When we speak of ETFs, common ones like SPDR S&P 500 ETF (NYSEARCA:SPY) and Vanguard 500 Index Fund ETF (NYSEARCA:VOO) come to mind. Investing in instruments which track the S&P 500 index is indeed the go-to for many retail investors today – and there’s no issue with that at all! That being said, there are other ETFs in the market which could also prove to be valuable additions to your investment portfolio.

Schwab US Dividend Equity ETF

The focus of this article will be Schwab US Dividend Equity ETF (NYSEARCA:SCHD). I will go over the underlying index, the fund’s performance and also the portfolio breakdown of the fund, and finally determine if investing in SCHD ETF is a sound investment decision.

Underlying index

SCHD ETF tracks the Dow Jones US Dividend 100 index, which comprises of 100 companies chosen for relatively strong fundamental performance and consistently high dividend payouts. The index is rebalanced annually in March to ensure a suitable selection of companies and also an appropriate weight for each company in the index.

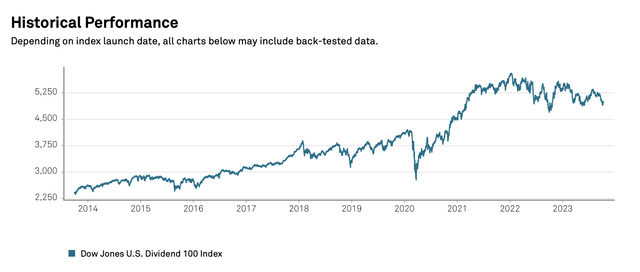

Historical performance of Dow Jones US Dividend 100 index (S&P Global)

We see that the index itself has experienced strong growth over the years, though there is a significant dip between 2020 and 2021 – the exact period where the Covid-19 pandemic hit and harmed the business of multiple companies worldwide. Nonetheless, the index has shown a strong rebound, recovering to pre-Covid levels in about a year.

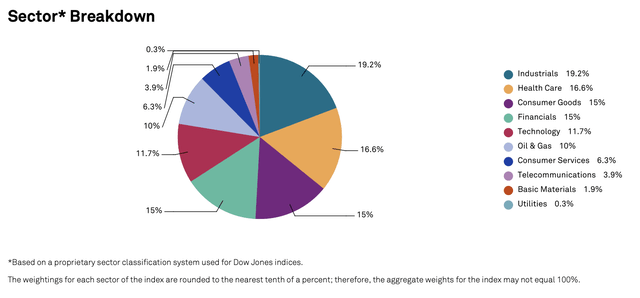

Sector Breakdown of Dow Jones US Dividend 100 index (S&P Global)

Going over the sector breakdown of the index, we see that about 77.5% of the fund’s constituents are in industrials, healthcare, consumer goods, financials and technology. There is reasonable level of diversification, with over 10% weightage in 6 different sectors, all of which are favourites among retail investors.

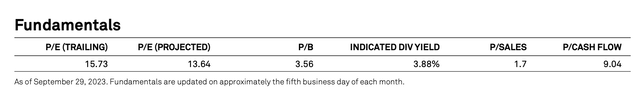

Fundamentals of Dow Jones US Dividend 100 index (S&P Global)

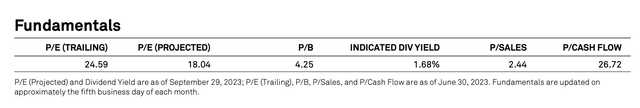

Fundamentals of S&P 500 Index (S&P Global)

In terms of relative valuation, I’ve pulled up the fundamentals of Dow Jones US Dividend 100 index and the S&P 500 index. A look at the price-to-earnings, price-to-book, price-to-sales and price-to-cash flow shows that the Dow Jones US Dividend 100 index could potentially be at a more attractive valuation compared to the S&P 500. We also note that the indicated dividend yield of Dow Jones US Dividend 100 index, which is 3.88%, is more than double that of the S&P 500’s, which stands at 1.68%.

Fund performance

Now that we know a little more about the underlying index that SCHD ETF is tracking, let’s go over the fund’s past performance.

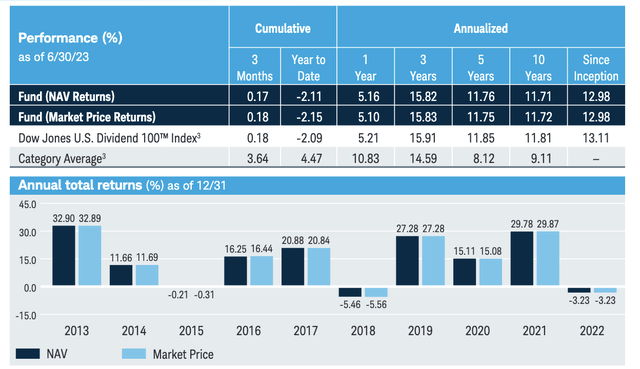

Historical returns of SCHD ETF (Charles Schwab Asset Management)

Over the past 10 years, the fund has done an annualized 11.72% return. Since inception, the fund has done an annualized 12.98%. We see that these metrics largely mirror the underlying index, which has annualized returns of 11.81% in the past 10 years and 13.11% since inception. Comparing the 10-year annualized return of SCHD ETF (11.72%) with the category average (9.11%), we see that SCHD ETF has outperformed the category average by 2.61% excess return. From the bar graphs that illustrate the annual total returns of the fund, we see that in the past 10 years, the fund has shown strong overall growth, achieving over 10% annual growth in 7 of the past 10 years. All in all, the fund’s performance has been stellar.

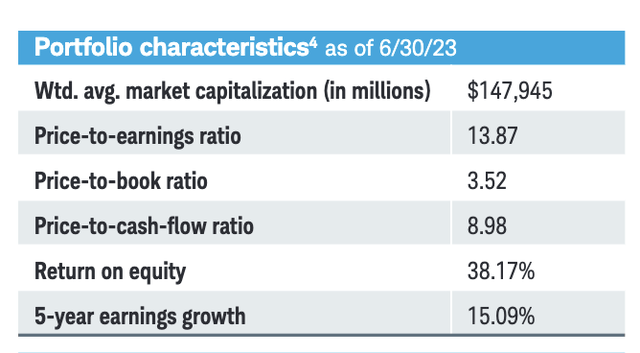

Portfolio characteristics of SCHD ETF (Charles Schwab Asset Management)

We now go over the portfolio characteristics of SCHD ETF. The valuation metrics are no surprise – we’ve gone through the same metrics for the ETF’s underlying index in the earlier part of the article. However, two things that hooked me are the return on equity of 38.17% and 5-years earning growth of 15.09%, both of which are strong indicators of profitability of the companies in the ETF’s portfolio.

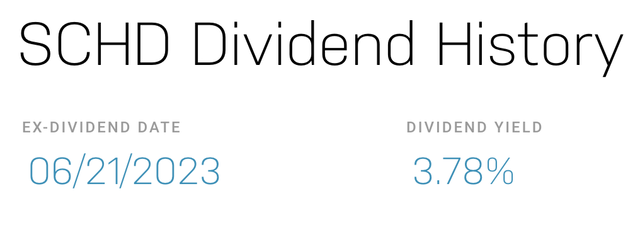

Dividend yield of SCHD ETF (Nasdaq)

We observe that SCHD ETF has a dividend yield of 3.78%, and pays an annual dividend of about $2.66 a share. Now, this is by no means the highest dividend yield in the ETF market. ETFs like Advocate Rising Rate Hedge ETF (NYSEARCA:RRH) boast over 20% in dividend yield. However, considering the consistency in returns of SCHD ETF’s portfolio, together with a dividend yield that is more than twice that of S&P 500 ETFs, SCHD ETF could prove to be a decent dividend-generating ETF with stable capital appreciation.

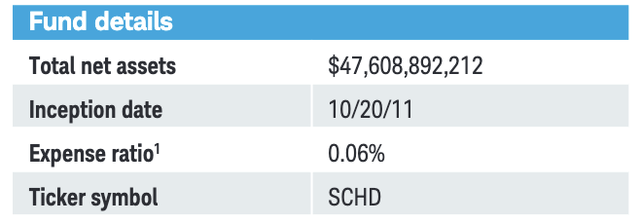

SCHD ETF Fund details (Charles Schwab Asset Management)

Apart from the large amount of net assets, another point to note is the low expense ratio of 0.06%. This is an indication of efficient management, as barely any operating or administrative costs are deducted from the fund value. In comparison, other ETFs like ARK Innovation ETF (NYSEARCA:ARKK) have expense ratios of over 0.7%, which is more than 10 times than of SCHD ETF’s expense ratio. Now, this is not a confirmation that ARK Innovation ETF is a worse ETF than SCHD ETF, as there are many more factors to take into account before making such a conclusion.

Portfolio breakdown

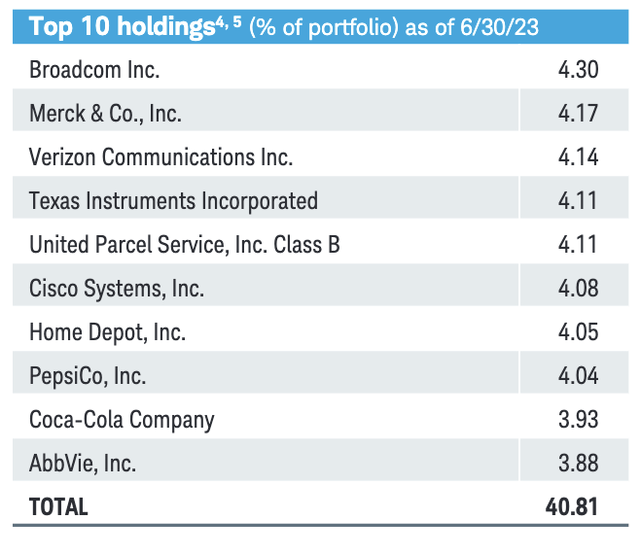

Let’s go over the top 10 holdings in SCHD ETF’s portfolio.

Top 10 holdings in SCHD ETF’s portfolio (Charles Schwab Asset Management)

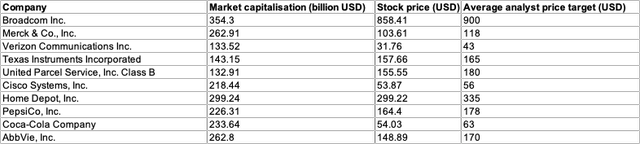

Market capitalisation, stock price and average analyst price target of each company in SCHD ETF’s top 10 holdings (Prepared by author)

We see that each company in SCHD ETF’s top 10 holdings is a large company with hundreds of billions of dollars in market capitalization. In particular, the average market capitalization of these companies at the time of writing is 226.72 billion USD – to put things into perspective, this is larger than the combined market capitalization of Spotify (NYSE:SPOT) and Netflix (NASDAQ:NFLX). In terms of valuation, we also observe that most of their stock prices are below analyst price targets. Now, this is not a call to action to buy all of these company stocks, as more due diligence is required to determine a fair valuation of these stocks. However, it is a good indication that the companies that make the bulk of the ETF’s portfolio are at a comfortable valuation.

What should I consider before investing in SCHD ETF?

The biggest thing to consider before investing in ETFs which track an underlying index, like SCHD ETF, is the market risk.

Market risk

This is a common risk that is present in all ETFs tracking particular indices. We need to understand that we are investing in a diversified basket of stocks. So, if we experience long periods of market correction, it’s likely that the ETFs in our portfolio will also see a tank in value. Similarly, when market sentiment is good and indices are up, the ETFs in our portfolio are likely to see a rise in value. All in all, market risk is definitely present when investing in SCHD ETF, and one should always consider his or her risk tolerance before investing in this ETF.

Investment decision

With all things considered, SCHD ETF is an ideal ETF to add into your portfolio if you’re looking into diversified equity investments that provide decent capital appreciation together with stable dividends. It’s not going to double your money in a year, but it’s definitely a good pick for the long term.

Read the full article here

Leave a Reply