Introduction

Sandoz (OTC:SDZNY) (OTC:SDZXF) is a global leader (and calls itself a ‘European champion’) in the generics and biosimilars sector as it has a strong position in the so-called off-patent medicines market. Sandoz only listed about a month ago after its separation from Novartis (NYSE:NVS) was completed. For every five shares of Novartis, Novartis shareholders ended up with one share of Sandoz.

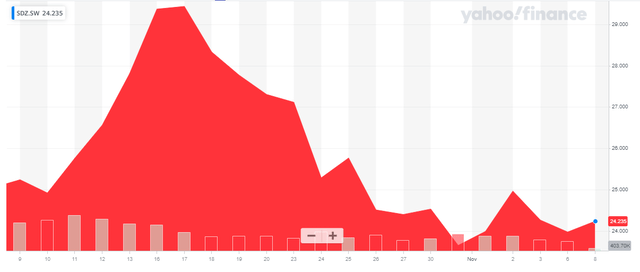

Yahoo Finance

The company’s primary listing is in Switzerland where the stock is trading with SDZ as the ticker symbol. Although the average daily volume is approximately 4.5M shares, this was likely impacted by pretty heavy trading in the first few days after its listing. Trading volumes in the past week averaged approximately two million shares.

The company reports its financial results in US Dollars. I will use the USD as base currency in this article and where necessary I will use a USD/CHF exchange rate of 0.90 (1 USD gets you 0.90 CHF).

The Company Recently Listed

It does make sense for Sandoz to operate as an independent entity and a dedicated and focused management will likely be able to continue to grow the company in the off-patent medicines market which currently has a $208B global value. According to the listing statement of Sandoz, over the next decade, the patents of several blockbuster medicines will expire, and it thinks there is a total addressable market opportunity of $580B. Sandoz generates approximately 50% of its sales in Europe while the North American market represents approximately 27% of its sales.

As an independently managed company, Sandoz may now be more aggressive in pursuing a slice of that market (while also cutting costs as management anticipates a 150bp margin expansion through organizational efficiencies). The company has already been building a pipeline of in excess of 400 generic products and also continues to invest in its production capacity with a $400M investment in a new plant in Slovenia currently underway. That plant should be operational by the end of 2026.

That expansion will be funded by the autonomously generated free cash flow. And that’s why it is important to keep a close eye on the financial results of Sandoz as a standalone entity.

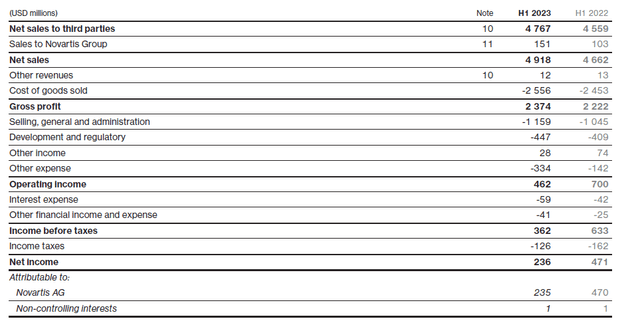

Looking at the H1 2023 results, which were published as a supplement to the listing prospectus, the company generated a total revenue of $4.92B. This resulted in a gross profit of approximately $2.37B and an operating income of $462M. That’s indeed a bit lower than in the same period of 2022 mainly due to higher SG&A expenses as well as a 10% increase in development and regulatory expenses.

Sandoz Investor Relations

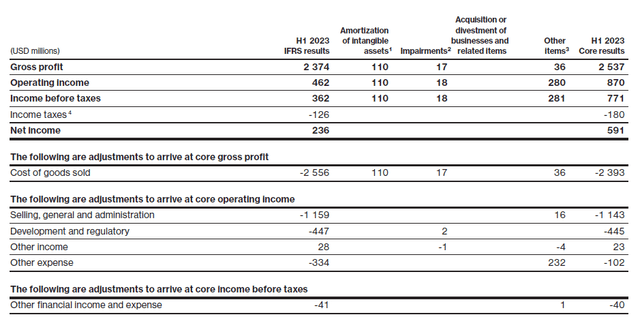

There also was a $334M ‘other expense’ and looking at the footnotes, this was mainly related to expenses specifically related to the spinoff and restructuring and rationalization expenses. As you can see below, there were quite a few of those ‘other items’ but the ‘other expenses’ were the main culprit for the impact on the comparable basis. As you can see below, the ‘core impact’ of the ‘other expenses’ was $102M which is in line with last year.

Sandoz Investor Relations

That also means the underlying financial results in the first half of 2023 were not materially worse than in the first half of 2022. Higher SG&A expenses were a drag but as inflation rates are now substantially lower, those expenses should stabilize.

The net income attributable to Sandoz (the income statement still shows Novartis as the spin-off was only completed subsequent to the end of the reporting period) was $235M, which works out to $0.55 or CHF0.50 per share. That is low but keep in mind there are at least $200M in pre-tax non-recurring items so the underlying normalized net income is likely more than 50% higher.

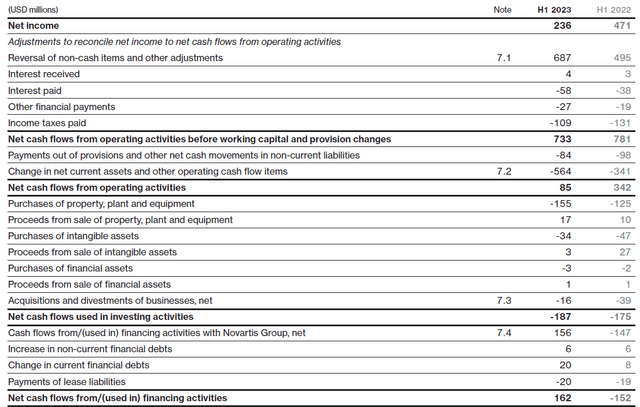

Looking at the cash flows, the company reported a total operating cash flow of $733M, but this includes $210M in change of provisions (which are non-cash at this point but could become non-recurring cash items in the future). Additionally, we should deduct $20M in lease payments and that means the underlying operating cash flow was approximately $713M.

Sandoz Investor Relations

We also see the total capex was $189M and this results in an underlying net free cash flow of $524M and around $500M if you would include the normalized tax payments as Sandoz owed more taxes than it actually paid in the first half of the year.

Unfortunately, the company does not provide detailed financial statements on a quarterly basis and it only provided a trading update on its third quarter. It reported a 9M 2023 revenue of $7.1B, which is a 6% increase and it reconfirmed the full-year guidance. The core EBITDA margin is expected to be 18-19% (implying an EBITDA result of $1.75B using the midpoint of the EBITDA margin guidance). Keep in mind this is the ‘core EBITDA’ and thus excludes non-recurring items like the spinoff costs and the restructuring costs.

This now allows us to calculate the underlying net profit. We know the annualized depreciation and amortization expenses are approximately $500M and I expect the annual interest expenses will be approximately $150M (I will fine-tune this after the FY 2023 results as Sandoz secured its own debt financing right before the spin-off, but this was not yet reflected in the financial statements). A recent bond offering by Sandoz allowed the company to place CHF750M in debt with a 2.125% coupon for the 3-year debt and a 2.6% coupon for the 8-year debt. This indicates the interest expenses will likely come in lower than my anticipated $150M, so I will likely be able to reduce my interest expense expectations for 2024.

This results in a pre-tax income of approximately $1.1B and applying a 25% average tax rate (the core tax rate was 23.3% in H1 2023 and 23.2% in H1 2022, so I am erring on the side of being cautious here) should result in a net income of $825M. That’s CHF743M or CHF1.72 per share. This indicates Sandoz is trading at about 14 times its anticipated core earnings for 2023.

While this set of results is interesting, it does not make Sandoz a screaming buy. However, there was one sentence in the listing statement that got my attention.

These initiatives are designed to drive improvements in our core EBITDA margin to 24-26% of sales by 2028 from 18-19% in 2023.

Indeed, the company expects its EBITDA margin to increase very substantially. As we can also expect the revenue to increase, even a single-digit annual revenue increase could result in seeing the EBITDA double within the next five years. And those longer-term perspectives are exactly why I am interested in Sandoz.

If I would assume a 3.5% annual revenue growth (I’m conservative here, I think a mid-single-digit growth rate is perfectly feasible) and a full-year revenue of $9.5B this year, the anticipated revenue for FY 2028 is approximately $11.3B. Assuming a 24% EBITDA margin (the lower end of the company’s guidance), the FY 2028 EBITDA would jump to $2.7B. Using a 5% revenue growth rate and a 26% EBITDA margin in an optimistic case scenario would result in a revenue of $12.1B and an EBITDA of $3.15B, but I prefer to use my more conservative metrics. The EBITDA CAGR in both scenarios would be approximately 10-12.5%.

Assuming a stable interest expense and a total depreciation and amortization of $600M (20% higher than in 2023), the pre-tax income would jump to $2.05B and the net profit would be approximately $1.6B or CHF1.45B. This represents CHF3.3-3.4 per share.

Investment Thesis

And that’s exactly why I will be picking up Sandoz in the near future. Not because of its 2023 results and not even for its 2024 results where the reported results should be closer to the underlying results. The promised margin expansion over the next five years is the big prize here. As the company will use just 20-30% of its net profit for dividends, it will retain plenty of cash on its balance sheet to self-fund growth and the development of generic brands.

The company had a total net debt of $3.75B (representing just over twice the anticipated EBITDA, just shy of the company’s own target to keep the debt limited to 1.7-2 times EBITDA) which means the current enterprise value is approximately $15B. This means Sandoz is currently trading at an EV/EBITDA multiple of approximately 8.5. If I would use an EBITDA multiple of 9 for 2028 (I don’t think this is unreasonable for the leader in Europe and a global leader) I end up with a fair value of CHF43-51 using my conservative and optimistic scenario respectively. I am also assuming the net debt remains stable and doesn’t decrease from the current levels. Discounting the CHF43 fair value back to 2024 using an 8% discount rate results in a current fair value of approximately CHF32.

I think spinning off Sandoz was a good move by Novartis as the standalone company will be able to pursue growth at a more aggressive pace. I am a buyer at the current price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply