It is possible that as you review our work on Global X Russell 2000 Covered Call ETF (NYSEARCA:RYLD) we will get maximum points for consistency and probably a failing grade for title creativity.

Seeking Alpha

That was the best way though, to repeatedly warn unsuspecting investors that basic math was telling them to not fall for the “yield” being dished out. This is what RYLD has done since the earliest article shown above.

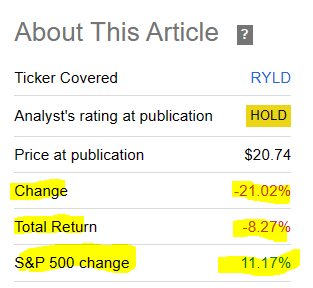

Seeking Alpha

We go over the facts once again and update our outlook on this fund. We also drop a solid idea of how you can outperform this fund if your heart is set on capturing yields.

The Current Setup

Global X has a wide variety of offerings and we have written about several of them previously. In fact, we use Global X SuperDividend® REIT ETF (SRET) as one of our “benchmarks” but in a satirical sense as it does the exact opposite of what we do in terms of searching for yield.

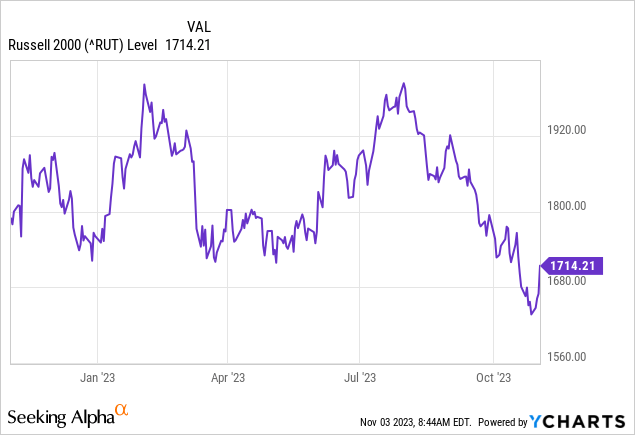

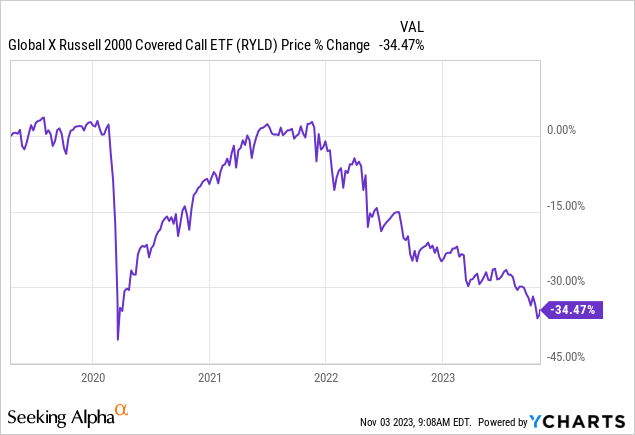

RYLD is a covered call writing fund and it has unfortunately the worst asset class to work on. The Russell 2000. Now, the asset class itself is not bad, but it has been an absolute disaster to work with considering that it is now trading near November 2020 levels (data as of end of last week).

Jim Bianco on X

This is of course in contrast to the S&P 500 (SPY) which is well above even its October 2022 lows. RYLD has tried to enhance this experience by selling calls on its positions.

RYLD

The covered call strategy has seen an explosion in popularity. Many funds have emerged to take advantage of this. Unfortunately most have done extremely poorly as they are married to the idea that selling shorter dated calls is the way to go. RYLD is no different than the sector median.

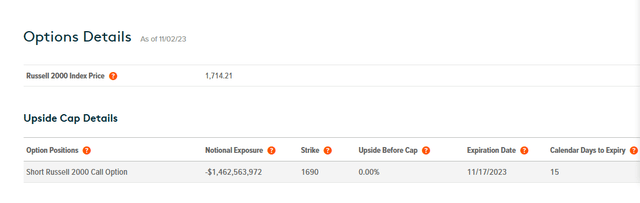

Below we can see that RYLD on its latest endeavor has sold calls on the Russell 2000 at the 1690 strike with an expiration for November 17, 2023.

RYLD

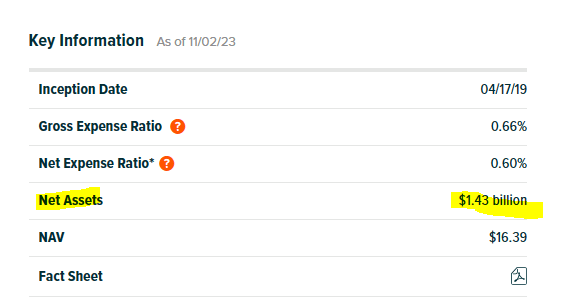

The total amount is for $1.462 billion notional value and that corresponds almost exactly with the fund’s total exposure.

RYLD

Now, Russell 2000 is not an index most of you follow, unlike the Dow Jones Industrial Average or the S&P. So here is where that index stands.

As you can see the index is already above that level. So it could soar to even 1,900 by November expiration and the fund would get zero benefit from that as it has capped all its upside. So there are few facts to glean from that. The first is that even after such an oversold state on the Russell 2000, both short and medium-term, the fund sold a call right near where the index was trading. This is what happens when you embrace a “blind” (as in you are indifferent to price and technicals) strategy. The second is that fund is not going to be liquidated come November 17. In a normal covered call scenario when your stock goes over the strike, you get called on it and you can decide next where you want to go. Here, RYLD’s entire position would have to be effectively liquidated as an offset to the calls sold. It won’t do that of course. It will likely have to buy back those calls at a loss and then the process starts again. So you have a “whipsaw” effect which destroys returns as you bought the assets back at a higher price than where you liquidated.

Returns Since Inception

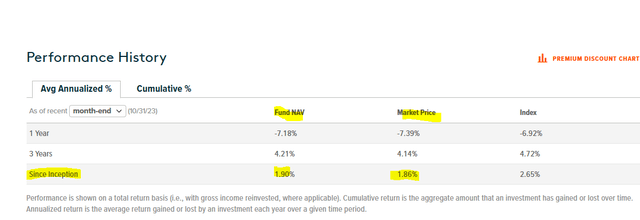

Everyone who uses the “double-digit yield” anywhere in their commentary should be asked to explain this return profile.

RYLD

Yes, the fund has produced sub-2% annual total returns since inception. Even the “I am getting my dividends and I don’t care” crowd has likely noticed the massive NAV erosion of 35%.

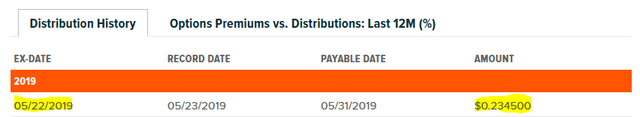

The same crowd might have also noticed that the very first distribution was $0.2345.

RYLD

The current one is about 16 cents. In other words total return actually matters and distributions have followed, and you have to be sitting for this, the change in NAV.

Where We Go From Here

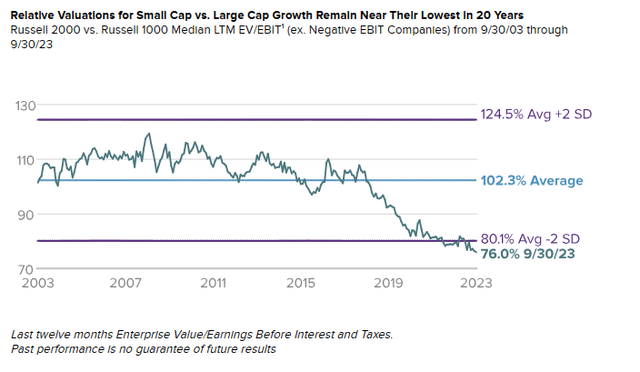

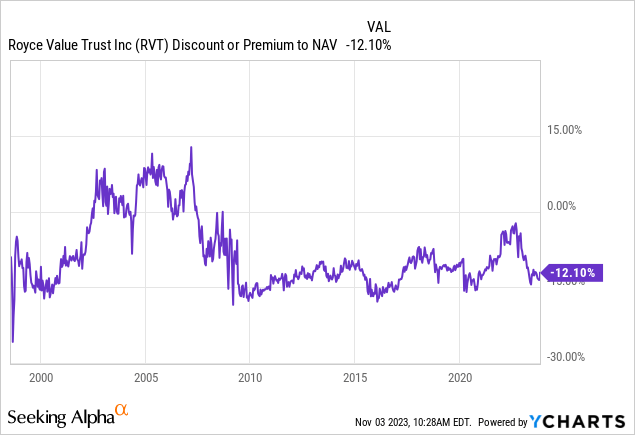

On the macro side, small cap stocks have almost never been this cheap. Royce Value Trust’s (RVT) manager, Chuck Royce, who has 60 years of experience in this field, puts up this rather interesting slide in his latest interview.

RVT

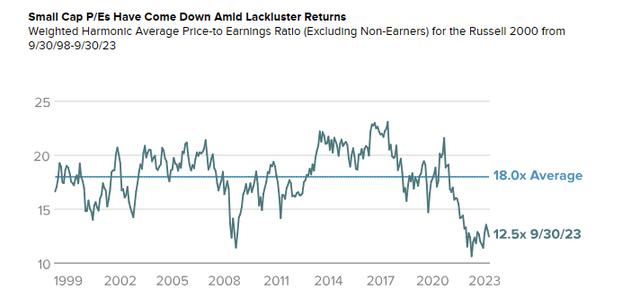

Even if we see them on an absolute sense (rather than vs. the silly priced large cap brethren), they are cheap.

RVT

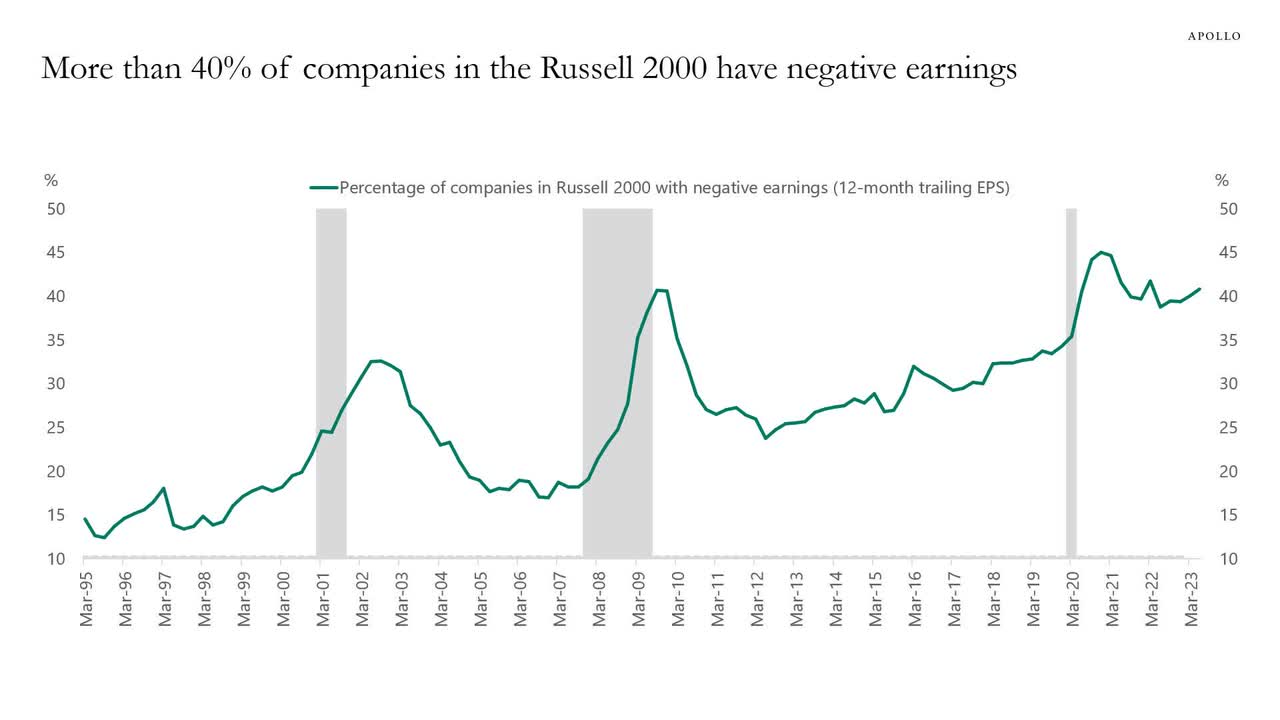

One counterpoint from our side is that both those include the companies with negative earnings. Those are not exactly a small fraction either.

Apollo Capital

So you need an expert manager like Chuck Royce to do the work for you.

Verdict

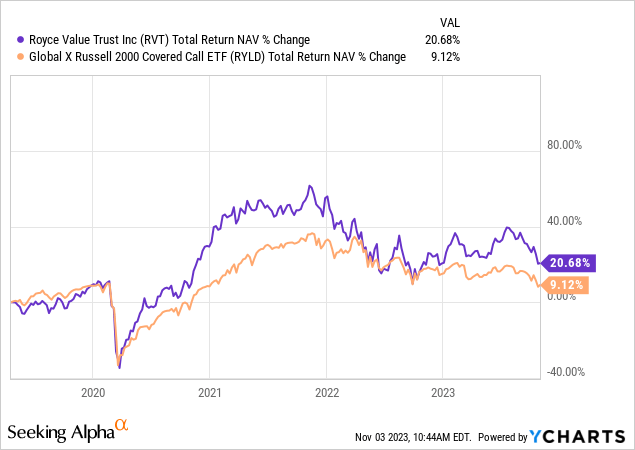

So small caps have a lot of value in them, but the index has too much junk. Of course RYLD only plays the index and does so blindly. You can see why we have zero love for it even here. Can RYLD outperform a straight small cap index ETF like iShares Russell 2000 ETF (IWM)? Of course it can. At least over some timeframes. It is a roll of the dice. But can it deliver anywhere close to its double-digit distribution yield?

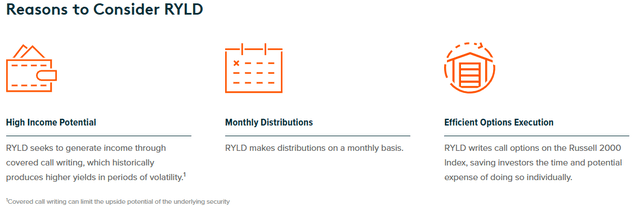

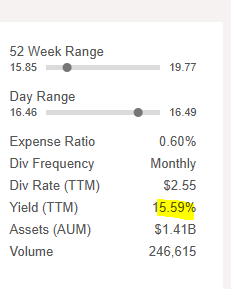

Seeking Alpha RYLD

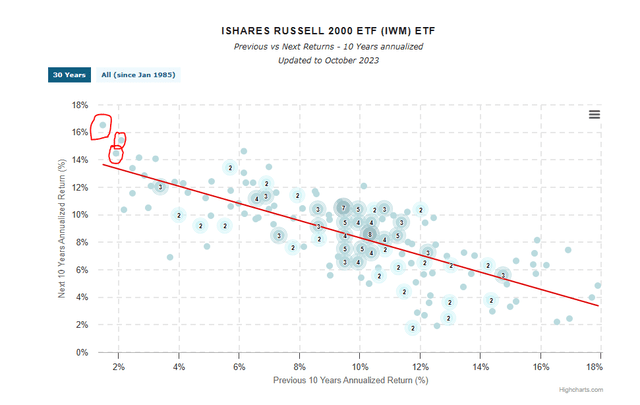

No chance at all. Zero. Nada. In fact it is virtually impossible to find any rolling multi-year period where small caps have delivered 15.5% compounded. There are only three instances which come close. Anyone want to guess when those were?

Lazy Portfolio

January 2009 (14.47%). February 2009 (16.33%) and March 2009 (15.42%). That chart also shows an amazing correlation between the previous 10-year return profile and the next 10-year return profile. So yeah, if your small caps get taken to the cleaners and we see Russell 2000 drop another 40% from here, you could get 15% annualized returns on a straight small cap fund. But RYLD won’t get there under any circumstances (even after a 40% drop) as the blind call selling is going to eat up a lot of your returns. Investors interested in small caps should look at RVT which we think is a far better choice.

The fund also trades at a nice discount to NAV that could close in the next bull market.

The managed distribution is far less (8.3% currently) but it represents something that the fund can deliver in total returns over time versus the RYLD payout.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here

Leave a Reply