Our Companies

|

Name |

Market Cap |

Strategy |

|

Medical Facilities (DR.TO)(OTCPK:MFCSF)(DR:CA) |

$230m |

Wonderful Business |

|

Citizens Bank (OTCPK:CZBS) |

$90m |

Excessive Discount |

|

Boston Omaha (BOC) |

$445m |

Wonderful Business |

|

R&R REIT (RRR.UN)(OTC:RRRUF) |

$35m |

Excessive Discount |

|

Truxton Trust Company (OTCPK:TRUX) |

$210m |

Wonderful Business |

|

Innovative Food Holdings (OTCQB:IVFH) |

$95m |

Wonderful Business |

|

America’s Car Mart (CRMT) |

$400m |

Wonderful Business |

|

BankFirst (OTCQX:BFCC) |

$220m |

Excessive Discount |

|

FitLife (FTLF) |

$150m |

Wonderful Business |

|

Old Market Capital (OMCC)* |

$40m |

Excessive Discount |

|

Logan Ridge Financial (LRFC) |

$65m |

Excessive Discount |

|

Greenfirst (GFP:CA)(OTCPK:ICLTF) |

$80m |

Excessive Discount |

|

M&F Bank (OTCPK:MFBP) |

$35m |

Excessive Discount |

|

HAYPP Group (HAYPP) |

$175m |

Wonderful Business |

|

Mid-Southern Bank (OTCQX:MSVB) |

$40m |

Excessive Discount |

*renamed from Nicholas Financial

H2 2024 Letter

Here is the link to three previous letters: Past Letters

River Oaks Capital is open for new investors, if you or anyone you know is interested in learning more about our fund, please visit our website or e-mail me at whuguley@riveroaks-capital.com

Thank you to all who have expressed your interest in River Oak Capital’s letters. They tend to be long and in-depth, much like the research River Oaks does on a company before we buy ownership. To that end, I have started a table of contents , to make the letter more navigable

- Investment Philosophy & Thoughts

- Companies added in H2 2024 (Innovative Food Holdings)

- Updates from H1 2024 Letter

- Mistakes

I. Investment Philosophy & Overview

“Shares are not mere pieces of paper. They represent part-ownership of a business. So, when contemplating an investment, think like a prospective owner “- Warren Buffett

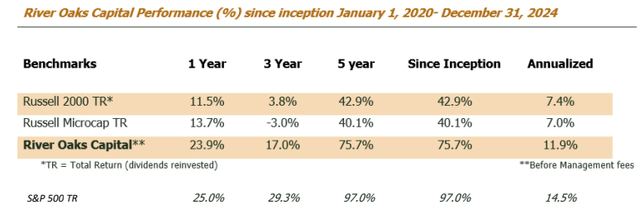

As I am writing this letter, River Oaks Capital has hit the five year milestone as a fund. What an incredible journey it has been so far with all of you alongside me as investors.

As I sat back and began to write my usual introduction to the investor letter, I started to reflect on the lessons I have learned over the past five years of investing in small, public companies – market capitalizations under $1 billion – and thought it would be fun to list out the ‘top 5 lessons learned over five years.’

Let me start this off with a quick story.

Lesson 1: Investing with a business owner, long-term mindset will set you apart in inefficient small, public companies.

I remember it like yesterday, in 2020 – as River Oaks Capital’s fund manager – I hopped on a plane for my first in person meeting with a small, public company’s management team.

I showed up to the meeting with a sports jacket on and a nice button down shirt and walked in with my notepad and list of questions – as we had always done in Private Equity when visiting management teams.

I walked into the company’s headquarters and could instantly tell the management team was confused and trying to assess the motive behind my visit. At first, I was unsure what was even going on.

I started to ask the first few questions on my notepad until eventually the CEO said something along the lines of “You are the first investor to visit us in person for many, many years.”

It immediately clicked that they didn’t even believe I would take the time to hop on a plane just to ask the management teams questions and get to know them.

I quelled their concerns by ensuring them the only reason I was visiting was because I planned on being a long-term owner of their company but would never buy ownership in a company without first getting to know the management team.

I felt that it was odd that no investors were visiting this management team – they were wonderful capital allocators – in person but I flew home that day just assuming most investors attended the shareholders’ meeting – which was in two month – instead of visiting the company in person.

After the visit, I started buying ownership in the company, so I made plans to attend the shareholders’ meeting – where I would get to meet their board and other investors.

This time I dressed in a full suit and tie because I figured this event would be well attended and I wanted to look as professional as possible.

I opened the door to the meeting and was immediately met by stares.

I was the only outside shareholder attending the meeting – aside from one other person who lived close by.

I vividly remember that awkward feeling of their confusion as to why again I got on a plane just to attend this meeting – they didn’t even have a chair ready for me to sit in.

Recall, when I started River Oaks Capital in the beginning of 2020, I had come from working in Private Equity where we would do extensive due diligence before buying a company.

This included spending a significant amount of in-person time with management teams, visiting the company’s facilities, attending multiple industry related conferences, talking to industry experts/competitors, etc.

We would spend months – if not years – getting to understand a company before buying significant ownership. This seemed appropriate because we would become a very large and long-term (10+ years) owner of the company.

As you can tell from my formal attire and preparedness for my first in person meetings, it was a shock to me that no one was doing the same due diligence in small, public companies.

Even though at River Oaks Capital, we were buying a much smaller percentage of a publicly traded company than at my Private Equity job, it was just in my DNA to treat each investment we made as though we were buying the entire company for many years.

In reality, what is the difference between buying 1% of a company versus 50+%?

If you bought 50% of a local restaurant, you would do rigorous due diligence, so why not do that same for any dollar amount you invest in a public company?

I now understood a major piece of my tangible value proposition to River Oaks Capital investors. Before buying ownership in any company, I get on a plane and do the same due diligence I had done in my Private Equity career – as very few small, public company investors are doing this.

Lesson 2: A vast majority of small, public companies’ success is based on the quality of their CEO and management team.

“The importance of the management team is inversely proportional to the size of the company.”

I wish I could find who said this so I could attribute the quote to them but I read it somewhere recently and it succinctly sums up the same lesson I have learned.

This really began to click for me when I was a little over a year into running the fund.

After doing extensive research on FitLife, I hopped on plane and headed to Fort Worth, Texas to go eat some delicious barbeque with FitLife CEO Dayton Judd – this time just wearing a collared shirt and jeans.

I was five minutes into asking Dayton questions about FitLife when I realized how overqualified he was to be running an under $100m market cap company.

I felt as though I was talking to a Fortune 500 CEO.

He knew every minute detail about Fitlife, articulately laying out their future plans – having an extremely rational approach to improving the business – and perhaps most importantly spoke to me business owner to business owner.

Dayton owns over 50% of Fitlife and we own a much smaller percentage but during our conversation he did not give me the sales pitch on Fitlife – as many small, public company CEOs do (only telling you how wonderful their business is and that they have no flaws) – he spoke to me as one business owner would speak to another.

He outlined what they were doing great at Fitlife but also told me areas where they could use serious improvement.

At the time Fitlife was being valued at ~18-20% free cash flow to equity yield (5-6 P/E ratio) and I was buying ownership in the company before I even got back to the airport.

Of course, this has worked in the opposite direction as well.

I have gotten on a plane eager to meet the management team as on paper their company looked incredibly undervalued.

Within five minutes, I realize there is a 0% chance we will invest in this company – as the management team gives you the “sales pitch” and you can tell they care very little about their investors and what happens to the free cash flow of the business once it pays their and the board’s salary.

I refer to someone like Dayton Judd as an ‘A+ capital allocator’ but I think Jim Collins in his book ‘Good to Great’ captures a Dayton type CEO best by calling them a ‘Level 5 leader’ – the highest on scale of 1-5.

Jim Collin defines a ‘Level 5 leader’ as someone with a ‘leadership style that is characterized by a powerful combination of personal humility and professional will, meaning they are highly ambitious for the organization’s success but with a modest and self-effacing attitude, prioritizing the needs of the company over their own personal gain.’

There aren’t many Dayton type CEOs in small, public companies but they are out there if you are willing to work hard enough to find them.

When flying home from Fort Worth that day, the one characteristic that worried me about Fitlife was they didn’t have a traditional ‘economic moat’ – a sustainable competitive advantage that protects the business from competitors – that large companies such as Coca-Cola and Apple have.

Which leads me to lesson three.

Lesson 3: Micro-cap and small-cap companies should take advantage of their small size by dominating an inefficient, fragmented niche industry.

In truth, it is very infrequent that you will find a small, public company that has a true ‘economic moat’ similar to that of Coca-Cola and Apple.

Over the past five years, I have found what we are really looking for is investing alongside A+ capital allocators who have discovered an inefficient, fragmented niche industry and use their exceptional talent to completely dominate their space.

As mentioned, A+ capital allocators in small, public companies are extremely rare so almost always inefficient, fragmented niche industries will be filled with C – below average – capital allocators – who often are just working for a pay check.

Therefore, if you plug in an A+ capital allocator into one of these industries they will simply run circles around their competition.

They are so much better and driven than their competitors that they will generate Coca-Cola and Apple type returns on investment without having any real sustainable competitive advantage within their business.

The sustainable competitive advantage is the A+ capital allocator’s ability to easily outperform their lessor competition – often later acquiring their competitors at depressed valuations thereby consolidating the niche industry.

Aside from Dayton Judd, over the years when I flown out to meet CEOs of other companies River Oaks Capital currently owns, such as Doug Campbell of America’s Car Mart, Tom Stumb of Truxton Trust Company, Bill Bennett of Innovative Food Holdings, Adam Peterson of Boston Omaha, Jason Redman of Medical Facilities, Mark Radabaugh of Amplex Internet (OMCC) and

Gavin O’Dowd of HAYPP Group – it was apparent that not only were they A+ capital allocators but they were head and shoulders above their competition and dominating a small, fragmented niche industry that would allow us to make excessive, durable returns as long as they were around.

Of course, a multi-billion dollar company could try to attack these small, fragmented niche industries but it is almost never worth their time or capital – as it would barely budge their revenue growth.

They would be far better off just acquiring one of our wonderful businesses we have ownership at a huge premium to today’s valuation.

Of note, many of the excessive discount companies we own – described in the next section – have A+ capital allocators as well, they just aren’t in inefficient, fragmented niche industries.

Lesson 4: Just because small, public companies are inefficiently (under) priced today doesn’t mean they won’t remain that way for many, many years– find a way to generate an adequate return without the market cap ever increasing.

This lesson has definitely been learned the hard way over the past five years.

Just because a company we buy ownership in today is inefficiently priced – trading well below fair value – doesn’t mean that it can’t become even more inefficiently priced after we buy ownership.

Furthermore, there are no guarantees it will ever become efficiently priced.

When I first started River Oaks Capital, I remember being so excited to buy ownership in a wonderful business with a great management team that was trading at a ~15% free cash flow to equity yield – 7-8 (P/E ratio).

My logic was that surely other larger investors would discover this company over the next few years and bid up the price of the stock.

Well, that didn’t work out as planned!

Due to the huge recent shift towards ‘passive investing’ – amongst other reasons talked about in the H2 2023 & H1 2024 letter – many wonderful, small public companies are remaining undiscovered and thus inefficiently priced for many, many years.

River Oaks Capital has adapted to this change by making our base case assumption that the market capitalization – share price – of the companies we buy ownership in will never change.

This means we must make an adequate return – 10-15+% per year – just from the free cash flow from the company.

If the share price never increases there are truly only two other ways for a company to provide adequate returns to their shareholders:

- Return capital via dividends or share buybacks.

- Re-invest the cash flow of the company back into the business at or above market returns – this will increase the capacity for dividends and share buybacks in the future.

River Oaks Capital now only focuses on buying ownership in two categories of companies.

Category 1: Companies that are already executing point 1 & 2 mentioned above.

A great example of this would be Medical Facilities, we bought ownership in Medical Facilities a little over two years ago and they are on pace to buy back 50% of the company in a two year span (mostly at a 6-8 P/E ratio) alongside paying a dividend – generating a 25%+ return for us per year.

They have really disproven the myth that you can’t buy back shares in illiquid, small markets! Category 2: Companies that are open to suggestions around returning capital to shareholders. I have been consistently flying around the country to meet management teams of company’s we already have ownership in to suggest they buy back shares – another piece of my tangible value proposition to River Oaks Capital’s investors.

Almost every company we own is trading well below fair value and instead of getting frustrated that their company is inefficiently priced they can take advantage of it by buying back ownership in their company.

It is perhaps the simplest capital allocation decision and is often only available to inefficiently priced, small public companies.

An investor friend and I recently flew out to meet with a company we both have meaningful ownership in to give them the pitch on buying back shares.

Our pitch was quick yet clearly effective.

Instead of trying to acquire other companies at a 10x+ P/E ratio – which they had been trying to do but hadn’t made any acquisitions yet – why not acquire a large percent of your own company at an incredible inexpensive 5 P/E ratio via share buybacks.

The company announced a share buyback program the next week!

This form of ‘suggestivist’ investing has been a lot more successful than I would have imagined as many of the companies we have ownership in have implemented share buyback programs after myself and other shareholders reach out.

This conversation goes better in person and when you have already been a long-term shareholder of the company – we have owned many of our companies for up five years now!

Of the companies we own, almost every management team is extremely skillful at running day- to-day operations and even A+ capital allocators when re-investing back into their business but a few very much welcome advice on how to return capital to shareholders.

If they aren’t already executing point 1 & point 2 or open to ‘suggestivist’ capital return advice, it is probably time to consider selling the company – as their share price may remain unchanged for many, many years.

Lesson 5: A margin of safety is imperative – especially in small, public companies.

When I dove head first into learning about value investing I read any and every book I could get my hands on. The concept of a margin of safety was reinforced to me multiple times all derived from chapter 20 of Ben Graham’s – Warren Buffett’s mentor – book ‘Intelligent Investor’ written in 1949.

A margin of safety is the principle of buying a company at a discount to its intrinsic (fair) value.

Ben Graham eloquently says, “the function of the margin of safety is, in essence, that of rendering unnecessary an accurate estimate of the future.”

However, there is a drastic difference between reading about a margin of safety and learning the necessity of it through first-hand experience over the past decade!

Mistakes are always made in the business world but it seems a disproportionate are made by small, public companies – maybe that is just me hyper focused on the area of the market we invest in!

Regardless, mistakes are just part of what happens when you run a business.

The only way we can protect ourselves against these mistakes is by ensuring we buy our ownership at such a discount to fair value that ample mistakes could occur and we would at the very least receive the cash we have invested back.

The two examples that pop into my head over the past five years are when we bought ownership in Galaxy Gaming and Bebe’s.

We sold our ownership in Galaxy Gaming earlier this year but suffice it to say enough mistakes were made to abruptly disrupt the progress of a wonderful business – addressed in the H1 2024 letter.

Ultimately, Galaxy Gaming sold to a strategic acquirer at a massive discount to what would have been fair value if the company hadn’t made constant missteps.

Despite all these blunders – due to the margin of safety we bought Galaxy Gaming at – we were able to get all of our cash back from our investment.

Additionally, we sold our ownership in Bebe’s a few months ago.

Again, there were a disproportionate number of mistakes made here that we could not have anticipated.

Ultimately, due to the financial strain of their largest shareholder – B. Riley – Bebe’s was forced to sell their most valuable assets for 50% of fair value. Despite this totally unforeseen negative outcome, we were able to generate a ~40% return in less than two years – due to the margin of safety at which we purchased our ownership.

A corollary to this lesson is that in small, inefficient public markets you will sometimes have a day where the stock price of a company we own goes down 30% for no reason related to the business.

For example, a 5% shareholder just wakes up one day and decides to sell all their shares in an illiquid company.

This rarely happens in any other areas of public markets and offers us an incredibly unique opportunity to increase our margin of safety – which we did in both Galaxy Gaming & Bebe’s.

I had to learn by many years of mistakes what happens if you purchase ownership in a company without a margin of safety and the inevitable business mistakes are made!

River Oaks Capital puts in the necessary ‘time requirement’ to find the few undiscovered gems in a forest left for dead.

There are a few small, underfollowed companies where their low valuation makes no sense at all – they are simply undervalued solely because they are undiscovered.

Furthermore, almost all wonderful small, public companies are undiscovered and undervalued due to a unique, obscure dynamic that cannot be picked up by a stock screener or algorithmic investing.

To fully appreciate a wonderful small, public company – such as the turnaround at Fitlife – and the reason behind its extreme undervaluation – requires getting on a plane to visit Dayton Judd to grasp the business turnaround he had in process.

In total, there are virtually zero eyeballs on any of these wonderful small, underfollowed public companies so you must roll up your sleeves and go find these companies yourself – something a computer simply cannot do.

Part of that ‘time requirement’ over this year included traveling to:

Bentonville, AK

Chicago, IL

Omaha, NE (2x)

Las Vegas, NV

New York City (3x)

Atlanta, GA

Luckey, OH

Tinley Park, IL

Indianapolis, IN

Dayton, OH

Cleveland, OH

Spokane, Washington

Covington, LA

Boston, MA

Cincinnati, OH

Somerset, NJ

Northampton, MA

Toledo, OH

Baltimore, MD

Rogers, AK

Durham, NC

Nashville, TN (2x)

New Orleans, LA Conference

Metairie, LA

Quick Recap

As outlined in the River Oaks Capital ‘Owner’s Manual’, our ultimate goal is to have our fund invested in 10-15 small, underfollowed wonderful businesses that check all these six bullet points:

- Sells a wonderful product that will generate substantial cash for years to come

- Treats their customers, employees, and community admirably

- Is run by honest and able people that also have ownership in the business

- Does not take excessive risk

- Has a long-term plan for the business

- Is selling ownership at a significant discount to fair value

However, small, underfollowed wonderful businesses are not always selling at a significant discount to fair value, so along the way we will also buy ‘excessive discount’ companies which are so deeply undervalued – $0.50 or less on the dollar – that almost none of the first five bullet points are needed as virtually any long-term outcome coupled with proper capital allocation will generate an acceptable return.

I. Companies added in H2 2024

Innovative Food Holdings (OTCQB:IVFH)

Innovative Food Holdings is a nationwide specialty food distributor to the food service industry. It is our sixth-largest position and has a market cap of $95m.

Like many transportation industries that get certain items from point A to point B, the food distribution system is no different. It is separated into bulk shipping – called broadline food distributors and specialty shipping – called specialty food distributor

The job of the food distributor is transporting food from the beginning of the supply chain – farms, ranches, factories, etc. – directly to the end of the supply chain – restaurants, cafeterias, airports etc. (any food that is bought outside of a grocery store).

The job of the food distributor is transporting food from the beginning of the supply chain – farms, ranches, factories, etc. – directly to the end of the supply chain – restaurants, cafeterias, airports etc. (any food that is bought outside of a grocery store).

In broadline food distribution there are three major players – Sysco (SYY), US Foods (USFD) and Performance Food Group (PFGC) – that dominate the industry.

These “big three” control over 50% of the food distribution market and are names that you probably recognize as their trucks are frequently seen driving around town.

These broadline food distribution companies connect mass production food operations – large cattle farms, rice manufactures, etc. – to restaurants, cafeterias, airports, etc.

As Bill Bennet – CEO of Innovative Food Holdings – broadly puts it ‘You can think of broadline food distributors as the Wal-Mart of food service distribution. They are very good at selling core commodities that everyone wants very cheaply. They specialize in breadth not depth of offerings. They are not very good at finding and selling niche food products that especially unique customers might be targeting.’

Simply put, it’s just too hard for broadline food distributors to maintain a large number of relationships with these niche food vendors.

Additionally, it’s not worth their time as it requires a lot of hand holding that doesn’t pay off in meaningful revenue for these massive broadline food distribution companies.

An example of a niche food producer that isn’t worth the time for broadline food distributors is ‘Ham Sweet Farm‘ who sells grassfed lamb – an item that is ordered infrequently by a small number of customers – out of Michigan (pictured on the right).

An example of a niche food producer that isn’t worth the time for broadline food distributors is ‘Ham Sweet Farm‘ who sells grassfed lamb – an item that is ordered infrequently by a small number of customers – out of Michigan (pictured on the right).

This is where Innovative Food Holdings steps in.

The specialty food distribution industry is highly fragmented amongst many players – mainly just locally delivering niche food products (such as grassfed lamb from ‘Ham Sweet Farm’).

Unlike most specialty food distributors, Innovative Food Holdings actively searches for these “mom and pop” specialty food producers – such as ‘Ham

Sweet Farm’ – who are only selling locally and offers them the ability to be plugged into a nationwide sales pipeline.

By being in business for over two decades, Innovative Food Holdings has developed a symbiotic relationship with the broadline food distributors – Sysco, US Foods, Performance Group, etc.

Innovative Food Holdings will do the work the broadline food distributors don’t want to do – find specialty food producers, vet them and bring them up to packaging and health standards.

They then add these specialty food producers such as ‘Ham Sweet Farm’ to the broadline food distributors’ nationwide sales catalog.

This is a win-win for everyone involved.

Now, ‘Ham Sweet Farm’ can sell their grassfed lamb nationwide – drastically increasing their sales – and the broadline food distributors can offer grassfed lamb to their end customers – increasing the depth of their offerings – without having to do the tedious work.

Before we dive further into how Innovative Food Holdings has begun to entrench their niche in the specialty food distribution industry, let’s first go over their recent transformation.

Innovative Food Holdings outstanding board – more on them later – in early 2023 decided it was time to bring in a new CEO – Bill Bennett – and management team.

Despite Innovative Food Holdings impressively growing their revenue over the past two decades, the prior management team made poor capital allocation decisions by trying to build direct-to-consumer e-commerce businesses which lost $12m over five years – ultimately pulling Innovative Food Holdings away from their core competency.

I have spent time with Bill in person and spoke with him many times over the past year – getting to know him well.

Bill is the level headed, common sense, astute capital allocator – having the characteristics of the A+ capital allocator referred to in the opening section – that Innovative Food Holdings desperately needed in order to focus on and thrive in their core specialty food distribution business.

Bill comes from a more corporate background – Kroger (KR), Wal-Mart (WMT), S.C Johnson and General Mills (GIS) – which often scares small, public company investors.

They worry that someone coming from a more structured background will not be able to adapt to the more entrepreneurial lifestyle of running a small company.

I had this concern too until I really got to know Bill. I learned that he left the corporate world because he wanted to do something on his own whether it be a start-up or a smaller company.

He wanted to step into a situation where he could “eat what he cooked.”

Bill saw that Innovative Food Holdings had a great core business alongside an incredible board. It just needed some cleaning up and professionalization in order to unleash the underlying profitable business.

As Hugh Evans, an investor I deeply respect with over 30 years of experience in the small, public company industry, told me when we were discussing whether River Oaks Capital should buy ownership in Innovative Food Holdings, “In my experience, 75% of the time a corporate CEO coming to small, public company completely fails, the other 25% of the time it becomes an astonishingly good investment.”

I have had a very similar experience as well.

I believe with Bill and the team he has brought in – including Brady Smallwood who he worked with at Kroger and Gary Schubert who he worked with at Wal-Mart – we have a very good chance at achieving the 25% outcome.

When Bill stepped in on day one he didn’t realize how dire the financial situation of Innovative Food Holdings had become saying “four alarm fires were going off on day one.” They started the turnaround by outlining what their two core competencies are:

- A special food distribution marketplace to all national food sales channels – their competitors mostly just distribute locally

- Their ability to find and train new small food vendors – such as ‘Ham Sweet Farm’

Bill and his team then laid out a three phase plan that revolved around these core competencies.

Phase 1: Stabilize

This entails fixing pricing and margins (which astonishingly hadn’t been adjusted for the past few years of inflation), divesting non-core assets (specifically the e-commerce businesses and unused buildings), cutting costs by reviewing every check that goes out the door and reducing headcount.

Phase 2: Build a Foundation for Growth

This means adding new broadline food distributors (more on this below), adding new specialty food vendors and executing small, inexpensive tuck-in acquisitions.

Phase 3: Grow and Scale

Once they have built a solid foundation and proven their ability to grow both organically and through acquisitions on a smaller scale, then begin to significantly grow their revenue and free cash flow – leveraging the asset light nature of their core business and consolidating their industry through more acquisitions.

Bill has done an outstanding job and has nearly fully implemented phase I and is well into phase 2.

But before we get into how they are implementing phase II. Let’s dive a little further into how their two core competencies work.

As mentioned, Innovative Food Holdings has deep connections with the broadline food distributors – Sysco, US Foods, Performance Group, etc.

So, whenever a restaurant wants to order grass feed lamb from a broadline food distributor such as US Foods, ‘Ham Sweet Farm’ appears in the restaurant’s US Foods catalog – even though the order is being fulfilled by Innovative Food Holdings – who gets ‘Ham Sweet Farm’ to overnight ship the order to the restaurant via FedEx.

This is referred to as ‘drop shipping’ and it involves essentially no working capital or inventory for Innovative Food Holdings.

In fact, the restaurant never knows that Innovative Food Holdings is involved in the transaction.

Additionally, Bill and his team actively search the U.S. to meet niche food vendors such as ‘Ham Sweet Farm’ and get them into their food catalog.

Bill and his team will continue to tirelessly travel to find new niche food vendors to organically grow revenue.

However, revenue growth can become exponential as Bill and his team integrate each siloed division of their company onto one platform and then start adding tuck-in acquisitions.

Over a decade ago, Innovative Food Holdings acquired a Chicago-based local specialty food distribution company called Artisan Specialty Foods for ~$1.0m-$1.5m.

Artisan Specialty Foods bought from local mom-and-pop niche food vendors similar to ‘Ham Sweet Farm’ but only distributed their products to 450 customers in the Chicago area.

Once Innovative Food Holdings took over, they plugged Artisan Specialty Foods’ products into their national sales catalog connected with the broadline food distributors.

Artisan Specialty Foods’ revenue doubled quickly from $5m per year to $10m+ – as they were no longer just selling products to the Chicago area.

When Bill and his team took over, they observed the enormous synergistic growth potential that is possible by buying local specialty food distributors – such as Artisan Specialty Foods – and immediately doubling their sales by plugging them into their national pipeline.

Bill also observed that before he was hired they were not taking advantage of cross-selling opportunities by selling Innovative Food Holdings’ other nationwide niche food vendors’ products into the Chicago market via Artisan Specialty Foods.

Furthermore, Artisan Specialty Foods had 1,200 new items Innovative Food Holdings could add to their already 7,000+ item food catalog they offer to broadline food distributors – further enhancing their value add to the broadline food distributors.

Bill and his team realized they could build an even more formidable portfolio offering by doing small, synergistic tuck-in acquisitions of local specialty food distributors – Phase 2 of their plan.

They have done just that over the past few months by acquiring Golden Organics – located in Denver, Colorado – for ~$1.6m with ~$7m of revenue and LoCo Food Distribution – based in Fort Collins, Colorado – for ~$350k with ~$5m of revenue.

These were both wonderfully synergistic acquisitions as Golden Organics has 800 items that Bill and his team can add to their national catalog – they have previously done very little in the organic space – additionally Golden Organics can now cross-sell the 8,000+ items in Innovative Food Holdings’ catalog to the Denver area.

The same goes for LoCo Food Distribution, which brings in 500 new items to add to Innovative Food Holdings’ portfolio and offers the same cross-selling opportunity.

Bill and his team plan on doing a few of these tuck-in acquisitions initially at very favorable valuations – 3-5x free cash flow to equity – to prove out the concept of their synergistic nature – showing they can double the revenue of the acquired company in 1-3 years while increasing their portfolio offering to the broadline food distributors.

If this works as planned, they will then begin to ramp up the number of tuck-in acquisitions per year.

As Bill said to me a few weeks ago, “this company will look unrecognizable in six months from where it was when I took over.”

The tuck-in acquisitions play a part in Bill’s statement but the real major transformation is from their recent contract as the sole gourmet cheese provider for a top 10 retailer in the U.S.

This is where River Oaks Capital stepped in.

Bill and his team raised ~$3.25m – at $1.60 per share (the market price at the time) – to build up inventory of gourmet cheese and buy the equipment needed to process the cheese.

The payback on the equipment will be less than one year as it will dramatically lower operating costs.

The Innovative Food Holdings board reached out to River Oaks Capital for us to invest alongside them in the equity raise and I immediately agreed as it was the board themselves who were so excited about the new opportunity.

Bill and his team haven’t quantified the total revenue this gourmet cheese contract could produce but have said it’s in the ‘tens of millions of dollars’ – very meaningful for an ~$70-$80m per year revenue business.

River Oaks Capital invested at a market cap of ~$80m.

If you include the gourmet cheese contract plus the two tuck-in acquisitions, it seems Innovative Food Holdings will hit ~$100m of revenue by the end of 2025 which should translate to $6-$7m of free cash flow to equity in the next 1-2 years – an 8-9% free cash flow to equity yield (11-13 P/E ratio).

At first glance, this may appear to below the typical margin of safety we desire for a wonderful business – $0.70 or less on the dollar – but there are a few factors to consider:

First off, their ability to grow their drop shipping business with nearly zero additional invested capital.

This requires virtually no working capital and very few employees – allowing future revenue growth to convert to significantly more free cash flow.

For example, Innovative Food Holdings recently partnered with a new major broadline food distributor and it only required them to hire 1 new employee.

Secondly, their ability to do dozens more tuck-in acquisitions of specialty food distributors.

If they can continue to acquire small, specialty food distributors at 3-5x free cash flow to equity (before synergies) and then double the revenue of the acquiree, the returns could be astronomical – they already have a large pipeline of potential targets lined up.

Thirdly, the sale leaseback of their Pennsylvania warehouse they own will make them a debt-free company.

They only use about ~25% of the capacity of the warehouse, which is valued between $15-$18m and should be sold this year.

They will use the proceeds – which will be un-taxed due to their $20m in Net Operating Losses – to pay down their ~$9m of debt and then have $6m+ of excess cash. Lastly, and probably most importantly, Bill, his team and the board.

The downside protection given to us by having an A+ management team alongside the most shareholder friendly board is extremely valuable.

I have gotten to know a few of the board members well and not only do they have extensive experience in properly returning capital to shareholders but they own over 50% of the company.

Furthermore, James Pappas – chairman of the board – has a deep expertise in the food industry.

Going forward, every decision the board makes will be the most logical and shareholder friendly choice.

II. Updates from H1 2024 Letter

Medical Facilities (DR.TO)

Medical Facilities has majority ownership in three surgical hospitals in South Dakota, Oklahoma and Arkansas, as well as one surgical center in California. It is our largest position and now has a market cap of $230m.

When Converium Capital – led by Michael Rapps – went activist over two years ago they laid out a turnaround plan to the board of directors:

- Suspend acquisitions

- Divest non-core assets

- Reduce overhead costs

- Evaluate and implement strategies to return capital to shareholders

The board – alongside Converium Capital – appointed Jason Redman as CEO to lead this turnaround around plan and he has executed it to near perfection.

I have gotten to know Jason Redman – recently catching up with him in December – as well as Michael Rapps and the work they have done for us shareholders has been truly incredible.

Jason and his team have now started step four of the turnaround – return capital to shareholders.

In November, Jason and his team sold the Blacks Hills Surgical Hospital – located in Sioux Falls, South Dakota – to Sanford Health for $194m (attached here) for ~12-14x free cash flow to equity.

Recall, Medical Facilities owns ~54% of the surgical hospital – receiving ~$105m in proceeds before tax.

This was followed up by an announcement that Jason and his team will be returning a portion of the proceeds from the sale via a $80m CAD “modified Dutch auction” tender offer of $15.50-$17.00 CAD per share – ~20% of the company.

Since the activist campaign over two years ago, Medical Facilities in now on pace to buy back over 50% of the company by the end of 2025. Additionally, they have been paying a $6m+ dividend per year – ~2.5% dividend yield.

Prior to the announcement of the tender offer, their ability to buy shares in the open market – where they have volume restrictions – has been an incredible sight to see – buying back 1.6% of the company in just December alone and $15m+ of shares per year!

I regularly reach out to Jason and the board to both thank them and reiterate our desire for them to continue to use excess cash to buy back shares up to $20+ CAD per share.

Over the past six months, I have had long conversations with a few experts in the industry and really gained a much deeper appreciation for the scarcity value of surgical hospitals.

When Obamacare was passed in 2010, it no longer allowed surgeons to have equity positions in surgical hospitals – all of Medical Facilities’ surgical hospitals were built before then.

However, existing surgical hospitals with surgeons that had equity positions were grandfathered in – they just can’t increase their equity position (their equity position is transferrable to other doctors though). The surgeons at Medical Facilities’ surgical hospitals own 35-49% of each hospital.

As a result of the 2010 law, very few surgical hospital have been built since – as one of the main motives of a surgical hospital was to the let the doctors receive equity in the profits and thus have upside from the hard hours they work and for performing the most lucrative types of surgeries (mostly Spine, ENT, and Orthopedics).

This is why Sanford Health was willing to pay quite a significant multiple for Black Hills – they are the only major surgical hospital in the area.

As mentioned in previously letters, prior to the Black Hill’s sale, Medical Facilities owned four surgical hospital – Sioux Falls, Blacks Hills, Oklahoma and Arkansas.

Sioux Falls and Black Hills have been their “cash cows” with Sioux Falls being their top-notch assets.

When trying to value their remaining three surgical centers, there are dynamics that need to be thought about outside of just the current free cash flow of the surgical hospital including: the current surgeons willingness to work for the acquirer, succession plans for older surgeons, future competition in the markets, the regulations around ambulatory centers versus surgical hospitals going forward, whether main hospital in that area will try to steal the surgical hospitals market share and the approval of the acquisition by the regulators based on market concentration.

There is a lot of politics and gamesmanship that goes on amongst competing hospitals and regulators.

However, after my recent conversation with Jason, and the way his team wonderfully navigated the Black Hills sales, I feel confident they will eventually be able to sell the remaining three hospitals at a significant premium from where they are being valued at by the public market today.

Over the past few letters, I have outlined the various scenarios (attached here) of how Medical Facilities could liquidate their surgical hospitals over the next few years.

After the Black Hills sales, it seems probable they will sell each hospital individually and continue to buy back shares with the proceeds until the remaining three hospitals are sold.

Before we dive into a sum of the parts valuation if each hospital is sold individually, it is worth noting that Jason continues to re-iterate that there are no “for sale” signs on any of the hospitals – they only look at potentially selling a surgical hospital if it is a very favorable transaction for the shareholders and the surgeons.

Now, the sum of the part valuation if each hospital is sold individually

- Sioux Falls

- Their ultimate cash cow

- Generates ~$30+m of free cash flow to equity

- Should be sold at a multiple at or above Black Hills – equaling $350+m

- Medical Facilities owns 51% of Sioux Falls which would translate to ~$180m dollars – ~$135m+ after taxes.

- This is ~80% of the current market cap after adjusting for the Black Hills sale.

- Arkansas

- The biggest turnaround facility since we have bought ownership in the company

- Now generating $15m+ of free cash flow to equity – close to Black Hills

- Arkansas may not command as high of a multiple as Black Hills but could be sold for $155+m.

- Medical Facilities owns 51% of Arkansas which would translate to $80+m – $60+m after tax.

- This is ~35% of the current market cap.

- Oklahoma

- Least profitable of the three remaining hospitals

- Generates $7-$8m of free cash flow to equity per year

- Could be sold for $60+m.

- Medical Facilities owns 64% of Oklahoma which translates to ~$40m – ~$30m after tax.

- This is 17.5% of the current market cap

These assumptions are using conservative estimations and shows that the current market cap is still 30-35% undervalued at a minimum – which could become even more drastic if management continues their incredibly accretive share buybacks.

It’s worth noting that Medical Facilities has ~$8m per year of corporate overhead costs – all of which could be removed by a strategic acquirer.

Some of these costs will decrease as individual hospitals are sold but the fixed costs of the holding company – audits, public filings, board insurance, salaries, etc. – will remain.

Taking that into account, we are currently getting a ~9-10% free cash flow to equity yield (10- 11 P/E ratio) after the Black Hills sale.

These fixed costs create a scenario where if Sioux Falls is sold, Medical Facilities would need to quickly sell Arkansas and Oklahoma as well.

If not, a significant portion of their free cash flow would be consumed by the fixed costs of the holding company.

I can attest that Jason and his team are well aware of this.

Citizens Bank is a community bank located in Atlanta, Georgia. It is the second-largest position in our fund and now has a $90m market cap.

Cynthia Day – CEO of Citizens Bank – continues to do a wonderful job at navigating the capital allocation of the over $122m of cash they received from the U.S. government’s ECIP funding and other favorable funding they received in 2022 – a 2% interest rate loan of perpetual preferred equity redeemable at ~28% of face value.

Earlier this year, I flew to Atlanta to visit with Cynthia, CFO Sam Cox, Chairman of the Board Ray Robinson and the rest of the Citizens Bank team in Atlanta at their shareholders’ meeting – my third visit to Atlanta to spend time with the team.

I have said this many times since we bought ownership in Citizens Bank three years ago but it’s worth repeating:

Not only have Cynthia and her team continued to build an incredible bank, but they have done a wonderful job over the past few years of treating shareholders exceptionally well.

Cynthia and her team could have easily used the $122m+ in cash to go out and make risky loans, over pay for acquisitions, increase their salaries or build new branches.

Instead, they have remained true to their very conservative nature that has kept the bank profitable for over 100 consecutive years.

Cynthia and her team have used the cash to buy back 10+% of the shares, increase the dividend to ~$2m per year and still have $95m+ of cash (75%+ of the cash they received) at the holding company – patiently waiting for more opportunistic lending conditions or a well-priced strategic acquisition.

As Cynthia and the board – who own ~30% of the company – have confidently reiterated every time I meet them, they are focused on profitability over grow and remain extremely conservative as it benefits not only shareholders, but the community they lend to as well.

When we first bought ownership in Citizens Ban three years ago, it was purely because the bank was well over 100% undervalued.

Along the way, as I have gotten to really know Cynthia and her team, it is now a bank I would gladly hold for years to come despite the ~70% increase in share price.

Amazingly, despite the share price increase, Citizens Bank is still an ‘excessive discount’ at their current ~$90m market cap valuation.

They still have $95+m of cash – more than their entire market cap – at the holding company of the bank alone!

This doesn’t include Citizens Bank itself, which has a book value of ~$85m.

Additionally, in a period where community banks under $1 billion continue to struggle to make adequate returns on equity as the fixed costs of running a bank continue to increase, Citizens Bank has generated a ~20+% return on book value.

They also have an outstanding ~50% efficiency ratio – due to their low costs of funds – with one of the most conservatively financed balance sheets throughout all community banks.

No doubt, some of this is due to the preferential terms of the over $122m of cash they received but Cynthia and her team absolutely play a major part in this as well.

They have done an outstanding job at growing low cost, strategic core deposits alongside a deep understanding of their community – mainly Atlanta – and knowing which loans to underwrite to increase profitability.

Lastly, I have talked about the government’s ECIP program ad nauseum over the years in my letters.

As mentioned, the government gave community banks in the U.S. – including Citizens Bank – unbelievably favorable ECIP loans – 2% non-cumulative preferred equity loans in perpetuity.

This November, the U.S. treasury put out an official policy announcement that all ECIP community banks have the option to buy back their preferred equity loans over the next ~2-8 years – depending on their lending standards – at a pre-calculated rate (attached here on pg. 6-7) that would currently be between ~8%-28% of face value.

Of note, the ECIP community bank is not forced to buy back the preferred equity and can elect to continue to pay the 2% interest in perpetuity if they so choose – but this would not be a wise choice for any bank as they could lose the optionality to buy it back in the future.

Although this announcement changes little in terms of free cash flow for Citizens Bank, it removes any uncertainty some investor may have had on how the government might treat the ECIP loans – the deal is signed and finalized!

Based on Citizens Bank’s current lending standards, it appears they would qualify to redeem their preferred equity at ~28% of face value in a little less than 8 years.

This means if we were to adjust their book value to reflect the new “fair value” of their preferred equity loan, they would have a book value of ~$170+m – nearly to 2x their current market cap.

Citizens Banks is currently generating $15m+ of free cash flow – a 16-17% free cash flow to equity yield (5-6 P/E ratio) that should continue to gradually increase to $20+m as they use their $95m+ in cash to organically grow loans or potentially acquire a synergistic community bank – a strategy they are certainly interested in (recall if Citizens Bank acquires a bank with an ECIP loan they can transfer that loan to Citizens Bank).

As a side note, since the shareholders’ meeting I have been in touch with Cynthia trying to get Citizens Bank to participate in a well-known Tulane University program – Burkenroad Reports.

Cynthia and her team agreed to do it this year!

The business students will write a detailed research report on Citizens Bank that will be distributed throughout the U.S. and given out at the annual Burkenroad’s conference.

Cynthania and her team will be attending the conference in April 2025 – come meet their team if you are in New Orleans! I, along with other large shareholders, have also been reaching out to Cynthia and her team to re-iterate buying back shares and they have said they will continue to opportunistically do so.

It has been an absolute pleasure to have Cynthia and her team allocate capital for us!

Boston Omaha (BOC)

Boston Omaha is a holding company that divides itself into four main segments: Billboard, Broadband, Insurance and Other Investments. It is our third largest position in the fund and now has a market cap of $445m.

This September I traveled to Omaha, Nebraska for the Boston Omaha annual meeting. This meeting was undoubtedly the most important shareholders’ meeting since Boston Omaha started in 2015 as the beginning of this year was filled with turmoil and uncertainty – including their co-CEO Alex Rozek leaving (with a large premium paid for his super voting shares) and the closing down of their asset management division.

I was able to catch up with CEO Adam Peterson and his team before the meeting and was immediately reminded of what a wonderful group of top-notch people Adam has surrounded himself with.

During the meeting, I thought Adam did a perfect job explaining where Boston Omaha is now, how he plans to simplify the business and their succinct plans going forward.

The key theme of the meeting was Boston Omaha’s three main segments – Billboard, Broadband and Insurance – have finally reached scale and Adam and his team are simplifying Boston Omaha by only focusing on these three main segments – the next chapter of their story has begun.

Before I describe his plan in more detail, I would note that I don’t think it is astute to invest in Boston Omaha without meeting Adam and his team in person.

Boston Omaha undoubtedly has a group of assets that are well positioned to make above average returns but the success of Boston Omaha largely relies on Adam and his team’s ability to execute going forward.

I have spent time with every CEO of Boston Omaha owned companies and they all have had very similar remarks on their excellent partnership with Adam – commenting on how brilliant he is at allocating capital with a long-term vision (decades) while allowing each CEO to autonomously run their individual company.

As you get to know Adam, you find he is one of the most driven yet centered people and after 10 years of running Boston Omaha he has a simplified, unwavering vision that he is hyper focused on executing.

He is an A+ capital allocator referenced in the beginning of the letter.

Adam opened the meeting describing how they knew it would take time and capital to get their three core businesses – billboard, broadband and insurance – to scale.

Finally, all three core businesses have achieved scale meaning they will produce higher and higher incremental free cash flow as their mature growth continues – with little capital expenditure required.

None of this is possible without going through the early stage, capital intensive pains of scaling each of these businesses.

Over the past decade, their three core businesses have generated ~9-10% returns on capital because of the upfront costs needed to grow to maturity.

Now that all three core business have hit scale, they should be able to generate ~15+% returns on the incremental capital invested in each business for many years going forward.

As Adam said, “I am very happy with where we are, and that we had the patience to invest in companies that cost more upfront but have much longer, durable cash flows once they achieve scale.”

Adam reiterated an investment philosophy he holds dearly by saying “investors underestimate and underappreciate durability of cash flow because often times you have to go through many years of heavy upfront capital expenditure in order to build a business that can generate long-term, durable above market returns.”

Adam and his team have remained consistent with this goal since their first letter to shareholders a decade ago. They have now finally got to the scaled, durable free cash flow part of their story.

In their very first letter they laid out the plan to invest in ‘long life assets that are protected on a supply basis (limited supply) and have low capital requirements after an intensive capital scaling period.’

Although it took longer than expected, when you look at Boston Omaha now, you will see Adam has remained steady to the original plan.

Now let’s look at the developments in each division of Boston Omaha

- Billboards:

Link Media – run by Scott Lafoy – is the sixth-largest billboard company in the U.S. with 7,600 billboards most in more rural locations. The billboard industry is very consolidated at the top – Lamar, OutFront Media and Clear Channel – who are all eager to grow.

However, the only way to meaningfully grow is through acquisitions – due to regulations organically growing a large billboard company is impossible.

Whereas the billboard industry is consolidated at the top, it is very fragmented once you exclude the major players.

This makes Link Media an incredibly valuable asset. A major company looking to expand rurally – such as Lamar – would gladly buy them for 8-10x+ revenue – not that Boston Omaha has any intention of selling.

The appraisal value for Link Media is likely ~$325m+ whereas the value to a strategic acquirer would be much higher.

This past year Scott and his team have really focused on lowering costs versus acquiring more billboards – reflected in the lower land and operating costs as a percentage of revenue.

While they will get back to acquiring smaller billboard businesses – as they just recently passed on a deal – it was important to lower costs before growing again.

I have personally learned a tremendous amount about rural billboards over the past six months.

I traveled to rural Ohio in December to meet the CEO of a large, rural billboard company and he really helped me further understand the true local dominance they can have – specifically due to regulations.

Rural billboard customers are almost always local advertisers and although they don’t pay as much as a national advertiser – such as Coca-Cola – they provide more consistent and predictable cash flow and don’t abruptly cancel contracts.

Often, their rural billboard advertisement even becomes a landmark in the local town – ‘take a right at the Mrs. Smith’s Grocery Store billboard.’

As it was laid out to me. There are only four ways to increase the free cash flow of a billboard company:

- Acquire a poorly managed billboard company and come in and cut costs & properly manage the company – very few if any billboard companies are selling at depressed multiples.

- Easement purchases – pay a one-time lump sum payment to the land owner where the billboard is located in exchange for never paying a lease again.

- Digital conversions – convert a ‘static’ billboard to a digital face billboard showing up to 8 advertisements – this is only worth it in very few locations. For example, only ~2% of Lamar’s billboards are digital.

- Build a “new” billboard – in some locations if you take down one of your old billboards you can build a new one in a more profitable location.

Link Media is well positioned in the billboard industry going forward with some attributes of a true ‘economic moat’ – rarely found in small, public companies.

2. Boston Omaha Broadband

Max Meisinger was appointed as CEO of Boston Omaha Broadband this August. At the annual meeting, Max laid out a very concise plan for their broadband division going forward – using their small size to their advantage. He has a deep understanding of the industry.

Boston Omaha Broadband has ~32k fixed wireless customers and ~30k fiber passing in between their three divisions: Airebeam (Phoenix, Arizona), InfoWest (St. George, Utah), and Utah Broadband (Draper, Utah) – attached here.

These numbers are from Q3 2024 and have almost certainly grown on the fiber side as they continue to build out fiber as well as win subsidized fiber contracts.

Additionally, Ben Elkins – who I have gotten to know well – now runs both Utah Broadband and Airebeam.

Ben knows how to navigate the rural western U.S. fiber internet buildout masterfully by ensuring a first mover advantage in the most attractive locations while doing a great job of winning government financed fiber contracts for certain rural towns.

Furthermore, Max and his team are now integrating all three broadband divisions together to leverage each other’s expertise and lower costs through synergies.

On top of that, Infowest took over Boston Omaha’s Fiber Fast Homes division – which builds fiber to very high ‘take rate’ communities such as Home Owner’s Associations (HOAs) and Manufactured Housing Divisions. Since taking over, Infowest has corrected many of their early mistakes made and lowered their cost per passing by 50% in two months.

Boston Omaha Broadband is one of very few broadband companies in the U.S that doesn’t have any debt. This is an astute decision in the early capital intensive stages of building fiber but they are nearing a stage where they will consider using a prudent amount of debt.

Rural Fiber is another area I have gained a much deeper understanding of by traveling over the past six months to these rural internet providers throughout the U.S.

Specifically, I gained a further appreciation for first mover advantages and why local fiber companies out compete the major players – I address this in more detail in the Old Capital Markets (OMCC) section further down.

Again, this is another industry with attributes of a true ‘economic moat’ – rarely found in small, public companies.

3. Insurance

General Indemnity Group is Boston Omaha’s surety bond insurance business run by Dave Herman.

In the past letters, I have mostly glazed over the insurance side of Boston Omaha by just saying it is worth around book value and then moving on.

However, Dave and his team are now on a successful path towards growing the business and increasing profitability.

They have done a wonderful job over the past few years of transitioning the insurance division from one that was just muddling along and barely profitable into a profitable, low-cost provider of surety bonds.

It’s taken a long time to automate their business , provide the necessary upfront regulatory capital and build the deep relationships needed to grow their premiums, but the insurance team now feels there is a straight forward path to make 12-15+% returns on equity – I have highlighted in previous letters why the outdated, inefficient surety bond market allows these returns to exist.

The major improvement Dave and his team made this year was merging all five of their insurance agencies together. Like their fiber division, they have unified all the segments together to leverage knowledge and reduce costs – their expense ratio has gone down from 89% to 79%.

4. Other Investments

This division is now largely just two investments:

Sky Harbour (SKYH): a publicly traded company with 16 private aircraft hangar campus locations across the U.S and adding more locations almost every month.

Boston Omaha owns ~12.3m shares – ~16% of the Sky Harbour’s outstanding shares (as of Q3 2024) – alongside 7.7m warrants with a cashless $18 strike price.

The value of their Sky Harbour ownership is ~$155+m.

I have written about Sky Harbour extensively in the H2 2022 letter. But as I have gotten to know Sky Habour’s CEO Tal Keinan, CFO Francisco Gonzalez and the Sky Harbour team even better throughout the years, they have absolutely amazed me at what they have accomplished since going public ~3 years ago.

In 2022, when Boston Omaha first invested in Sky Harbour, they had 5 private aircraft hangar campuses.

That year I went to visit two of the five. I am amazed that in less than three years , they have leases for 16 private aircraft hangar campuses and are on pace to achieve their goal of 20 by the end of 2025!

Not only are Tal and Francisco A+ capital allocators but the speed at which they have executed this buildout is unfathomable!

Keep in mind that many of these private airports are owned and run by slow negotiating, bureaucratic municipal governments . Getting into 20 top-notch private airports this quickly is a breathtaking accomplishment.

I have little doubt that Tal and Francisco are well on their way to hitting and exceeding their long-term goal of 50 private aircraft hangar campuses – which would make Boston Omaha’s ~16% ownership worth close to or above the entire current market cap of Boston Omaha.

Crescent Bank (CB&T): a three branch bank located in New Orleans that specializes in sub-prime auto loans Boston Omaha has ~15.6% ownership in CB&T bank which is worth ~$25+m.

I know the chairman of the board – Gary Solomon – well and although the sub-prime auto lending industry is going through one the toughest times in their history – this is addressed in detail in the America’s Car Mart section below – the team Gary has built at CB&T – led by CEO Brian Donahue – will navigate us through these unfavorable conditions.

In total, since the beginning of 2024, Adam and his team have done a tremendous job in right-sizing the business, simplifying operations and reducing costs.

This includes consolidating their fiber and insurance divisions, reducing their billboard costs and divesting their asset management business – helping them reach more mature, durable growth.

Trying to value Boston Omaha is no easy task – which is certainly a portion of reason for their undervaluation.

The first thought when valuing Boston Omaha is the downside protection we are given at a $445m market cap valuation.

If you use a very modest equity appraisal value of their Link Billboard business of $300+m plus the value of their Sky Harbour ownership -~$155m, you already get more than the current market cap. This doesn’t include:

- Boston Omaha Broadband which they have invested ~$200+m into and on track to generate 12m+ of free cash flow to equity this year increasing to $25m+ as the business matures.

- General Indemnity Group which is a $35+m insurance business

- 15.6% ownership in CB&T – worth $25m+

- ~$15m of cash for their asset management divestment

- $29m of cash on the balance sheet

- $73m of NOLs

Using conservative estimates this gets you to a $760m+ market cap – ~70% above the current market cap.

They have also recently implemented a $20m share buyback program but have only used $1.5m as of Q3 2024. Share buybacks should increase as they receive ~$15m of cash from their asset management divestment over the next year.

From a free cash flow perspective, after you adjust their market capitalization – deducting their ownership of everything aside from their three core businesses – they generate ~20+m of free cash flow to equity after holding company costs – which is a ~10% free cash flow yield (10 P/E ratio).

This doesn’t include the increasing free cash flow to equity on the broadband side, which should grow $10m+ over the next 1-2 years as fiber passings and take rates substantially increase.

R&R REIT (RRR.UN)

R&R REIT is a REIT (Real Estate Investment Trust) that owns 16 budget hotels – Red Roof Inns and Hometowne Studios – throughout the eastern half of the U.S. It is our fourth-largest position in the fund and now has a $35m market cap.

R&R REIT continues to pursue their plans of nearly doubling the number of hotels they currently own – 16 – over the next few years.

That being said, no hotels were acquired in 2024 and one was divested for $5.7m.

They used a portion of the $5.7m of proceeds from the sale to pay down ~$3m in debt and a pay out a ~$1m special dividend – a ~4% dividend yield.

In 2024, their 16 hotel occupancy rate fell from 69.2% to 66.5% and revenue per room dropped from $65.37 to $63.37 compared to 2023 – not unexpected as lower income customers struggled throughout 2024 due to inflation.

This caused their free cash flow to equity to temporarily be in the ~3-$4m range versus $5+m over the past few years.

When I spoke with CEO Irfan Lakha he did not seem concerned as he stated the hospitality industry is very cyclical and we expect to see ebbs and flows – this year didn’t surprise them.

Over the past year, lower income customers have cut back on both their hotel use and spending when at a hotel.

However, this could also be viewed as good news for long-term R&R investors, as many potential acquisitions are under more distress than they were a year ago – allowing R&R to acquire hotels at their desired 9-10 cap rate (~10-11 P/E ratio) – a 12-15+% return on equity if a modest amount of debt is used.

Recall, although R&R has $11.5m+ of cash and the ability to add more debt to the balance sheet, they will need to raise ~$40m+ of equity – more than their entire market cap – in order to double the size of their hotel footprint.

Irfan and his team are actively looking for hotel acquisition targets – mainly in the eastern U.S.

However, their plans of marketing R&R’s growth strategy to investment banks and other large investors haven’t occurred yet.

Irfan doesn’t want to raise additional capital until they have an ample number of hotels they are ready to acquire and present to potential investors.

As mentioned in previous letters, R&R was started in 2014 by billionaire real estate entrepreneur Majid Mangalji who sold his 16 hotels into the R&R REIT in exchange for shares priced at $0.20 CAD per share – for tax shelter.

Furthermore, Majid and the R&R management team own over 90% of the R&R shares at a cost basis of ~$0.20 CAD per share. I can’t imagine any scenario where they would raise equity that would dilute themselves.

The other reason for the delay in the equity capital raise is it has been hard to raise money for REITS – especially in the first half of 2024 – particularly due to the uncertainty around long-term interest rates.

In the meantime, Irfan and his team are looking at alternative ways to creatively raise capital (such as Joint Venture partnerships, etc.) until large investors are again willing to provide capital to REITS.

R&R REIT has an accounting book value of $0.20 CAD per share – which doesn’t accurately reflect fair value as there is accelerated depreciation – and was appraised in 2019 for $0.33 CAD per share.

The share price has increased over the past year and is now close enough, ~$0.18 CAD per share – where an equity raise at $0.20+ CAD per share seems close to achievable – especially if they can show investors attractive acquisition prices on the new hotels they plan to acquire.

Additionally, recall we invested at ~$0.12 CAD per share but even at $0.18 CAD per share or a market cap of $35m – we are still getting an 8-10% free cash flow yield on depressed earnings (10-12 P/E ratio) which doesn’t include $11.5+m of cash on the balance sheet (30+% of the market cap) and the ~4% special dividend we received.

Our downside protection at R&R REIT is amongst the strongest of all the companies we own as their 2019 asset appraisal is still ~85% above current valuations – even management will indirectly say the current share price doesn’t make any sense.

Although R&R will unlikely reach the value of the multi-billion dollar REIT that Majid Mangalji and his team built in 2003, if Irfan, Majid and the rest of the R&R team are able to grow their portfolio of hotels in any meaningful way our ownership will be worth much more than our assumed current fair value of $0.25 -$0.33 CAD per share.

Truxton Trust Company (OTCPK:TRUX)

Truxton Trust Company (‘Truxton’) is a wealth management and banking company located in Nashville, Tennessee. It is our fifth largest position in the fund and now has a $210m market cap.

In the beginning of 2024, we started buying ownership in Truxton (see detailed write-up in H1 2024 letter).

As mentioned, when I flew out to Nashville to meet CEO Tom Stumb, CFO Austin Branstetter and Vice Chairman Andy May, it was immediately apparent that not only was Truxton far from being just a bank – which I had viewed it as for years – but also Tom and his team were one of those rare, wonderful, A+ capital allocation management teams that you hardly ever find in small, public companies.

Truxton was started in 2004 and went public by raising $20m in equity from mostly employees and Nashville natives – who almost all are still shareholders today.

Tom and his team have never raised equity since – while growing the business to a $210m market cap and paying out $45m in cumulative dividends alongside continuing to buy back shares – $4m worth of shares in 2024 alone.

Moreover, they have generated an average of a 20% return on equity over the past 20 years.

Suffice it to say, Tom and his team have found their inefficient, fragmented niche market and have vastly outcompeted the little competition they do have.

So how have they accomplished such remarkable returns for us shareholders?

The first key, which I originally missed, is Truxton is not a bank. Truxton is a wealth management firm for high-net-worth individuals – with a bank attached to it.

As CEO Tom Stumb says, “ We operate essentially as a multi-family office for ~260 families.”

Truxton is a one stop shop for wealthy individuals, business owners, and their families – with a net worth typically between $25-$50m – looking for a more personalized service for: strategic wealth and tax planning, investment management, fiduciary assistance, as well as banking and capital advisory services.

Tom and his team (who previously worked at the major banks/wealth management companies) identified that wealthy individuals with a very high net worth – but not high enough to have their own family office – wanted a one stop shop, with more personalized service.

These wealthy individuals were paying for a major wealth management company advisor and still needed to hire an accountant, lawyer, insurance agent, broker and other specialists.

Not to mention, major wealth management companies have a high turnover rate and each department is siloed – meaning a customer is often forced to have multiple revolving relationships.

The industry was ripe for disruption and Truxton did just that!

What is exciting for us going forward is that Truxton only has ~$2 billion of assets under management throughout ~260 families– mainly in Nashville and the surrounding area.

The wealth management side of Truxton right now only generates 50% of Truxton’s $19-$20m of free cash flow to equity per year.

However, the growth potential here is being misunderstood by many investors.

The returns on equity generated on the wealth management side of the business are 30+% and will continue to increase as their assets under management grow. Virtually zero capital expenditure or regulatory capital is needed to grow this side of the business – the only real costs are hiring additional wealth advisors.

Tom and his team can grow the assets under management 10+% per year for the foreseeable future – as word of mouth alongside strategic hiring is quickly spreading their client base outside of Nashville.

Most importantly, once Tom and his team gain a new wealth management client they very rarely lose them.

Truxton’s clients have sophisticated needs and they are astonished how well Truxton can handle them – all through one office – for a very a reasonable fee – ~1.0%-1.25% management fee per year.

Truxton’s free cash flow to equity this year was ~$19-$20m – a ~9-10% free cash flow to equity yield (10-11 P/E ratio).

Truxton paid an ordinary dividend of ~$5m, a special dividend of ~$2.8m and bought back $4m+ of shares over the first nine months of the year.

So, of the $19-$20m of free cash flow to equity generated by the entire business, they returned ~$12+m of it to investors – ~65+% of their free cash flow to equity.

As the wealth management division grows 10+% per year and the bank only grows at a modest amount, Truxton’s earnings will no longer be split 50% from wealth management and 50% from the bank.

The wealth management division – which generates a 30+% return on equity – will start to become a disproportionate amount of their earnings.

In short, the wealth management side of Truxton should grow from $2 billion to close to $3 billion in assets under management over the next few years.

This should translate into Truxton generating $27-30m+ of free cash flow to equity which they can 100% distribute to shareholders via dividends and share buybacks and still be able to grow their wealth management division at 10%+ per year.

That being said, the banking side of Truxton shouldn’t be overlooked. They operate a ~$1b in assets bank with just one branch that generates a 10% return on equity and has never lost money on a loan in its twenty year history!

All in all, we are so fortunate to have Tom and his team – who own ~20% of the company and ~33% if you include retired employees – running this wonderful business for us as they meticulously navigate the tremendous growth opportunities of the future while continuously monitoring and mitigating the risks of the business.

They are mitigating their largest risks by properly compensating wealth advisors and diversifying their Nashville concentration.

I look forward to us being shareholders for years to come. Additionally, I will report back when I visit their new office building in Nashville soon. I have heard it is an impressive upgrade.

America’s Car Mart (CRMT)

America’s Car Mart is a deep subprime auto lender with 155 car dealership locations. It is our seventh-largest position in the fund and now has a $400m market cap.

This July I flew out to Bentonville, Arkansas to meet with CEO Doug Campbell and his team. I can’t re-iterate enough how lucky we are to have Doug and his team running America’s Car Mart for us – he is an A+ capital allocator alluded to in the opening of this letter.

A lot of the last letter focused on Doug’s extensive background in the auto industry and how he plans on using that experience to professionalize and upgrade America’s Car Mart (attached here).

Thus far, his major developments have been on centralizing and outsourcing all the unnecessary activities that burden America’s Car Mart’s 155 dealerships alongside building out their new loan operating system to improve their lending standards.