The RTX Dividend Investment Thesis Remains Decent, Thanks To The Management’s Reiterated Guidance

We previously covered RTX Corporation (NYSE:RTX) in July 2023, discussing its mixed prospects, attributed to the accelerated removals of the Pratt & Whitney fleet and the potential impact on its bottom-line.

These had been well-balanced by the raised forward guidance and expanded backlog through FY2025, with the headwind likely to be temporary.

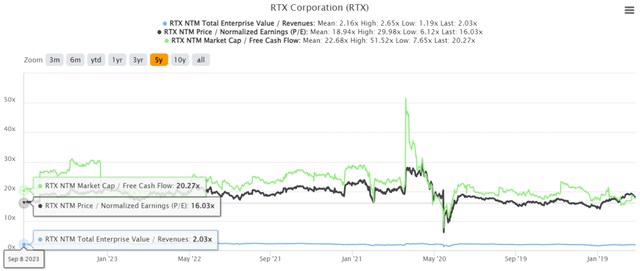

RTX 5Y EV/Revenue, P/E, and Market Cap/ FCF Valuations

S&P Capital IQ

Since then, the RTX stock has continued to trade sideways, mirroring the market wide performance, implying a lack of bullish support. This situation is interesting to observe indeed, since RTX still trades at NTM EV/ Revenues of 2.30x, NTM P/E of 16.03x, and Market Cap/ FCF of 20.27x as of September 08, 2023.

While these numbers may seem impacted compared to its 1Y mean of 2.33x/ 18.87x/ 24.30x, it appears that the stock has only moderated nearer to its pre-pandemic mean of 1.99x/ 16.36x/ 19.60x, respectively.

In addition, RTX has released another update on the Pratt & Whitney GTF fleet on September 11, 2023, way ahead of the upcoming FQ3’23 earnings call in October 2023, with the management expecting to record a painful $3B pre-tax charge in FQ3’23.

On the other hand, the management has also reiterated its FY2023 EPS guidance of $5.00 (+4.6% YoY) and Free Cash Flow generation of $4.3B (-11.8% YoY) at the midpoint, while confirming its share repurchase target worth $3B.

Based on RTX’s lowered FY2025 Free Cash Flow projection of approximately $7.5B and the current share count of 1.46B, we are looking at an approximate FCF generation of $5.13 per share then.

Combined with its normalized Market Cap/ FCF of 19.60x, it appears that there is a reduced margin of safety to our long-term price target of $100.54 indeed.

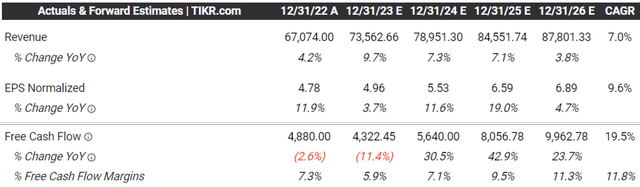

Consensus Forward Estimates

Tikr Terminal

Then again, RTX investors must also note the Pratt & Whitney headwind will not last forever, with the consensus already estimating a normalized FY2026 FCF generation of $9.96B, implying a raised price target to $133.67.

Therefore, while the upcoming FQ3’23 earnings call may be painful, we are not overly concerned since the management has taken critical steps to manage Mr. Market’s expectations, attributed to the recent news release with most of the pessimism likely embedded by October 2023.

Moving forward, RTX investors may want to pay attention to its balance sheet of $5.39B (-8.4% QoQ/ +13.2% YoY). While the sum appears to be robust, the FCF headwinds may trigger its increased reliance on short-term commercial paper borrowings from the $1B reported in FQ2’23 (+900% QoQ/ +566.6% YoY).

Thanks to the Fed’s sustained hike thus far, these short-term borrowings also come with higher interest rates of 5.5% (+1.2 points QoQ).

Due to its growing long-term debts of $32.73B (inline QoQ/ +6.6% YoY), RTX has naturally reported higher annualized net interest expenses of $1.33B in the latest quarter (+5.7% QoQ/ +1.2% YoY) as well.

Combined with the annualized dividend cash flow of $3.37B (+6.8% QoQ/ +5.7% YoY) and $3.32B of its debts maturing through FY2025, it is unsurprising that Mr. Market is growingly bearish on its intermediate term execution.

This is especially since it is uncertain how much of a bottom line impact the Pratt & Whitney issue may actually be over the next few years.

So, Is RTX Stock A Buy, Sell, or Hold?

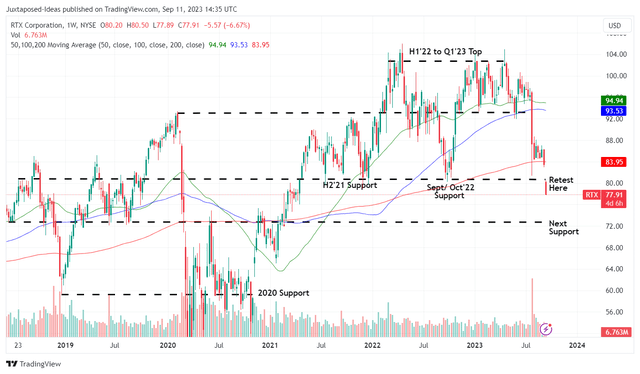

RTX 5Y Stock Price

Trading View

For now, we are cautiously rating the RTX stock as a Buy, due to the attractive upside potential to our long-term price target.

However, this rating comes with a very specific caveat indeed. The latest news release has already triggered the unfortunate breach of the stock’s critical support levels of $80s, with the selloff likely to continue over the next few days.

As a result of the potential volatility, interested investors may want to wait a little longer and only add at its next support levels of $72.

Then again, the RTX management has already reiterated its capital returns of between $33B and $35B through 2025, with its dividends likely remaining safe based on the Seeking Alpha Quant rating of B+.

Those depressed levels also trigger its expanded forward dividend yield of 3.27%, compared to its 4Y average of 2.42% and sector median of 1.55%, providing opportunistic income investors with a highly attractive entry point.

Nonetheless, it goes without saying that RTX Corporation stock is only suitable for those with higher risk tolerance, since it remains to be seen when we may see a floor to this decline and when the pessimism surrounding the Pratt & Whitney issue may fade.

Only time may tell.

Read the full article here

Leave a Reply