Investment Thesis

Imagine the benefits as an investor when building a dividend-income investment portfolio with a reduced risk level that helps you generate extra income (which can help you cover your monthly expenses or be used to reinvest) and to increase this amount year over year. Such a dividend strategy can further help you to reduce reliance on stock market volatility while at the same time contribute to achieving an attractive Total Return.

The objective of The Dividend Income Accelerator Portfolio that I will build within the next months and which I will document transparently here on Seeking Alpha, is to realize these benefits for you as an investor.

The Dividend Income Accelerator Portfolio should serve as a guideline for you to reach an attractive mix between dividend income and dividend growth, while striving to secure an attractive Total Return and offering a reduced level of risk.

In today’s article, I will explain why I have decided to select The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) as the first acquisition for this investment portfolio. I will dive deeper into why I consider SCHD to be the perfect choice to start building an investment portfolio from zero and the reasons for which I believe it’s an excellent strategic buy in order to successfully implement the investment approach of The Dividend Income Accelerator Portfolio.

The Dividend Income Accelerator Portfolio

As detailed in my previous article on Seeking Alpha, The Dividend Income Accelerator Portfolio’s objective is to generate income via dividend payments, and to annually raise this sum. In addition to that, its goal is to attain an appealing Total Return when investing with a reduced risk level over the long term.

The Dividend Income Accelerator Portfolio’s reduced risk level will be reached due to its broad diversification over sectors and industries and the inclusion of companies with a low Beta Factor.

Below you can find the characteristics of The Dividend Income Accelerator Portfolio:

- Attractive Weighted Average Dividend Yield [TTM]

- Attractive Weighted Average Dividend Growth Rate [CAGR] 5 Year

- Relatively low Volatility

- Relatively low Risk-Level

- Attractive expected reward in the form of the expected compound annual rate of return

- Diversification over asset classes

- Diversification over sectors

- Diversification over industries

- Diversification over countries

- Buy-and-Hold suitability

Investing $1,000 in The Schwab U.S. Dividend Equity ETF

Over the next months, I aim to invest a monthly amount of $400 ($100 a week) to build The Dividend Income Accelerator Portfolio.

However, I have decided to allocate a larger initial position to SCHD. This helps us reach a broader diversification and to reduce the risk level of the portfolio. Allocating a higher percentage to SCHD than subsequent acquisitions ensures that upcoming individual companies will not disproportionately dominate the overall portfolio.

This helps us invest with a lower risk level from the start and therefore helps us to increase the probability of achieving attractive investment results over the long term.

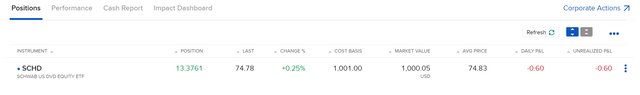

I have decided to invest $1,000 in SCHD. This means that presently, SCHD is the sole position within The Dividend Income Accelerator Portfolio.

Source: Interactive Brokers

Through a $1,000 investment in SCHD, we ensure that the initial individual company that will be added to The Dividend Income Accelerator Portfolio will have a percentage below 10% (the following acquisitions will occur weekly, each amounting to $100).

The Top 5 Holdings of SCHD

SCHD is invested in a total of 104 holdings. The following five companies are currently the Top 5 holdings of The Schwab U.S. Dividend Equity ETF:

|

Company |

Allocation |

|

Amgen |

4.41% |

|

Cisco Systems |

4.36% |

|

Broadcom |

4.19% |

|

AbbVie |

4.19% |

|

The Home Depot |

4.17% |

Source: Seeking Alpha

Amgen

With a proportion of 4.41%, Amgen (AMGN) is currently the largest position of The Schwab U.S. Dividend Equity ETF. Amgen is a manufacturer of human therapeutics. The company from the Biotechnology Industry operates worldwide and currently has a Market Capitalization of $137.23B. Amgen offers shareholders a Dividend Yield [FWD] of 3.32%. It has shown a Dividend Growth Rate [CAGR] of 16.75% over the past 10 years.

Cisco Systems

Cisco Systems (CSCO) is from the Communications Equipment Industry and was founded back in 1984. It has a Dividend Yield [FWD] of 2.78% and has shown a Dividend Growth Rate [CAGR] of 4.43% over the past 5 years. Its relatively low Payout Ratio of 39.69% indicates that there is plenty of room for future dividend enhancements.

Broadcom

Broadcom (AVGO) is the third largest position of The Schwab U.S. Dividend Equity ETF, representing 4.19%. At its current price level, the company pays a Dividend Yield [FWD] of 2.14%. Broadcom has shown a Dividend Growth Rate [CAGR] of 23.34% over the past 5 years.

AbbVie

AbbVie (ABBV) is the fourth largest position of SCHD. It pays a Dividend Yield [FWD] of 4.02%, and has a Payout Ratio of 46.32%. The company has shown a 5 Year Dividend Growth Rate [CAGR] of 12.34%. These metrics indicate that the company combines dividend income with dividend growth, aligning with the investment approach of The Dividend Income Accelerator Portfolio.

The Home Depot

The Home Depot (HD) represents the fifth largest position of The Schwab U.S. Dividend Equity ETF, accounting for 4.17%. The company currently has a Market Capitalization of $325.93B. The Home Depot offers a Dividend Yield [FWD] of 2.57% while it has shown a Dividend Growth Rate [CAGR] of 15.75%.

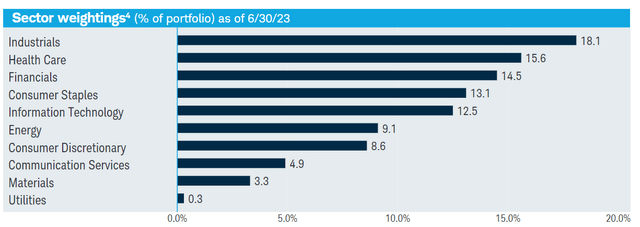

The Diversification over Sectors of SCHD

Below you can find SCHD’s Sector Weightings: the graphic shows that the Industrials Sector holds the highest percentage of the overall portfolio, representing 18.1% of this ETF. The Health Care Sector makes up 15.6% of SCHD, representing the second largest Sector. The Financials Sector accounts for 14.5% of this ETF.

Source: schwabassetmanagement.com

The fact that no Sector makes up more than 20% of this ETF indicates that it provides investors with a broad diversification, thus implying a reduced risk level. By selecting SCHD as the first acquisition for The Dividend Income Accelerator Portfolio, investors benefit from a broad diversification and reduced risk level right from the start.

Why the acquisition of SCHD for The Dividend Income Accelerator Portfolio is a strategic buy

When constructing an investment portfolio from scratch, I believe it is crucial to provide it with a reduced risk level right away. This helps us to increase the probability of achieving excellent investment results over the long term. If our first acquisition were an individual company, the portfolio’s risk level would typically be significantly higher until we accumulate a sufficient number of holdings that allow us to achieve a broader diversification. For this reason, I generally recommend to start with an ETF when building an investment portfolio from scratch.

The reasons for which I have opted to select SCHD over other ETFs are diverse: one of the main reasons is its exceptional alignment with the balance we aim to achieve between dividend income and dividend growth in The Dividend Income Accelerator Portfolio.

SCHD’s Dividend Yield [TTM] stands at 3.53% and its Dividend Growth Rate [CAGR] over the past 5 years lies at 13.92%. In addition to that, SCHD helps us to achieve a broad diversification over sectors and industries, allowing us to decrease the portfolio’s risk level.

The Schwab U.S. Dividend Equity ETF reflects the investment approach of The Dividend Income Accelerator Portfolio while helping us to operate with a reduced risk level from the start. This makes The Schwab U.S. Dividend Equity ETF the perfect strategic buy for The Dividend Income Accelerator Portfolio.

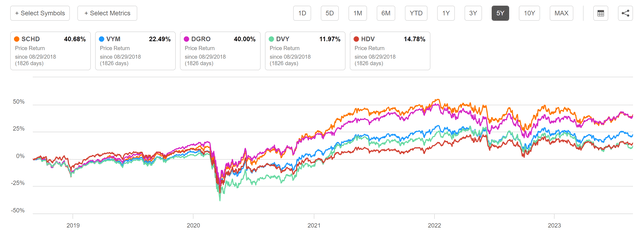

SCHD In Comparison to its Peer Group

When compared to other ETFs, I believe that SCHD comes with several benefits for investors. Its Dividend Yield [TTM] of 3.53% stands above the one of VYM (VYM) (Dividend Yield [TTM] of 3.12%) or DGRO (DGRO) (2.38%).

Even though it’s true that SCHD’s Dividend Yield [TTM] is lower than the one’s of DVY (DVY) (Dividend Yield [TTM] of 3.73%) or HDV (HDV) (Dividend Yield [TTM] of 4.11%), its 5 Year Dividend Growth Rate [CAGR] is significantly higher: while SCHD’s Dividend Growth Rate [CAGR] over the past 5 years stands at 13.92%, DVY’s is 6.24% and HDV’s is 6.32%.

These metrics strengthen my belief that The Schwab U.S. Dividend Equity ETF is the most adequate ETF to help us successfully implement The Dividend Income Accelerator Portfolio’s investment approach.

In addition to that, the graphic below highlights that SCHD has performed better than its peers over the past 5 years.

Source: Seeking Alpha

I hold the belief that this ETF has the potential to continue outperforming its peers due to its emphasis on companies with a track record of consistently paying dividends. Moreover, thanks to its combination of dividend income and dividend growth, I believe it will outperform those that only focus on a high Dividend Yield.

It is further worth mentioning that SCHD has a significantly lower Expense Ratio when compared to its peer group: while SCHD’s Expense Ratio stands at 0.06%, DGRO’s Expense Ratio is 0.08%, DVY’s 0.38%, SDY’s (SDY) is 0.35%, and HDV’s is 0.08%. These metrics strengthen my opinion to select SCHD as the most adequate ETF for our investment portfolio.

Risk Factors

Even though it is absolutely true that investing in The Schwab U.S. Dividend Equity ETF is not free of risks, I believe that the risk factors are slightly lower than investing in other high Dividend Yield ETFs. This is mainly the case due to the ETF’s focus on high quality companies that pay a sustainable dividend.

Due to its focus on companies that are able to pay sustainable dividends, I believe that the risk of dividend cuts from companies that are part of SCHD to be generally lower than ETFs that only focus on high dividend yield companies. For this reason, I also believe that the probability of achieving an attractive Total Return over the long term is slightly higher for SCHD investors than for investors of other high dividend yield ETFs. This is also the case because SCHD combines dividend income and dividend growth while providing investors with significantly more growth opportunities.

However, it should be mentioned that SCHD has a relatively strong concentration on its Top 10 Holdings, which make up 40.77%. This implies that a weak performance from one of its Top 10 Holdings could have a relatively strong negative effect on the ETF’s performance. I see this concentration as one of the main risk factors for SCHD investors.

Even though difficult macroeconomic conditions could also have a strong impact on the performance of SCHD over the short term, I believe that the selection of companies that pay a sustainable dividend can help to reduce the downside risk of this ETF in times of market turmoil.

For these reasons, I believe that The Schwab U.S. Dividend Equity ETF is the perfect fit for different market conditions and the ideal buy-and-hold ETF. I strongly believe this ETF will help us to successfully implement the investment approach of The Dividend Income Accelerator Portfolio.

Conclusion

With the first acquisition for The Dividend Income Accelerator Portfolio, we have made a strategic buy in order to implement the desired investment approach.

Having selected SCHD, we combine dividend income with dividend growth. SCHD provides investors with a Dividend Yield [TTM] of 3.53% while it has shown a Dividend Growth Rate [CAGR] of 13.92% over the past 5 years. At the same time, investors benefit from a reduced risk level due to its broad diversification and its strong focus on companies that pay a sustainable dividend.

Due to these characteristics, I believe this ETF is the perfect acquisition and an excellent strategic buy to start successfully building The Dividend Income Accelerator Portfolio.

I am constructing and documenting this dividend-income-oriented investment portfolio here on Seeking Alpha in order to help you generate extra income in the form of dividends and to help you increase this amount on a yearly basis while investing with a reduced risk level.

I strongly believe that you will benefit enormously when implementing the investment approach of The Dividend Income Accelerator Portfolio and when investing over the long term. Its focus on dividend income and dividend growth helps you to generate extra income without the need to sell positions of your portfolio. Due to its additional focus on Total Return, this strategy aims to steadily increase your wealth.

For the next week, I plan to publish an article about the second selection for The Dividend Income Accelerator Portfolio. It will be another buy that helps you combine dividend income with dividend growth, which is attractive in terms of risk and reward and therefore fits into the portfolio’s investment approach.

Author’s Note: Thank you for reading! I would appreciate hearing your opinion on my selection of SCHD as the first acquisition for The Dividend Income Accelerator Portfolio. I also appreciate any thoughts about The Dividend Income Accelerator Portfolio or any suggestions for companies that would fit into its investment approach!

Read the full article here

Leave a Reply