Cathie Wood has become the poster child for future themed investments. She has garnered support and criticism over the past few years. While she had huge returns in 2020 and 2021, the remainder of the time ARK Innovation ETF (NYSEARCA:ARKK) has been extremely pedestrian. While 2023 started off pretty hot September and October performance has certainly cooled down.

At its inception, ARK Investments gained significant attention and accolades for their innovative investment strategies and for having a female CEO. I celebrate all that she has accomplished. She was able to raise a ton of money, and she became the face of technology themed investing. Currently, sentiment appears to have shifted against Woods and ironically that might make it a decent buy but not a compelling one. I currently rate ARKK a hold and would rather pick and choose from amongst its holdings than purchase this ETF.

Woods recently has championed bitcoin as seen here seemingly doubling down on her convictions even as over $500 million has flowed out of her fund.

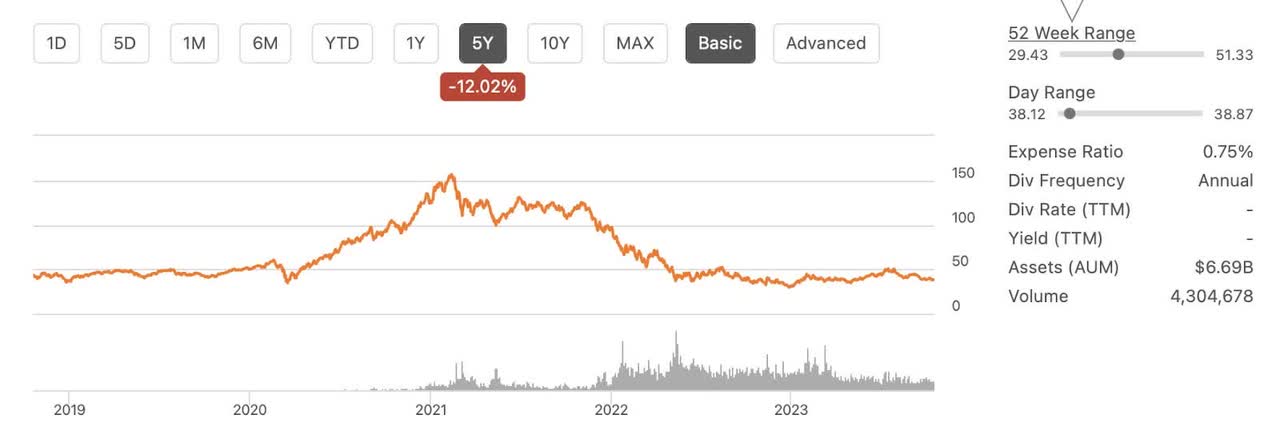

One thing that stands out about CEO Woods is her conviction. No matter what has occurred in the market; the present time is seemingly the best time to invest in ARK. I appreciate the unbridled optimism and confidence even if I question the results. Over the past five years ARK has returned negative 12% and has paid zero in dividends.

Seeking Alpha

Now I understand that ARK focuses on growing tech companies so it makes sense that ARK doesn’t pay a dividend but it doesn’t make sense that the fund is not making any cents over the past five years. Ark demonstrates the danger of investing with the television stars of the financial world. Woods stays in the news because staying in the news is a good way to get funds for your fund.

Hope and growth are always right around the corner but a quick comparison shows that you would be better off investing in the S&P 500 during almost any time period than investing in ARK.

Seeking Alpha

Of course ARK could explode to the upside for a short period of time, but the evidence seems to demonstrate that there are better places to invest in technology. A quick look at ARK’s top ten holdings shows a number of popular tech names. I would argue that an individual investor would be better off investing in a few of the individual companies named below instead of investing in ARK shares.

Seeking Alpha

These holdings are not innovative. They are the companies that many people would recognize and are often trading at premiums such as Tesla which is over 10% of the fund. There is nothing particularly innovative about investing in Tesla now.

Zoom is another example of a popular name that many recognize and will never reach the popularity that it had during the pandemic. There are too many competitors at better price points, and even though I am a Zoom subscriber, I consider it no better than Google Meet or in some cases even facetime.

Investors should understand that an investment in ARK is an investment in the theme of technology not necessarily an investment in innovative technology. In September, Woods went on Bloomberg and stated how raising rates destroyed a lot of performance which you can read about here. I would argue that doesn’t fully explain the five year returns.

The catch twenty two is that to get investors ARK needs to show its holding well known names and well known names are typically priced at a premium. Sure there are dips in these names and Woods has shown the ability to capitalize at times on those dips. She recently bought the dip in Coinbase (COIN) and made a good return on those shares.

Alongside every successful trade that ARK makes is a trade that did not go so well. This year Twitter was written down 47%.

Reasons to Avoid ARK

Personality Driven Stocks: ARKK is a personality driven stock. Investing in ARK is an investment in Wood’s worldview. Skepticism regarding Wood’s efficacy is at an all time high. This might make it a good opportunity but it also highlights the losses and lost opportunities that past investors have faced. I am always hesitant to buy cult-like stocks based on charismatic leaders. I consider Woods to be one of those leaders.

Market Volatility: The first and perhaps most obvious challenge is market volatility. ARK Investments’ strategies often involve high-growth, high-risk assets, which can be more sensitive to market fluctuations. As global economic conditions change, the portfolio’s performance can be impacted. Cathie Wood and her team must be adept at managing these fluctuations and adapting their strategies accordingly. Up to date, ARK has struggled with the rising rate environments and shows little ability at its current size to pivot accordingly.

Scalability: As ARK’s assets under management (AUM) have grown, the challenge of effectively managing a larger pool of assets becomes more pronounced. The more capital a fund attracts, the harder it can be to find suitable investments without significantly impacting market prices. Managing the scale of their investment vehicles while maintaining their performance will be a key challenge for ARK. The truth is ARK is too big and can’t focus on many of the small cap technology companies that are actually leading innovation and disruption.

Rotation in Investment Themes: ARK’s strategies are heavily focused on thematic investing. A sudden shift in investor sentiment or macroeconomic factors could lead to a rotation away from the themes that ARK is heavily invested in. Adapting to these shifts and identifying the next big opportunities will be essential. This makes ARK’s results difficult to predict and increases the volatility.

Diversification Risk: Concentrating investments in high-growth, high-risk themes can be rewarding when those themes perform well. However, it also exposes ARK to higher levels of risk if those themes underperform or face unforeseen challenges. Maintaining diversification while sticking to their innovation-focused strategy will be a balancing act for ARK. Included in this is that ARK is fairly concentrated into some fairly well known companies that still trade at a premium. From a value perspective, these high flyers could be at risk of further drops.

Interest Rate Environment: Changes in interest rates can impact the attractiveness of various investment assets. ARK is too sensitive to interest rate change for my tastes. If interest rates rise significantly, it could affect the valuation of companies, especially those with high price-to-earnings ratios. ARK Investments must be prepared for the potential impact of shifting interest rate environments on their portfolio holdings.

The Main Reasons to Consider ARKK

Innovation-Centric Approach: ARKK focuses on innovative and disruptive technologies and industries, which often have significant long-term growth potential. This approach allows investors to participate in the development and adoption of groundbreaking technologies, such as artificial intelligence, electric vehicles, and genomics.

Emerging Trends: Cathie Wood’s ability to identify emerging trends and capitalize on them early has resonated with investors.

Diversification: ARKK offers diversification across a range of innovative sectors, reducing single-stock risk. By investing in a basket of companies with exposure to various high-growth themes, investors can potentially spread risk more effectively than investing in individual stocks. For investors that don’t want to do any research, ARKK provides an opportunity to get a piece of some large growing technology companies.

Active Management: ARKK is an actively managed ETF. This means that the fund’s managers, including Cathie Wood, make decisions based on their research and views of the market. In a world where many investors opt for passive index funds, active management can provide the flexibility to adapt to changing market conditions and take advantage of opportunities as they arise. If you have confidence in Wood’s ability to make wise investments, then ARKK would be a wise choice. I am personally skeptical of Wood’s track record and think the overall success has been rather limited in regards to performance.

Long-Term Vision: The strongest quality of Cathie Wood’s leadership is her conviction and long-term investment horizon, which aligns well with investors looking for sustainable growth. Her focus on the potential of technologies over the next five to ten years and beyond distinguishes ARKK from short-term, speculative investments.

Transparency: I appreciate how Woods steps out regardless of performance. I always respected athletes that talk to reporters whether they play well or badly. Woods does an excellent job of focusing on communication and ARK Invest provides detailed information about their holdings, investment strategies, and research, fostering transparency and helping investors understand the rationale behind their investments.

Access to Difficult-to-Reach Assets: ARKK invests in companies that may not be easily accessible to individual investors due to their relatively small market capitalization or the industries they operate in. This provides a unique opportunity for retail investors to access potentially high-growth assets. This is probably the best reason to consider ARKK as an investment.

Risk Management: While ARKK’s approach is high-conviction and focuses on innovation, risk management is an integral part of their strategy. They actively monitor their portfolios and adjust holdings as needed to mitigate risks.

Liquidity and Trading: ARKK is an exchange-traded fund (ETF), which provides liquidity and easy trading options. Investors can buy and sell shares throughout the trading day, benefiting from transparency, real-time pricing, and lower fees compared to many mutual funds. For people looking for liquidity, ARK is a decent choice.

Final Thoughts

While there are certainly some valid reasons to consider investing in ARKK, such as its innovation-centric approach, access to otherwise difficult-to-reach assets, active management, and transparency, the risks and challenges should not be underestimated. Wood’s performance record over many time periods has not been strong. Investors must weigh the potential rewards against these inherent risks and carefully consider their risk tolerance and investment goals.

Ultimately, the decision to invest in ARK Innovation ETF or similar funds should be made with a clear understanding of the associated risks, the fund’s historical performance, and a well-defined investment strategy that aligns with one’s financial objectives. Investing in such funds should not be solely driven by a charismatic leader’s personality or short-term market sentiment, but rather a carefully considered, long-term investment approach.

For these reasons, I currently rate ARKK as a hold. I would not want to short any company that has shown it can have excessive spikes, but I would not want to buy a fund with ARKK’s long term performance. As always, please do your own due diligence before buying any positions and good luck investing. Please like, comment and follow this article. I appreciate it.

Read the full article here

Leave a Reply