U.K.-based accounting software specialist Sage (OTCPK:SGGEF) has had a solid stock performance of late.

I last covered Sage with my “buy” note Sage: A Neglected British Software Company With A Long Growth Runway. My thesis was that Sage has a sticky customer base, strong product and attractive business model but the shares looked cheap considering all that.

Since then, the change in value is 47% upwards.

The company continues to look attractive to me and business is moving forward well enough. But the sharp share price increase means I now regard the valuation as stretched and accordingly am moving my rating to a “sell”.

Cloud strategy is Paying Rewards

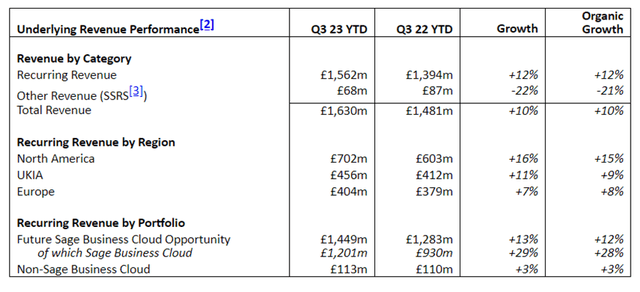

In recent years Sage has been moving towards a cloud-based model intended in part to boost recurring revenues. As can be seen from the topline financial summary below covering the first nine months of the current financial year, this seems to be delivering.

Company announcement (footnotes excluded)

The first half of the year saw underlying annualised recurring revenue up 12% to £2.1bn. The company attributed this to a strong performance across all regions, with growth balanced between new and existing customers. That is good news and suggests broad business health.

Meanwhile cloud native annualised recurring revenue grew 30% to £612m), due to new customer acquisition and migrations from cloud connected and desktop products. So the cloud focus seems to be working in the way Sage hoped.

I think the underlying attraction of the business remains the same. The cloud strategy could help it improve both revenues and profit margins over the long term, which is welcome news.

But there are also some risks here. While Sage’s business remains brisk – particularly in North America – I think a broad business slowdown increasingly evident in many markets could bite into businesses’ IT budgets. This is where part of the strength of Sage’s model comes through: it is rather entrenched in many customers due to switching costs and it is core to business operations. But it would be naïve to expect that a global economic slowdown does not pose some risk to revenues, especially when it comes to signing up new customers.

Net Debt Remains a Point to Note

The company has ample liquidity and brought net debt down by 6% between the end of September and end of March.

Nonetheless, at £691m I still think it is higher than I would like. That is higher than the past two years’ statutory earnings combined. The company can manage this debt fine, I don’t doubt. But for a business that generated £194m of free cash flow in its first half, I feel Sage could bring down its net debt faster while the economic environment remains relatively benign.

Valuation now Looks Stretched

The Sage share price has certainly shot up since I last covered it. But what about the business’ financial metrics?

Looking at last year’s performance compared to the last full pre-pandemic year (2019), things hardly look great.

|

2022 |

2019 |

% variation |

|

|

Revenue (£m) |

1,947.00 |

1,936.00 |

1% |

|

Operating Profit / (Loss) (£m) |

367 |

382 |

-4% |

|

Profit Before Tax (£m) |

337 |

361 |

-7% |

|

Profit after tax from continuing operations (£m) |

260 |

266 |

-2% |

Chart calculated and compiled by author using data from Hargreaves Lansdown

That means that, based on last year’s earnings and its current market cap of £10.4bn, the company is trading on a P/E ratio of 40. The increased valuation means that the dividend yield is now just 1.8% at a time when many FTSE 100 peers are offering double, triple or even quadruple that.

Could the valuation be based on future earnings expectations more than past performance? Here is the company’s outlook for its present financial year:

“Building on strong momentum in the first half, we now expect organic recurring revenue growth for FY23 to be in the region of 11%, driven by continued strength in Sage Business Cloud. We continue to expect other revenue (SSRS) to decline, in line with our strategy. Operating margins are expected to trend upwards in FY23 and beyond, as we focus on efficiently scaling the Group.”

Broadly speaking that sounds like it ought to translate to higher per-share earnings, though the wording is vague and there are no specific expectations set.

But even if earnings do grow – and in the medium-term I feel confident they will, thanks to the company’s cloud-first strategy shift of recent years, as well as its intrinsically strong business model – we might still be looking at a prospective P/E ratio in the thirties.

That seems high to me for a company that has been inconsistent in recent years and has decent rather than great growth opportunities ahead of it. I wouldn’t buy Sage for my portfolio with a P/E ratio above 20 and even that would be a bit of a push, depending on its financial outlook. So I now see the shares as overvalued and am changing my “buy” rating to a “sell” on that basis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply