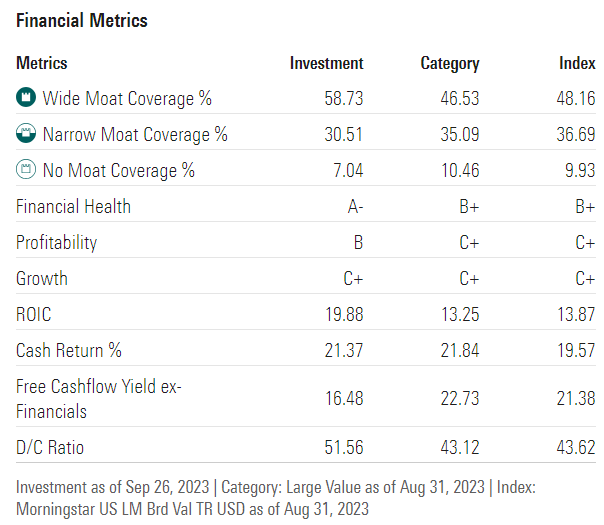

Morningstar

VIG is a highly diversified portfolio that steadily expands its holdings to every non-high-yield 10+ year streak stock.

The top 10 holdings are a rock-solid group of world-beaters.

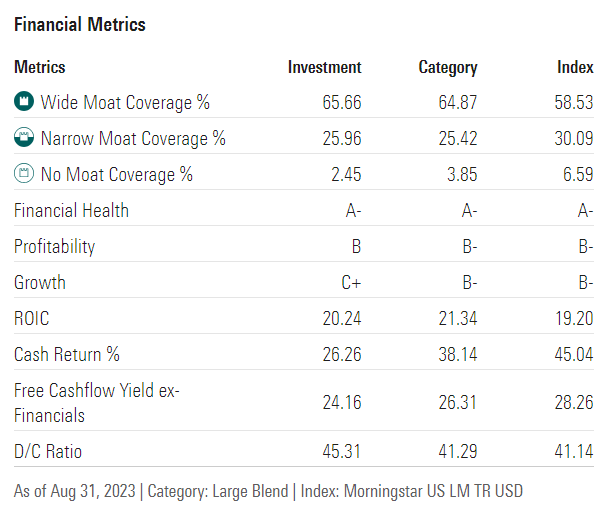

Morningstar

The moatiness of this portfolio is surpassed only by Invesco QQQ Trust ETF (QQQ) and VanEck Morningstar Wide Moat ETF (MOAT), an all-wide moat ETF.

The financial strength is phenomenal, and the profitability at 20% returns on invested capital and 24% free cash flow yields are spectacular.

The 45% payout ratio is very safe.

Morningstar

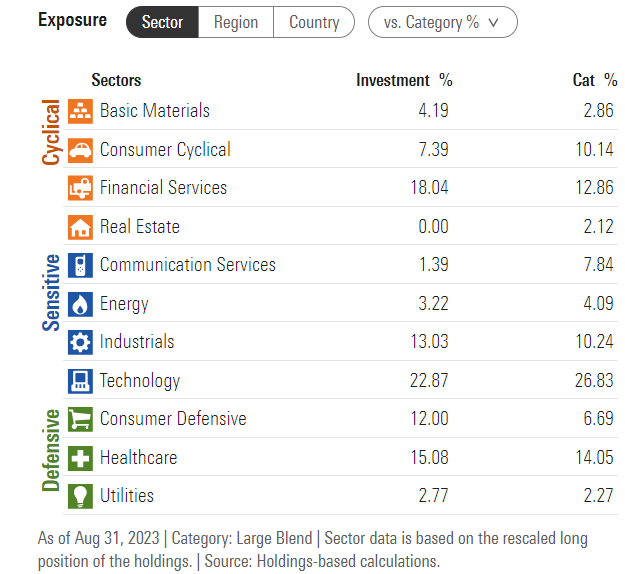

VIG is a diversified portfolio with exposure to 10 out of 11 sectors, and its largest sector, 23%, is rightfully the best tech firms on earth.

The downside of that much tech is much higher valuations.

Morningstar

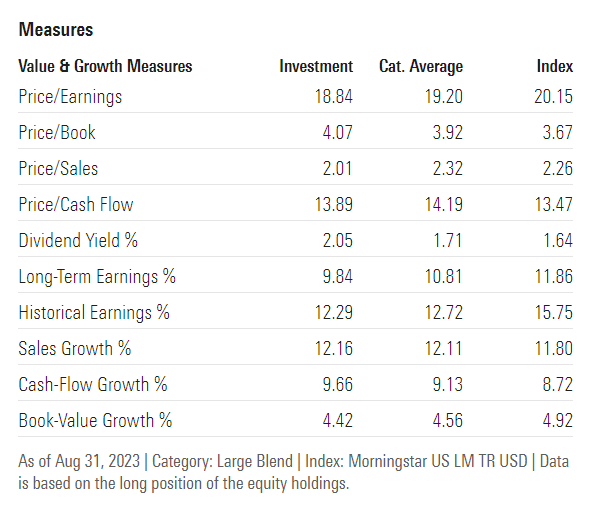

The S&P trades at 18X forward earnings and VIG just 19X, and adjusted-for cash, it’s just 13.8.

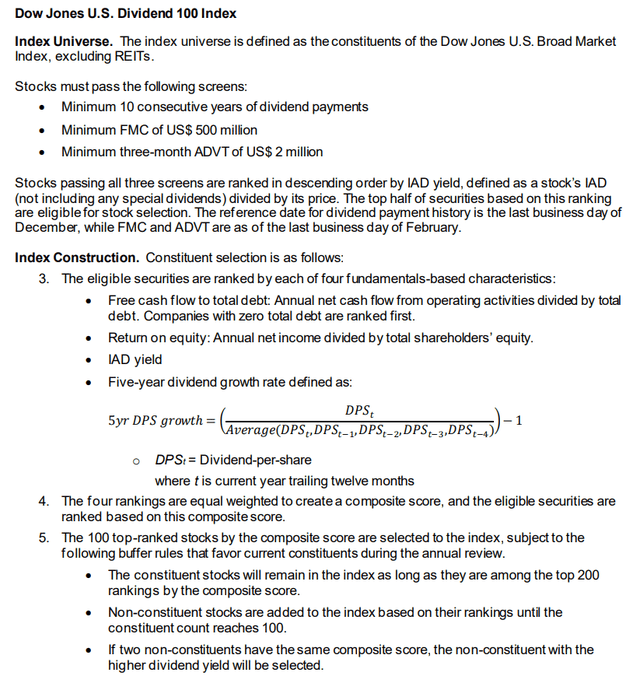

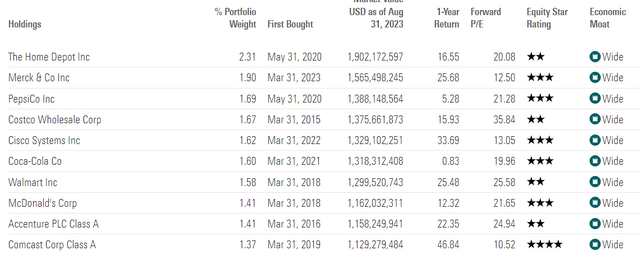

SCHD Top Holdings

Morningstar

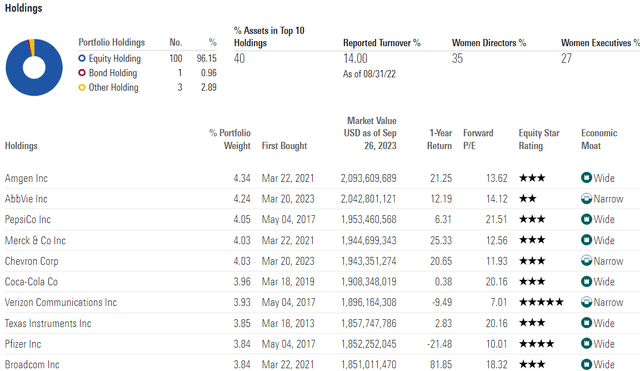

SCHD is a more concentrated portfolio, but its top names are all rock-solid dividend stocks.

6 out of its top 10 are Ultra SWANs, with the rest being SWANs or Super SWANs.

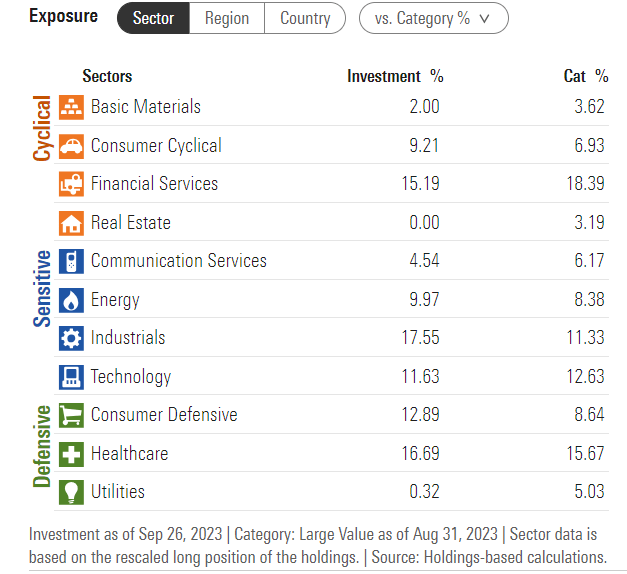

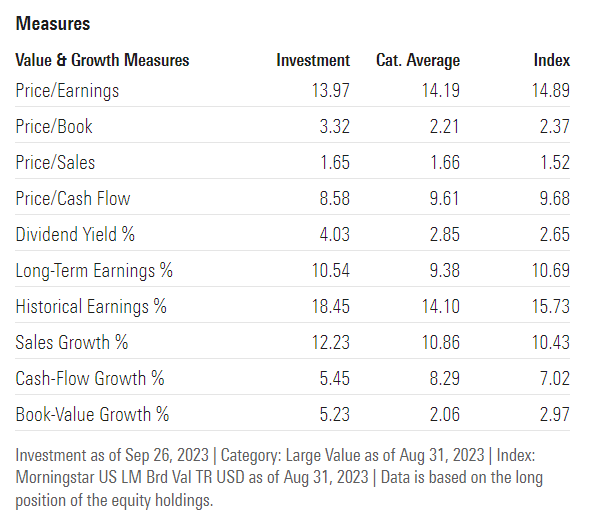

Morningstar

SCHD is rich in moatiness and has rock-solid balance sheet safety.

The 52% payout ratio is secure (60% or less safe for most companies).

The 20% returns on invested capital are 36% above its peers, and its free cash flow yield of 17% is impressive (5+% is considered good in the U.S.).

Morningstar

SCHD has half the tech exposure that VIG has, which significantly helps its valuation profile.

Morningstar

SCHD’s P/E today is the mid-range for where the S&P tends to bottom in recessionary bear markets.

In other words, the S&P tends to fall to a P/E of 14, and SCHD is already there, pricing in a recession for 2024.

If you adjust for cash, the P/E is just 9.7X, almost anti-bubble valuations pricing in just 2.5% long-term growth!

Historically SCHD is 25% undervalued and VIG just 11%. Both are potentially worth buying, but only SCHD is a table-pounding Buffett-style “fat pitch” buy right now.

Why? That brings me to reason 2 for buying SCHD over VIG today.

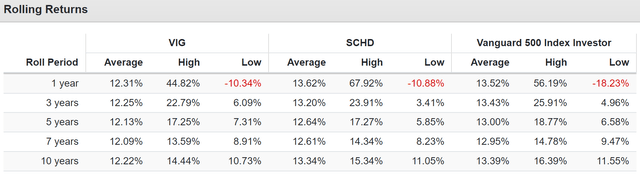

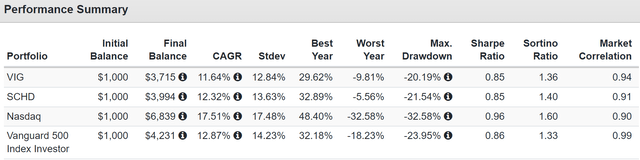

Reason Two: Historical And Future Likely Returns Are Better For SCHD

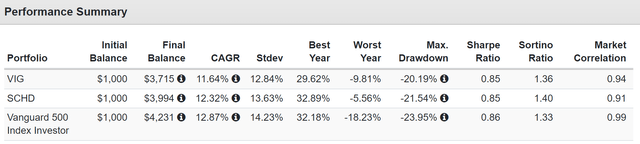

Total Returns Since 2011

Portfolio Visualizer Premium

Over 12 years, there is a 90% chance that superior returns are due to fundamentals, not luck.

SCHD is expected to outperform VIG by about 2.5% per year in the long-term.

So far, it’s been closer to 1.3%.

Portfolio Visualizer Premium

So you might be thinking, “What does 1% or 2% per year make if you love the ETF’s holdings?”

First, even 1% can make a difference over the long term.

- 1% higher returns over 30 years (retirement time frame) = 35% higher inflation-adjusted money

- 2% higher returns over 30 years = 81% more real money

- 2.5% (Morningstar consensus) = 110% more real money.

In other words, SCHD is expected to generate significantly more real money over time.

And there is one other important thing to remember.

Yield is a lot less speculative than future growth.

Imagine two companies, A and B.

Company A yields 2%, and B yields 10%.

Company A is expected to grow 10% over time and B 2%.

Both are expected to deliver 12% long-term returns, but one pays you most of those in cash, and the other makes you wait for years for growth that might not happen.

Let’s not forget another critical difference between higher yield + fast-growth SCHD and fast-growth but low-yield VIG.

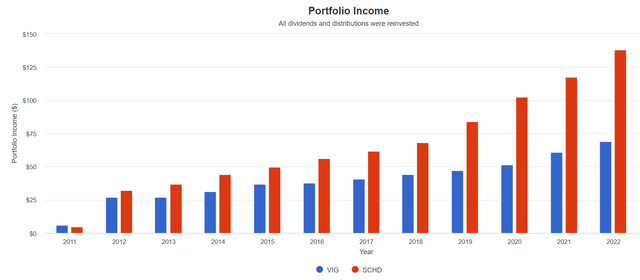

Reason Three: SCHD Is The Better Dividend Minting Machine

What happens when you buy something with 2X the yield and slightly faster long-term growth? Secure income magic.

Portfolio Visualizer Premium

Over time, this superior income generation really adds up.

Dividends Per $1,000 Investment In 2012

| Metric | SCHD | VIG |

| Total Dividends | $790 | $474 |

| Total Inflation-Adjusted Dividends | $585.19 | $351.11 |

| Annualized Income Growth Rate | 15.7% | 9.8% |

| Total Income/Initial Investment % | 0.79 | 0.47 |

| Inflation-Adjusted Income/Initial Investment % | 0.59 | 0.35 |

| Starting Yield | 3.2% | 2.7% |

| Today’s Annual Dividend Return On Your Starting Investment (Yield On Cost) | 13.8% | 6.9% |

| 2023 Inflation-Adjusted Annual Dividend Return On Your Starting Investment (Inflation-Adjusted Yield On Cost) | 10.2% | 5.1% |

(Source: Portfolio Visualizer.)

After just ten years, SCHD delivered almost 2X the inflation-adjusted income. In the future, analysts expect dividend growth to be similar for both ETFs as it’s been in the past.

- 9% to 11% for VIG

- 13% to 16% for SCHD.

What does the potential for 4% to 6% better income growth mean over time?

- Over 30 years, 5% better income growth = 332% better inflation-adjusted income.

Reasons SCHD Isn’t Right For Everyone

Even though SCHD is a better dividend stock than VIG, that doesn’t mean it’s right for everyone.

SCHD Doesn’t Own Most Of These World Beaters (VIG top holdings 11 to 30)

Morningstar

Morningstar

VIG owns all the aristocrats worth owning and future aristocrats as well. Those are some spectacular companies whose yield is not high enough to ever get into SCHD.

Another downside to SCHD is the high tax expenses. They are about 1% and nearly 2X higher than VIG (and the S&P).

12% post-tax returns so far are great, but that extra 0.5% tax expense might potentially become important if growth estimates prove false.

And we also can’t forget about the downsides to a more concentrated portfolio.

VIG owns 315 companies while SCHD 100.

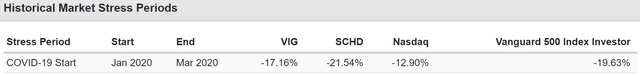

That concentration usually leads to superior growth and returns, but at the cost of higher volatility.

Morningstar

Now, the volatility of SCHD doesn’t show up in the summary stats. But it does show up in recessions.

Morningstar

And that’s just the month of March.

That 4% might not seem like much, but it might make the difference between holding on through a bear market and selling near the bottom out of panic.

Morningstar

Morningstar

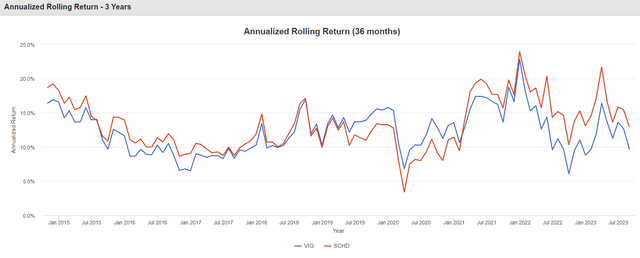

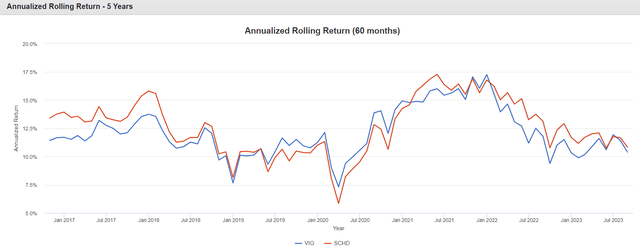

And while SCHD has run circles around almost every dividend ETF, including VIG long-term, there have been periods of as long as two years in which VIG’s more tech-focused portfolio did outperform.

This is why a diversified portfolio is needed, to avoid becoming envious and overtrading through momentum chasing.

Bottom Line: Both Are Great Dividend ETFs, But SCHD Is Hands Down The Better Buy Right Now

Don’t get me wrong, VIG is a world-class ETF.

It’s far better than NOBL for investing in the most dependable dividend stocks. It’s the gold standard aristocrat ETF.

And in the future, Morningstar’s analysts think it can deliver about 12% long-term returns, which is 2% better than the S&P and 1% better than the official aristocrats.

So, if you’re a dividend aristocrat investor looking for the SWAN-iest of the Ultra SWANs, VIG is a wonderful potential option.

But SCHD is hands down the better choice right now.

It yields almost twice what VIG does and has a faster consensus growth rate.

That means potentially 4.3X more inflation-adjusted income over the next 30 years.

Its historical returns prove its strategy superior, thanks to numerous quality screens on top of a dividend growth streak screen.

Long term, it could potentially deliver 3X the total returns.

Its valuation is also superior, with 25% undervalued vs. 13%.

VIG trades at a solid 13X cash-adjusted P/E, but SCHD trades at a cash-adjusted PE of just 9X.

Yes, compared to the S&P 500’s 10% premium or the Nasdaq’s 12% VIG is a bargain.

But SCHD is trading at a 25% slap you in the face, Buffett-style, table-pounding “fat pitch” valuation of just X cash-adjusted earnings.

Here’s SCHD’s 10-year consensus total return potential.

- 3.7% yield + 10.5% growth = 14.2% long-term return potential

- discount: 25%

- 10-year valuation boost: 2.9%

- 10-year consensus total return potential: 17.1% annually = 385% vs 135% S&P 500.

I don’t know about you, but when I can lock in a nearly 4% very safe yield, growing at double-digits, at a 25% discount?

As they say in the army. “Where’s the question, drill sergeant?”

VIG is a great dividend ETF. But SCHD right now is one of the smartest financial decisions a long-term income growth investor can make.

Read the full article here

Leave a Reply