In the recently released financial report for the fiscal third quarter, QUALCOMM Incorporated (NASDAQ:QCOM) highlighted strong operational performance and strategic planning for sustainable long-term growth. Qualcomm’s President and CEO, Cristiano Amon, expressed satisfaction with the company’s technological advancements and underscored the promising future of on-device AI. He emphasized that Qualcomm is uniquely positioned to capitalize on this emerging trend due to its platforms’ efficiency and high performance. This piece presents a technical analysis of Qualcomm’s stock price to identify future trends and potential investment opportunities. The study reveals that the stock rebounds from a significant support level, signaling possible upward movement. The stock’s behavior on the monthly chart also underscores its prospects for bullish market activity.

Qualcomm’s Financial Highlights and Challenges Ahead

Qualcomm recently unveiled its financial results for the fiscal third quarter of 2023, signaling robust operational performance and strategic positioning for long-term growth. Cristiano Amon, President and CEO, expressed satisfaction over the company’s technological leadership and the promising future of on-device AI, emphasizing Qualcomm’s unique capability to harness this trend due to its platforms’ efficiency and computing performance. The third quarter appeared highly favorable from a shareholder perspective as the company returned $1.3 billion to its stockholders. This included $893 million in cash dividends and $400 million through the repurchase of 4 million shares of common stock. It indicates a robust capital return, making it an attractive stock for current and potential investors.

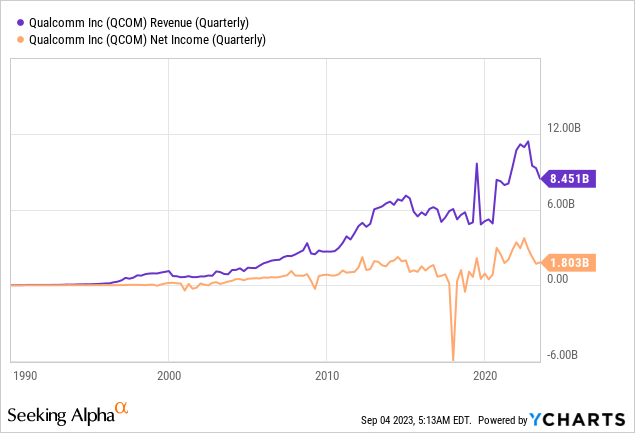

On the business front, Qualcomm showed diverse revenue streams. The company’s handset sector led the charge with a revenue of $5.3 billion, owing mainly to the superiority of the Snapdragon® 8 Series Mobile Platforms. The automotive division followed with revenues of $434 million, bolstered by Qualcomm’s increasing influence in digital cockpits and telematics systems, as evidenced by the recent Automotive Summit in Suzhou, China. The Internet of Things (IoT) was another strong performer, registering $1.5 billion in revenue, thanks partly to successful collaborations like the Meta Quest 3 virtual reality headset and the new Wi-Fi 7 customer design. The quarterly revenue was approximately $8.45 billion, while net income was around $1.8 billion. Although these figures are marginally lower than the last quarter, the general trajectory shows an upward trend, as illustrated by the accompanying chart.

However, the outlook remains cautiously optimistic, given the uncertain macroeconomic environment. The company foresees a downward trend in handset units in 2023, mainly owing to a slower recovery in China. Despite these headwinds, the company has successfully executed cost-reduction strategies, promising a 5% cut relative to the fiscal 2022 exit rate. Additionally, Qualcomm has committed to implementing further cost actions in the first half of fiscal 2024 while continuing to invest in its strategic priorities.

Qualcomm’s fiscal third-quarter results reflect a well-balanced portfolio, promising technological advancements, and a shareholder-friendly approach. However, external macroeconomic factors continue to loom, calling for cautious optimism as the company navigates through the latter part of the calendar year.

Navigating Qualcomm’s Technical Strength

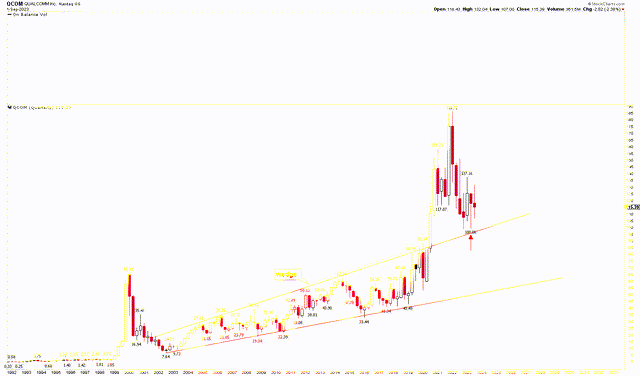

The quarterly chart reveals a robust bullish trend for Qualcomm, illustrated by the sharp price trajectory from its 2002 low of $7.64 to its all-time high of $185.72. This upward movement was encapsulated within a wedge pattern broken post-COVID-19, leading to accelerated gains. Qualcomm’s stock benefited from various synergistic factors following the pandemic. The transition to remote lifestyles in work, education, and entertainment fueled the need for advanced communication technologies. As a market leader in wireless tech and semiconductor manufacturing, Qualcomm was well-positioned to meet this demand. The company’s robust 5G technology and chipset offerings experienced heightened demand as telecom companies accelerated 5G rollouts globally.

Additionally, increased consumer electronics sales increased the demand for Qualcomm’s components. Supply chain limitations also benefitted Qualcomm by increasing semiconductor prices, thus enhancing profit margins. The external dynamics catalyzed by the pandemic dovetailed with Qualcomm’s key strengths, driving its financial metrics and share price upward.

Qualcomm Quarterly Chart (stockcharts.com)

The stock is retracing toward the wedge’s support line, suggesting robust support around the $100 mark. After rebounding from this support zone, the stock price appears poised for further gains. The quarterly candle for Q2 2023 displays a strong wick, signaling bullish market momentum.

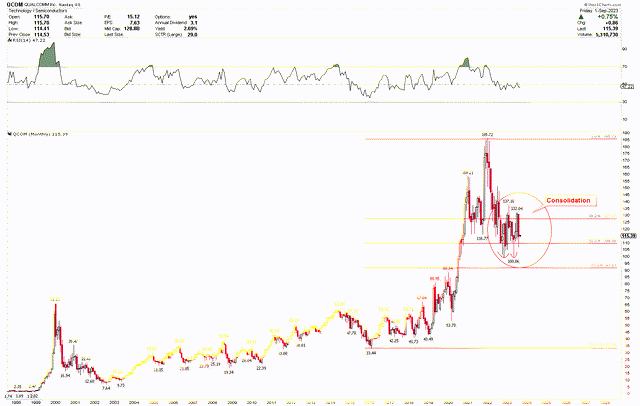

A monthly chart further corroborates this bullish trend, showing a Fibonacci retracement from the low of $33.44 to the high of $185.72. The stock has found a floor at the 50% retracement level, with no monthly close below it, indicating sustained bullish sentiment. This is further evidenced by a double-bottom formation on the monthly chart at $99.27 and $100.26, with a neckline at $133. A monthly close above this threshold could trigger the next rally, making it an attractive entry point for investors. A monthly close below $90 would invalidate this bullish outlook.

Qualcomm Monthly Chart (stockcharts.com)

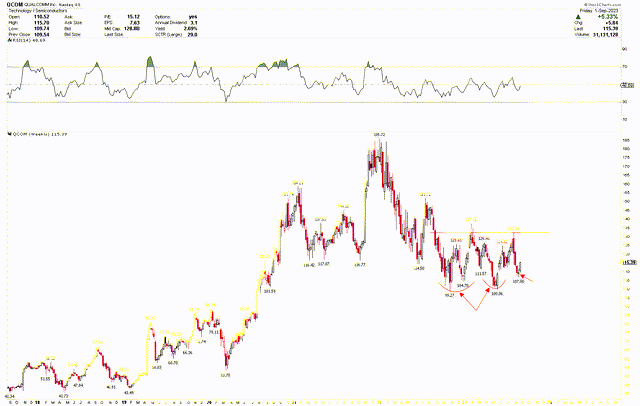

The weekly chart offers additional insights, more clearly showing the double-bottom pattern. The last two weekly candles suggest a strong reversal, indicating the onset of a new upward rally. The current low-level fluctuations in the RSI indicate that the stock still has room to demonstrate strength before initiating a bullish move.

Qualcomm Weekly Chart (stockcharts.com)

Investors may find it favorable to buy Qualcomm shares at current price levels due to this solid bottoming process. Investors can further increase holdings if any price correction develops.

Market Risk

Although Qualcomm has enjoyed robust growth, it’s crucial to consider the unpredictable nature of the broader macroeconomic environment. Global economic volatility could ripple effect on the company’s diverse business segments and consequently influence its stock value. Specifically, Qualcomm is bracing for a downturn in handset sales in 2023, primarily due to a slow-paced economic recovery in China-a key market for the company. A significant slump in this region could have an outsized impact on both revenue and future growth. While past supply chain hiccups have been advantageous for Qualcomm, there’s no guarantee that future disruptions will yield similar benefits; they could undermine the company’s operational performance and financial stability.

In addition, Qualcomm’s stronghold in 5G technology and chipsets is not impervious to competitive pressures. An uptick in rivalry from other technology leaders could threaten its market share and profit margins.

From a technical perspective, the stock price is correcting towards a critical support level of around $100. A failure to maintain this level, particularly with a monthly close below $90, could upend the current bullish outlook and necessitate a more cautious stance from investors.

Bottom Line

In conclusion, Qualcomm has delivered a compelling narrative of resilience, innovation, and financial stability in its fiscal third-quarter report. Under the leadership of Cristiano Amon, the company has skillfully harnessed technological trends like on-device AI, leveraging its platform efficiency and performance capabilities. From a shareholder standpoint, Qualcomm continues to be a standout with its significant return of capital through dividends and stock buybacks. On the operational side, Qualcomm has showcased a balanced and robust portfolio, underlined by substantial contributions from its handset, automotive, and IoT segments. While the handset business remains a cornerstone, the company is steadily diversifying into other promising areas, ensuring a well-rounded approach to revenue generation.

From a technical standpoint, the stock price has significantly recovered from the solid $100 support level and is establishing a firm base. This consolidation phase typically precedes notable upward price movements. If the stock maintains a monthly closing price above $90, Qualcomm is projected to experience further gains. Investors may find it favorable to purchase shares at current prices and consider increasing their holdings should a minor correction occur.

Read the full article here

Leave a Reply