I have been writing on Seeking Alpha for 10 years and never mentioned Realty Income Corporation (NYSE:O) in a standalone article until now. This real estate investment trust’s (“REIT’s”) valuation has failed to reach an extreme (high or low) that would warrant my attention. And, I didn’t know what I could add to the conversation. Effectively, I would have put a Hold/Neutral rating on the company the vast majority of the time.

What’s changed in early October 2023? Basically, the valuation backdrop is becoming more interesting for a Buy recommendation, after two years of sharply higher interest rates in America. Commercial real estate has been entering a recession this year, and REITs generally have performed poorly all of 2023 for investors.

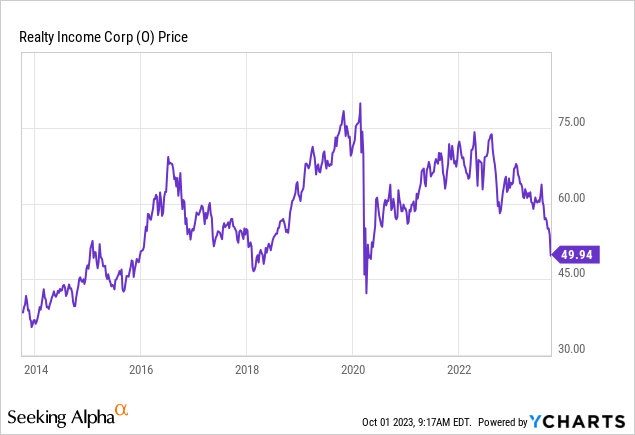

YCharts – Realty Income, Weekly Price Changes, 10 Years

My summary bullish argument is the U.S. Federal Reserve central bank is getting close to reversing direction on both interest rate hikes for the financial system and the restrictive Quantitative Tightening (QT) selloff of trillions in U.S. bonds, previously bought to support the economy since 2008. If the Fed does not change course radically in the coming months, I am afraid a deep recession is all but assured for 2024, after the largest 2-year jump in interest rates since the 1970s. In my opinion, we are dangerously close to a point of no easy return to normal in the commercial real estate market.

My buy logic for Realty Income is we are reaching for a fear extreme in REIT investor sentiment during October-November, precisely at the moment of peak pain inflicted by Fed credit/banking policy. If this view proves correct, buying Realty Income into the end of 2023, especially on further weakness under $50 for the price, could be a super-intelligent move in your brokerage account. We may be approaching a high-yield, low-risk moment to jump into a position.

The Business

Realty Income is one of the largest and most successful REITs publicly trading since 1994. It has consistently paid and raised its dividend over almost three decades. Many analysts and investors consider the company to be one of the most conservatively managed in the REIT space.

The business model is single properties are owned and leased on long-term contracts, usually with terms of 10 years or greater in length, often to blue-chip company customers. Basic company design and goals are listed below, taken from Realty Income’s website.

Company Website – Business Model Explanation

Company Website – Business Model Explanation

Company Website – Business Model Explanation

Company Website – Business Model Explanation

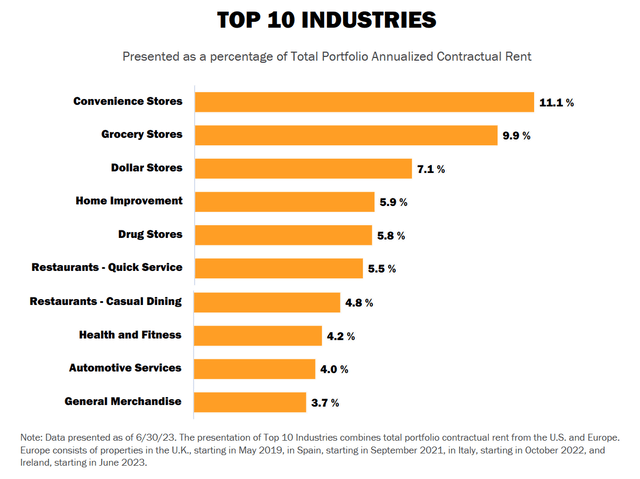

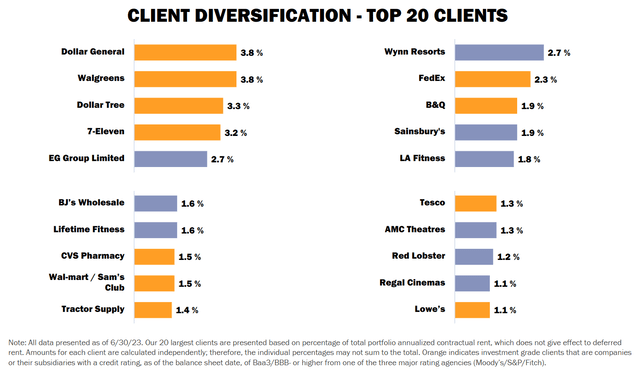

The company uses limited leverage in diverse locations all over the country, and increasingly overseas. Its diversification in assets may be the strongest reason for dividend income investors to seriously consider Realty Income for purchase and long-term ownership.

Company Website – Portfolio Highlight Page

Company Website – Portfolio Highlight Page

Company Website – Portfolio Highlight Page

The Valuation Story

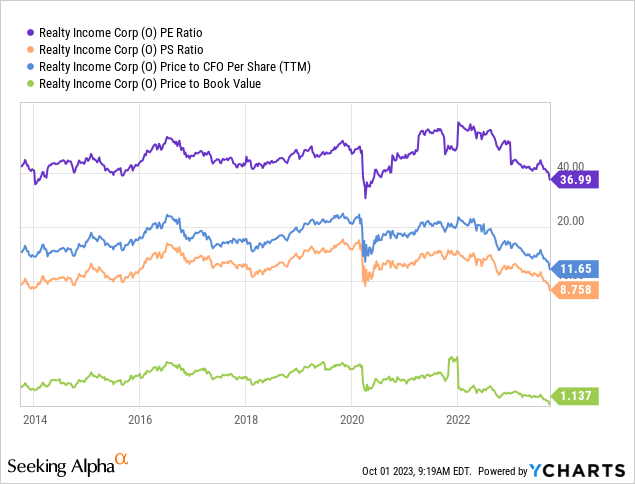

The 20%+ trust price decline since July has pushed the valuation on current/trailing results to its lowest level overall since 2010. You can review 10-year lows on earnings, sales, cash flow, and book value below.

YCharts – Realty Income, Price to Basic Fundamentals, 10 Years

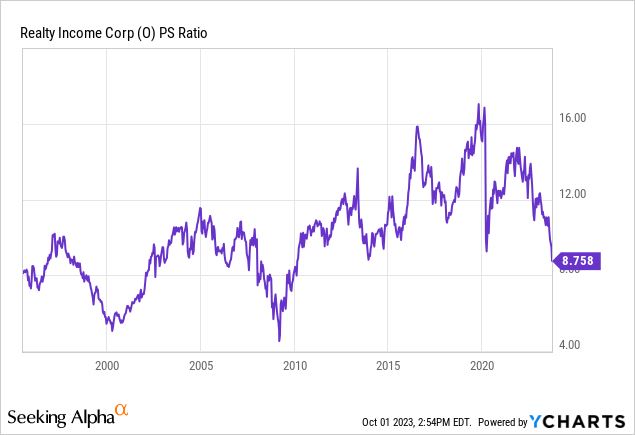

For me, the main data point to watch (since relative financial ratios of liquidity and debt have remained relatively constant over the years) is the price to sales ratio. Today’s 8.7x multiple on sales is roughly a 20% discount to its long-term average back to 1995. And, only the recessionary periods of 2000-02 and 2008-10 produced even lower valuations on revenue.

YCharts – Realty Income, Price to Trailing Sales, Since 1995

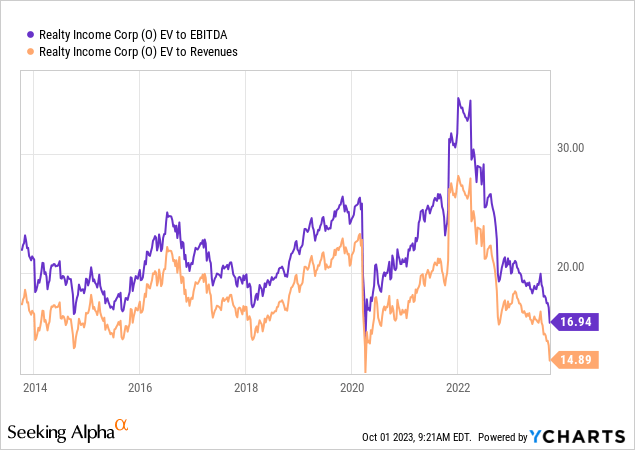

When we include debt and cash levels, the enterprise valuation is equally reaching for decade lows into early October. EV to core cash EBITDA results of 17x is a 20% discount to its 22x average over 10 years. EV to revenues of 14.9x is also around 20% below its 19x average over the same span.

YCharts – Realty Income, EV to EBITDA & Revenues, 10 Years

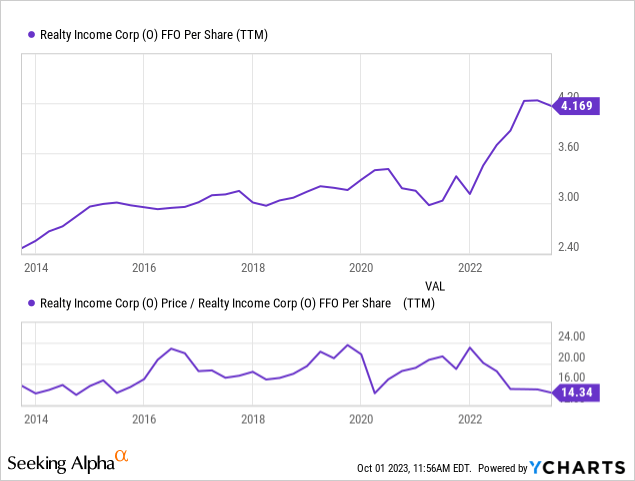

The traditional REIT measure of Funds From Operations (FFO) is hovering near $4.20 annually, representing a price to FFO ratio of 14.3x, the lowest valuation since 2015.

YCharts – Realty Income, Funds From Operations, 10 Years

Dividend Income

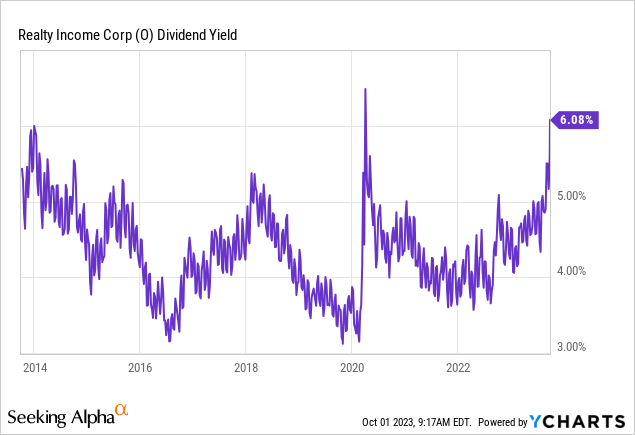

Perhaps the main reason to contemplate adding Realty Income to your portfolio is the dividend yield is making sense again, after failing to keep up with rising inflation and interest rates during the second half of 2021 and all of 2022. Outside of a few days in late March 2020 at the height of pandemic panic selling, the trailing nominal 6.08% cash distribution rate (6.15% on a forward basis as indicated by management) is the highest since late 2009 (not pictured).

YCharts – Realty Income, Trailing Dividend Yield, 10 Years

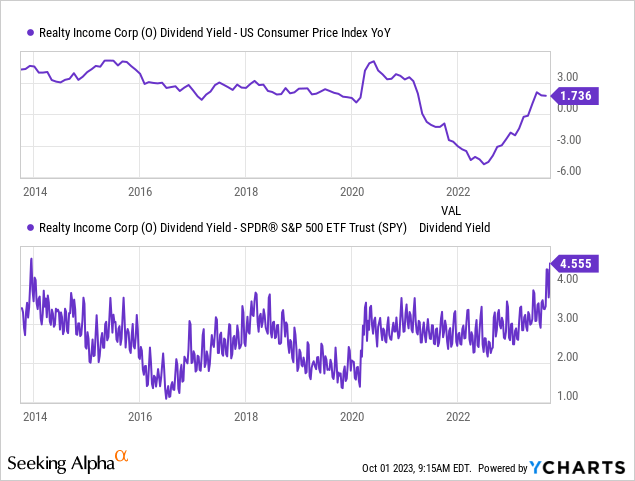

Below, I have charted the Realty Income cash distribution rate vs. U.S. CPI inflation changes YoY, alongside a relative comparison against the S&P 500 index dividend yield. All told, the dividend yield vs. existing inflation is near its 10-year average again on the big trust price swoon during late summer, while the cash yield premium of +4.55% annually vs. the prevailing S&P 500 rate is the best spread since late 2013.

YCharts – Realty Income, Relative Dividend Yield vs. CPI Inflation and S&P 500 Equities, 10 Years

Technical Trading Momentum

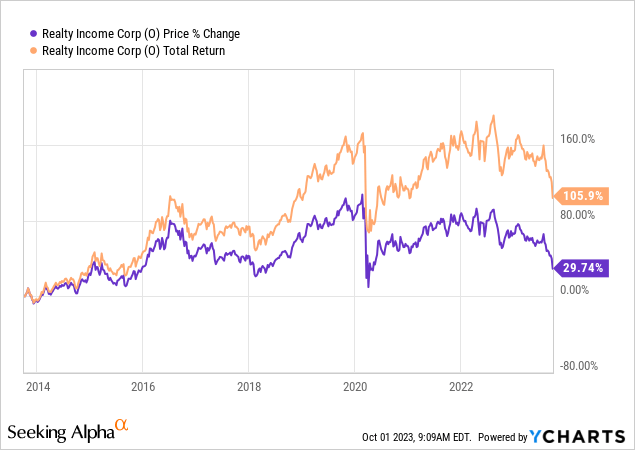

On the 10-year graph of price and total returns below, you can plainly see the 7% compounded rate of total investor gains was mostly a function of the dividend yield. Another point to contemplate is both price and total returns have been negative since February 2020, just as the COVID-19 pandemic showed up.

YCharts – Realty Income, Price & Total Returns, 10 Years

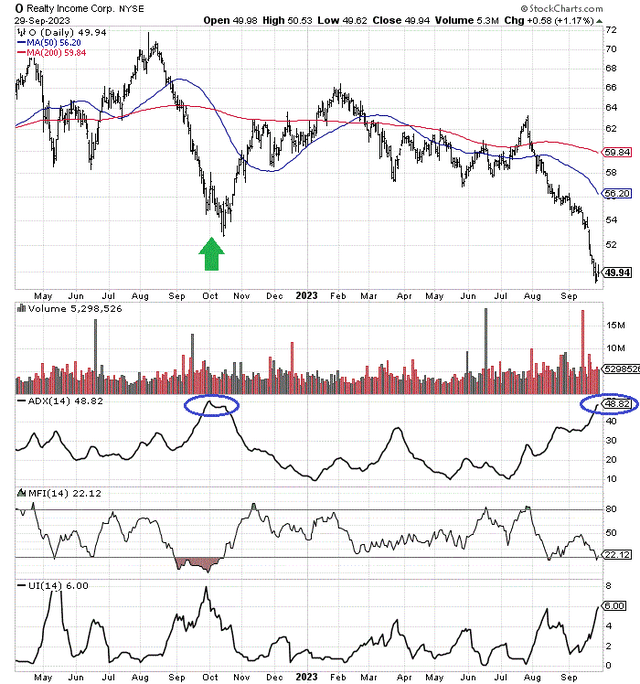

On daily technical changes in price and volume, Realty Income has become quite “oversold” on the 18-month chart below. The 14-day Average Directional Index measure of volatility over three weeks is getting close to its highest reading since late September 2022 (blue circles). A similar oversold setup to a year ago on the 14-day Money Flow Index and 14-day Ulcer Index (another volatility score) is also now present.

Marked with the green arrow, if we follow the exact pattern of last year, several additional weeks of downside in price could be next. Then, a sizable rebound, retracement, or outright long-term reversal may play out into early 2024 (possibly on an unexpected Fed pivot in interest rate policy).

StockCharts.com – Realty Income, Daily Price & Volume Changes, 18 Months, Author Reference Points

Final Thoughts

One twist on management decision-making is the company has engaged in an aggressive merger/acquisition spree since 2020. Measured from 2019 before the pandemic jumped into our lives, assets, sales, income, and cash flow have all grown in the +150% to 200% range. These deals usually involve exchanging new shares for real estate assets. So, results per share have grown nicely, but nowhere near the nominal size increases for the operating business as a whole. As such, I openly wonder if the company has expanded too fast, at what could turn out being a top in real estate values during 2022-23.

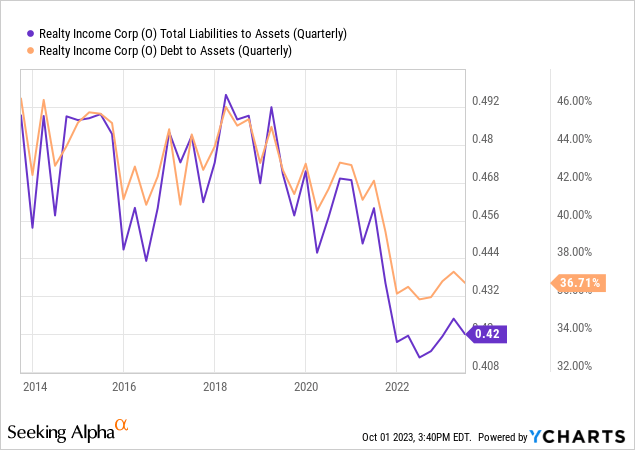

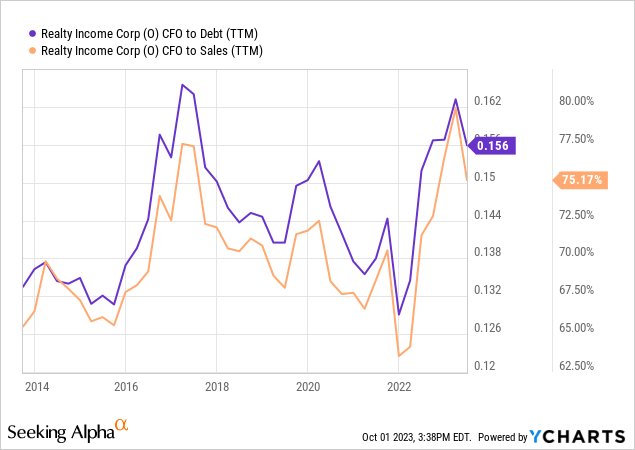

Yet, the optimistic view is liquidity on the balance sheet has actually improved from 2019, looking at total liabilities and debt to assets, alongside cash flow generation on debt and sales.

YCharts – Realty Income, Total Liabilities & Debt to Assets, 10 Years

YCharts – Realty Income, Cash Flow to Debt & Sales, 10 Years

Pulling all the ideas together (pros and cons), at prices under $50 I now rate Realty Income a Buy. Considering the honest odds of a serious recession in 2024, I put Strong Buy territory closer to $40, which would bring a rearview valuation closer to the early 2009 Great Recession lows.

What’s the main risk owning Realty Income? My opinion is current pricing looks to be well-supported by operating fundamentals. Further downside may be a function of even higher long-term borrowing rates in America. The jump in acceptable bond yields during late summer is the primary reason a majority of REIT prices have imploded over the last 8-10 weeks.

And, if higher interest rates appear in October-November, Realty Income could remain under-selling pressure by investors. Of course, rising rates will also dramatically increase the odds of a deep recession next year, which would hurt both real estate values and rent-renewal negotiation success.

For a simple forecast, a severe or prolonged recession on elevated interest rates could keep Realty Income in the $40 to $50 range per unit. For a bullish projection, a sizable new QE effort by the Fed to forcibly reverse interest rates would conversely argue everyone to dive back into the inflation hedge pool, meaning this name could reverse abruptly and violently for the price upside. A minor recession or soft landing with far lower interest rates could be enough to send Realty Income back above this year’s high trade of $67, over the next 12 months. Such would be good for a total return including dividends of +40% from $50.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here

Leave a Reply