81 Stocks in RIG/Rose’s Income Garden

RIG = Rose’s Income Garden is meant to grow income and continues to do just that. The majority of the 81-stock portfolio is common stock, with some preferred shares and HY financials thrown in for diversity and of course, the income. It also was built with quality in mind for high grade investments that will have rising income and also capital gains that should follow along.

Below is a chart found at The Macro Trading Factory “MTF” revealing the asset classes:

|

Asset-Class Breakdown |

|

|

Asset-class |

% of Portfolio |

|

Common Stocks |

75.43% |

|

Common Units |

0.00% |

|

Preferred Shares |

5.21% |

|

Preferred Units |

0.55% |

|

IG Bonds |

0.00% |

|

HY Bonds |

0.65% |

|

CEF |

4.11% |

|

ETF |

12.63% |

|

Cash |

1.43% |

|

Total |

100.00% |

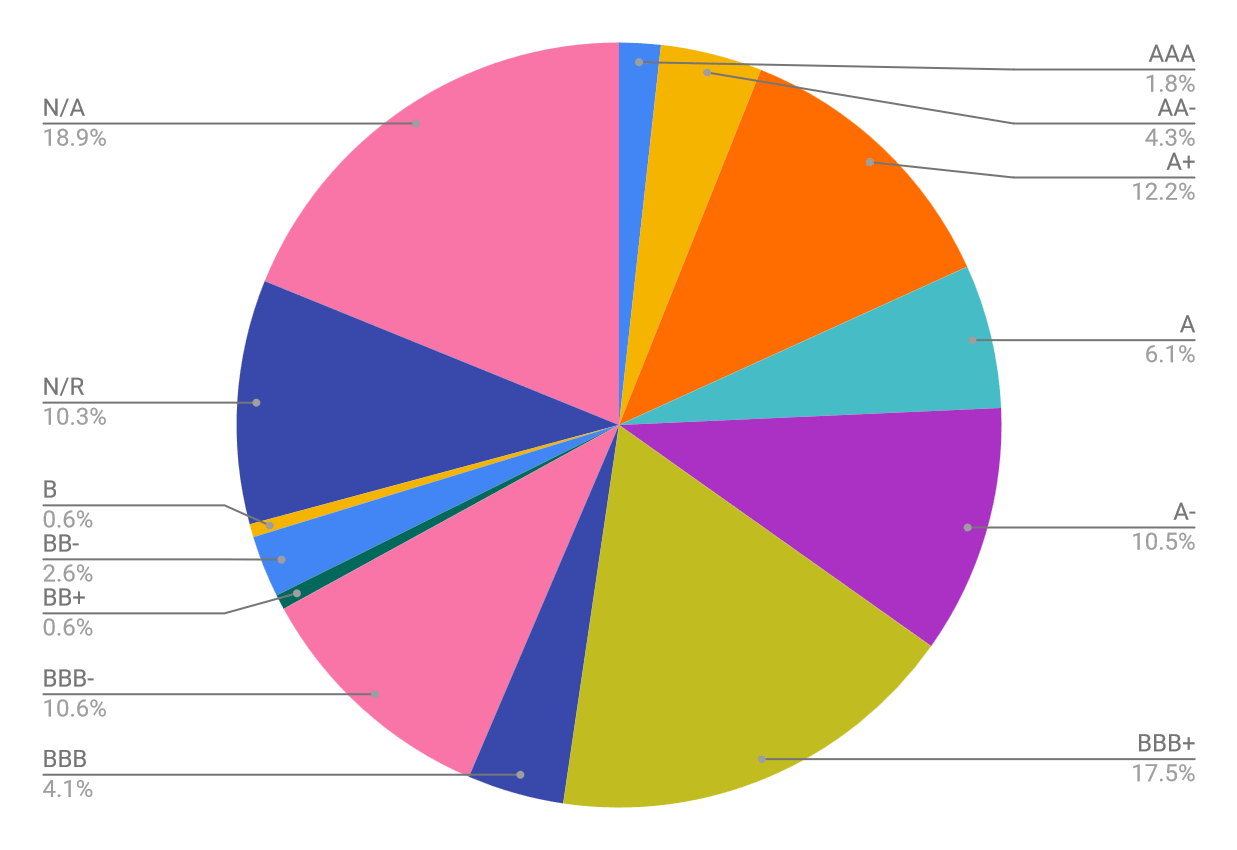

The Credit ratings from MTF are also revealed below:

|

Credit Rating |

% of Portfolio |

|

AAA |

1.74% |

|

AA+ |

0.00% |

|

AA- |

4.25% |

|

AA |

0.00% |

|

A+ |

12.04% |

|

A |

6.02% |

|

A- |

10.42% |

|

BBB+ |

17.35% |

|

BBB |

4.05% |

|

BBB- |

10.49% |

~30% of the investments are not rated, as they are financials themselves that offer loans.

Below is a beautiful color wheel showing the quality and diversity of the investments within RIG.

RIG Investment Credit Rating Wheel (Macro Trading Factory Oct 2023)

RIG: 11 sectors

Percentages of holdings in each sector are listed in the chart below.

38 companies fall into the defensive category for RIG and are listed in bold print.

Defensive sectors – 31 companies

The first 4 sectors listed are considered defensive.

– Consumer Staple

– Healthcare

– Communication Tele

– Utility

Lately, especially these past 2 years, the communication tele sector has been very sensitive and perhaps no longer should be considered in this group, but it remains there for now.

Bonds and Cash – 2 investments

– Fixed bond and the Cash MMA are held as defensive.

Individual Defensive Stocks – 5 companies

-2 Ind Def = Industrial defensive = Lockheed Martin (LMT) and General Dynamics (GD)

-3 RE Hc Def = real estate healthcare stocks: Omega (OHI), Medical Properties Trust (MPW), and Sabra (SBRA).

The chart column abbreviations:

#Co = number of companies in the sector.

%PV = percent of portfolio value.

% 23 Inc = percent 2023 income.

|

Defense |

#Co |

% PV |

% 23 Inc |

|

|

10 |

Cons-Staple |

11.36% |

10.78% |

|

|

9 |

HealthCare |

14.66% |

11.62% |

|

|

3 |

Com-Tele |

2.94% |

4.10% |

|

|

9 |

Utility |

11.35% |

9.55% |

|

|

Total 4 Sectors- 31 stocks |

40.31% |

36.05% |

||

|

1 |

Fix bond |

0.63% |

0.59% |

|

|

(JPST) |

1 |

Fix bond ETF |

12.63% |

5.35% |

|

2 |

Ind-Def |

4.05% |

2.16% |

|

|

3 |

RE-Hc-Def |

2.79% |

5.85% |

|

|

Total Other 7 stocks |

20.10% |

13.96% |

||

|

Total Defense- 38 stocks |

60.40% |

50.00% |

||

|

Cash |

1.43% |

|||

|

SOLD Inc |

0.0% |

1.95% |

||

| Other Sectors | ||||

|

4 |

Tech |

5.75% |

2.04% |

|

|

2 |

Cons-D |

0.73% |

0.40% |

|

|

6 |

Industrial |

4.12% |

5.12% |

|

|

2 |

Material |

1.19% |

0.95% |

|

|

14 |

Financial / BDC |

11.70% |

24.03% |

|

|

9 |

Energy |

10.24% |

10.30% |

|

|

6 |

RE-equity Reit |

4.43% |

5.23% |

|

| TOTAL- 43 Other |

38.17% |

48.0% |

||

| TOTAL – | 81 |

100.0% |

100.0% |

Cash is also considered defensive and adds to the total but is a separate entry for now.

The 38 defensive stocks provide ~60% of RIG value and basically 50% of the income, which is the goal for RIG.

43 stocks comprise the remainder of the sector holdings and 40% RIG value.

Financial/ BDC by far outshines all of the others providing 24% of all income with 11.7% of the value from 14 investments.

Dividend Income

40 of 81 companies paid with 7 raises and 2 special payments.

Dividends for Q3 are up 7.5% from Q1 and 16.8% higher than Q2.

Q3 dividends up secondary to the new monthly payers: JPST for parking cash and NML, along with adding to positions of ARDC, DNP, and getting special payments from NMFC and TCPC.

Q2 dividends were down as there was no STWD bond payment which only pays in Q1 and 3. Some other stocks were sold which were discussed at that time and in this article during Q2.

Current yield is 5.1% with the estimated forward yield being 5.9%.

Below is the September dividend information listed by the payment date.

|

Stock |

Stock |

Date |

div/sh |

Yearly |

Div% |

Other Dividend |

10/1 |

|

Ticker |

Name |

Rec’d |

$ Div |

Yield |

Comments |

Price |

|

|

(PFLT) |

PennantPark Float |

1 |

0.1025 |

1.23 |

11.55% |

Monthly Pay |

10.65 |

|

(V) |

Visa |

1 |

0.45 |

1.8 |

0.78% |

230.01 |

|

|

(WEC) |

WEC Energy |

1 |

0.78 |

3.12 |

3.87% |

80.55 |

|

|

(ENB) |

Enbridge |

1 |

0.6648 |

2.64 |

7.95% |

Canada exch rate |

33.19 |

|

(DAC) |

Danaos Shipping |

1 |

0.75 |

3 |

4.53% |

66.22 |

|

|

(LYB) |

LyondellBasell |

5 |

1.25 |

5 |

5.28% |

94.7 |

|

|

(SO) |

Southern Co |

6 |

0.7 |

2.8 |

4.33% |

64.72 |

|

|

(JPST) |

JPMorgan Ultra-Short Income ETF |

7 |

0.2176 |

2.5 |

4.98% |

monthly pay varies |

50.18 |

|

(JNJ) |

Johnson & Johnson |

7 |

1.19 |

4.76 |

3.06% |

155.75 |

|

|

(CMI) |

Cummins |

7 |

1.68 |

6.72 |

2.94% |

Raise from $1.57 |

228.46 |

|

(SBLK) |

Star Bulk Carriers |

7 |

0.4 |

1.6 |

8.30% |

Raise from 35c |

19.28 |

|

(MAC) |

Macerich |

8 |

0.17 |

0.68 |

6.23% |

10.91 |

|

|

(AMGN) |

Amgen |

8 |

2.13 |

8.52 |

3.17% |

268.76 |

|

|

(TGT) |

Target |

11 |

1.1 |

4.4 |

3.98% |

110.57 |

|

|

(XOM) |

Exxon Mobil |

11 |

0.91 |

3.64 |

3.10% |

117.58 |

|

|

(CVX) |

Chevron |

11 |

1.51 |

6.04 |

3.58% |

168.62 |

|

|

(DNP) |

DNP Select Inc Fund |

11 |

0.065 |

0.78 |

8.19% |

Monthly Pay |

9.52 |

|

(WBA) |

Walgreens BA |

12 |

0.48 |

1.92 |

8.63% |

raise overdue |

22.24 |

|

(HD) |

Home Depot |

14 |

2.09 |

8.36 |

2.77% |

302.16 |

|

|

(OBDC) |

Blue Owl Capital |

14 |

0.07 |

1.5 |

10.83% |

13.85 |

|

|

(MGEE) |

MGE Energy |

15 |

0.4275 |

1.71 |

2.50% |

68.51 |

|

|

(HSY) |

Hershey |

15 |

1.192 |

4.77 |

2.38% |

Raise from 1.036 |

200.08 |

|

(NS.PR.C) |

NuStar Energy pfrC |

15 |

0.7743 |

3.1 |

12.02% |

Raise w/ Libor |

25.79 |

|

(VTRS) |

Viatris |

15 |

0.48 |

0.48 |

4.87% |

No raise/ overdue |

9.86 |

|

STWD Bnd |

Starwood Bond 4.75% |

15 |

2.375 |

4.75 |

4.75% |

Pays 2x /year-fixed |

96 |

|

(DUK) |

Duke |

18 |

1.025 |

4.1 |

4.65% |

Raise from 1.005 |

88.26 |

|

(MCD) |

McDonald’s |

18 |

1.52 |

6.08 |

2.31% |

Raise next time |

263.44 |

|

(SHEL) |

Shell plc |

26 |

0.662 |

2.65 |

4.12% |

Raise from .575 |

64.38 |

|

(D) |

Dominion Energy |

20 |

0.6675 |

2.67 |

5.98% |

No raise/ overdue |

44.67 |

|

(LMT) |

Lockheed Martin |

22 |

3 |

12 |

2.93% |

Raise next time |

408.96 |

|

(SLRC) |

SLR Investment |

28 |

0.1367 |

1.64 |

10.66% |

Monthly Pay |

15.39 |

|

(ARCC) |

Ares Capital |

29 |

0.48 |

1.92 |

9.86% |

19.47 |

|

|

(PEP) |

PepsiCo |

29 |

1.265 |

5.06 |

2.99% |

169.44 |

|

|

(SPG) |

Simon Prop Grp |

29 |

1.9 |

7.6 |

7.04% |

Raise from 1.85 |

108.03 |

|

(UNP) |

Union Pacific |

29 |

1.3 |

5.2 |

2.55% |

Raise soon/ overdue |

203.63 |

|

(ARDC) |

Ares Dynamic Credit AllocFund |

29 |

0.1175 |

1.41 |

10.93% |

Monthly Pay |

12.9 |

|

(AVGO) |

Broadcom |

29 |

4.6 |

18.4 |

2.22% |

Raise next time |

830.58 |

|

(TCPC) |

BlackRock TCP Cap |

29 |

0.44 |

1.36 |

12.44% |

34c Reg +10c special |

11.74 |

|

(NMFC) |

New Mountain Fin |

29 |

0.36 |

1.28 |

9.88% |

32c Reg +4c special |

12.95 |

|

(NML) |

Neuberger B MLP Income Fund |

29 |

0.0584 |

0.7 |

10.17% |

Monthly Pay |

6.88 |

Raises- 7

Cummins (CMI)

Industrial sector engine maker founded in 1919 and is headquartered in Columbus, Indiana. It has an S&P credit rating of A+ and now has 18 years of raising the dividend.

The quarterly raise was 11c/ 7% from $1.57 to $1.68.

It has a 5-year dividend growth of 7.5%.

Star Bulk Carriers (SBLK)

Industrial sector shipper of dry bulk cargo with 128 ships was incorporated in 2006 and is headquartered in Marousi, Greece. No S&P credit rating and the dividend varies.

This was a quarterly raise from 35 to 40c, but still remains down for the year.

Not celebrating as yet, but shipping seems to be doing well and the dividend should be settling into this range for now.

Hershey (HSY)

Consumer Staple sector maker of confectionery and pantry items was founded in 1894 in Hershey, PA. It has an S&P credit rating of A and 14 years of raising the dividend.

The quarterly raise of 15.6c is a very delightful, delicious one of 15.06% and a 5-year DGR of 8.8%.

NuStar Energy preferred shares C (NS.PR.C)

Energy sector company that operates in the transportation and storage Terminaling of LP/gas products. It was incorporated in 1999 and is headquartered in San Antonio, TX.

The preferred shares/C are new to the portfolio and were purchased last month. It has a call date of Dec 15, 2022, and just recently became fixed to floating rate of 3M Libor +6.88% or close to 11%. This does involve a K1 tax form, but from my reading, there is not much UBTI to report, however, that can change. It is new for RIG, and I am limiting the size until the exact consequences are determined.

Duke Energy Corp (DUK)

Utility sector company operating in electric, and gas was founded in 1904 and is headquartered in Charlotte, NC. It has a BBB+ S&P credit rating and now has 19 years of raising the dividend.

This quarterly raise of 2c from $1.005 to $1.025 is 2%, below the 5-year DGR of 2.7%, so somewhat disappointing.

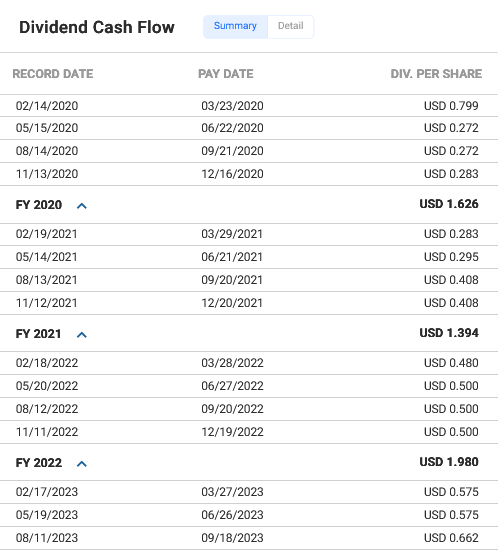

Shell plc (SHEL)

Energy sector Royal Dutch Shell was founded in 1907 and changed its name to Shell in 2022. It is headquartered in London, UK. It has an AA- S&P credit rating and did cut the dividend in 2020 ending a long streak of raises. It has already been raising that dividend nicely for shareholders as shown below from the FAST Graphs listing since then.

SHEL 3-year dividend performance (FAST Graphs October 1, 2023)

It still has a way to go to get back to the original payment of $3.20 yearly, but the current $2.65 is welcome.

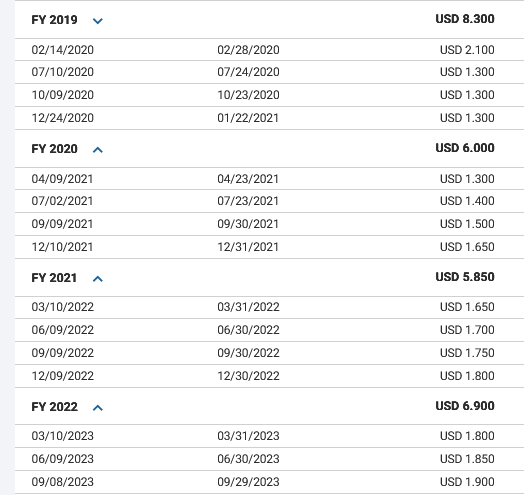

Simon Property Group (SPG)

This real estate investment trust owns quality and premier international property and has an A- S&P credit rating. It did suffer declining income as most retail operations did during covid restrictions and cut the dividend in 2019. It has been raising it slowly and nicely for a few years now, but still not back to 2019, but is close. Below is the history of the dividend from the FAST Graphs performance listing.

SPG 3-year dividend payments (FAST Graphs October 2, 2023)

BDCs Special Payments -2

TCPC and NMFC are Business Development Companies/“BDCs” that often will give special payments with regular dividend. I can never decide if the special should be included with the yearly dividend total as they are not recurring, so the amounts shown may differ from the actual regular for that reason.

Portfolio Value

September ended with the portfolio being up 14.61% over SPY since inception in November 2021. It is pretty much even this year to end the Q3, but precisely down 0.03% for the year, excluding dividends. With dividends, it is up easily 6% for this year. With the composition having none of the magnificent 7 tech/ communication stocks: Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, or Tesla, the RIG growth and maintaining income works well.

Summary/Conclusion

RIG has a 5.1% current yield and is estimated to have a forward yield of 5.9%. With it also being a value portfolio, capital appreciation should advance in time. With lots of cash sitting in the money market JPST, more income and stocks will be added as they become attractive. RIG is alive and well along with earning quality income now and for the future.

Read the full article here

Leave a Reply