In mid-December, I warned Roku, Inc. (NASDAQ:ROKU) investors that ROKU’s FOMO surge wasn’t sustainable as it surged into well-overvalued zones. As a result, a further valuation re-rating would have required the company to deliver significant outperformance to justify such a move. With ROKU down nearly 30% from my previous Sell article as it underperformed the S&P 500 (SPX) (SPY) significantly, I consider the thesis to have played out accordingly.

So what happened that led to ROKU investors deciding to bail out of the stock post-earnings, notwithstanding a decent fourth-quarter earnings release by Roku? Moreover, Roku’s forward guidance also suggests a positive outlook. Investors who paid close attention to Roku’s earnings call would have gleaned management’s less sanguine commentary over the growth momentum of its media and entertainment or M&E vertical. Roku’s core M&E segment is pivotal to the health and profitability of its platform business. As a result, I believe it’s justified that any less-than-perfect commentary to justify ROKU’s expensive valuation should lead to a more defensive “sell first, ask questions later” posture. Investors sitting on substantial gains from ROKU’s November 2023 lows ($55 level) likely took profit to protect their gains.

Accordingly, management seemed optimistic during its conference call, suggesting that Roku has diversified its business model beyond M&E spending. However, the market’s negative reaction suggests investors aren’t convinced unless Roku could provide more clarity over the slowdown and impact on full-year profitability. Roku has committed to balancing growth and profitability in 2024, paying more attention to its free cash flow improvement. Despite that, the lack of clear growth guidance on full-year adjusted EBITDA likely worried investors.

Accordingly, Roku telegraphed that it has aimed to post “further improvements in adjusted EBITDA for full-year 2024.” In addition, the company highlighted that YoY comps could be more challenging, as it anticipates “challenges in the M&E environment for the rest of the year.”

I believe that likely caught analysts and the market by surprise, as some analysts peppered management with questions relating to M&E spend. As a result, I think it suggests further growth in adjusted EBITDA for FY24 could prove to be much more challenging than anticipated, suggesting 2024 could potentially be a flat year at best.

Notwithstanding the cautious commentary indicated by management, Roku’s fundamental drivers have improved over the past year. Management provided salient updates over key metrics, indicating that Roku has continued to scale remarkably well. Accordingly, the company delivered an FY23 adjusted EBITDA of $4.3M. While it’s nothing spectacular, it underscores the market’s confidence that the worst in its business performance has likely bottomed out in FY22.

Moreover, critical underlying metrics indicate that Roku’s market leadership should remain robust. The company posted active accounts of 80M, up from 70M a year ago. In addition, engagement has also improved, as Roku streamed 4.1 hours per active account daily in Q4, up from 3.8 hours in the previous year. In addition, the company has also retained its position as the “#1 TV streaming platform by hours streamed in both the U.S. and Mexico.” Consequently, I assessed that Roku’s platform-agnostic approach toward ad-supported streaming has demonstrated its value proposition with consumers, bolstering its appeal. Notwithstanding the increasingly competitive streaming landscape, Roku seems well-poised to benefit from the continued shift away from Linear TV as advertisers further adjust their budgets over time.

With the significant post-earnings battering, ROKU has dropped into a more attractive zone, although it’s still priced at a premium. Seeking Alpha Quant assigned ROKU with a “D” valuation grade. However, ROKU bulls might argue that its best-in-class “A+” growth grade helps justify its growth premium. As a result, I view ROKU with the lens of a growth stock. With that in mind, investors concerned with its tepid outlook and negative commentary on M&E spending must remain cautious.

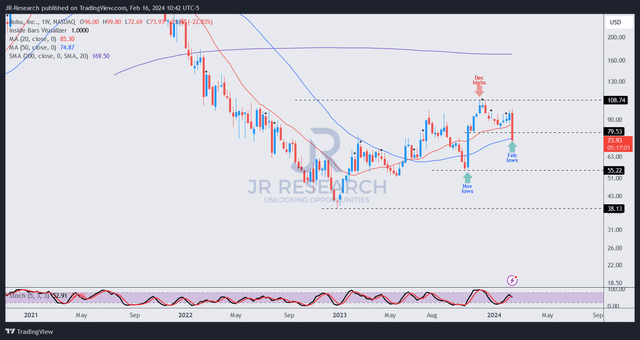

ROKU price chart (weekly, medium-term) (TradingView)

With the selling pressure ROKU taking out the $80 support zone, the downside volatility is anticipated as the market shakes out dip-buyers who expected that level to be defended decisively.

Consequently, investors who prefer a validated bullish reversal signal should wait for the level to be retaken by dip-buyers looking to capitalize on the post-earnings decline.

However, I’m of the view that ROKU’s steep plunge should still be undergirded by robust buying sentiments, as it remains in a medium-term uptrend. In other words, bullish buying sentiments have already returned to the stock since its lows in late 2022. As a result, buying significant dips on an uptrend stock like ROKU is a viable strategy.

Therefore, I view the risk/reward over ROKU as increasingly more constructive, attributed to the post-earnings battering.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here

Leave a Reply