Introduction

In this article I am going to introduce you to a company that probably many people already know about, but which is worth analyzing because of its important competitive advantage. Rightmove’s (OTCPK:RTMVF) business model is very simple to understand and the competitive advantage based on the network effect makes the company a well-fortified stronghold to face the competition.

The company is capable of generating exceptional returns on investment and an average operating margin of around 70 percent; the opportunity is made more attractive by the fact that the company could currently be valued at its fair price.

Business Model

Rightmove is the UK’s number one property advertising portal and has been the preferred and most widely used search portal for those interested in selling, buying or renting homes for more than 20 years. Rightmove can be considered a monopolist in its niche since for many years more than 80% of the time spent on property portals in the UK has been spent on Rightmove. Because of the competitive advantage provided by the network-effect Rightmove has been able to distance itself a great deal from its competitors, offering a better service to its customers and gaining considerable pricing power in return.

Rightmove’s main business is thus based on selling advertising services to real estate agencies, but the considerable amount of data regarding the real estate market has enabled the company to offer additional services as well. Rightmove’s various businesses can be divided into these categories:

- Advertising: real estate agencies or home builders pay a fixed subscription in order to sponsor their properties on the portal, they can then also pay for additional advertising services to get an advantage over their competitors. The company also offers space for properties outside England but that are still of interest to the British public, and in addition to residential properties we also find commercial ones. Advertising services are also offered to third parties such as removal companies or schools. In FY22 this segment accounted for 90 percent of sales.

- Data: the amount of data regarding the housing market collected by Rightmove is reprocessed and sold to agents and landlords, surveyors, insurers, mortgage lenders and brokers and local authorities. They also offer valuation services and unique demand-side property data to surveyors and property professionals. In FY22 this segment accounted for the remaining 10 percent of revenues.

According to data released by the company in HY23 Rightmove’s market share is around 86% (2022: 85%). Most of the traffic is generated organically, Rightmove has been the portal of choice for home seekers and consequently also for those who want to advertise properties, in 2022 there were more than 2.3 billion visits on the platform and people spent more than 16.3 billion minutes within it, and 70% of this time was spent through mobile devices. Rightmove’s two closest competitors are Zoopla and OnTheMarket, and over the years they have been unable to undermine Rightmove’s dominance due to network effect and the difficulty (as well as cost) of moving traffic to other platforms.

This state of supremacy has allowed the company to steadily increase the price of its services (with the exception of 2020) and currently the Average Revenue Per Advertiser (ARPA) is £1,411 per month (+9% yoy compared to 2022). An important aspect to keep in mind is also the evolution of the number of memberships, in HY23 the number of memberships was 19,116 (+1% yoy) of which 16,093 Agency branches and 3,023 New Homes developments, down from 20,121 memberships in 2016. Although still the vast majority of real estate agencies are on Rightmove, the continuing price increase may have led smaller agencies to have to use the services of cheaper portals. The penetration of the more expensive packages is also interesting to consider. The penetration of the top Estate Agency package, Optimiser, has increased from 34% in 2022 to 36% (June 23) while that of the New Homes top package, Advanced is 49% (42% Dec. 22).

The slowdown in the real estate market over the past year has shown the resilience of Rightmove’s business and how much the services offered by the company are needed by those in the industry. In fact, greater demand for real estate has generated more competition from sellers and thus the need to continue to sponsor themselves to increase the likelihood of closing as many deals as possible. Good positioning is especially useful during periods of market slowdown.

Financial Overview

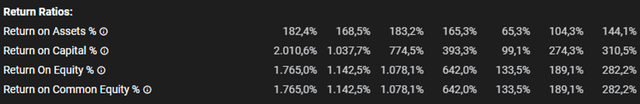

Rightmove’s enormous competitive advantage and monopolistic position have translated into exceptional performance from a financial perspective, especially in terms of profitability and return on investment.

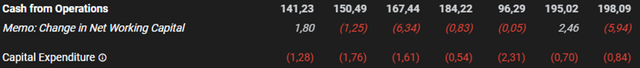

Revenue increased from about £220 million in 2016 to £333 million in 2022, with projected revenue in 2023 around £363 million. As mentioned earlier the increase in turnover was mainly driven by higher prices and the adoption of the more expensive packages with more services within them. In the same time frame the operating margin averaged around 73 percent (except in 2020, which was 65.7 percent due to discounts made during the pandemic period) and a net income margin around 60 percent. All earnings are turned into cash, which is why the fcf margin is equal to, if not slightly higher than the net income margin.

Revenue 2016-2022 (TIKR)

Rightmove’s business model requires very little capital to run, and for this reason CapEx are an insignificant part of Cash from Operations. This also affects the return on capital ratios, which are very high.

2016-2022 (TIKR)

The high return on investment and low CapEx expenditures are clearly positive aspects, but at the same time they highlight management’s difficulty in allocating the resources generated. The low capital intensive nature of this business model, means that there are unlikely to be opportunities to invest large amounts of the cash generated with satisfactory returns, which is why the company distributes all of its profits through dividends and constant share buybacks. The number of weighted average diluted shares outstanding since 2016 has decreased from 950 million to less than 827 million (down 13 percent), while the dividend per share has increased from £0.05 to £0.09. In the latest report, management announced that it will slightly increase investment in the business to achieve organic growth while maintaining an operating profit margin of 70-72%.

As for the Balance Sheet, the company has £38 million in cash and cash equivalents and £35.7 million in total liabilities.

Valuation

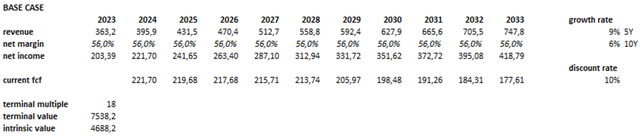

As is my usual practice I will consider three different scenarios in terms of revenue growth, margins, and multiples to get an idea of Rightmove’s intrinsic value. I will use a discount rate of 10 percent.

Author’s estimate

For the base case scenario I have estimated slightly lower revenue growth than analysts, who expect about £530 million in 2027, but I am more optimistic about margins, expectations are for a net margin around 53 percent. As a final multiple I used a P/E of 18, which is the lowest in the last 10 years.

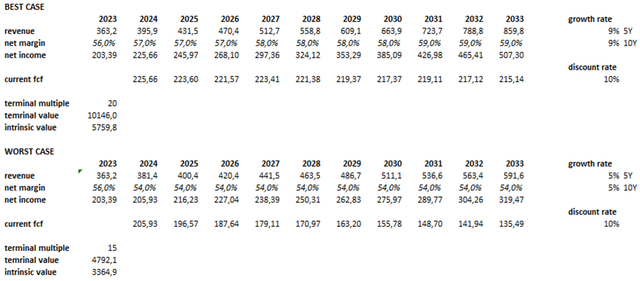

Author’s estimate

In the best case scenario in addition to higher revenue growth I used a net margin closer to the historical average, while in the worst case a constant net margin of 54 percent and a P/E of 15.

For the revenue growth estimates I based on the assumption that the company will be able to continue to increase prices in the near future (perhaps by adding additional services), it could then also be successful in attacking the commercial real estate niche given the brand value it has created in the residential real estate. A negative factor could be stagnating or declining membership numbers; by raising prices, smaller agencies might not be able to sponsor themselves on Rightmove, preferring other, cheaper portals, even at the cost of cutting themselves off from a huge user base.

The worst case scenario considers a stagnation in the number of memberships or a slight decrease in them, as well as a lower price increase than in previous years. As mentioned earlier in recent years the company has managed to increase the prices of its services without losing too many customers and thus demonstrating considerable pricing power, so I think the probability of the worst case scenario occurring is low, though not zero. To conclude, the hypothetical intrinsic value of Rightmove could be, £3.3 billion, £4.7 billion, and £5.7 billion for the worst, base, and best cases, respectively.

I think the most likely scenario is the base case, with an intrinsic value around £4.7 billion. Given a market cap. of £4.3 billion the company at the moment could be correctly valued to offer a future return around 10 percent. The risk of suffering a permanent loss of capital seems limited, considering that in my worst case scenario the company could have an intrinsic value of $3.3 billion (-23% from current prices). Clearly, the closer the market price is to the worst case the more the probability of poor returns is reduced. The high quality of the business and the slight margin of safety could be a good opportunity in terms of risk/return.

Risks

Given the company’s current dominant position in its niche and the steadfastness with which it has maintained its competitive advantage over the past 20 years, I think it is very difficult for Rightmove to suffer a deterioration of its business due to competition. In 2023, Rightmove’s business model has also proven resilient to deterioration in the housing market; it would still suffer greatly in the event of a worse crisis (comparable to that of 2008), which would lead real estate agencies and home builders to cut back as much as possible. Even in the latter scenario, however, given the flexibility of the business model, and the excellent balance sheet, the company would be able to remain profitable and survive any severe recession. Rightmove’s major criticality is the fact that it has probably reached its maturity stage, and management does not have many opportunities to reinvest the huge amount of cash it generates appropriately within the business. Future growth will come primarily from price increases and secondarily from adding new services and expanding into the commercial real estate niche.

Conclusion

Rightmove is an exceptional company with a competitive advantage that is difficult to replicate and an absolute market leader position that is extremely difficult to attack. The company’s prospects are good even if some uncertainties are present, such as the decline in membership over the years. The fact is that as long as Rightmove succeeds in attracting the attention of those interested in changing homes, real estate agencies will be forced to be present on their portal, accepting even future price increases.

In conclusion, given the quality of the company I think the current price offered by the market may offer a slight margin of safety. For transparency I will tell you that a small percentage of my portfolio is invested in Rightmove, with an average purchase price of about £5 a share. Should the stock fall further due to short-term problems or general fear in the market, I will be happy to increase my position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply