Back in June this year, I wrote an article on Realty Income Corporation (NYSE:O) in which I laid out my thinking on why investing in O comes with a meaningful opportunity cost.

In the article Realty Income: Time To Reallocate To Better Risk-Adjusted Alternatives my argumentation revolved around O’s stock price and how it has been overly resistant to the looming recession risks and higher interest rate costs. Since then, O’s total returns have been negative 7.8%, while the broader U.S. equity REIT market has gained around 1%.

Now, with this article my goal is to focus on O’s dividend story and really answer whether it is rational from a fundamental level to allocate into O with an intent to capture great and growing dividends.

Lately, I have been also contemplating on adding O to my dividend portfolio given O’s track record, somewhat acceptable yield, M&A power and, most importantly, upper-investment grade balance sheet, which is crucial in the context of current macroeconomic dynamics. Granted, there are many other benefits associated with O such as strongly diversified portfolio, well-laddered lease profile, embedded rent escalators etc.

Yet, there are a two major factors, which have hold me back from deploying part of my capital into O.

#1 – Relatively unattractive dividend yield

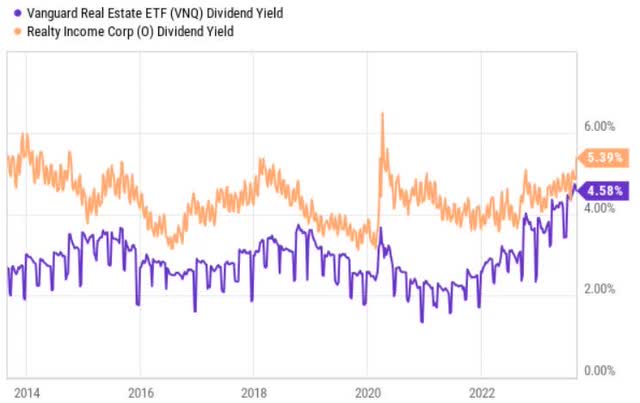

Currently, O yields around 5.5%. This is more or less in line with where the dividend has been over the past decade. There have been some periods in which the dividend yield has decreased to 4%, but in the grand scheme of things I do not consider this a material difference.

Ycharts

If we compare the 10-year historical dividend yields of O and the Vanguard Real Estate Index Fund ETF Shares (VNQ), we can notice that the spread has significantly narrowed, exceeding the historical norm.

This means that as of now O does not offer any notable premium for dividend-seeking investors relative to the overall REIT market despite being positioned as a dividend-oriented investment.

One might argue that it is like comparing apples to oranges and that O’s is way more financially more resilient and proven its ability to deliver growing dividends.

Partially true.

I would agree that these are different investments (i.e., on the apple and orange comparison), but I would disagree with the thesis that O is much safer than VNQ.

There are at least two arguments for this.

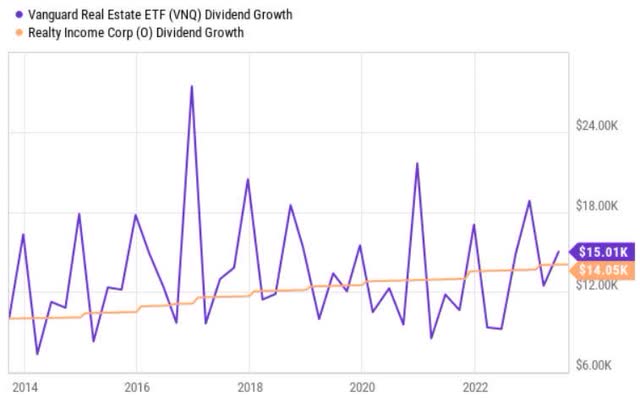

First, if zoom back 10 years and look at the compare the cumulative dividend growth of O and VNQ, we will once again notice an interesting dynamic.

Ycharts

The total dividend growth for VNQ has been much more volatile than for O, but on a cumulative basis, the total result is very similar. So already here we conclude that O has failed to provide investors with an abnormal dividend even though it is commonly viewed as the “REIT dividend king”.

Second, VNQ consists of a diversified set of sectors and entities, which together mathematically cancel out idiosyncratic risk. This is obviously not the case with O, where we are talking about clear singe security risk.

Finally, when it comes to the attractiveness of O’s dividend (or rather lack of it), there is little motivation to invest in O, while the fixed income markets are providing juicy yields.

The difference between O’s yield and the U.S. 10-year Treasury note is just 150 basis points. Compared to T-bills, the difference comes down to only 10 or 20 basis points. And we are not talking about corporates credit, where there are some clear pockets of higher yield that are backed with strong fundamentals.

A potential challenge to this comparison would be that O is able to grow the underlying dividend, while a pure-play exposure to fixed income does not offer this luxury.

Well, I do not think that O will be able to sponsor notable growth going forward due to its current AFFO payout profile, leverage and just in general higher interest rate environment (see more details below). At the same time if interest rates continue to go up, O will likely fall. Fixed income positions will also drop, but if you hold them until maturity, you can derive higher income through reinvesting in cheaper bond. If the interest rate go up, the probability is high that there will be greater returns for a fixed income holder due to the duration effect and O’s rich valuations.

#2 – Higher for longer scenario damaging O’s equity story

The key principle how O is able to create shareholder value and grow its dividend is by capturing a positive spread between the cap rate and its weighted average cost of capital (i.e., WACC). This is not something O-specific, but a general principle for almost all equity REITs.

To do so, O has to find and acquire sufficiently high-yielding properties, where the corresponding cap rates cover the underlying financing costs. In practice, O can also acquire properties at cap rates below the WACC and then redevelop or bring in new tenants to boost the NOI.

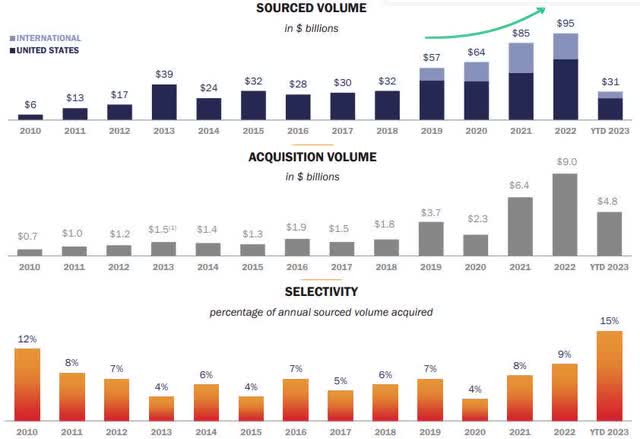

Realty Income Investor Presentation

Lately, it has been very challenging to find and sign new deals, which offer some meaningful spread from the O’s WACC. The fact that the selectivity percentage of O has exceeded the 10-year high is a clear testament of that.

I would also argue that the recent deal, where O invested $950 million in Bellagio, Las Vegas also confirms this as it agreed for a yield-bearing preferred equity interest structure, which is very uncommon for O.

With that being said, let’s assume that O somehow manages to find accretive deals, which offer a positive spread from its WACC. Considering Bellagio’s transaction and O’s increasing focus on the international markets and different sectors of real estate, I think that the Company will manage to find identify new inorganic growth targets.

However, here is the problem.

In my humble opinion, O underestimates its WACC or at least determines it in a very optimistic manner.

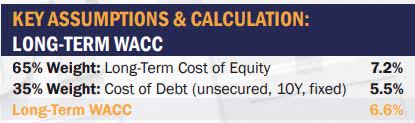

Realty Income Investor Presentation

O has calculated its long-term WACC at 6.6%, which is ~ 200 basis points above the U.S. 10-year Treasury and only ~ 100 basis points above the U.S. T-bill. So, 6.6% is the yardstick for O when making a final investment decision whether to buy new property or not.

To make matters more interesting, O has determined its 1-year nominal WACC at 5.5%, which is used to measure initial earnings accretion. This WACC is used to spread invest in high-quality real estate opportunities.

Looking at the YTD investments, O has acquired properties at a weighted average cap rate of 6.9%, which provides only 30 basis points of spread to accommodate further value creation for the existing shareholders.

The YTD debt financings have been stipulated at an effective semi-annual yield of ~5.15%. The cost of financing for revolver is obviously a bit higher, albeit still partially offset by some favorable hedges.

Realty Income Q2 2023 Supplemental Information

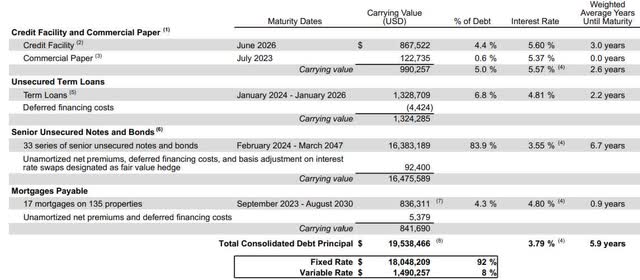

Up until now, O has managed to register positive AFFO growth and thus being able to keep the dividend growing. The key reasons for this is the existing cost of financing of 3.79%, which is way below the historically (and recently) acquired property cap rates.

However, already now we can see that the financings related to the credit facility, commercial paper and unsecured term loans are around 5 – 5.5%. The main element, which has kept the financing costs low is the senior unsecured note and bond component. This financing source yields 3.5% and has a relatively long maturity profile.

Gradually, O’s financing costs will converge to the market level as the existing unsecured financing expires, forcing O to attract fresh and higher-yielding debt to refinance.

As a result, O will have to suffer from reduced spreads that are associated with historically acquired properties. Considering the tiny margin of safety when it comes to the spread between WACC and cap rates, I do not see how O will manage to increase dividends much further.

The bottom line

So my worry here is that if the interest rates remain elevated for a longer period of time, O’s ability to accommodate meaningful growth in its dividend without sacrificing the AFFO payout or the capital structure seems limited.

In a nutshell, while there is no substantial basis for shorting O, dividend-seeking investors should seriously consider better yield alternatives as O’s case seems to not offer sufficiently attractive yield against the backdrop of high-yielding fixed income instruments and major headwinds stemming from higher interest rate environment.

Read the full article here

Leave a Reply