It has been almost half a year since my latest portfolio update on Seeking Alpha, so let’s get started. To check out my prior portfolio updates, click here: First portfolio article and second portfolio article.

About me and objective

I’ll quickly summarize this because I already talked about this in my previous article:

I am a 24-year-old Business Informatics graduate from southern Germany who works as a software developer and author on Seeking Alpha in my free time. I aim to achieve financial freedom through long-term investing in companies with good management, dominating their industries and having significant growth potential. I hold companies for the long term, check on them frequently, and sell if the thesis is no longer intact. I aim to keep stock turnover at less than 20% of the positions per year and concentrate my portfolio around 15-20 positions.

In October, I aimed for a 60% allocation to Great Capital Allocators, 25% to Tech Leaders, 10% to high-growth and 5% to trades. I now aim to have even more in the Great Capital Allocator basket(which I define as companies with high-quality management and a track record of excellent capital allocation) and less high-growth stocks (which are often unprofitable and highly valued) and tech leaders. I learned that it feels much easier for me to own stocks that aren’t on the cutting edge of technology. For example, I much rather hold Texas Instruments (TXN) in its boring Analog semi-market than exciting Nvidia (NVDA).

Tracking the portfolio

In recent months, I started to closely track a few KPIs, which I believe do a good job of evaluating the portfolio. I calculate all these in my valuation spreadsheet, but the values aren’t updated too frequently, maybe a few times a year. These KPIs are weighted averages, so each company’s position size is accounted for. Let me explain why I choose these:

- Free Cash Flow yield: I chose the FCF yield as the basis of my valuation. I believe that Free Cash Flow per share growth drives returns over the long run, so I want to track this metric.

- Owner Earnings yield: OE yield is an enhancement to the FCF yield, which I believe smooths out a few things and makes it more representative. I adjust FCF for Stock-based compensation expenses, add back growth capital expenditures (this often has to be estimated) and adjust net working capital changes, primarily changes in accounts receivable/payable and inventories.

- Expected Growth: This is a conservative estimation for each company based on management long-term guidance, industry growth projections or if nothing else, extrapolating past growth (if it seems reasonable).

- Owner Return on Invested Capital: OROIC is my version of ROIC. I use my calculated Owner Earnings as a basis instead of NOPAT. I calculate the invested capital part of the equation with and without Goodwill.

- Insider Ownership: I prefer businesses with owner-operators with large ownership in the business. Bonus points if it is still founder-led.

Portfolio KPIs (Authors KPIs)

Changes since the last portfolio update

Since my last update, I continued to narrow down the portfolio by focusing on my best ideas and removing expensive or low-conviction stocks. I bought the following stocks:

- UFP Industries (UFPI) manufactures and sells wood end products. The company is moving away from commodity products, with over 60% of sales in value-added products. It is well-managed and at a cheap valuation.

- Ulta Beauty (ULTA) is a beauty products retailer that has sold off in line with other retail stocks in the last months. It has a history of generating very high ROICs and is trading at its cheapest historical valuation.

- Carlisle Companies (CSL) manufactures and distributes roofing solutions. It used to be an industrial conglomerate that continuously sold off its weak segments and now is a roofing pure play with high ROIC.

- AO Johansen (AOJ) is a Danish distributor of electrical and plumbing supplies. The company is founder-led and has ~30% market share in Denmark. It invested heavily into automation in the last years and trades at a very compelling valuation.

- Ashtead (OTCPK:ASHTF) has an oligopolistic position in the equipment rental market in the U.S. together with United Rentals (URI). It’s an industry where the big will get bigger and both companies are well managed.

I also sold out of a few companies:

- Microsoft (MSFT) is a great company, but I wanted to focus on smaller market caps. Furthermore, it is already dominating its industry and trades at a high valuation, requiring a lot of growth. Almost all growth has to come organically, as M&A is very tough and buybacks aren’t that helpful at the current 2% FCF yield.

- Alphabet (GOOGL): A similar reason to Microsoft, but it trades at a cheaper valuation and is not the same quality as Microsoft’s business.

- Zebra Technologies (ZBRA): I underestimated the cyclical nature of the business and overestimated its ability to go from hardware sales to a higher proportion of software/service sales. Napco Security (NSSC) has a similar investment case but does a much better job of generating high-margin revenue from its hardware. Sadly, my timing was quite bad here and I reinvested the money from Zebra before Napco crashed 40%. I wrote more about the situation here.

- Veeva Systems (VEEV) is a great business, but I’m not too fond of the capital allocation. It is very asset-light but keeps hoarding cash. It trades at a high multiple, so buybacks don’t make much sense. M&A isn’t much of a factor for management and they don’t have debt to pay down. They should just dividend it out.

- Sonova Holding (OTCPK:SONVF) is a good company, but I noticed it did not grow in conviction after owning it for a year. The valuation also isn’t great and I generally see better risk rewards in other stocks.

- Sartorius Stedim (OTCPK:SDMHF): Similar reasons to Sonova. It is a good business, but I don’t need it in my concentrated portfolio. I reinvested the money into its competitor, Danaher (DHR).

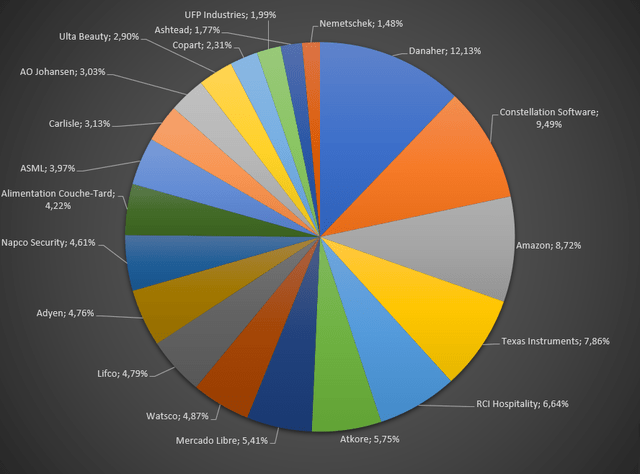

Heavy Moat Investments portfolio (Excel)

Above you can see my current portfolio. I like all the companies in my portfolio right now. Still, if I were to consider selling, it would probably be Nemetschek (OTC:NEMTF) or UFP Industries, just based on the small position size and relatively low conviction compared to the other companies.

I hope you can get some inspiration from this article and strategy. How do you construct your portfolio and do you have any suggestions for me? I’m still young and eager to learn, so let me know in the comments below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply