I believe RH’s revenue has the potential to grow significantly over the next 10 years despite recent revenue declines amid macro uncertainty. In this article, I will discuss the revenue drivers and the risks associated.

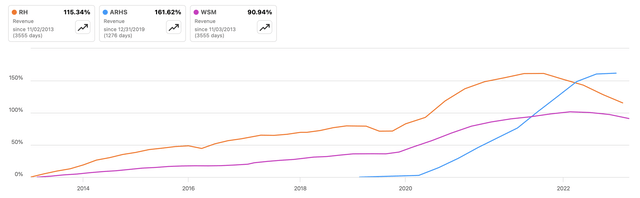

RH revenue vs peers (Seeking Alpha )

I think there are 2 reasons why RH has experienced revenue declines greater than those of its peers. Firstly, over the past couple of years, RH’s revenues have slowed considerably and in Q2 2023 revenues declined 20%, this decline was initially caused by supply chain difficulties caused by the pandemic as RH struggled to supply the increased demand caused by stimulus packages. In 2022 trends started to soften as inflation and macroeconomic factors caused demand to decrease. I believe this slowing demand was masked by the supply chain issues, which caused RH to post higher revenues due to the fulfillment of orders from prior quarters to catch up. This has resulted in 2023 revenues declining sharply vs the more likely gradual decline over the 2 year period.

Secondly, RH hasn’t been executing its strategy at its full potential. In 2016 RH reduced its gallery opening cadence to 3 galleries per year to rearchitect its logistics platform, despite raising the cadence back to 5 galleries per year in 2019, openings have been plagued by the Pandemic environment, construction delays and lack of product newness. This poor execution has resulted in only 4 galleries being opened since 2020. On the Q2 2023 call Gary Freedman, CEO, acknowledged these poor execution missteps and I believe RH’s execution is set to improve and will drive growth over the next 10 years.

Revenue Drivers

Gallery Transformation

RH believes they can reach $5-$6 billion in revenue in North America, I believe that this is understating the full potential. When Gary Freedman took over RH in the early 2000’s they had 106 legacy galleries, since then the number has decreased to 81 with 28 being Design galleries and 35 remaining legacy galleries. Over time RH has the potential to reach 60-70 design galleries which I believe will result in a potential $2 billion opportunity based on the revenue per square foot uplift by replacing legacy galleries with design galleries. RH has reported that when they open up a design gallery in a market where they had a legacy gallery prior, they see a 100% uplift in sales. I think that RH can get back to opening 4-5 galleries per year, in Q1 RH claimed they have 12 North American Galleries in development scheduled to open over the next several years which would result in 4 galleries per year.

On top of that $2 billion opportunity with gallery transformations, I think RH has incremental opportunities with smaller design studios in smaller markets. RH already has a couple of these such as the East Hampton location and they have identified 40 additional locations, although not quantifiable I believe this can provide incremental revenue to the $5-6 billion target as well as providing data to potentially open larger design galleries in the future.

Product Elevation

Despite short term pricing headwinds due to what Gary Freedman described as “arrogant pricing” I expect RH will be successful in raising prices over the long term, albeit at a slower rate than previous years.

RH describes their transformation as climbing the luxury mountain, as RH climbed the luxury mountain they have released new higher quality collections such as RH Contemporary and RH Modern. These new collections have commanded higher prices as the brand gains recognition, it was reported that RH Modern on average had 50% higher prices than RH interiors, while RH Contemporary was 35% more expensive than RH Modern. This hasn’t been without its difficulties though, RH Contemporary was delayed 3 times and almost a year and half in order for manufacturing partners to catch up with production. Along with other macro reasons, RH believe this was part of the reason that demand for RH slowed this year, in Q2 CEO Gary Freedman claimed

we know we kind of — or muscle atrophied a bit in new product introductions and trying to ramp back up wasn’t our — yes, it wasn’t our best work. We learned from that. We’re going to snap back from that. And you will see us not only snap back, you’ll see us better than you’ve ever seen us.

Along with slower demand, RH will also be discretely lowering prices for its new products coming out later this year. Part of these price reductions is due to the give back of some cost relief from freight and materials, while the main reason is due to overconfidence in raising prices due to strong demand trends from easy macro conditions. This has cost RH some market share, although thanks to the quick reversal in philosophy I believe this is only temporary.

in our efforts to elevate the brand, I think we weren’t as kind of critical minded looking at price. I mentioned last conference call, I thought we probably were a bit arrogant looking back. And now I think we’re laser-focused and laser sharp. – Gary Freedman Q2 2023

In the second half of 2023, RH will be launching 70 new collections across its ranges, this will result in 80% of products being new and a massive transformation of the value proposition thanks to lower prices and higher quality. I expect this newness to provide a wide range of product values that will allow RH to gain share from the high end and the low end of its target market. Over the next, decade RH has multiple new collections including; RH Couture, RH Bespoke, RH Color, RH Antiques & Artifacts and RH Atelier. The recent learnings from execution and pricing will allow RH to drive incremental demand and higher prices over time despite the less aggressive price increases per collection.

International Expansion

I believe RH has significant opportunity Internationally and it will drive the majority of the growth in RH over the next 10 years. RH estimates that the international opportunity Is $20-$25 Billion in revenue. According to Statista, the global furniture market is $550 billion so there is plenty of room for RH to grow from nothing.

RH was set to expand internationally with the launch of RH England in the summer of 2021, however, this launch was only completed in June 2023, 2 years after first hoped. I believe this is a good thing though, RH really took their time to make sure the gallery was outstanding rather than rushing into uncharted territory, giving the brand the best possible chance of success. RH England is not a fair representation of what economics are possible in Europe, the location Is far from convenient (1 hour 45 minutes from London) unlike other RH galleries and is therefore a statement of the brand rather than a revenue driver. RH’s slow methodical International expansion gives it a greater chance of success when compared to a rapid expansion licensing the brand to other countries. In previous years RH has claimed

I mean we have people knocking down the door here, trying to partner with us, with our brand, wanting to partner with us in China, partner with us in the Middle East, partner with us in Europe, partner with us in South America, partner with us in Mexico. Like there is not — I don’t think there’s a country that’s unrepresented as far as people like knocking on our door, wanting to take our brand globally. – Gary Freedman, CEO

this demonstrates the demand RH already has overseas despite no galleries. This also proves RH could grow extremely fast internationally at the cost of giving up brand control which I think would be detrimental for the long term success. Instead, RH is planning on opening 4 smaller sized galleries (15-20k Sq Ft) over the next 18 months in Europe, followed by another 4 large galleries in 2025. Over time I expect RH to open 5 International galleries per year, a similar cadence to the US. However, in contrast to the US they are not replacing legacy galleries, this will result in roughly double the revenue growth rate. I also believe these stores also have the potential to be significantly more valuable than incremental US stores because they are opening up entire countries to the RH brand rather than just states which will drive significant online traffic in a greenfield space.

Smaller Bets

RH has a number of smaller initiatives that I believe can become significant businesses over time, with very little downside risk.

RH Guesthouse

RH states the North American luxury hotel market is worth $200 billion, RH entered this market in September 2022 with the launch of their New York Guesthouse. The goal was to create a new market for luxury and privacy, with only 6 guest suites costing more than $2000 per night I believe they have certainly done that. At first glance, this may seem more like a brand building exercise but in Q3 2020 Gary Freedman said

Do I think things like guesthouses could be meaningful long term? They might be.

suggesting there is more to come here. RH is set to open its second Guesthouse in Aspen which will give a greater picture as to the economics of these businesses.

RH Residences

RH is entering the $1.7 trillion North American housing market with RH residences in Aspen. RH in a joint venture will be designing and creating luxury housing that will be sold fully furnished with RH interiors, I believe that this is a natural stepping stone for the RH brand and remains well within their core competencies of conceptualizing and selling spaces.

In Q4 2020, RH claimed they had already received multiple unsolicited proposals to purchase the homes sight unseen, and to place deposits to reserve a home demonstrating the demand for well-designed homes. I believe the opportunity here is massive with the potential to design homes, apartments and holiday homes in partnership with homebuilders or potentially acquire one all around the world.

Risks

Over the long term execution risk is the biggest risk I see. RH has demonstrated they can create amazing spaces, however creating these spaces in a timeframe that benefits shareholders is a different story. RH has 4 galleries set to open in North America in the next year and 4 Internationally over the next 18 months, I believe if they execute these it will demonstrate they are focused once again.

Secondly, competition is also a risk. Over the past year retailers have been running promotions to gain share at the expense of long term brand value. This, and lack of product newness has caused RH to lose some market share. If new products don’t stem the share loses this could cause the company to react with promotions that they have spent so long trying to avoid. RH’s new collections and the accompanying source books, along with its stunning galleries and hospitality efforts should drive significant new demand as they have in the past. These factors will insulate them from competition and over time grow the brand value enabling it to climb the luxury mountain.

Conclusion

I believe that RH has multiple opportunities to drive revenue growth over the next 10 years. Longer term it’s possible that RH’s revenues are multiples higher than they are today with International expansion having 5x the opportunity of North America and forays into adjacent competencies providing significant upside potential, I think RH is a good buy today.

Read the full article here

Leave a Reply