Preview

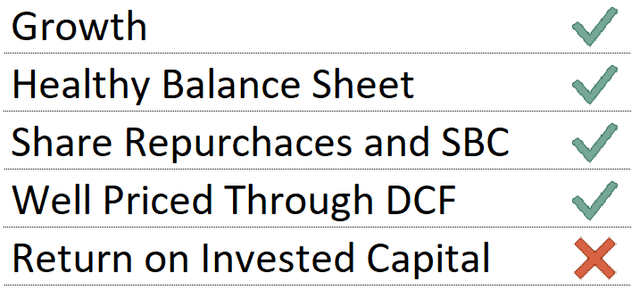

In this article, I evaluate the security by giving a “Pass” or “Fail” rating for five different attributes. Ratings are given by interpretation of relevant and measurable information. A security will be considered favorable if it receives a “Pass” for each of the following five attributes:

- Long-term growth in Revenue, Net Income, and Free Cash Flow.

- A Healthy Balance Sheet on a Net Debt/EBITDA basis.

- Share Repurchases outweigh Stock-Based-Compensation.

- A Fairly-Priced Stock Through a Corporate Discounted Cash Flow Analysis.

- Average Return on Invested Capital “ROIC” is greater than WACC.

Overview

Ryder System, Inc. (NYSE:R) is a prominent logistics and transportation company with three key business segments: Fleet Management Solutions (“FMS”), Supply Chain Solutions (“SCS”), and Dedicated Transportation Solutions (“DTS”). FMS offers leasing, maintenance, and rental services for trucks and trailers in the U.S. and Canada. SCS provides integrated logistics services, including distribution, transportation, and e-commerce solutions in North America. DTS offers turnkey transportation solutions in the U.S. In 2022, Ryder announced its exit from the FMS business in the United Kingdom.

1. Growth

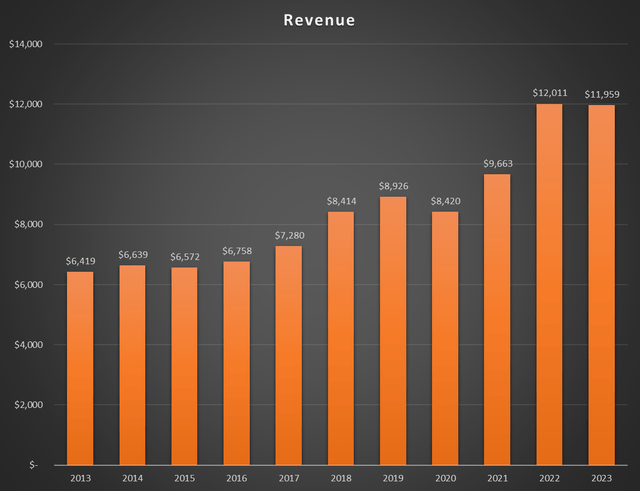

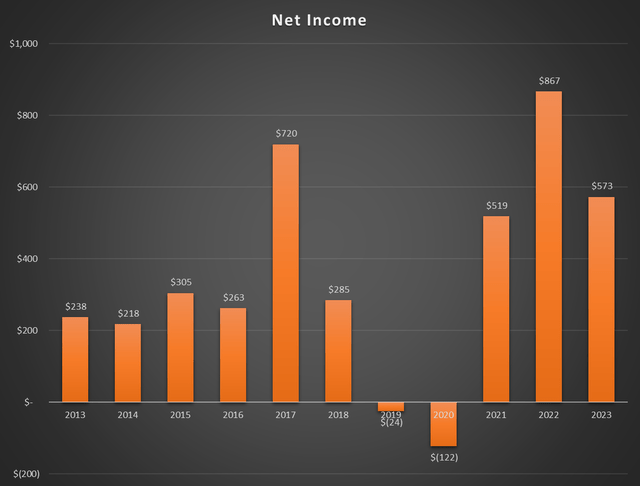

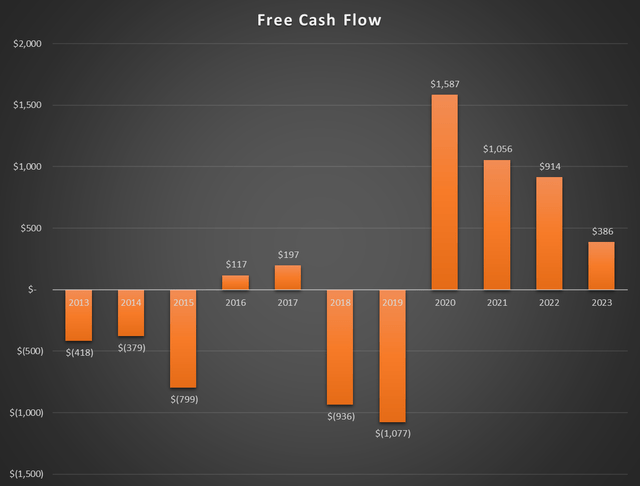

For Growth, I want to see a long-term increase in Revenue, Net Income, and Free Cash Flow. Ryder has done a fine job growing revenue through 2022 with a slight dip in 2023. However, analysts still predict a steady continuation of growth in the upcoming years. Net Income was a little dicey in 2019 and 2020, as expected for a freight and logistics company during a COVID lockdown and supply crisis. However, they have managed to really turn things around with record levels in 2022. Free cash flow is a bit interesting, with a massive increase in 2020, and then degrading. For a company with such heavy capital expenditures and depreciation, I expect free cash flow to be a little wonky compared to the other metrics. However, I see evidence of long-term growth, and for that, I will assign a “Pass” for this attribute.

Revenue Ryder (Author)

Net Income Ryder (Author)

Free Cash Flow Ryder (Author)

2. Balance Sheet

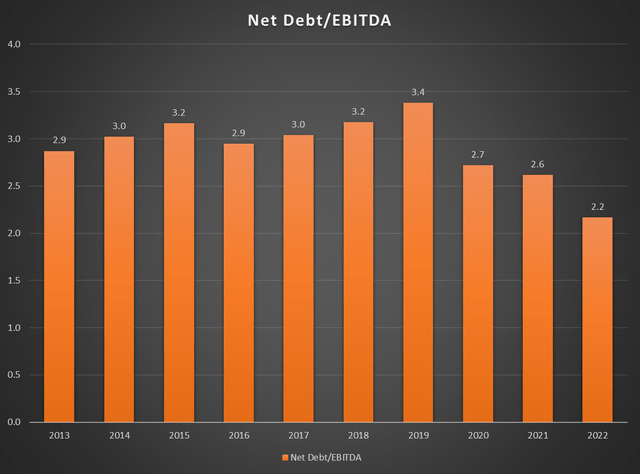

Ideally, I’d like to see a Net Debt/EBITDA ratio of less than 3. As this ratio grows, there are more issues with interest rates eating up profits, and creditors categorizing the security as risky. Unfortunately, Ryder is in a very capital-intensive industry, with relatively small margins. Because of this, generally more debt is needed to grow the business. That being said, they have done a decent job keeping this ratio low over the past three years. I’m happy to give this attribute a “Pass”

Balance Sheet (Author)

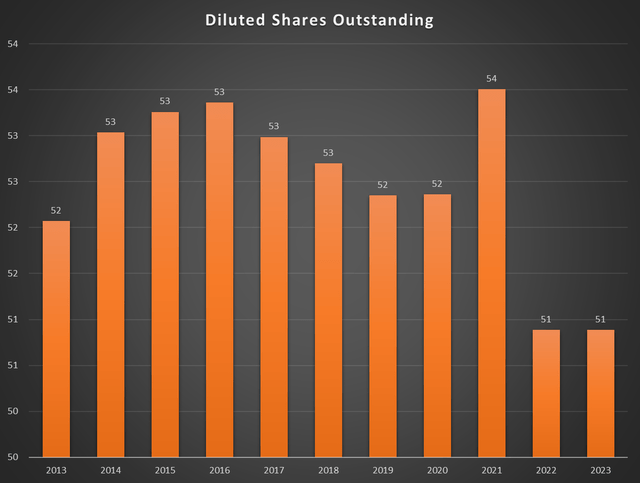

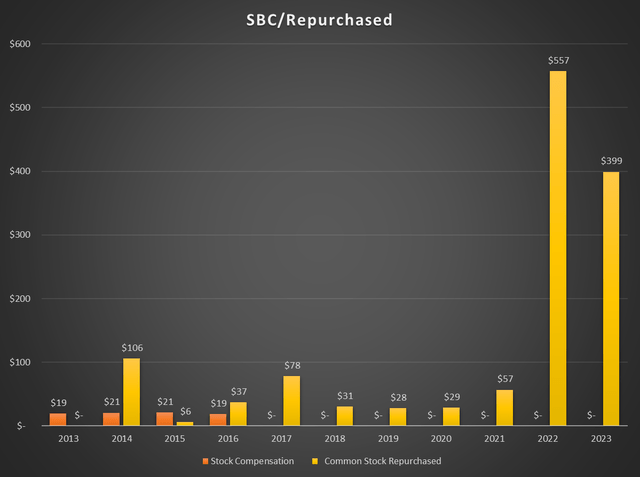

3. Stock-Based Compensation and Share Repurchases

The share dilution chart looks pretty flat, which I’m okay with. I really don’t want them diluting me as a shareholder and I don’t see that here. They also don’t offer stock-based compensation which means more cash to me as the investor. Furthermore, a lot of capital is being put towards share repurchases. I’ve seen better charts here, but I’ll give this attribute a “Pass”.

Share Dilution (Author)

SBC (Author)

4. Valuation

The valuation segment will consist of passages dedicated to risk and discount factor, the discounted cash flow model, and a valuation discussion.

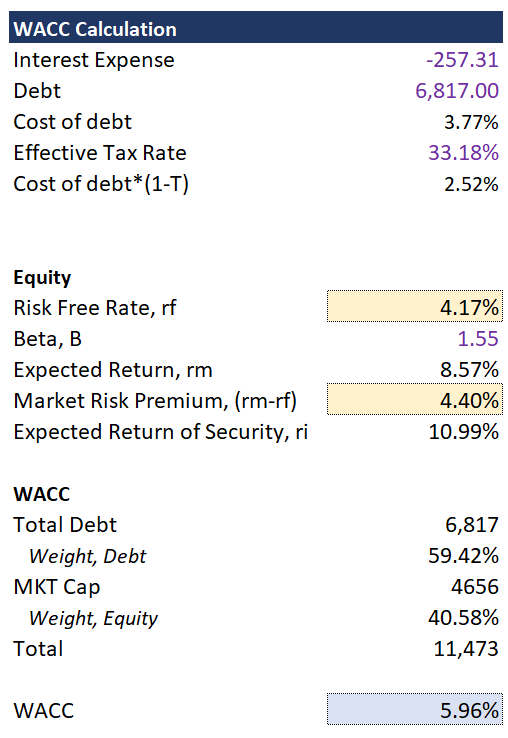

Risk and Discount Factor

For my Discounted Cash Flow Analysis (“DCF”), I am using Free Cash Flows to The Firm (“FCFF”), also known as Unlevered Free Cash Flow. If Unlevered Free Cash Flows are being used, the firm’s Weighted Average Cost of Capital (“WACC”) should be used as the discount rate. This is because one must take into account the entire capital structure of the company to include the shares of all investors. A portion of the WACC was found by using the Capital Asset Pricing Model (“CAPM”). The assumptions are shown here:

WACC (Author)

This riskiness Ryder is measured by a beta of (1.55). A beta does not necessarily measure volatility, but it measures sensitivity to the rest of the market. A beta of greater than 1 means the stock is more sensitive to the market, and eludes a higher risk, which means investors require a higher return. A beta of less than 1 means the stock is less sensitive to the market, and eludes a lower risk, which means investors require a lower return.

The Risk-Free Rate used was the current 10-year Treasury Bond Rate of 4.17%. This would be a guaranteed return an investor could gain risk-free, so it only makes sense that the investor should gain a higher return for more risk.

The Market Risk Premium is simply the Expected Return of a broad index minus the Risk-Free Rate. This would be the premium the investor would need to invest in the security versus a simple broad index or ETF. This value was found on Damodaran Online.

Using the Capital Asset Pricing Model (“CAPM”), we arrive at an Expected Return of the Security of 10.99%. After factoring in debt obligations, we arrive at a WACC of 5.96%. Note the WACC is small compared to the expected return because of the weight carried by debt obligations. Anyway, this will be used as the Base Case discount factor moving forward.

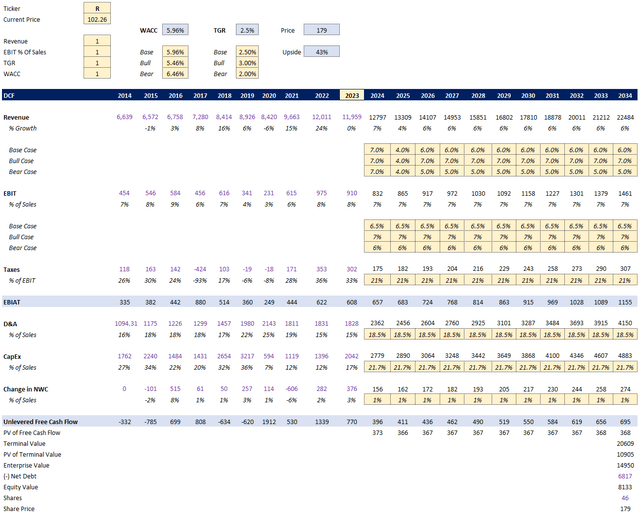

Discounted Cash Flow Model

The DCF models a Base Case Scenario, a Bull Case, and a Bear Case. Assumptions are shown in the tan boxes.

DCF (Author)

From the top down, assumptions for each category are explained:

- WACC – Base Case was previously calculated. Bull and Bear are deviations of the Base Case. This should account for any noise in the WACC calculations.

- Terminal Growth Rate (“TGR”) – This is the rate we believe the security will grow indefinitely. Generally, a solid Base Case assumption is 2.5%, to represent long-term market inflation. I have deviations from this for the Bull and Bear Case, respectively.

- Revenue Growth – For all cases, I input analyst estimates for 2024 and 2025. For the remainder years, I input reasonable assumptions based on historical averages.

- Earnings Before Taxes (“EBIT”) – Each case follows a different range of average historical margins.

- Taxes – Average of historical rates. I went on the higher end here.

- Depreciation and Amortization – Average of historical rates.

- Capital Expenditures – Average of historical rates.

- Change in Net Working Capital – Average of historical rates.

Valuation Discussion

By modifying my switches for each assumption, I arrive at the following price distribution:

- Base Case – Fair Value of $179 for (43%) upside.

- Bull Case – Fair Value of $395 for (74%) upside.

- Bear Case – Fair Value of $63 for (-61%) upside.

Overall, I would say Ryder is slightly undervalued. From a risk-reward standpoint, there is evidence that investing in this security is better than investing in a broad index or ETF. For this reason, I will give a “Pass” for this attribute.

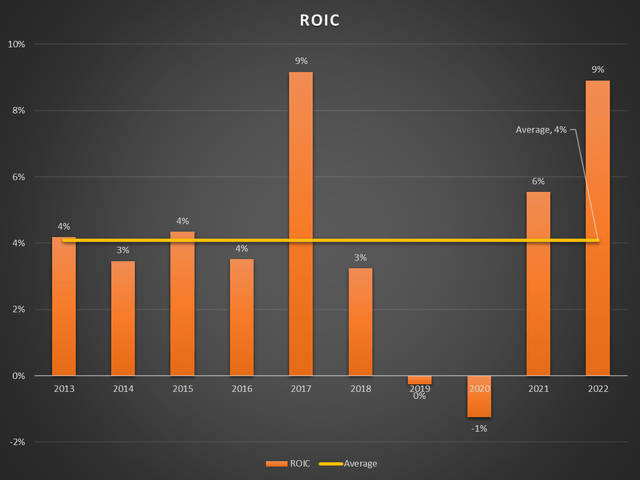

5. Return on Capital

I like to see the average Return on Capital (“ROIC”) higher than the WACC of the security. If ROIC is greater than WACC, this tells me management efficiently allocates capital and generates value. If ROIC is lower than WACC, this means the security destroys value. This brings me to my next point as to what concerns me the most about Ryder. An average of ROIC 4% is very low in general. In fact, this is even lower than its own WACC of 6%. Even if numbers were fudged in a bullish direction, I think we could say best case scenario, Ryder is neither generating value nor destroying it. For me, this attribute is a “Fail”.

ROIC (Author)

Review

Attributes (Author)

Ryder has growth, a solid balance on a net debt/EBITDA basis. They are reasonable with share repurchases and stock-based compensation and are even well priced through a DCF. That being said, the ROIC compared to WACC is a bit of a letdown. If I’m owning a company for the long term, then I would like one that generates value. Because of the supply chain crisis hitting some of these metrics hard, I believe there are greener pastures ahead for Ryder and its ROIC metric. I’m not jumping up and down for them, but I think Ryder deserves at least a “Hold”.

Read the full article here

Leave a Reply