Last week started off with a higher-than-expected inflation reading, which tanked markets on Tuesday. The Consumer Price Index (CPI) increased 0.3% in January, driven by persistently high shelter costs.[1] This forced market participants to finally heed some of what the Fed has been communicating about fewer and later rate cuts this year.

On the earnings front, ride-share companies made a splash last week. Lyft (LYFT) reported better-than-expected results, but it was guidance for a 2024 profit margin increase of 500 basis points which sent the stock skyrocketing 67%.[2] Later it was revealed that this was a clerical error, and that the outlook only expected a 50-basis point expansion. Despite the revision, Lyft shares held on to some of those gains and still hit a 52-week high. Uber (UBER), which reported results a week earlier, beating analyst expectations on the top and bottom-line, announced its first-ever buyback of $7B on Wednesday.[3] This led to the stock increasing by 14% on that day. All of this, as drivers went on strike for fair pay.

On the leisure front, impressive results from Airbnb (ABNB)[4] and Tripadvisor (TRIP)[5] suggested that consumers are still shelling out for travel and experiences. Fast casual restaurant Shake Shack (SHAK)[6] indicated the same as they beat on the top and bottom-line, but the restaurant space has been more mixed as Denny’s (DENN) and Wendy’s (WEN) reported disappointing results last week.

Retail sales for January were also released last week, showing a dip of 0.8% MoM, the largest drop in nearly a year.[7] Sales at home improvement and garden stores saw the sharpest decline of 4.1%, which doesn’t bode well for Home Depot’s (HD) earnings report next week, or Lowe’s (LOW) the week after that. This is just another recent data point that suggests consumers are taking a breather after remaining resilient in the face of higher inflation and interest rates last year.

Now with 79% of S&P 500® companies having reported, the FactSet blended S&P 500 EPS consensus stands at 3.2%, an uptick from 2.9% the week prior.[8]

Buybacks in Focus

A couple of big names announcing share repurchase programs during the Q4 2023 earnings season stole headlines in the last few weeks. Meta (META) announced a $50B buyback plan on their Q4 call, signaling the confidence the c-suite has in their growth prospects this year and propelling the stock higher.[9] And as mentioned above, Uber announced their first ever buyback of $7B last week. “Today’s authorization of our first-ever share repurchase program is a vote of confidence in the company’s strong financial momentum,” Uber CFO Prashanth Mahendra-Rajah announced in a press release on February 14.[10] While those announcements caught investors’ attention, how have buyback announcements in general been holding up this earnings season?

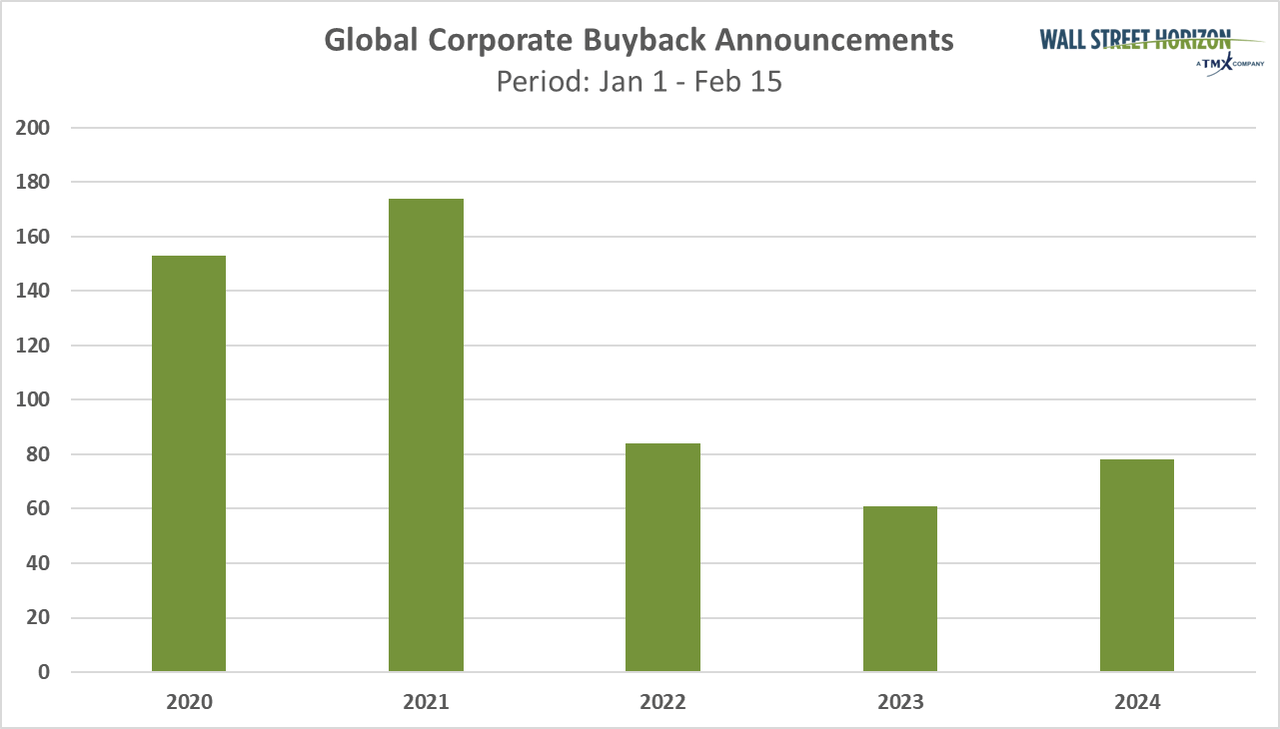

Taking a look at the data, the total number of buybacks announced in the first seven weeks of the year is rather light at 78. While this is still better than last year’s count of 61 buyback announcements, it’s well below the 5-year average of 110. This shows companies are returning less value to shareholders in the form of buybacks. The number of dividend announcements at this point is also lighter than usual, although as we pointed out last week, the share of dividend increases is higher than it has been in a year.

Wall Street Horizon

Last Peak Week of the Q4 Earnings Season

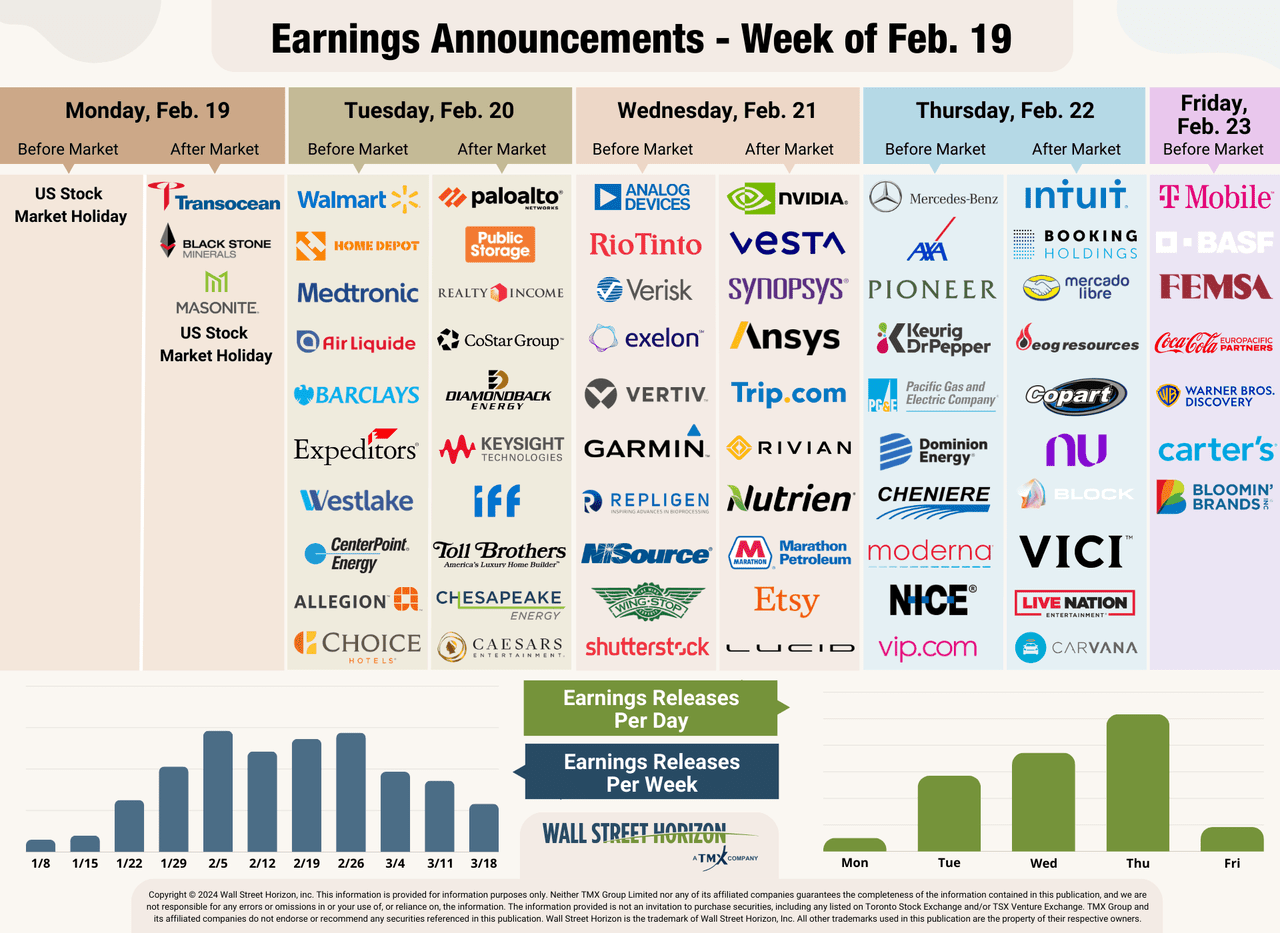

This week, we get a better read on the US consumer when retail reports start to trickle in, starting with Walmart (WMT) and Home Depot on Tuesday. We also hear from the last of the Magnificent 7 and AI darling, NVIDIA (NVDA), who just surpassed Alphabet’s (GOOG) (GOOGL) market cap on Thursday.

Wall Street Horizon

Outlier Earnings Dates this Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.[11]

This week, we get results from a number of large companies on major indexes that have pushed their Q4 2023 earnings dates outside of their historical norms. Five companies within the S&P 500 confirmed outlier earnings dates for this week, three of which are later than usual and therefore have negative DateBreaks Factors*. Those three names are International Flavors & Fragrances (IFF), Dominion Energy (D), Pool Corporation (POOL). Etsy (ETSY) and EOG Resources (EOG) confirmed earlier than usual dates, and therefore have positive DateBreaks Factors*.

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Q4 Earnings Wave

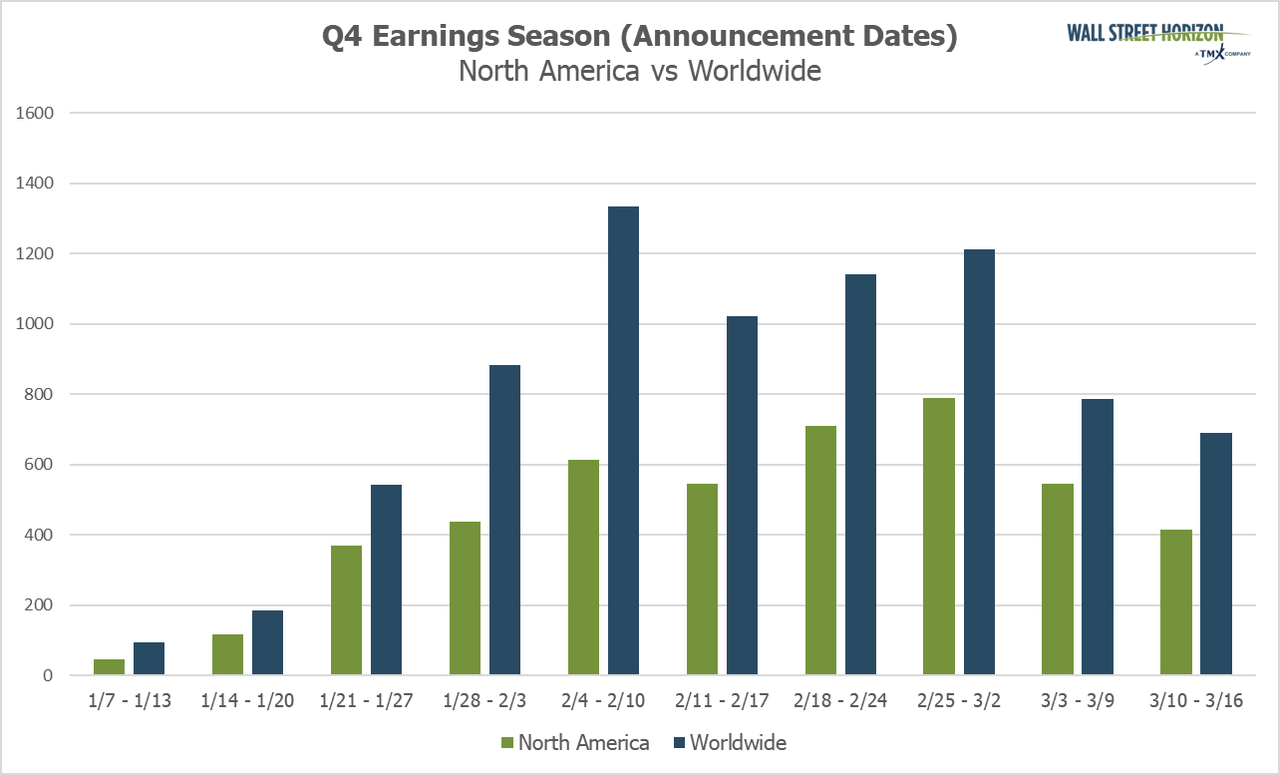

This week marks the last peak week of the Q4 earnings season, with 1,584 companies set to report. Currently, February 22 is predicted to be the most active day, with 524 companies anticipated to report. Thus far, 74% of companies have confirmed their earnings date and 44% have reported (out of our universe of 10,000+ global names). Roughly 79% of the S&P 500 has reported.

Wall Street Horizon

1 CONSUMER PRICE INDEX – JANUARY 2024, U.S. Department of Labor, February 13, 2024, U.S. Bureau of Labor Statistics

2 Lyft Announces Fourth Quarter and Full-Year 2023 Results, Lyft, Inc., February 13, 2024, https://investor.lyft.com

3 Uber Announces Inaugural $7 Billion Share Repurchase Authorization, Uber, February 14, 2024, https://investor.uber.com

4 Shareholder Letter, February 13, 2024, Airbnb Investor

5 Tripadvisor Reports Fourth Quarter and Full Year 2023 Financial Results, Tripadvisor, February 14, 2024, https://ir.tripadvisor.com

6 Shake Shack Announces Fourth Quarter and Fiscal Year 2023 Financial Results, Shake Shack, February 15, 2024, https://investor.shakeshack.com

7 Advance Monthly Sales for Retail and Food Services, United States Census Bureau, February 15, 2024, Monthly Retail Trade – Sales Report

8 Earnings Insight, FactSet, J https://advantage.factset.com

9 Meta Reports Fourth Quarter and Full Year 2023 Results; Initiates Quarterly Dividend, Meta Platforms, Inc., February 1, 2024, https://s21.q4cdn.com

10 Uber Announces Inaugural $7 Billion Share Repurchase Authorization, Uber, February 14, 2024, https://investor.uber.com

11 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, Time Will Tell: Information in the Timing of Scheduled Earnings News

Original Post

Read the full article here

Leave a Reply