Written by Nick Ackerman, co-produced by Stanford Chemist.

RiverNorth Capital Management offers several interesting and unique closed-end funds. One of the approaches they have chosen to take across several of their funds is municipal bond exposure. They take the approach of incorporating a fund-of-fund approach where they’ll invest a sleeve of the portfolio in other muni CEFs while the other portion of the portfolio will be invested in individual muni bonds.

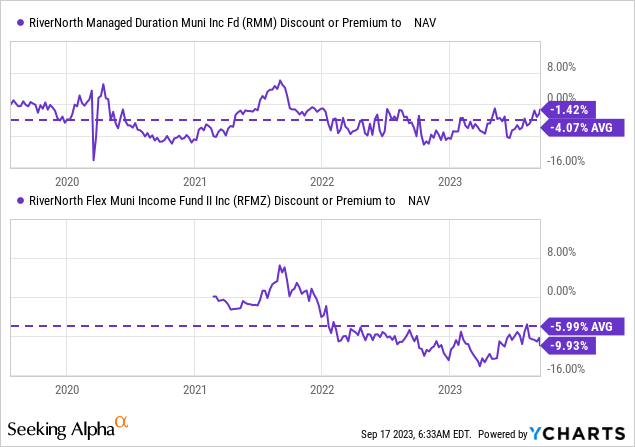

By offering several funds in this similar fashion, five funds currently, to be exact, an opportunity to exploit discounts/premiums comes in the form of swap trades. One such opportunity has presented itself in the form of RiverNorth Managed Duration Municipal Income Fund (NYSE:RMM), which is trading at one of the narrowest discounts, while RiverNorth Flexible Municipal Income Fund II (NYSE:RFMZ) is trading at the widest.

The Basics

RMM

- 1-Year Z-score: 2.06

- Discount: -1.42%

- Distribution Yield: 7.15%

- Expense Ratio: 2.39%

- Leverage: 40.60%

- Managed Assets: $524.6 million

- Structure: Term (anticipated liquidation date July 25th, 2031)

RMM’s investment objective “seeks to provide current income exempt from regular U.S. federal income taxes with a secondary objective of total return.”

RFMZ

- 1-Year Z-score: 0.15

- Discount: -9.93%

- Distribution Yield: 7.83%

- Expense Ratio: 2.33%

- Leverage: 39.5%

- Managed Assets: $600.244 million

- Structure: Term (anticipated liquidation date February 26th, 2036)

RFMZ’s investment objective is “to provide current income exempt from regular U.S. federal income taxes with a secondary objective of total return.”

As we can see, the objective of each fund is the exact same, and this similarity also translates into how they look to potentially achieve the objective.

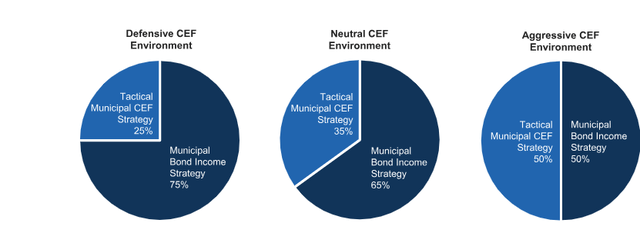

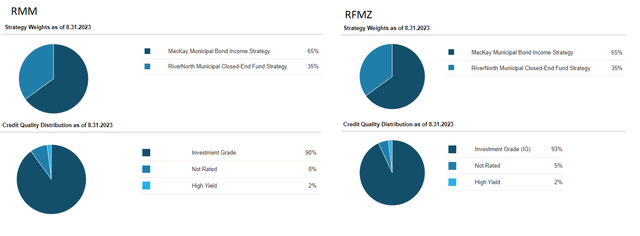

The fund’s fund-of-fund sleeve is managed by RiverNorth, and the invidious bond sleeve is managed by MacKay Shields. The different environments that CEFs can find themselves in terms of defensive, neutral or aggressive will determine the weighting of each sleeve.

RiverNorth Muni Fund Approach To Different Environments (RiverNorth)

In general, I believe there are better ways to gain exposure to munis, and these funds aren’t a great way to play it. For one, the fund of fund sleeve, while it can exploit discounts on discounts, also means fees on fees. This can become a problem when we are talking about muni bonds that may carry 3 to 5% coupons.

RiverNorth funds operate with an expense ratio of around 2.35%; then, you put another 1 to 2% from the underlying fund on top of that. That all adds up to not a lot of yield left on the bone for generating returns. That wasn’t counting interest expenses, either. The total expense ratio, including leverage for RMM, comes to 4.68%, and RFMZ’s total expense ratio comes to 4.36%.

So, when looking at these funds, it’s important that RiverNorth and MacKay are successful in generating gains, as the yields just aren’t there.

Of course, when we are discussing leverage expenses, that does mean that these funds utilize leverage, which again puts the CEF sleeve part of their portfolio in a scenario of leverage on leverage. Muni funds are often highly leveraged too, with the RiverNorth funds at around 40% each. RMM at 40.6% and RFMZ at 39.5%

RFMZ isn’t the latest fund they launched with this approach, as it was launched in 2021. They launched RiverNorth Managed Duration Municipal Income Fund II (RMMZ) in 2022. These were becoming a nearly annual offering, but it looks like in 2023, there weren’t any filings for even planning a new one.

RMM isn’t that old either, being launched in mid-2019. Both of these funds launched in the CEF 2.0 structure with a planned termination date. Of course, RMM, being the older fund, would be expected to liquidate first. Additionally, RMM launched with a twelve-year term, and RFMZ launched with a fifteen-year term. So that puts it back quite a bit further as well.

That being said, we have quite sometime before that starts playing a role in each fund’s performance. Additionally, each fund has ways of extending the term of going perpetual that investors should be aware of.

The Opportunity For A Swap

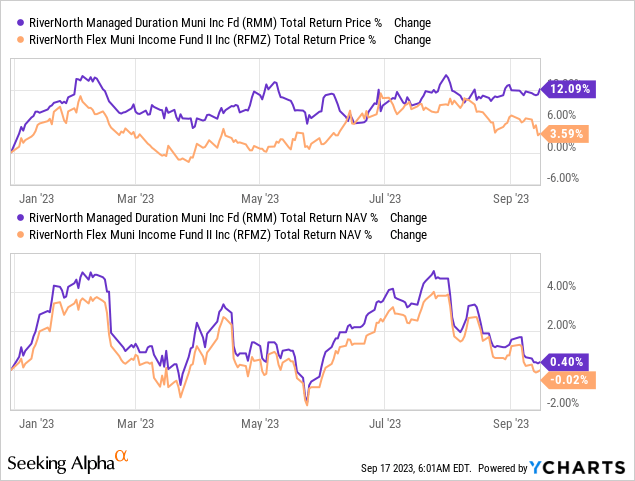

On a YTD basis, RMM on a total NAV return basis has blown RFMZ away. However, the total NAV results have been virtually identical.

Ycharts

Given the returns on a share basis we’ve seen on RMM, we know that the fund’s discount is narrowing materially as it significantly exceeds the returns of the underlying portfolio. Even in the case of RFMZ, we’ve seen some discount narrowing as the fund’s share price has performed better.

Not only is the discount for RFMZ looking better on an absolute basis, but RMM is also trading above its longer-term average while RFMZ is trading below its longer-term average. So, the swap potential on a relative basis makes sense as well.

Ycharts

Diverging Performance Risk

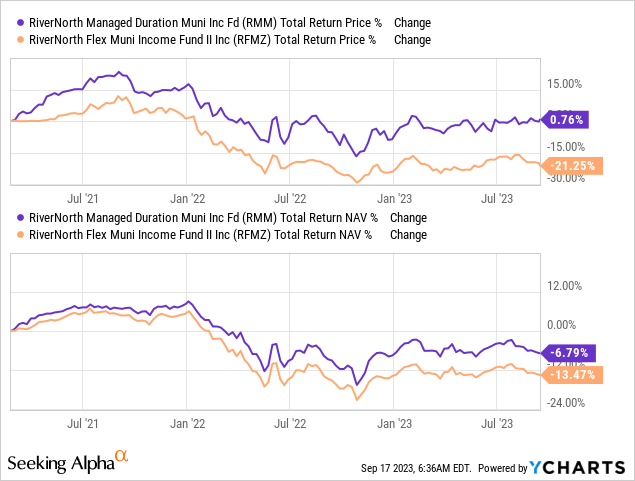

One factor to consider with a swap trade is the risk that each fund diverges in performance in terms of the total NAV results. This has occurred if we look back further and compare performance since RFMZ’s inception to today.

Ycharts

One of the reasons for this could be that while the funds take the same approach and overlap, they aren’t exactly the same portfolios. RMM carries an estimated unhedged duration of 9.96 years in its portfolio and an estimated hedged duration of 6.92 years. Comparing that to RFMZ’s estimated unhedged duration of 10.69 years and estimated hedged duration of 7.22 years, we can see that RFMZ is carrying a bit more interest rate sensitivity.

So, on the surface, we are looking at funds that are virtually positioned the same, and the performance on a YTD basis has been nearly identical. However, given the duration differences, that’s a strong clue that there is going to be a bit of nuance between each.

RMM And RFMZ Portfolio Positioning (RiverNorth)

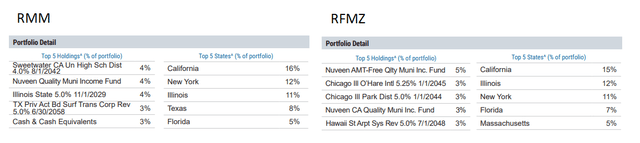

Looking at the portfolio a bit deeper, we can continue to see some of the similar features of each fund in terms of state weightings. However, in looking at the top five holdings of each fund, that’s where we can start to see more differences.

RMM And RFMZ Holdings (RiverNorth)

Therefore, the main risk here is that one portfolio starts significantly diverging and cancels out the potential gains expected from making a swap trade.

Managed Distributions

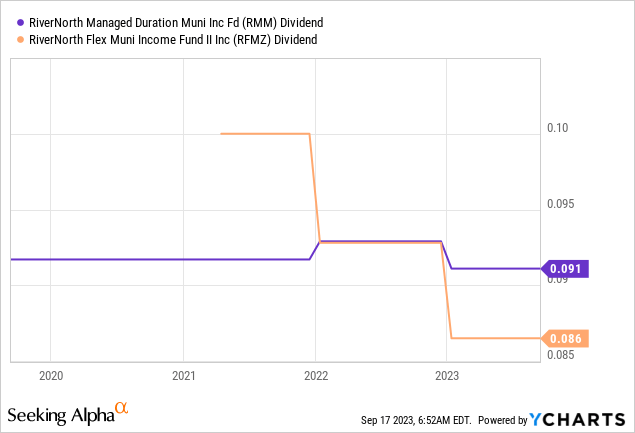

Another similarity between the funds is that they both have implemented a 6.75% NAV-based managed distribution. This is reset annually based on the final five trading days of the calendar year. Though even this policy is subject to change, as is always the case. The 6.75% itself was a change for 2023 after it had previously been 5.5% in prior years.

That change saw the distributions hold up much better heading into 2023, as they would have seen a sizeable drop in their monthly distributions otherwise. I believe they did this to blunt the drop in the payout and leave them more competitive in a rising interest rate environment.

When RFMZ launched, it began with a 6% managed distribution rate policy. It then dropped down to the 5.5% policy, which is why we saw a drop heading into 2022 when RMM raised.

Ycharts

So, these managed distributions are subject to change quite frequently if the last few years are any guide. That isn’t necessarily a bad thing, but it does leave them fairly unpredictable from year to year.

Unfortunately, neither fund supports these higher distributions as RMM’s NAV rate has drifted to 7.04% and RFMZ’s has drifted to 7.06%. If they keep the same managed plans heading into 2024, they could see drops in distribution. However, we do have quite a bit of 2023 left, meaning a lot could change between now and then.

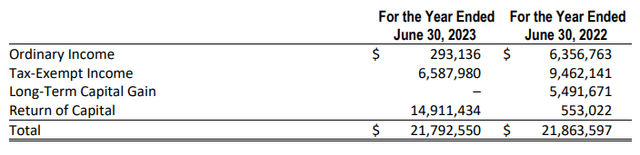

Besides the issues I highlighted above about high expense ratios and high leverage risks, another area that should be considered is that tax-exempt income from these funds can be hit or miss. As a muni fund, most muni investors want to consistently see tax-free distributions for the most part. In CEFs, that isn’t always the case, but for these funds, it’s really a surprise on what you might see.

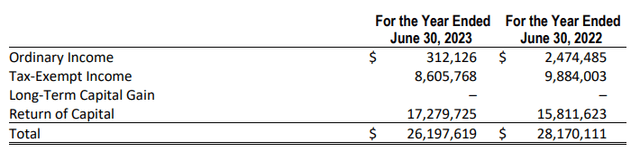

Here is a look at the tax classifications for the last two years for RMM:

RMM Distribution Tax Classification (RiverNorth)

Here is a look at RFMZ:

RFMZ Distribution Tax Classifications (RiverNorth)

As you can see, return of capital makes up a significant portion of the payouts. The NAVs are down, which means they are technically destructive ROC distributions as well. Their managed distribution policy is set at nearly 7%, with most other muni funds paying between 3 and 5%. So, it’s only natural to expect such large ROC distributions as they can’t earn these levels through income generation alone on their underlying muni or muni fund holdings. Again, that really goes back to the expectation that performance would come from gains if RiverNorth is successful rather than the income generated on the portfolio.

However, even besides that fact, while ROC has its own benefits of deferring tax obligations, it isn’t quite the same as tax-exempt income that muni fund investors might really be looking for. Both funds had even had a fairly sizeable amount classified as ordinary income in 2022 – though it’s good to see that has come down, as that could have been quite the shock if an investor wasn’t expecting it from a muni fund.

Conclusion

Investors in RMM could consider making a move over to RFMZ at this time to exploit a larger discount. Not only is the discount looking more tempting for RFMZ on an absolute basis, but on a relative basis as well, RMM looks a bit pricey while RFMZ is a better value.

A key risk is that the underlying portfolio of RMM performs materially better. That would potentially negate the positives of realizing discount contractions on RFMZ while seeing a discount widen for RMM if the outperformance is material. We had seen that play out since RFMZ’s launch. One of the reasons for that could be a higher duration during a period of aggressive Fed interest rate hikes. The shorter-term results show that the performance has been much more similar.

Read the full article here

Leave a Reply