Quanex Building Products (NYSE:NX) provides components for the window business. The stock has given a breakout and is trading near the breakout level. I believe it has a great upside potential. Additionally, despite declining sales, its profitability has increased, and its balance sheet also looks strong. Its valuation is also cheap; hence, I think it might be the right time to buy the stock. So, I assign a buy rating on NX.

Financial Analysis

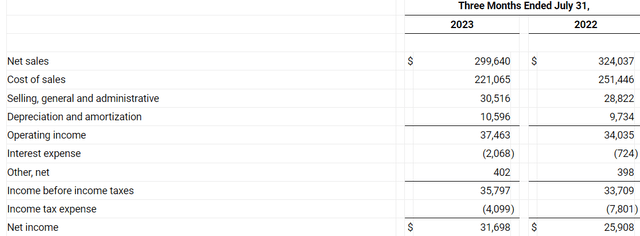

NX announced Q3 FY23 results. The net sales for Q3 FY23 were $299.6 million, a decline of 7.5% compared to Q3 FY22. The company struggled in the North American market, which impacted its sales. The sales from its fenestration and cabinet component segments in North America declined by 4.1% and 23.6% in Q3 FY23 compared to Q3 FY22. A softer market demand impacted both segments, and the cabinet component segment sales were also affected by lower hardwood pricing. Other than the pricing and the internal factors, I believe it was external factors that largely impacted the company’s operations. To some extent, the softer demand resulted from a slowdown in North America’s construction industry due to rising interest and mortgage rates.

NX’s Investor Relations

But despite the decline in sales, the company managed to increase its profitability, which was impressive. A decline in raw material inflationary pressure helped to increase profitability and margins, but other than that, lower income tax expense and cost control measures by the management helped them to achieve better profitability. The EBITDA margins improved in Q3 FY23 compared to Q3 FY22, and the net income also increased 22.4% in Q3 FY23 compared to Q3 FY22. Despite lower sales, its EBITDA and income increased, which shows efficient management. Some positive factors will help the company in growing sales in the coming quarters. They faced destocking issues for some of their products in the three-quarters of FY23, but the company mentioned that the order pattern they are experiencing is showing that the destocking headwind has started to abate. In addition, the raw material inflation is now under control, which will benefit them in the coming quarters. So, these are some factors that might help them in the coming quarters. Now, I want to mention some of the risks to balance things out. Suppose even if they start to experience positive growth, I don’t think the growth will be significant because there are some macroeconomic headwinds like high interest rates in Europe and the construction market slowdown in North America that are still impacting and might continue to hamper its sales growth in the coming quarters. I believe that the company will have trouble increasing sales growth unless these factors are under control.

Technical Analysis

Trading View

NX is trading at $28, and the setup here is extremely bullish. The setup made here is perfect for the long entries. In the month of July, the stock broke out of the $28 level, which is also near the all-time high of the stock. In 2021, the stock reached an all-time high of $29, but after touching that level, the stock fell quickly. But after two years, the stock price has broken out of an important range, and what impressed me more is that whenever a stock gives a breakout, it either shoots up directly or the breakout fails. But in this case, after the breakout, the stock has beautifully consolidated near the breakout range for almost three months, which is a positive sign because consolidation after a breakout increases the chances of a breakout being successful. So, I believe the breakout might be successful, and to remind you, there are no resistance zones or levels to stop the stock price as it is at an all-time high. Hence, looking at the price action, I am bullish on NX and think it has great upside potential.

Should One Invest In NX?

Their CFO by the end of Q3 FY23 was $64.1 million, a rise of 24% compared to Q3 FY22, and the FCF also increased by 23.3% in Q3 FY23 compared to Q3 FY22. So, the liquidity looks strong, and the cash-generating ability of the company is impressive. They also repaid $25 million of debt in Q3 FY23, and the management mentioned that their main focus will be paying down debt in the coming quarters, which is a positive sign. Their balance sheet looks strong, and if we look at NX’s valuation. NX has a P/E [FWD] ratio of 11.79x, which is lower than the sector ratio of 20.39x, and has a Price / Cash Flow [TTM] ratio of 6.1x compared to the sector median of 12.8x. So, along with solid fundamentals, its valuation looks favorable. NX is looking fundamentally strong, the destocking issue is also slowing down, and the stock has given a solid breakout. Hence, I think this might be the right time to buy the stock. So, I assign a buy rating on NX.

Risk

OEMs are their main clientele, and they have a lot of sway over purchase and payment terms. Furthermore, they have less negotiating power regarding pricing and supply because many of their suppliers are enormous international conglomerates with a vast number of customers who are far larger than them. By negotiating reasonable price concessions when necessary and lowering their production costs through a variety of strategies-such as controlling their procurement process to control the cost of components and raw materials, keeping multiple supply sources when feasible, and putting cost-effective process improvements into place-they try to manage this pricing pressure and maintain their business relationships with OEMs and suppliers. Nevertheless, their operational margins might suffer, and their efforts in this area might not be successful.

Bottom Line

Despite declining sales, its profitability has been increasing, which shows the management’s efficiency, and its balance sheet looks strong. Additionally, the stock has given a breakout and is looking bullish. Hence, considering these factors, I assign a buy rating on NX.

Read the full article here

Leave a Reply