With the legacy automakers facing major union strikes and potential cost increases, Rivian Automotive, Inc. (NASDAQ:RIVN) has the potential to quickly become a leading contender in the electric vehicle (“EV”) race. The company has ramped up EV production, and the stock dip last year has provided a much better valuation. My investment thesis is Bullish on Rivian, though a September swoon would provide a more opportune entry point.

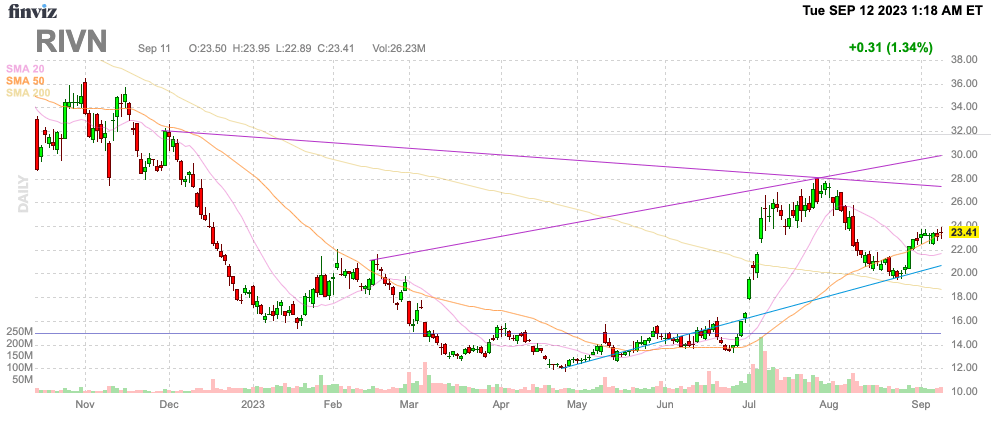

Finviz

Production, Production, Production

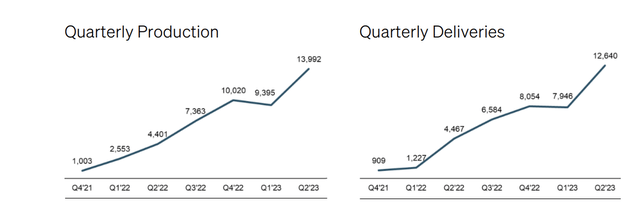

As with Tesla (TSLA) or any other auto manufacturer, the primary focus will always be production growth. Over the last year, Rivian has constantly hit substantial production growth levels, whether or not the company hit revenue targets.

In the last quarter, Rivian produced 13,992 vehicles while delivering 12,640 vehicles. The key here is that the EV company only entered 2022 having produced 1,003 vehicles in Q4’21.

Rivian Q2’23 Shareholder Letter

Rivian has gone through a massive ramp phase and now is on pace for 52,000 vehicles produced in 2023. The next phase of the business is to turn higher production into profits as the business scales.

The EV manufacturer still forecasts producing a massive $4.2 billion adjusted EBITDA loss for 2023. The Q2’23 per vehicle loss improved by ~$35,000, but Rivian won’t greatly increase quarterly production in the 2H to cut these massive ongoing losses.

The company produced 23,387 vehicles in the 1H with the guidance only targeting 28,613, or ~14K vehicles produced per quarter, in the 2H of the year. Rivian produced nearly 14K EVs in Q2 alone, so volumes and scale won’t help with cost reductions in the 2H.

Even though Rivian correctly highlights the gross profit per unit delivered dipped ~$35K, the company is still losing nearly $33K per unit. The EV manufacturer generates about $80K in revenues per unit sold, suggesting costs need to be cut roughly in half to reach the long-term 25% gross margin goal.

The R1 line will hopefully see a material reduction in costs when Rivian retools the line in 2024 and increases annual production to 85,000. The company has a 150,000 plant capacity, but due to the Amazon program limiting production on the delivery vans, Rivian is shifting production capacity down on the EDVs from 85,000 to 65,000 vehicles.

Favorable Valuation

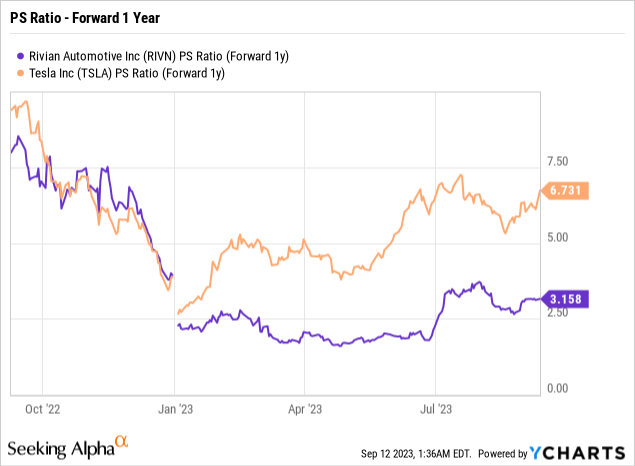

While Rivian still has a lot to prove, the company now has the size and the proven capability to build EVs at scale. The business now has a faster growth rate compared to Tesla while having a cheaper valuation, especially after the Morgan Stanley $400 price target sent the stock 10% higher on Monday.

The stock trades at half the forward P/S multiple of Tesla at 3.1x, with far higher growth rates. Rivian is targeted at 50% to 60% growth rates in the next couple of years, reaching $10.9 billion in 2025 revenues, while Tesla is targeted at 20% to 30% growth rates over the next couple of years.

Rivian makes different vehicles with an SUV (R1S) more competitive with the Chevy Tahoe and other large SUVs and a delivery van for Amazon. Tesla is an EV competitor, but Rivian doesn’t exactly compete with Tesla.

Historically, the faster-growing and smaller company trades at the higher forward valuation multiples. Usually, the market rewards growth, even knowing scale is a prime reason Tesla isn’t growing as fast with revenues set to top $100 billion this year.

Rivian still has a cash balance of $10.2 billion, with total liquidity of $11.3 billion. The company has a substantial amount of capital to invest in growing production, with capacity already in place to triple production.

The looming UAW strike for the legacy automakers will have an unknown impact on EV manufacturers like Tesla and Rivian. To the extent a strike impacts the markets, the stock becomes very appealing on any dips, with strike impacts to legacy auto markets only beneficial to the new EV entrants.

The UAW is asking for a large 46% pay raise, but the more important request is a 32-hour work week. In theory, a reduction to the work of union workers would make ramping up EV production difficult, leaving Rivian less impacted by legacy models hitting the market.

Rivian skyrocketed off the lows in late June near $14, but the stock appears to have found support above $20 now. The stock might give back a few points here, but investors shouldn’t expect another dip back to the yearly lows.

Takeaway

The key investor takeaway is that Rivian Automotive, Inc. has made a real push at being a peer to Tesla in the domestic EV race with multiple vehicles that don’t really compete with the market leader. The stock is appealing at less than half the forward P/S multiple of Tesla, though the biggest risk to the investment story over the next year is a general plateau in production of the R1s until the retooling takes place next year.

Investors should load up on weakness, with $20 likely the new low in Rivian stock.

Read the full article here

Leave a Reply