Luxury furniture retailer RH (NYSE:RH) – formerly Restoration Hardware – reported robust second quarter earnings, but investor sentiment wavered as the company’s Q3 outlook hinted at headwinds in the luxury housing market.

The luxury housing market, after experiencing two years of rapid expansion, is now facing a necessary recalibration. While the industry grapples with a cooling period, it remains resilient, largely fueled by high-net-worth individuals who still perceive real estate as a secure investment. However, this optimism is tempered by concerns over the rising cost of living, a prominent issue that Americans rank among the top challenges facing the nation.

Inflationary pressures persist across the U.S., prompting questions about the sustainability of luxury real estate. Adding to the complexity, mortgage rates are currently at 20-year highs, further dampening the prospects for the luxury housing market and the broader economy. Despite this, RH reported impressive numbers for the second quarter and an even more ambitious roadmap ahead. With revenue reaching $800 million and adjusted operating margins eclipsing 22.2% – surpassing guidance – the company’s recent success is rooted in a combination of factors.

I have been bullish on RH for some time, and despite the expected weakness in the housing sector, I remain bullish on the long-term prospects for the company and I am willing to add to my position on any weakness in RH’s stock price.

RH’s Ambitious Expansion Plan

RH’s second-quarter revenue received a boost of $25 million due to faster-than-anticipated deliveries. Additionally, the company strategically deferred approximately $40 million in advertising costs from Q2 to Q3, coinciding with the delayed release of its RH Interiors Sourcebook. The Sourcebook serves as a centerpiece of RH’s marketing strategy, showcasing its latest collections, designs, and inspirations. By shifting advertising expenses to coincide with its release, the company is ensuring that its promotional efforts are synchronized with the availability of its new products. This synchronization is crucial for creating a buzz and generating interest among its customer base.

Furthermore, deferring these advertising costs will allow RH to capitalize on seasonal trends and consumer behavior. The current quarter often sees increased consumer activity, especially as people prepare for the holiday season and consider home improvements. By strategically allocating advertising spend to this period, RH will likely capture the attention of potential buyers when they are more receptive to making purchasing decisions.

Further, as the company anticipates the launch of its RH Contemporary Sourcebook in late October and RH Modern Sourcebook in early January, it sets the stage for a series of transformations. The company plans to refresh its galleries over the next few quarters, culminating in an inflection point expected to peak in the first half of 2024. This peak is dependent on the full-scale deployment of new collections and an entire year of Sourcebook mailing. The company foresees that while the initial product transformation may temporarily impact margins negatively, as sales growth stabilizes and supply chain efficiencies improve, this will ultimately lead to margin expansion.

RH’s Global Expansion Amid Challenges In The UK Housing Market And Interior Spending Insights

RH’s goals for global dominance have taken center stage as it expands outside its core North American markets. This summer, the company made an exciting entry into the United Kingdom with the grand opening of RH England, The Gallery at Historic Aynho Park, a 73-acre 17th-century estate.

While RH’s expansion into the UK may seem well-timed, it unfolds against the backdrop of challenges in the British housing market. Recent surveys indicate that British home prices are expected to drop by 4% this year, a more pronounced decline than previously anticipated. The reasons behind this downturn are multifaceted, driven by high interest rates and the escalating cost of living. The Bank of England (BoE), in response to soaring inflations, has embarked on an aggressive tightening of monetary policy. In less than two years, the BoE has hiked borrowing costs by a staggering 515 basis points, significantly increasing the expenses associated with servicing mortgages. According to Reuters, recent BoE data shows a substantial drop of more than 5000 in mortgage approvals by banks and building societies in July. The situation is further highlighted by real estate website Zoopla, which projects a 21% decline in home purchases this year, falling to levels last seen in 2012.

Despite these housing market challenges, RH holds a unique position. The company anticipates that its primary revenue streams in the UK will come from interior design and trade businesses, focusing on high-value repeat clients, including interior design firms and hospitality projects. The steady growth of quote books lays the foundation for RH’s inaugural Sourcebook mailing in the UK, further bolstering its presence in this market.

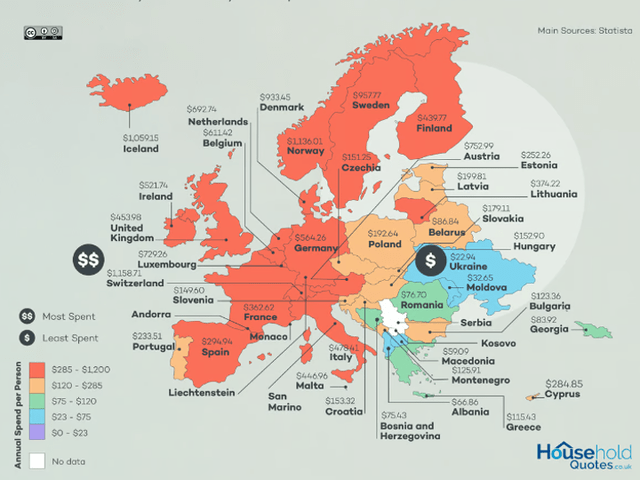

Beyond the housing market dynamics, it’s worth delving into the spending habits of Britons when it comes to home renovation. A recent study reveals that the average Brit allocates approximately $453.98 (£321.71) to interior-related expenses, amounting to 15.2% of their monthly paycheck. This statistic positions the UK as the 13th highest spender in Europe in this category. Interestingly, the bulk of this expenditure, amounting to $139.17 or 4.66% of a monthly paycheck, is channeled toward enhancing living and dining spaces. The study also highlights a stark contrast between Londoners and Scots, with London residents investing ten times more in interior decorating than their counterparts in Scotland. Comparatively, the title of the biggest spenders in Europe in terms of interior spending goes to Switzerland, Norway, and Iceland.

Exhibit 1: Interior design spending statistics (Europe and the UK)

Household Quotes

RH’s entry into the UK marks the beginning of possibly the most important phase of the company’s history as its UK entry will set the foundation for the company to expand into other neighboring European nations.

RH’s North American Transformation Amid Housing Market Challenges

Back on its home turf, RH has no intentions of slowing down. The company is set to unveil RH Indianapolis and RH Cleveland in the latter half of this year, bolstering its physical presence in key markets. However, RH Palo Alto and RH Monaco are now scheduled for early 2024 openings, reflecting a calculated approach to store expansion. Beyond these immediate openings, RH has an impressive pipeline of 12 North American galleries in development, set to open in the next several years. Furthermore, the company sees untapped potential in addressing new local markets. By establishing design studios in neighborhoods, towns, and small cities favored by affluent residents and visitors, RH aims to create a more accessible shopping experience.

This localized approach has already yielded positive results, with RH successfully validating the strategy in East Hampton, Yountville, Los Gatos, Pasadena, and its former San Francisco gallery in the Design District. These locations, encompassing spaces ranging from 2,000 to 5,000 square feet, have generated annual revenues within the range of $5 million to $20 million.

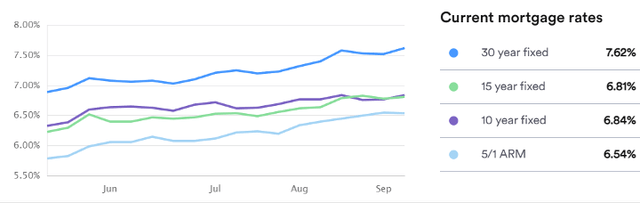

However, RH’s expansion plans coincide with challenges in the broader U.S. housing market. According to Bankrate’s weekly national survey, mortgage rates have surged to an average of 7.42% for 30-year mortgages. This upward trend in rates is expected to persist into the rest of 2023, particularly in urban areas where housing supply remains limited.

Exhibit 2: 30-year mortgage rate

Bankrate

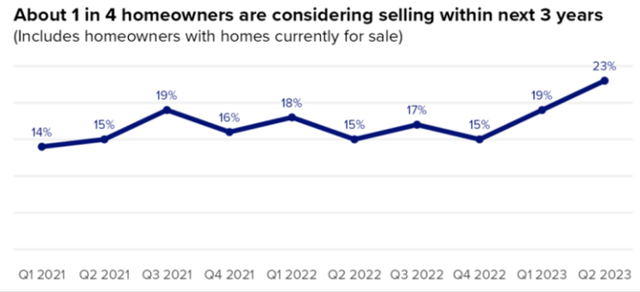

Realtors report a 7.9% decrease in the number of homes actively for sale in August compared to the previous year. Furthermore, there has been a 7.5% decline in newly listed homes, and the median price of homes for sale increased by 0.7% annually, following two months of consecutive declines. Interestingly, a recent Zillow report highlights a shift in homeowners’ sentiments, with 23% considering selling their homes in the next three years or already listing them-a substantial increase from the previous year.

Exhibit 3: Homeowner sentiment

Zillow

This projected increase in housing supply may influence home prices, although the impact could be tempered by continued mortgage rate increases, affecting demand. The Federal Reserve’s indication of potential rate hikes further clouds the housing market’s near-term outlook.

Gary Friedman, CEO of RH, said during the earnings call:

There’s interest rate cuts or pricing comes down. Home prices come down to kind of close that gap.

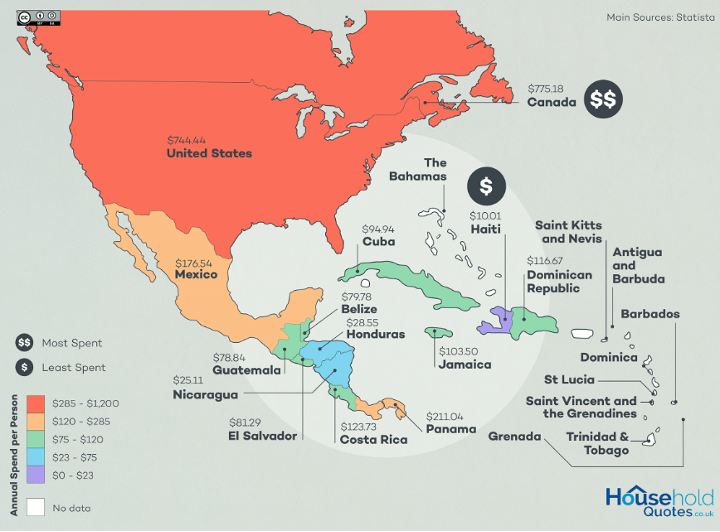

Despite the challenging housing market, in the United States, the Joint Center for Housing Centers of Harvard University (JCHS) reveals that home improvement spending increased significantly from 2019 to 2021 and has continued to rise. Although a slowdown in home improvement projects is unavoidable, the market is expected to be worth $485 billion in 2023. In North America, both Canadians and Americans allocate substantial sums to interior design, outspending other countries in the region by over $500. Notably, Canadians allocate a higher proportion of their income (24.59%) to home decor compared to Americans (16.11%). Mexicans exhibit the highest relative spending, with the average Mexican dedicating 27.34% of their monthly paycheck to interior decorating.

Exhibit 4: Interior design spending statistics (North America)

Household Quotes

RH may face challenges in the short term because of the challenges faced by the housing industry in the U.S., but none of these clouds hanging over the company seems to threaten RH’s long-term growth as none are stemming from a permanent deterioration of the company’s market position.

RH’s Ambitious Ecosystem Expansion Strategy

RH’s vision extends beyond traditional retail. One of the key elements of RH’s strategy is the creation of immersive design galleries, aiming for revenues of $5 billion to $6 billion in North America and $20 billion to $25 billion globally. These spaces provide customers with a holistic shopping experience, allowing them to interact with products, gain inspiration, and envision how RH’s offerings can enhance their homes.

RH’s expansion is not confined to physical spaces alone. The company is venturing into the hospitality industry with RH guest houses, targeting a niche market of luxury-seeking travelers within the $200 billion North American hotel industry. Additionally, the company aims to enter the vast North American housing market with RH Residences, offering fully furnished luxury homes, condominiums, and apartments with integrated services.

With digitalization becoming an integral part of every industry, RH has also established its digital footprint to complement its physical presence. The World of RH is an online portal that allows customers to explore and draw inspiration from the depth and dimension of its brand. The company also plans to introduce RH Media, a content platform celebrating influential leaders shaping the world of architecture and design. By celebrating influential leaders in these fields, RH will not only enhance its brand presence but also engage a global audience interested in design trends and innovation. These ambitious expansion strategies position RH as a major player in the global market with the potential to access a market opportunity valued at $7 trillion to $10 trillion.

Takeaway

RH defied challenges in the luxury housing market in Q2 and delivered an impressive financial performance. While the home furnishing sector undergoes a recalibration, RH stands out with its strategic initiatives. The company’s success can be attributed to a multi-faceted strategy that extends well beyond traditional retail. RH is on an ambitious expansion path, both geographically and conceptually, with the goal of changing not only how it sells products but also how it shapes living spaces. The company’s expansion plan seems well thought out, particularly given the challenges in the housing market. Further, its focus on high-value clients positions it well to weather market uncertainties better than many of its rivals.

I believe we are still in the very early stages of RH’s growth story, and I will not hesitate to add to my position if the current pullback in RH’s stock price pushes the stock price closer to $250.

Read the full article here

Leave a Reply