Since we previously wrote about the SPDR SSGA Multi-Asset Real Return ETF (NYSEARCA:RLY) inflation has cooled considerable. Is inflation completely tamed, and should we hence sell RLY, or will inflation remain an issue in the coming years that warrants an investment in a real asset ETF like RLY?

We do not think that inflation will average as little as 2% in the coming years, and hence think it’s still a smart idea to invest in a diversified and actively managed real return ETF like RLY. Diversifying lowers the risks and the active management is helpful because not all inflation hedging investments are working as can be expected given their historical inflation betas.

Inflation gone?

We witnessed a sharp reduction in inflation from 9.1% in June 2022 to 3.7% in August.

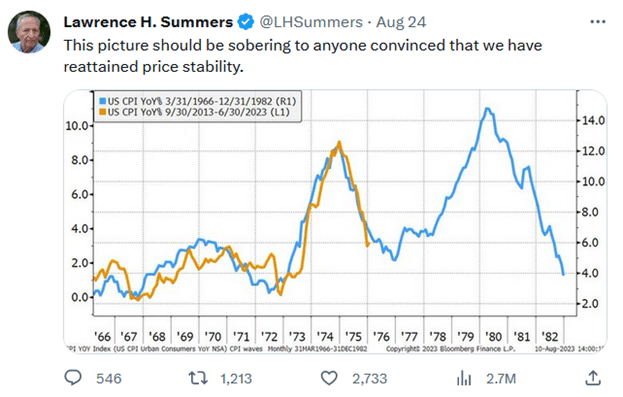

On the other hand, while inflation has cooled in the last few months, a new rise in inflation figures in the coming years cannot be excluded if the current inflation cycle keeps following the path of the inflation cycle in the 70’s…

Figure 1: Inflation cycles (Bloomberg)

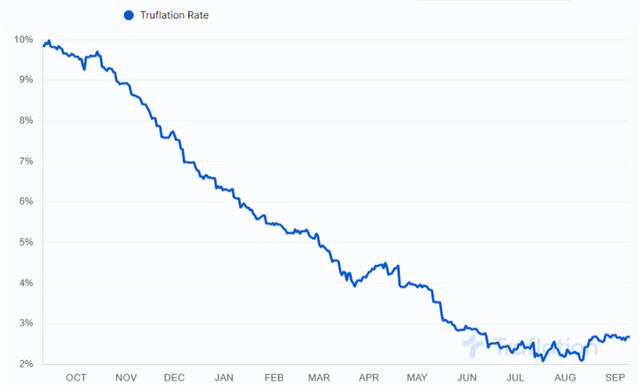

Truflation offers a daily updated, “big data” inflation measure. It has a dynamic and transparent methodology that responds sooner to global market conditions than e.g., the monthly updated CPI figures. The so-called “Truflation rate” fell to 2% but moves now again closer to 3%.

Figure 2: Truflation rate (Truflation)

Bloomberg columnist Mohamed El-Erian recently discussed the possibility that “the process of a consistently moderating inflation rate becomes stuck in the 3%-to-4% range, consistently above the Fed’s 2% inflation target and keeping the structure of market interest rates higher for longer”.

De-globalization, de-carbonisation and demographics are pushing inflation figures higher than we were used to in the past decade. We also do not think that inflation will average as little as 2% in the coming years, and we wouldn’t be surprised if the FED increases its inflation target to 3 or 4%. This would allow them to be less restrictive compared to the current situation with a 2% inflation target, and might help to avoid a (severe) recession. In 2012 FED Chairman Ben Bernanke set the 2% target inflation rate. Until then, the FED didn’t have an explicit inflation target.

In 2020 the FED revised its Statement on Longer-Run Goals and Monetary Policy Strategy. The FED would aim for an inflation that averages 2% over time. In practice this means that following periods when inflation has been running persistently below 2 percent as was the case in the years before, appropriate monetary policy would allow an inflation running above 2 percent for some time.

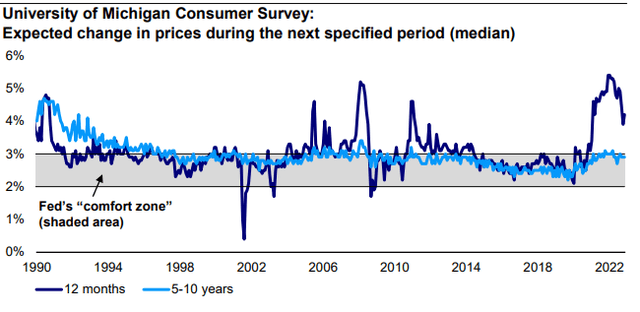

Since the 2020 revision, the longer term inflation expectations have already increased from 2 to 3%.

Figure 3: Inflation expectations (Invesco)

Please note that Invesco doesn’t talk any more about the FED’s 2% target, but about the FED’s 2 to 3% comfort zone….

If inflation is to stay above 2%: real return ETF remains a good idea. Let’s take a look at the performance of real return assets.

Performance

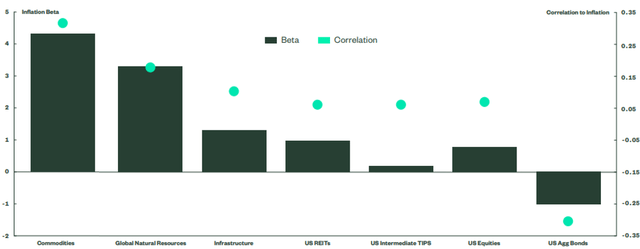

The assets with the highest inflation beta and correlation to inflation are commodities and natural resources, followed by infrastructure, REITs and TIPS.

Figure 4: Inflation beta and correlation (SSGA)

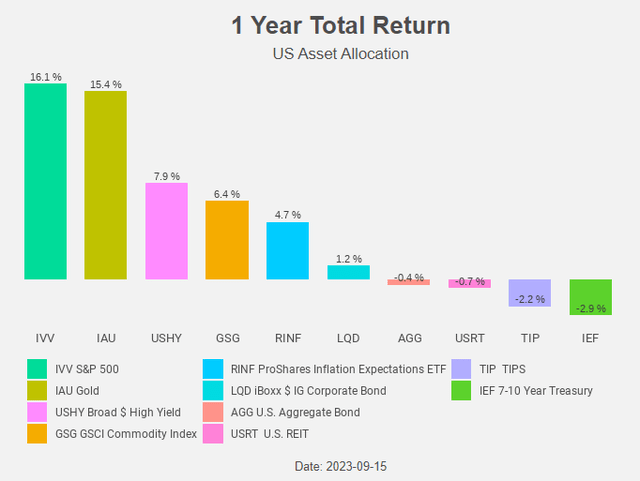

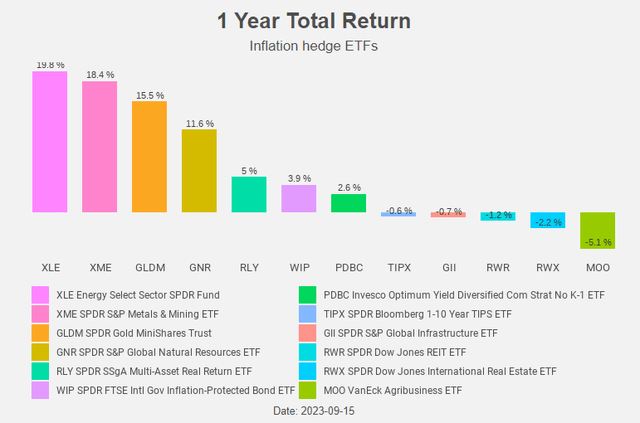

In the past 12 months, equities and commodities (including gold) are the best performing asset classes. Treasury bonds, TIPS and REITs are the worst performers due to the rising (real) interest rates.

Figure 5: Total Return Chart (Radar Insights)

The bad performance of TIPS (and REITs) is remarkable.

The inflation led to higher interest rates and hence lower bond prices. TIPS are considered to be an inflation hedge, but this didn’t play out. TIPS are a treasury bonds whose principal value is indexed to inflation. When inflation rises, the TIPS’ principal value is adjusted up in line with the rise in (CPI) inflation. The coupon payments are based on a percentage of the (adjusted) principal, and hence TIPS investors receive higher coupons when inflation rises.

The TIPS yield is hence a “real” interest rate because it reflects the actual (or real) increase in purchasing power of the investment, taking into account the effects of inflation.

The issue with TIPS is they are not a simple bet on inflation. TIPS are made up of two portions, which might make the movement of TIPS through interest rate cycles confusing. There is the direct inflation linked component, but there is also a fixed income component. The fact that the fixed income component can move in the opposite direction of inflation is what makes profiting on TIPS so difficult.

Just like “normal” nominal bonds, TIPS are also bonds. Nominal bonds fall in value when nominal bond yields rise, and TIPS fall in value when real bond yields rise. The TIPS’ price adjusts in response to the increase in inflation, but if the real interest rate rises, the impact of the inflation adjustment might not be enough to offset the loss caused by the rising real rate.

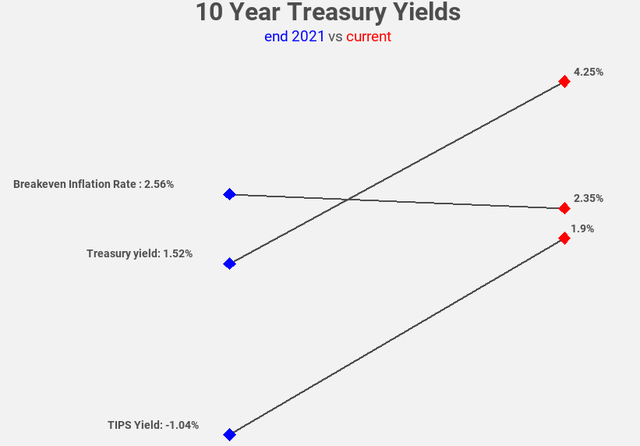

At the end of 2021 the 10 year (nominal) treasury yield was at 1.52%. The (real) TIPS yield was at -1.04% and hence the breakeven inflation rate was 2.56%. In the meantime, nominal interest yields rose to 4.25%, while real interest rates rose to 1.9%.

Figure 6: Treasury yields (Radar Insights)

So while nominal interest rates rose 2.73%, real interest rates rose 2.94%! And rising yields led to falling bond prices. The inflation adjustment supported TIPS, that slightly outperformed nominal bonds, even though real yields rose more than nominal yields.

Owning TIPS in an inflationary environment is not a no-brainer win.

But the long-term expected return of a TIPS is materially higher now due to significantly higher (real) TIPS rates.

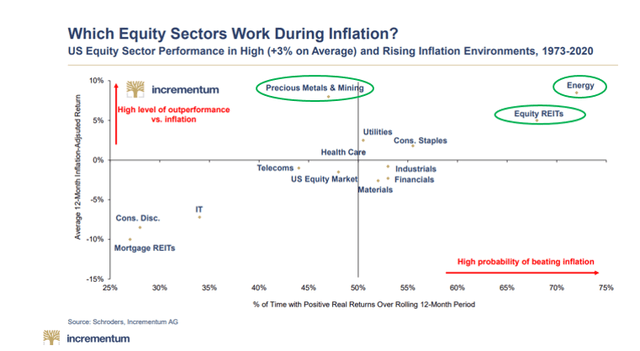

Also, some certain equity sectors hedge against inflation: energy, REITs and metals & mining are the best performing equity sector in inflationary environments. All three are included in RLY.

Figure 7: Equity sectors and inflation (Incrementum)

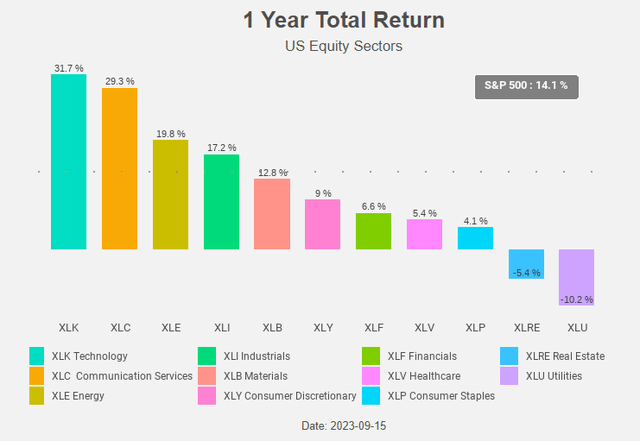

While energy performs well indeed, the same cannot be said of REITs.

Figure 8: Total Return Chart (Radar Insights)

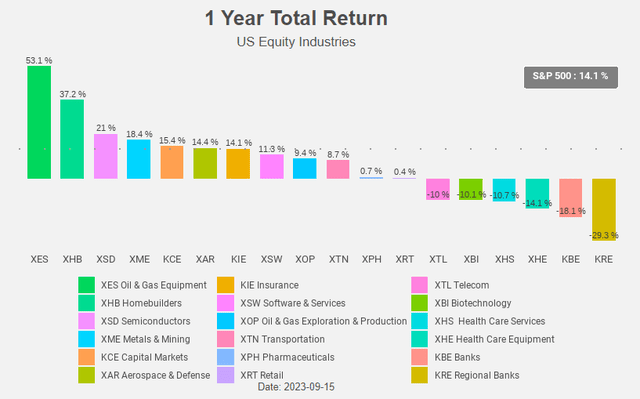

The best performing equity industry is Oil & Gas Equipment & Services. Also, Metals & Mining perform well.

We’re pleased to see that industries we’ve written about before are showing up among the top performers: Oil & Gas Equipment & Services, Homebuilders and Metals & Mining.

Figure 9: Total Return Chart (Radar Insights)

Now, let’s take a look in detail at RLY’s building blocks.

RLY

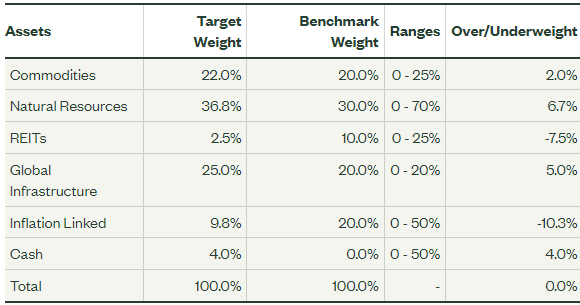

RLY is an actively managed ETF that is currently overweight natural resources (agriculture, energy, and metals and mining), infrastructure, cash and commodities.

RLY is underweight TIPS and real estate.

Figure 10: Portfolio Allocations (SSGA)

We like this active management approach and the positions the fund managers take. We’re positive about commodities, although we prefer the iShares S&P GSCI Commodity-Indexed Trust (GSG) above the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF, PDBC.

We are less positive about real estate.

Figure 11: Total Return Chart (Radar Insights)

SPDR S&P Global Infrastructure ETF (GII), the second-biggest position in the fund, remains a drag on the overall performance of RLY. GII invests in the transportation, utilities, and energy infrastructure sub-industries. GII is the only overweight position that’s not performing very well. The portfolio managers remain positive about both global natural resource equities and infrastructure equities because they “stand to benefit from infrastructure spending along with longer-term trends of decarbonization and other green energy thematic”.

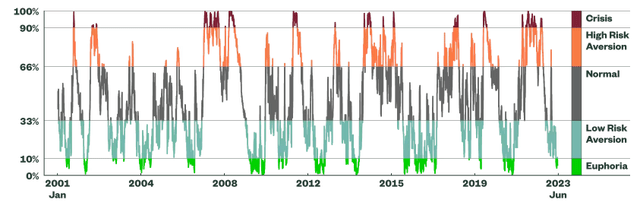

RLY uses a proprietary risk sentiment indicator (the Market Regime Indicator). The indicator employs a quantitative framework and forward-looking market indicators, including equity- and currency-implied volatility, as well as credit spreads, to identify the current market risk environment. Tracking risk appetite shifts in the market cycle helps frame tactical asset allocation and volatility targets.

Figure 12: Market Regime Indicator (SSGA)

At the end of June the indicator was pointing to a low risk aversion and that’s why the fund became more offensive and built down the cash position to 4%. At the moment, the cash position increased again to 5.6%.

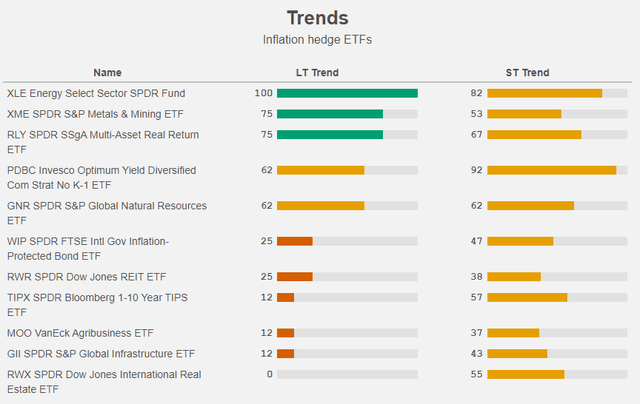

Global infrastructure, REITs and TIPS remain in a long term downtrend.

Figure 13: Trends (Radar Insights)

Energy and Metals & Mining equities remain in a long term uptrend, as is the case for RLY itself.

Conclusion

With the exception of infrastructure, the overweight positions in RLY are outperforming, while the underweight positions are underperforming. The active management is paying off and as a result, RLY is in a long term uptrend.

We do not think that inflation will average as little as 2% in the coming years, and hence think it’s still a smart idea to invest in a diversified and actively managed real return ETF like RLY.

Read the full article here

Leave a Reply