In my most recent Robinhood Markets, Inc. (NASDAQ:HOOD) article, I had rated the stock a “weak hold”, citing 60% YTD run and the fact that the company was not expected to be profitable even in 2024. Since then, the stock has lost more than 15% compared to the market’s 1% loss. Does the sell-off make the stock more attractive now? Let’s find out by reviewing what stood out in the Q2 report and what to look forward to in Q3 and beyond. Let us get into the details.

The Good from Q2

- Robinhood reported its first-ever GAAP profitable quarter in its history, and the company was (rightly) quick to highlight that in its Q2 report. This was driven by a 10% increase in net revenue and decreasing operating expenses.

“In Q2, we reached a significant milestone by achieving GAAP profitability for the first time as a public company,” said Vlad Tenev, CEO and Co-Founder of Robinhood Markets. “Guided by our bold product roadmap we’re continuing to innovate for our customers, grow assets, gain market share, and change the industry for the better.”

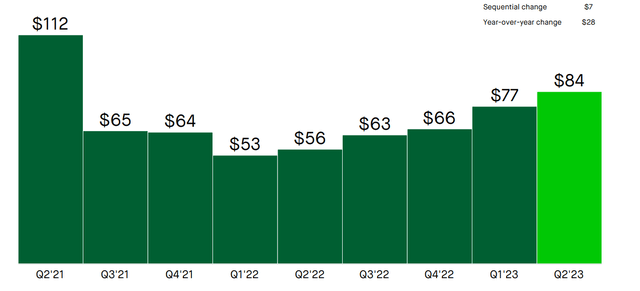

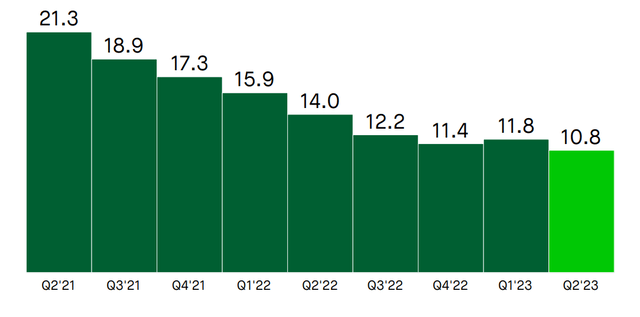

- Average Revenue Per User (“ARPU”) went up to $84 and this marks the 5th consecutive quarter that it went up. In addition to being up about 10% QoQ ($77 in Q1 2023) and 50% YoY, this is also the highest level in more than two full years, providing enough hope that ARPU may once again breach $100 soon (last seen in Q2 2021).

HOOD ARPU Q2 2023 (/investors.robinhood.com)

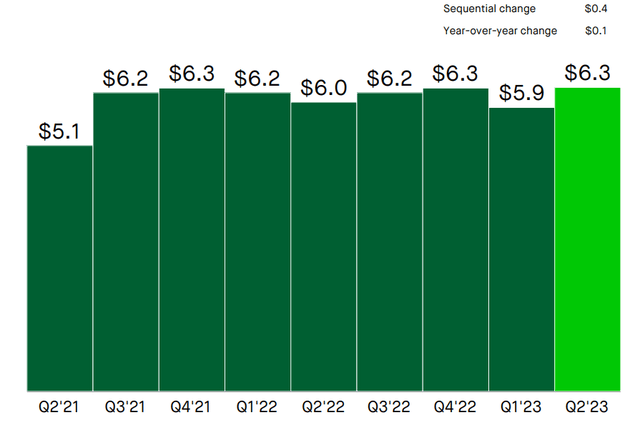

- Robinhood’s cash and short-term investments balance has crossed $6 billion, which now represent nearly 65% of the company’s market capitalization. This is an attractive value proposition to investors, even after factoring the $3 billion in long-term debt.

Hood Cash and ST Investments (investors.robinhood.com)

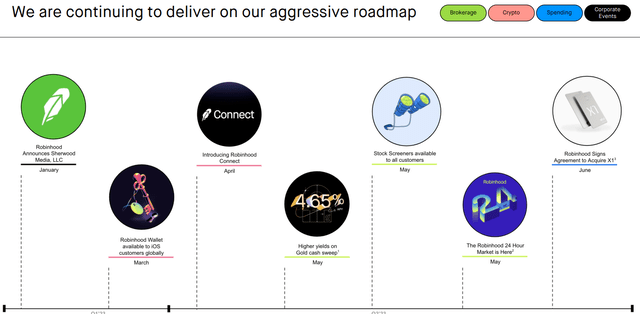

- Finally, being a Robinhood customer, I am well aware of the company’s new initiatives including their efforts to “deepen relationships with existing customers” and these efforts are beginning to bear fruits.

- For example, by offering an interest rate of 4.90%, Robinhood was able to generate a cash sweep balance of $11 billion (up from $8 billion at the end of Q1)

- The company still remains on track to launch its brokerage services in the UK by the end of 2023 and has started to hire for key roles, as reported in Q2.

- The company also announced that as of July 2023, 24×5 hour market is available to all customers on select stocks and ETFs. As a (low value to Robinhood) customer, I can attest these features are available even on my account.

What To Look Forward To?

- Fundamental Strength: It was reported recently that Robinhood’s cash sweep balance totaled $13.3 billion in August, compared to $12.7 billion in July. As covered in the “The Good from Q2” section above, this was at $11 billion at the end of Q2. This shows customers are looking at Robinhood as a relatively safe place to stash their money and earn up to 4.9% in the process. Obviously, Robinhood is far from a regional bank, but the confidence shown is encouraging.

- Buyback: Robinhood recently announced that it plans to buyback nearly 55 million shares once held by Emergent Fidelity Technologies. That’s 6% of the company’s float (see “The Not So Good” section below). With $8.5 billion in cash and short-term investments (relative) easily accessible, Robinhood should have no problem funding this buyback from its reserves.

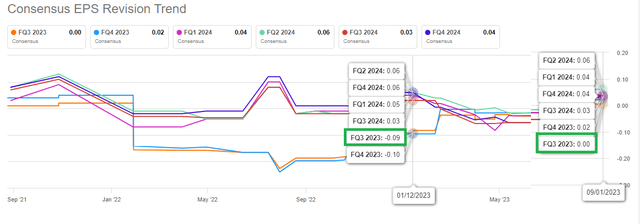

- Increasing Expectations: Robinhood’s expected EPS in Q3 2023, slated to be reported in early November, has gone from -9 cents per share at the beginning of the year to breaking even as shown below. This indicates growing confidence in the company’s ability to not just generate revenue but to be consistently, operationally profitable sooner than later.

Hood Q3 EPS Projection (Seekingalpha.com)

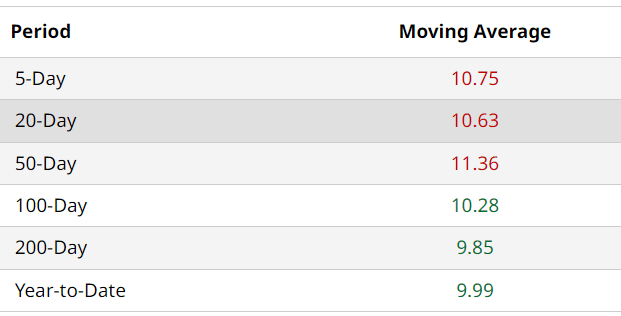

- Technicals: Finally, from a technical perspective, despite recent weakness, Robinhood stock is trading more than 8% above the all important 200-Day moving average. The stock’s recent weakness shows up in its Relative Strength Index [RSI] with the 14-Day RSI being close to the oversold level, but looking at the 1-year chart below, I expect the stock to have strong support between $9 and $10, right where the 200-Day moving average is.

HOOD Moving Avgs (Barchart.com)

Hood Chart (Seekingalpha.com)

The Not So Good

The two sections above are largely in favor of the stock, but this does not mean there are no issues that investors need to be aware of.

- MAU Decline: Monthly Active Users [MAU] decreased by 1 million, bringing the total to 10.8 million. This gets a bit more worrying when you realize Robinhood has pretty lenient conditions to be met to qualify as an active user. One may qualify as an active user by meeting just one of the following conditions:

- executing a debit card transaction

- transitioning between two different Robinhood screens on a mobile device while being logged into their Robinhood account

- loading a page on a web-browser while being logged into their Robinhood account

As the company notes in their fine-prints (page 15 here), MAU does not measure the frequency or duration of these visits and interactions. In short, with such low threshold, losing a million “active” users is concerning. On a positive note, though, it could just be that the ones remaining are the more “serious” users who actually contribute to the revenue. This may result in better ARPU and a more predictable revenue stream down the road.

This trend seems to be continuing in Q3 as well, as August’s MAU declined 4% following a 2% jump in July.

HOOD MAU (investors.robinhood.com)

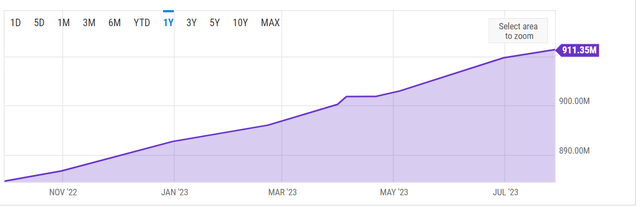

- Dilution: Robinhood’s total shares outstanding has gone up by about 15 million, or about 2% since my Q1 review. This may sound miniscule, but for a company still losing money, everything compounds. In about two years of being a public company, share count has gone up about 10% and is something to be monitoring each quarter.

Hood Shares Outstanding (YCharts.com)

- Overvalued, Stand-Alone and Relative: Despite the 15% haircut since my July article, Robinhood’s stock is trading at 7.3 times 2022’s revenue. This has gotten worse since Q1 when the comparable number was at 6. Block, Inc. (SQ), a fellow high aspirant in Fintech, is now trading at 1.8 times 2022’s revenue. In other words, Robinhood’s valuation is still quite rich both on stand-alone basis and peer-comparison basis.

Conclusion

I rate the stock a “Hold” here, but given the momentum being show in ARPU, revenue, and moderating expenses, I am upgrading the stock to a “strong hold”, although this is not an official rating on Seeking Alpha. I find it encouraging that the company is not only delivering on its roadmap but is also doing so across different segments/revenue streams ranging from Brokerage to Crypto.

In short, Robinhood is still a disruptor in its industry, but the stock seems way ahead of itself despite the fall over the last couple of years. I am looking at selling cash-secured puts at lower prices, say $8, to be able to acquire shares about 20% lower than the current market price. At $8, Robinhood’s stock will be trading at less than 3 times 2023’s expected sales ex-cash and debt, and that seems attractive enough for me.

Hood Delivered Roadmap (investors.robinhood.com)

Read the full article here

Leave a Reply