RITM: the good and the bad

Rithm Capital Corp. (NYSE:RITM) could seem like an ideal candidate for income-oriented investors. It is currently yielding 10.4% (on a FWD basis). In addition to such a mouth-watering yield, there are also good reasons to believe such a payout to be sustainable thanks to its differentiating business model.

RITM differentiated itself from other mortgage REITs (mREITs) in a few key ways. The top differentiations in my view are its vertical integration, its focus on non-agency mortgages, and its focus on single-family rentals. Its vertically integrated platform allows it to be involved in all aspects of the mortgage lifecycle, from origination to servicing. This gives it significant competitive advantages in terms of controlling costs, margins, and customer relationships. Its significant exposure to non-agency mortgages allows it to enjoy higher yields. As a background for readers new to mREIT, non-agency mortgages are mortgages that are not backed by the government and hence come with more risk. As compensation for such risks, they typically offer higher yields than agency mortgages, and RITM historically has been doing a good job managing such risks with its expertise. Finally, exposure to single-family rentals provides RITM with a diversified source of income and helps to reduce its overall risk profile.

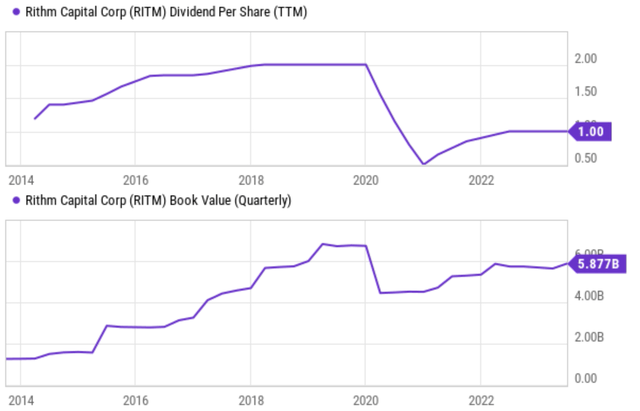

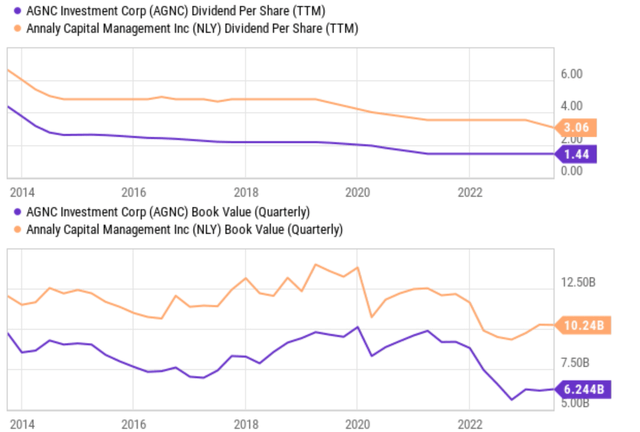

Historical data, in my interpretation, seem to support the soundness of its business model. The first chart below shows RITM’s dividend per share and also book value over the past 10 years. As seen, admittedly, it has to cut its dividend amid the COVID-19 pandemic (like almost every other mREIT stock). But the payout quickly recovered and stabilized. In the meantime, its book value has maintained an overall upward trend over the long term. In contrast, other leading mREITs such as AGNC Investment (AGNC) and Annaly Capital Management (NLY) have suffered chronic dividend declines and book value losses (see the second chart below).

Given the above, it’s difficult to argue for a bearish thesis on the stock. My thesis in this article is to caution potential investors about the risks hidden behind RITM’s 10%+ dividend yield. I will detail two main risks in the remainder of this article. First, I will explain why RITM’s current yield is not as high as it appears when properly contextualized. Second, I will explain why RITM faces a number of profitability headwinds on the horizon, especially with its relatively high leverage.

Source: Seeking Alpha

Source: Seeking Alpha

RITM’s yield properly benchmarked

As appealing as a 10%+ yield could be, any yield should be properly contextualized at least in the following two ways.

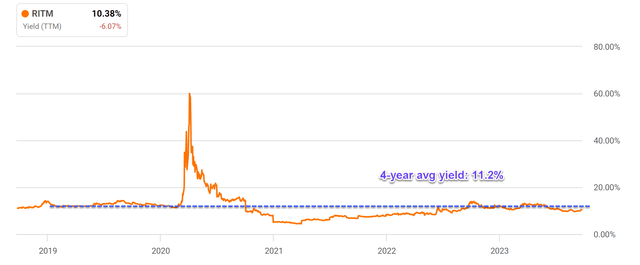

First, it should be benchmarked against its own historical track record. As shown in the next chart below, RITM has yielded an average of 11.2% over the past 4 years. As a result, its current forward yield of 10.4% is actually below its historical average by about 8%.

Second, it should be benchmarked against risk-free rates, which serve as the foundation for all asset valuation. A higher risk-free rate automatically demands a higher premium on all asset prices. As seen in the second chart below, the yield on 10-year Treasury bonds (US10Y) has averaged 2.27% over the past five years and currently sits at 4.44% as of this writing. As such, the gap between RITM’s current yield of ~10.4% and 10-year Treasury rates is thinner than 6%. In contrast, the average spread has been more than ~8% (11.2% minus 2.27%) in the past 5 years.

Source: Seeking Alpha

Source: Seeking Alpha

RITM’s leverage risks

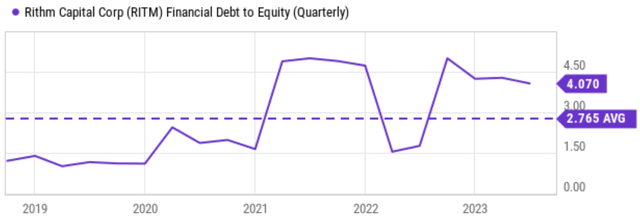

As seen from the chart below, RITM’s leverage is at a quite high level. Its current debt-to-equity ratio of 4.07x is not only far above its historical average of 2.75x, but also near the peak level in years. Given the current macroscopic conditions (i.e., high inflation rates and high-interest rates), I see a few possible ways that RITM’s profit could face strong headwinds going forward.

First and foremost, RITM may have to pay higher interest rates on its own borrowings. This could reduce the company’s net interest margin (“NIM”), which is the gap between the interest income it earns on its mortgage portfolio and the interest expense it pays on its own borrowings. The narrower the gap, the harder it is for the company to make a profit. RITM’s high leverage ratios could make it especially susceptible to such headwinds.

Second, high inflation and high-interest rates could potentially lead to more delinquencies and/or defaults. It is true that such risk is common to all mREIT companies. However, my view is that RITM could be more sensitive to such risks due to its exposure to non-agency mortgages. As aforementioned, non-agency mortgages are mortgages that are not backed by the government and hence RITM would absorb all the impacts on its own if losses occur to its loans.

Source: Seeking Alpha

Other Risks and Final Thoughts

I have focused on the negatives so far, and it is important to mention that there are some positives too. To reiterate, I view its differentiating business model and its management team as the biggest positive. In addition, the market valuation seems to have some of the above risks priced in. As seen in the next chart, RITM is currently trading below its book value. Its P/BV ratio hovers around 0.78x, below its historical average by about 10%. However, as mentioned above, when its valuation is assessed in terms of its dividend yields, it shows a premium. If you recall, its current FWD yield of 10.4% is below its historical average of 11.2% by about 8%, implying a valuation premium.

Overall, the signal is a mixed one, and hence I am recommending a HOLD rating. Potential investors should look beyond the 10%+ dividend yield, contextualize it properly, and examine the business fundamentals. I certainly see plenty of positives in its differential business model. But at the same time, I also see equally strong negatives given the macro conditions, especially when combined with its current leverage.

Source: Seeking Alpha

Read the full article here

Leave a Reply