Investment Overview

Sanofi (NASDAQ:SNY), the French pharma giant, announces its Q3 2023 earnings next Friday, Oct. 27. I last covered the company back in August last year, when its share price was nearing a 10-year low value of $38. I issued a hold rating, writing as follows:

Sanofi stock has fallen to 2.5-year lows on the threat of litigation in relation to Zantac, trial halts of Tolebrutinib, a hit to its insulin pricing, and a sparse pipeline. Investors need to decide if these are dangerous long-term headwinds or chimeric issues that the company can navigate through or sidestep without too much damage.

If you believe the former, it would be best to wait and see what the litigation will look like, whether the trial holds are resolved, etc. You may end up buying Sanofi at a higher price, but it will be a much less risky investment. If you believe the latter, you may find that this is the best chance you will have to buy Sanofi stock at a 20% discount to its normal trading range

Fast forward 14 months and Sanofi’s stock price has risen by >25% since my note. The company has been making some solid progress on many fronts – net sales across the first half of 2023 were up >4% year-on-year, to $20.2bn, operating income up 8% to $6.1bn, net income up 10% to $4.9bn, and earnings per share (“EPS”) up 9.8%, to $3.9 per share.

Sanofi has not shared detailed guidance for full-year 2023. In a press release announcing Q2 2023 earnings, management issued the following statement:

Sanofi now expects 2023 business EPS to grow mid single-digit at CER, barring unforeseen major adverse events. Applying average July 2023 exchange rates, the currency impact on 2023 business EPS is estimated between -6.5% to -7.5%. This upgrade includes approximately €400 million of expected one-off COVID vaccine revenues in the second half of the year.

With current fluctuations muddling the outlook, it’s hard to know whether Sanofi’s share price and market cap valuation will respond positively to management achieving the target EPS growth – FY22 EPS was $7.2, implying a price to earnings (“P/E”) ratio of ~7.3x, which is low enough to suggest shares remain undervalued – or negatively – it’s worth noting that since Sanofi’s share price jumped from ~$47 per share to $57 per share, on positive data shared in relation to key asset Dupixent in chronic obstructive pulmonary disease (COPD), plus the easing of Zantac litigation concerns, it has tended to trade only downward or flat.

In this post, ahead of Q323 earnings, I’ll recap the company’s strengths, weaknesses, opportunities and threats, and take a detailed look at growth prospects within the current product portfolio and pipeline opportunities to watch.

Sanofi Overview – By The Numbers

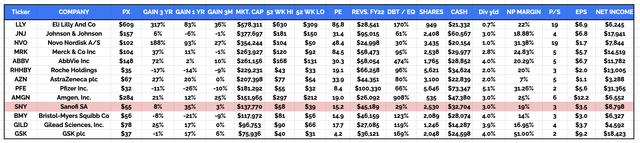

In my last note on Sanofi, I provided a comparison table in which I looked at key numbers in relation to the “Big 8” US pharma, and I reproduced an updated table below, also including several other large European pharma.

Big Pharma comparison table (data from TradingView, Google Finance)

As we can see, Sanofi’s share price performance over the last year – +38% – has been impressive, although as mentioned above the company has bounced back from its lowest value since 2018, and momentum has slowed to a halt in recent months. The three-year gain is just 8%.

The company pays a dividend that currently yields 2.6%, which is about average for the sector, although its PE ratio of ~15x, and P/S ratio of ~3x are low for the sector, implying a potential “buy” opportunity. Net profit margin of 19% is slightly below the sector average.

Sanofi Product Portfolio – Specialty Care

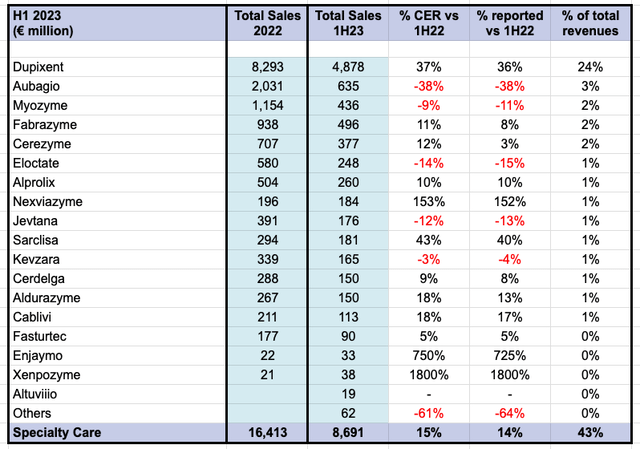

Sanofi has a diversified Bio Pharma / Pharmaceuticals portfolio, with 18 major products within its specialty care division driving $16.4bn of revenues across FY22 and $8.7bn across 1H23. Its general medicines divisions consist of >11 major products accounting for $13.6bn of revenues in FY22, and $6.1bn in 1H23, and its vaccines division, which covers influenza, polio, pertussis, meningitis, travel and endemic, and booster vaccines, plus others, drove $7.2bn of revenues in FY22, and $2.4bn in 1H23. The consumer healthcare division contributed $5bn of revenues in FY22, and $2.72bn in 1H23.

Sanofi product sales – Specialty Care (Sanofi)

If we look at the Specialty Care division (table above) we can immediately identify the key asset as Dupixent, a monoclonal antibody that is approved to treat atopic dermatitis, asthma, chronic rhinosinusitis, eosinophilic esophagitis, and Prurigo Nodularis.

Dupixent, administered via subcutaneous injection every 2-4 weeks, looks set to gain approval in COPD also after clinical studies showed it outperformed current standards of care, and an application already has been filed with the FDA for approval in chronic spontaneous urticaria. Analysts at Morningstar have suggested that the drug’s peak sales could eventually pass $17bn per annum before patent expiration is expected in 2031.

Dupixent accounted for ~24% of Sanofi’s revenues in 1H23, and that figure could grow as the drug is expected to surpass >$10bn of revenues this year, and potentially >$17bn by 2030. Dupixent already has become one of the world’s best-selling drugs, but the market will want to see evidence of strong growth across quarter 3 to ensure the sales momentum is being maintained.

It would be fair to say that Dupixent is Sanofi’s jewel in the crown and its future performance is key to unlocking shareholder value. As such, Dupixent’s Q3 sales performance will be a closely studied figure when Q323 earnings arrive next week.

Meanwhile, the multiple sclerosis therapy Aubagio lost its patent protection this year, and as we can see, its sales are suffering as generic drugs are permitted to be sold alongside the original. Doubtless, analysts will be watching to see if the growth of Dupixent revenues can offset the fall in Aubagio revenues, which is what happened in Q223.

Other revenue figures to look out for include Nexviazyme – likely a long-term replacement for Myozyme in Pompe Disease, with “blockbuster” (>$1bn per annum) revenue potential, and Sarclisa, a multiple myeloma therapy, and potential rival to Johnson & Johnson’s (JNJ) >$4bn per annum selling Darzalex.

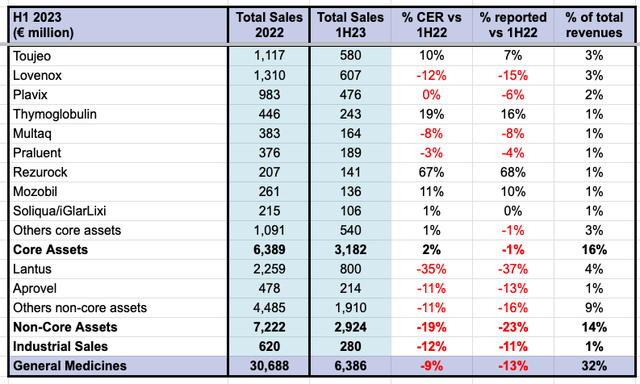

Sanofi Product Portfolio – General Medicines

The General Medicines division underperformed in 1H23, with revenues falling by ~7%.

General medicines division recent performance (Sanofi)

As we can see above this is a potentially problematic division for Sanofi. In March, the company slashed the price of its insulin medication by 78%, reducing out-of-pocket costs for the product to $35 per month, as per guidelines in the Inflation Reduction Act. Lantus sales fell 35% year-on-year across the first six months of 2023, and third-quarter performance will be closely scrutinized – I would expect the year-on-year comparison to have deteriorated further.

Meanwhile, in 2022 only two drugs within the general medicines division – long acting insulin product (less affected by new pricing regulations) Toujeo, and the anticoagulant Lovenox – achieved blockbuster sales. Elsewhere across the division, REZUROCK, indicated for graft vs. host disease, could achieve >$500m in peak sales, analysts believe, but otherwise, overall performance looks a little flat.

It ought to be interesting to hear what plans management has for this division during the Q3 earnings call Q&A – would the pharma consider spinning it into another company, perhaps even alongside its consumer health division? In recent years, Pharma giants Pfizer (PFE), Merck (MRK), Johnson & Johnson and GSK (GSK) have all done similar, prioritizing their drug development/pharmaceuticals businesses over legacy assets and consumer health, in pursuit of lengthy patent protections, and higher margins.

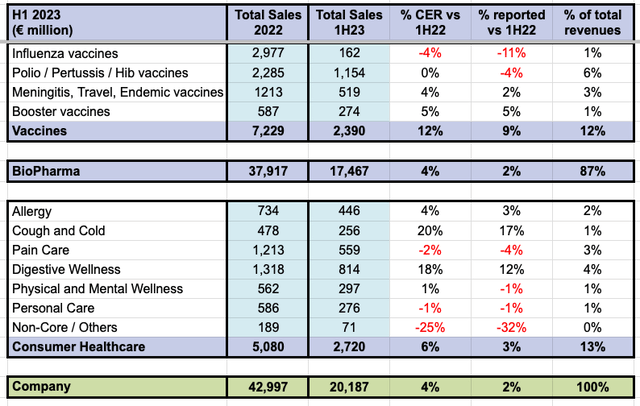

Sanofi Product Portfolio – Vaccines and Consumer Healthcare

Sanofi’s vaccines division has been thriving recently, whilst consumer healthcare is performing satisfactorily.

Vaccines and consumer healthcare product revenues recent (Sanofi)

Although influenza sales figures were low in 1H23, management says it expects “the same record sales as last year” (source: Q223 earnings call transcript), which makes sense, as influenza shots are primarily given in the fall. As such, we can expect a significant bump to division revenues when Q3 earnings are reported, and this ought to be a positive catalyst for Sanofi, even if analysts have priced the increase into their Q3 revenues expectations for ~$12.1bn revenues.

Despite my reservations voiced above, Sanofi’s Chief Financial Officer (“CFO”) Jean-Baptiste de Chatillon told analysts on the Q223 earnings call that:

We want to grow consumer health. We want to maximize the value. We want really to give the management teams the maximum opportunity to grow this value.

In July this year, Sanofi announced its acquisition of Qunol, a U.S.-based, market-leading brand in health and wellness, in a deal valued at ~$1.4bn. According to a Sanofi press release:

This transaction will strengthen Sanofi’s Consumer Healthcare’s (“CHC”) Vitamin, Mineral and Supplements (VMS) category, one of the largest and fastest-growing consumer health categories in the U.S., focusing on the active ‘healthy aging’ segment.

With ~10k people in the US turning 65 on a daily basis, obtaining a foothold in the healthy aging market may prove to be a masterstroke on Sanofi’s part, and although I would not be expecting major revenue figures when Q3 results are announced, it will be interesting what progress is being made, as this acquisition could help drive growth within consumer health up to and beyond the next decade.

Near-Term Approval Shots and Promising Pipeline Assets

So far, my overview has looked at Sanofi’s approved products, and with Aubagio the only major short-term patent expiry issue, the outlook – certainly for vaccines and specialty care – is promising, which I would expect to be reflected by good results when Q3 earnings are announced next week. As mentioned, Sanofi’s insulin-based assets are more problematic and may be acting as a handbrake on the company share price.

Looking at Sanofi’s pipeline, however, there are several reasons for optimism. Firstly, three new product launches have recently occurred. Altuviiio is a hemophilia A therapy, approved in September, with peak sales expectations of >$2bn per annum. Beyfortus, an antibody that acts as a preventive for RSV lower respiratory tract disease in babies, is a likely blockbuster, with a peak sales range of $700m – <$3bn, and Tzield, which Sanofi acquired via its buyout of Provention Bio, helps delay the onset of Type 1 diabetes, could drive up to $2bn per annum, it’s been suggested.

These assets will help to beef up revenues across vaccines, general medicines, and specialty care, and there are more exciting assets likely to gain approval, such as multiple sclerosis therapies tolebrutinib – dogged by safety issues but expected to be a candidate for approval in 2024 – and frexalimab, atopic dermatitis therapy amlitelimab, and fitusiran, the small interference RNA therapeutic, which could address both hemophilia A and B.

To summarize, Sanofi appears to have a diversified, well-balanced pipeline with multiple blockbuster drugs either recently approved or close to approval, and multiple opportunities across all three phases of the drug development process, capable of sustaining recent upward revenue momentum.

The likes of Beyfortus, Tzield and Altuviiio may share sales data in Q3, and although it will be too early to make a full judgment on long-term revenue possibilities, with no other data to hand, analysts will doubtless study these early figures and use them to inform rating upgrades or downgrades.

Litigation Woes Ease

Since Sanofi’s share price slump last September, the clouds appear to have lifted somewhat in relation to the Zantac litigation. As mentioned in my previous note, it had been speculated that Sanofi and fellow accused pharma Pfizer, GSK, and Boehringer Ingelheim, plus other generic drug makers, could be forced to pay anything from $10bn – $45bn in fines, but in December, a US court threw out ~50k cases brought against GSK and Sanofi stating that they were not backed by “sound science.”

That does not bring an end to the saga, but it places Sanofi in a stronger position than last year – in June, Sanofi also won a case against Boehringer Ingelheim, which was seeking indemnification for any future Zantac litigation liabilities, based on the fact Sanofi acquired its healthcare business back in 2016.

Concluding Thoughts: Sanofi Set Fair Ahead of Q3 2023 Earnings, But Compelling Valuation Growth May Not Be On Menu

To summarize my research into Sanofi ahead of Q3 2023 earnings, I find a company that appears to be in good health, with long-term debt of ~$15.5bn manageable, even if current portion of long-term debt stands at ~$4.3bn. The cash position reported as of June 2023 was $8.7bn, and total current assets were $33bn.

In terms of overall performance, past and near future, I’d expect good sequential growth from Sanofi in Q3 thanks to additional influenza revenues and the strong growth of Dupixent. I would be mindful of falling Lantus and Aubagio revenues but would expect lost revenues to be offset by gains, which ought to frame results positively.

I’d additionally be excited to see early revenue figures for Altuviiio, Beyfortus, and Tzield, and within consumer health, any impact from Qunol. Still to come this year is a pivotal data readout for fitusiran, which is a potential share price needle-moving event, although I would not necessarily expect an update next week. progress of recently approved rare disease assets, including nexvizyme, also should be instructive.

Overall, I’m expecting a positive set of earnings, although owing to a lack of detailed forward revenue guidance, I’m not sure I’m expecting a significant share price spike, even if key determining factors such as Dupixent sales, new product launches, and easing of litigation worries go in the company’s favor, as I expect them to do.

Based on the flat share price performance since the spike generated by Dupixent data and legal matters in March, however, I would opt to give Sanofi another “hold” recommendation as opposed to a “buy” recommendation.

Sanofi has several assets – perhaps even an entire division of them – that are responsible for slowing growth at the company, and affecting profitability, which is slightly below average for the sector. It may take several more earnings quarters before Sanofi can definitively address these issues, and for its newly launched, or soon-to-be-launched assets to establish themselves as commercially viable.

As such, I’d rate Sanofi as a solid prospect for anyone looking for long-term value within the global pharmaceutical industry – a reliable, dividend-paying blue chip – but I would stop short of promising dynamic short-term share price growth. For now, at least, investors will mainly look to the dividend. Ideally, Sanofi would want to add one more “jewel in the crown” asset to its portfolio to match Dupixent, which is not quite capable of driving valuation on its own, however successful it has been to date.

Read the full article here

Leave a Reply