There are some compelling valuations in the chip space when considering future growth rates and impressive free cash flow out-year outlooks. But finding a name with a modest current P/E multiple and a still-sanguine growth trajectory is a bit tougher. Could it be time for legacy-tech to make a comeback? We are getting hints of that from names like Intel and AMD, and QUALCOMM (NASDAQ:QCOM) offers value in my view.

I have a buy valuation on this low-P/E stock as shares attempt a reversal of a downtrend that began at the start of 2022.

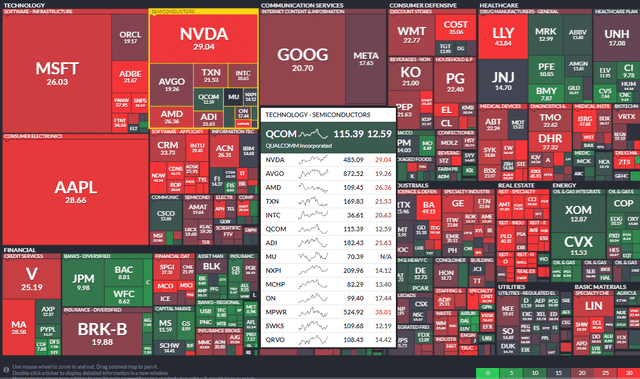

Finding Value in The Semi Space: S&P 500 Forward P/E Ratio Heat Map

Finviz

According to Bank of America Global Research, Qualcomm designs, develops, and supplies semiconductors and collects royalties on wireless handheld devices and infrastructure based on its dominant position in code-division multiple access (CDMA) and other related technology patents. In addition, Qualcomm provides systems software and components to wireless handset vendors and promotes applications and services that run on high-speed wireless networks. The company operates primarily through two segments: CDMA Technologies and Technology Licensing.

The San Diego-based $129 billion market cap Semiconductors industry company within the Information Technology sector trades at a low 15.1 trailing 12-month GAAP price-to-earnings ratio and pays an above-market 2.8% dividend yield. Following its August 2nd Q3 2023 earnings report, the stock features a modest 24% implied volatility percentage and has a low 1% short interest.

Back in early August, QCOM reported disappointing Q3 numbers. While earnings results were slightly better than expected, a 23% YoY sales drop was driven by difficulties in China’s handset market while still-high channel inventory levels were a drag on the quarter. Moreover, its IoT and Automotives segments experienced a slowdown amid international sluggishness.

Particularly problematic was the management team’s cautious guidance for Q4, predicting a 25.4% revenue drop, which was below street expectations. Growth prospects may improve into 2024 amid better seasonal conditions and if China demand finally turns it around, and be on the lookout for new developments like the Snapdragon 4 Gen 2 platform and improvement in Automotives (which was actually a standout area in the last quarter), Consumer IoT, and Wi-Fi 7 solutions for potential upside catalysts.

Key risks from the long side include unfavorable resolution terms with Huawei, a major player in the tech industry, and a broader global economic downturn which could lead to a lower adoption rate of smartphones worldwide. Geographically, as the company expands its presence in emerging markets, it may face challenges such as pressure on pricing or market share along with heightened competition.

Of course, further tensions and growth risks in China specifically could have adverse effects on the company’s operations and profitability. Moreover, some Wall Street analysts assert there are structural uncertainties with Qualcomm at the moment. Citi even downgraded the semiconductor stock a month ago.

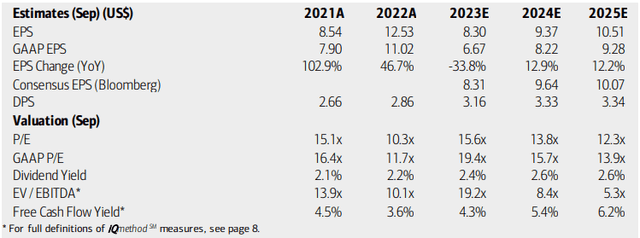

On valuation, analysts at BofA see earnings falling sharply this year, but per-share profit growth is seen as normalizing to a low-teens EPS rate in the out years. The Bloomberg consensus forecast is about on par with what BofA projects. Dividends, meanwhile, are expected to rise next year before settling out above $3 per share. With low to mid-teens earnings multiples looking ahead, the stock is not all that expensive considering the growth rate, and free cash flow is steady. The yield is nothing to sneeze at either.

Qualcomm: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

Looking closer at the valuation, if we assume $9 of next-12-month operating EPS and apply a 16 non-GAAP P/E, then the stock should trade near $144. That earnings multiple is at a discount to its 5-year average and below that of the broader sector to account for the growth rate forecast and higher borrowing costs today.

Also take a look at QCOM’s PEG ratio – I assert that value should be about 1.06 based on the 12.8 forward operating P/E using my normalized EPS figure and a 12% annual growth rate – that is at about a 10% discount to its 5-year average of 1.15. Finally, its semiconductor peers generally trade with P/Es in the mid-teens.

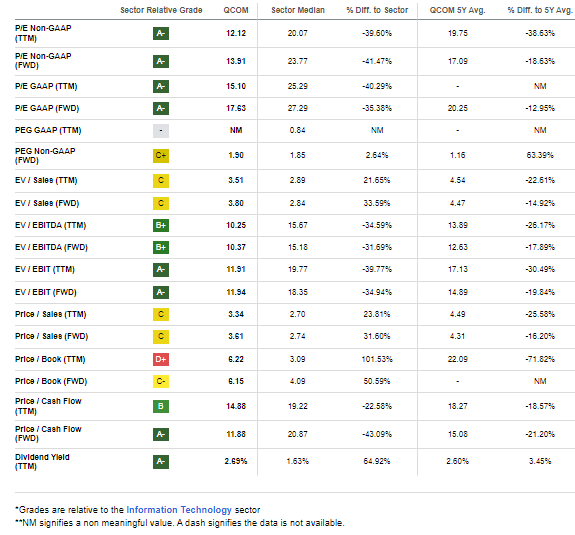

QCOM: Solid Valuation Metrics Considering The Growth Trajectory in 2024 And Beyond

Seeking Alpha

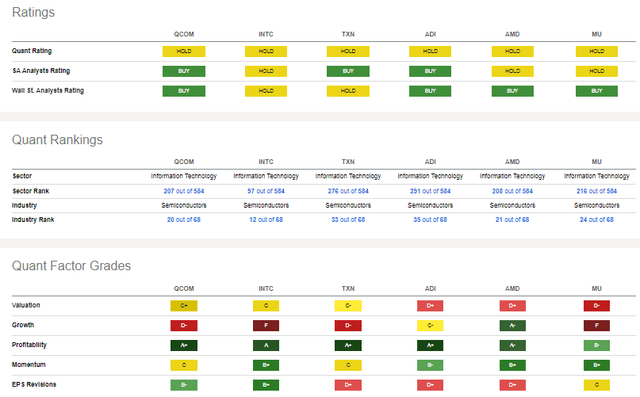

Compared to its peers, QCOM features a reasonable valuation given some of the poor grades listed below, and I assert that QCOM is even more attractive using normalized profit numbers. What’s more, Qualcomm being a legacy tech name has generally consistent profitability and its recent EPS revisions are above-average compared to the industry. Share price momentum has been poor though, as I’ll detail later.

Competitor Analysis

Seeking Alpha

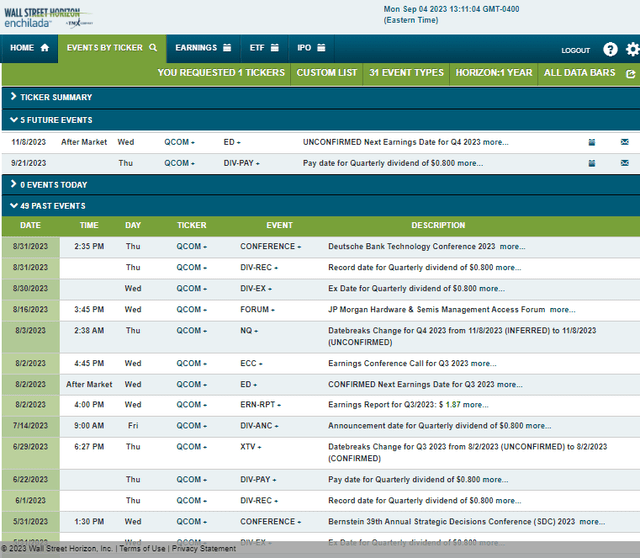

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2023 earnings date of Wednesday, November 8 AMC. Before that, the stock has a dividend payable date on the 21st of this month. No other volatility catalysts are expected over the next several weeks.

Corporate Event Risk Calendar

Wall Street Horizon

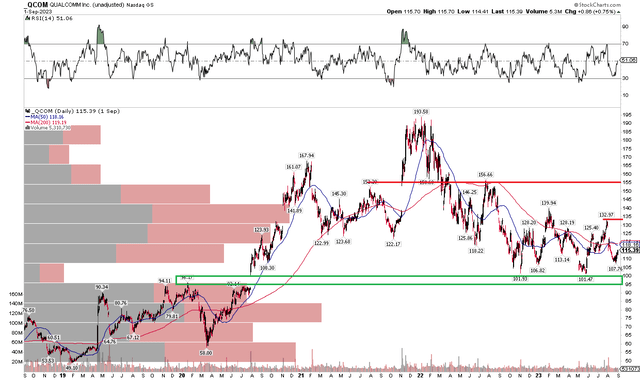

The Technical Take

QCOM has been a significant laggard in the tech space this year. Notice in the chart below that shares have repeatedly tested a key support area in the $93 to $101 area – so long as the stock is above that, then a long position can make sense technically. I see resistance at $133 – the early August (pre-earnings) peak. More important potential resistance comes into play closer to $160.

Unfortunately for the bulls, QCOM has a flat 200-day moving average, indicating no apparent uptrend. The good news is that a downtrend in the stock price that took shares from $193 to $101 has abated, and a bearish to bullish reversal is trying to take shape. A breakdown below $90 or so would be dangerous from a long point of view, though. It could be a tough slog for the bulls on any up moves due to significant volume by price up to that noted $160 point.

While I would like to a breakout above $133, long here with a stop under $93 is a favorable risk/reward setup even with the lackluster momentum.

QCOM: Shares Holding Key Support

Stockcharts.com

The Bottom Line

I have a buy rating on QCOM stock. The chart looks decent enough from a risk/reward point of view while the valuation suggests the stock is materially inexpensive.

Read the full article here

Leave a Reply