Pity the poor small caps, and their fans. I’m one of them. But I’m also a realist. As such, I have to admit that small-cap investing has changed, maybe forever. Here’s why.

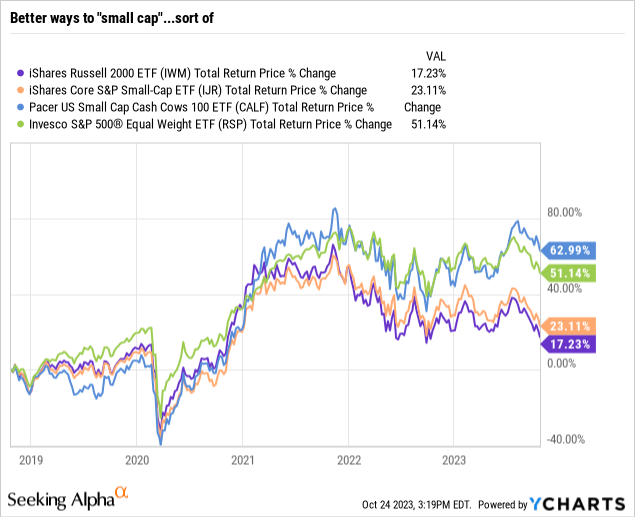

Traditionally, the Russell 2000 small cap index was the primary way investors characterized the performance and makeup of that part of the US stock market. The iShares Russell 2000 ETF (NYSEARCA:IWM) amassed more than $40 billion in assets on that basis, since its June 2000 inception. The S&P SmallCap 600 Index and its associated ETF, the $63 billion iShares Core S&P Small-Cap ETF (IJR) have rivaled IWM for small-cap stock investors. Vanguard, Schwab, and others have ETFs devoted to this market segment as well.

But the older I get, and the more I evolve as an investor (as any investor should), the more I look for what is worth focusing on and what is redundant. And I’m starting to think that small caps may add very little value to portfolios versus what they once did.

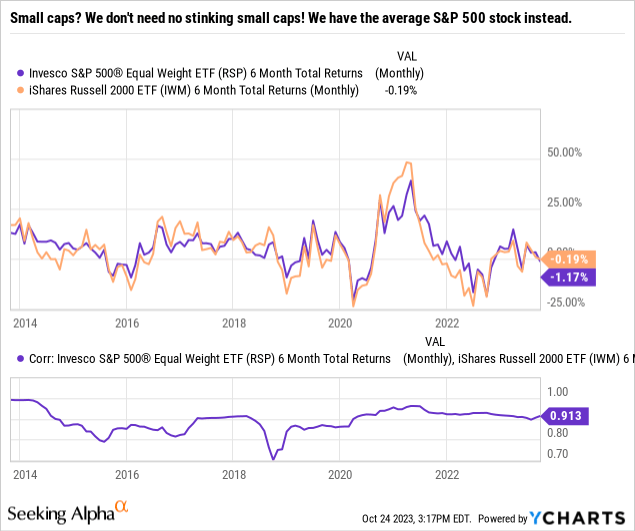

That opinion is greatly enhanced by what I see emerging within the S&P 500. It has become so skewed toward the biggest companies, the rest can be looked at in one of two ways. Some investors will look at them and conclude they are irrelevant. But given the standards of membership in the S&P 500 versus those of the Russell 2000 (where just being of a certain size is nearly enough to get in), I’m starting to get friendly to the idea that the lower-capitalization stocks within the S&P 500 are the “new small cap stocks.” That makes ETFs like the Invesco S&P 500 Equal Weight ETF (NYSEARCA:RSP) relatively more interesting, as well as other ETFs that focus on that smaller end of that index.

Small caps versus S&P 500: how we got here

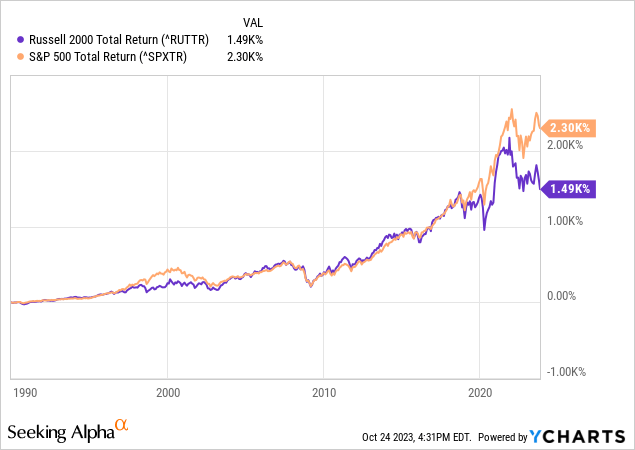

Here’s some history, for those who have not been immersed in this stuff since the 1980s like I have. See this chart below, where until very recently, the Russell 2000 outperformed the S&P 500. As of the end of 2021, small caps held a cumulative 500% lead over the S&P 500 (2,500% to 2,000%) going way back to 1990. And small caps dominated the late 1990s, the last time investing turned into a casino, the way it has in recent years.

It is all about what investors want… and how they’ve been trained

Except this time around, it is not the small caps that investors favor. I think that has a lot to do with the success of the S&P 500 Index, not to mention its promotion and recognition in the media and in 401k plans as “the stock market.” I suspect many investors don’t really understand what the S&P 500 is and isn’t, and I have and will continue to write to educate folks about that.

As for small caps, they have the decided disadvantage of being not nearly as “sexy” to a new generation of investors. Sure, there are meme stocks and the occasional small-cap heroes. But it seems to me that investor psychology is no longer so closely tied to diversification. That’s what a decade of S&P 500 dominance versus small caps, international stocks, value stocks, dividend stocks, and just about anything else equity-related will do.

Small-cap value? Yawn!

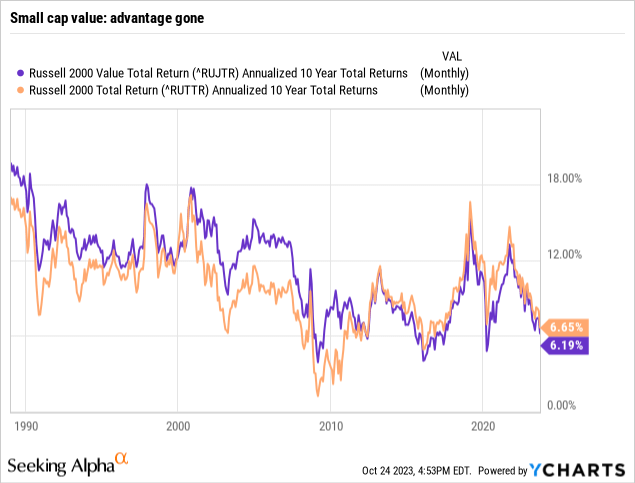

Oh, did we hear a lot about the virtues of small-cap value investing over the past 10-15 years! During my days as an investment advisor (which ended when I retired from that in 2020), I was constantly bombarded by sales pitches based on the small-cap value advantage, how well it had done for so long, and the rationale for that continuing was air-tight. But when we look at this next chart, that advantage has disappeared over the past 10 years.

Maybe it will rebound, and maybe for a long time. But modern markets work in a way that makes that less likely. It is more of a popularity contest and a shorter attention span that drives the stock market for long periods of time. That is especially the case now, in the midst of a bear market that languishes but hasn’t really broken down the way bear markets typically do. “Buy the dips” is still the law of the land apparently.

And the dips they are talking about are in the S&P 500 cap-weighted index and the Nasdaq 100. Everything else is a second-class citizen. That’s my read on market psychology, and how it has changed in recent years, thanks to a whole new group of market participants. Retail investors are more impactful than ever, and so are algorithmic traders. Day trading is off the charts, and option usage is too. What has taken a step back is true “price discovery.” That is why, even with small cap indexes selling at deep discount multiples on earnings and revenue versus those of bigger stocks, whatever “value” lies there… just lies there, not recognized.

There are bright spots in small-cap land. I like the approach taken by Pacer US Small Cap Cash Cows ETF (CALF), a $3.8 billion ETF that starts with the S&P 600 and then screens and weights by cash flow. That creates a higher quality small cap index, but it might be more of a supporting position, rather than a core part of a long-term portfolio I build.

RSP: the small-cap alternative that isn’t really a small-cap ETF

This S&P 500-centric environment leads me to believe that RSP is a solid alternative to many small-cap funds. To be clear, the S&P 500 contains no small-cap stocks, as the lowest market caps are around $4 billion. And about 30% of the current index has a market cap at or below $20 billion. RSP’s average market cap is $34 billion. But compare that to the market cap of the 100 largest companies in the index. It is nearly $500 billion!

So, what we have here is a bifurcated market. And rather than over-analyze the definitions of “small”, “mid” or “large” when it comes to capitalization, I’m making the case for a combination of S&P 500 membership combined with a not-mega cap size, as a forward-looking alternative to small-cap stocks.

Frankly, I just don’t see the tide toward larger companies versus smaller ones changing so quickly. Even in the event of a recession and market crash, the way markets function today (highly correlated during declines), the cream that rises to the top is likely to be the companies that don’t have the debt issues and do have the power of indexation behind them. Specifically, any stock in the S&P 500 is going to be bought when money flows into that index. And like it or not, this generation of market participants has a collective fixation on the S&P 500. Learning all about small-cap investing’s virtues will take a lot of re-education.

Conclusions: most interesting?

I like RSP relative to IWM as a way to invest in “non-mega cap stocks.” RSP gets a Hold rating from me. But that is versus the S&P 500 since my big picture view remains that the entire stock market has a bearish tilt to it, and will until some “clearing out” of speculation and recognition of a fading consumer and exploding debt occurs.

And, if you are not familiar with my approach to ETF ratings, I don’t put as much stock (pardon the pun) in them as many do. I do favor equal weighting over market cap weighting in the period ahead, as the disparity between the two is historically off the charts, and due to revert to the mean, so to speak. So I favor RSP versus SPY as well. But as I dig deeper into this, I aim to identify ETFs that have some of the competitive advantages versus small caps and mega caps that I see in RSP, but with more focused/concentrated portfolios than owning 500 stocks in equal weightings.

And, like that famous TV commercial character, the world’s most interesting man (which I clearly am not!), I don’t often invest in small-cap stock ETFs. But when I do, I’ll likely use IJR and CALF, not IWM.

Read the full article here

Leave a Reply