Ralp Lauren (NYSE:RL) has increasingly witnessed declining sales in its core North American market. While growth in Asia and Europe has offset these declines, the sales declines in North America remain concerning and are likely to weigh on the stock price somewhat. It also seems doubtful that the strong growth witnessed in the Asian market recently could be maintained at the same pace given the outsized role of China in this growth after its emergence from Covid-19 related lockdowns.

The sales picture

Ralph Lauren reported a decline of around 10% in revenues from North America. In its most recent earnings call management noted that the decline was partially attributable to different shipping times for Spring products. However, it also acknowledged that a fairly substantial portion of the declines were attributable to continued inflationary pressures on more value-oriented consumers. These pressures have also been seen at other retailers and, in my view, seems unlikely to dissipate in the near future as inflation remains somewhat elevated.

The company reported a particularly large decline in North American wholesale sales where revenue declined by around 16%. This partially resulted from the ongoing trend of extensive promotional sales at US department stores who have been working to clear inventory. Declines from department stores have indeed long been a challenge for Ralph Lauren and the brands dependence on these channels for distribution a point of concern among some analysts. I tend to agree that some of these department stores can affect the air of exclusivity that often surrounds a luxury brand. Given Ralph Lauren’s attempts in recent years to regain this air of exclusivity further declines in wholesale sales are not unexpected nor particularly concerning in my view.

Nevertheless, Ralp Lauren has also reported declining sales through its North American digital channels. These declines are somewhat more concerning, in my view, particularly at a time when other luxury brands have seen fairly robust sales growth through their online sales channels. Investors in Ralph Lauren should monitor sales through these channels closely in the upcoming quarters.

The company reported an 18% increase in sales in its Asian business. This growth was primarily driven by growth in China with management noting in this respect that –

China accelerated to more than 50% growth as we lap significant COVID-related restrictions in the prior year period. Our brands demonstrated strong momentum during the Golden Week and 6/18 Festival.”

This type of reopening euphoria was also quite common across other markets, where reopening’s occurred much earlier than in China. However, this euphoria in other markets has started to fade away and sales declines are now becoming more common. While cultural differences may alter the Chinese experience somewhat, the euphoria seems unlikely to last too long in my view. Just as the euphoria started fading in other markets, I expect the reopening euphoria in China to start fading fairly soon. This could then result in a meaningful slowdown in growth rates in Ralph Lauren’s Asian business.

There have indeed already been early signs of the reopening euphoria in China coming to an end much more rapidly than in other markets. Vogue Business has noted a clear trend of deceleration in consumer spending on luxury goods within China in the past few months. Vogue noted that despite earlier expectations of prolonged rebound sales in China, nearly half of surveyed luxury consumers spent less than RMB 22,499 on luxury items in Q3, ending September 2023, according to a study by Vogue Business and Barclays. This represents a 10-percentage point increase compared to Q2 in the number of shoppers in the lower-spending bracket (RMB 22,499 or less). This shift is attributed to a steady influx of middle-tier spenders moving into the lower spending tier.

Sales in Europe were quite strong with an 8% increase in revenue in the European business. However, part of this growth was attributed to earlier wholesale shipments for Spring which will then have a negative impact on sales in the second and third quarter. Furthermore, there are now also clear signs of demand for luxury goods in Europe being on the decline. It remains to be seen how these shifting demand patterns affects Ralph Lauren’s sales picture in the remaining quarters of the year.

While the upcoming holiday season could provide a boost to sales, I am not confident that this would be substantial enough. Most retailers have already indicated that they expect a much more gloomy sales outlook over the holidays than last year. While the luxury industry has been less impacted by the slowdown in sales, the weaker sales growth among aspirational buyers seems likely to persist and leaves little room for a substantial uptick in holiday sales.

Expanding margins

As Manika Premsingh rightly observed, the most notable development in Ralph Lauren’s recent earnings report is the expansion of margins, a trend observed in recent company earnings reports. This is attributed to a general cooling down of inflation, especially due to the increasing gap between producer price inflation and consumer price inflation. The company’s gross margin has climbed to 68.8%, marking the highest level in two years, while its operating margin has climbed to 13.4%.

Premsingh observed in this respect that –

In fact, geography wise, the adjusted operating margins are even higher. Asia has the highest margins at 24.7%, followed by Europe at 21.5%, with both markets witnessing a rise in margins from Q1 FY23. Even the US, which saw a drop in margin by 60 basis points is at 19.6%. However, items like unallocated corporate and restructuring expenses proved to be a drag on the overall margins.

The ongoing expansion in Ralph Lauren’s operating margins certainly contribute materially towards making the stock more attractive for long-term investments. Management also appears to be fairly confident that these margins can be maintained in the near term.

Valuation

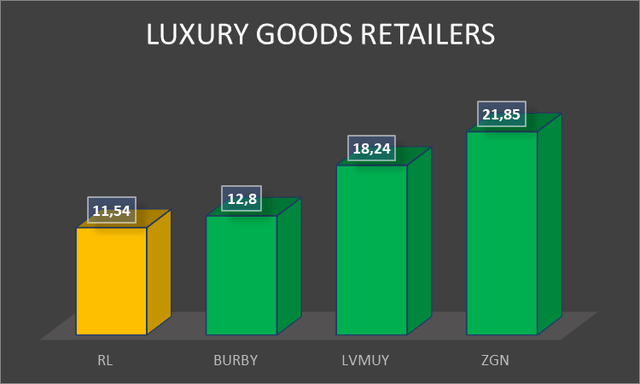

Ralph Lauren is currently trading at a forward P/E ratio of around 11.54 which is the lowest of the major luxury goods retailers considered in the peer comp chart below. This is also well-below the stocks 5-year average forward P/E ratio of around 14.6.

LUXURY GOODS RETAILERS FWD P/E RATIOS (Author created based on data from EquityRT)

The current valuation has clearly priced in the risk of sales declines adequately. This offers investors an attractive upside opportunity should the sales picture, particularly in North America, turn around. Nevertheless, the challenging sales environment (which I expect to persist for now) could see greater volatility in the share price in the near term. It is for this reason that I rate the stock a hold at present.

Conclusion

The current landscape for Ralph Lauren is nuanced. The decline in North American sales is a concern, but it’s important to note that the company has demonstrated an ability to navigate inflationary pressures and make strategic adjustments in response to shifting market dynamics. This has see a substantial improvement in operating margins across most of its businesses.

Nevertheless, the decline in North American wholesale sales, while expected, underscores the need for Ralph Lauren to continue strengthening its distribution channels. Additionally, the dip in North American digital sales demands close attention in an era where e-commerce has become increasingly important for other luxury goods manufacturers and retailers.

Ralp Lauren’s buoyant growth in the Asian market, particularly in China, is undoubtedly a highlight. Yet, there’s an element of caution here. The euphoria witnessed post-Covid-19 restrictions is showing early signs of tapering off. This could then result in a decline in sales growth at its Asian business.

From a valuation perspective, the low forward P/E ratio signals that the market has may have already factored in the sales challenges. This presents a potential upside opportunity if the company can effectively address these issues and turn the sales trajectory around. Nevertheless, the risk of increased volatility as a result of uncertainty in the sales outlook leads me as a somewhat more risk averse investor to rate the stock a hold.

Read the full article here

Leave a Reply