We continue to be hold-rated on Qorvo (NASDAQ:QRVO). Consistent with our expectations and management’s, QRVO’s financial outperformance in the September quarter was “supported by content gains” at their biggest customer, Apple (AAPL), with the company achieving revenue, margin, and EPS above the high-end of its August guidance. We don’t expect the financial outperformance to continue in 2024; we expect the flattish 2024 smartphone TAM coupled with increased competition with Qualcomm (QCOM) and Huawei to limit growth for the company’s advanced cellular division sales, which represents ~77% of total sales.

Management is already guiding lower for 4Q24 after a 70% QoQ growth in sales this quarter to $1,103.5M, outpacing the consensus at $1B. Sales are expected to decline 9% QoQ next quarter to $1B, this time slightly outpacing consensus of $987M. We think customer demand did improve this quarter versus management’s guidance last earnings call, the advanced cellular group grew 106% QoQ and 8% Y/Y to $850.1M. Still, we believe the outperformance was due to the large smartphone customer ramp from AAPL due to the iPhone 15 cycle. We’re cautious about AAPL in the near-term and maintain our hold-rating on the stock as we think there is little visibility in the market on the smartphone recovery timeline. The smartphone industry is expected to see a recovery from the post-pandemic inventory correction in the back end of the year, but we continue to see muted smartphone TAM growth in 2024. We expect the smartphone TAM for 2024 to be flat to modestly up; without a substantial rebound in smartphone end demand, we don’t think QRVO will be able to outperform expectations for FY24 of 13-15% Y/Y growth.

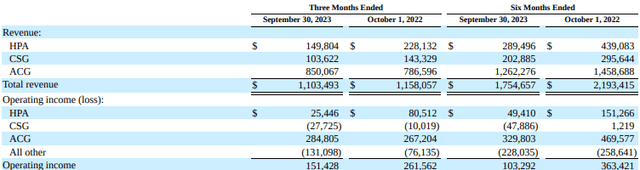

The following outlines QRVO’s 2Q24 earning results.

2Q24 earning results

We also expect the company to face gross margin headwinds over the next 1-2 quarters due to fab underutilization and higher cost of goods sold. This quarter, QRVO’s non-GAAP gross margin increased 470 basis points QoQ to 47.6% due to better factory utilization and improved sales driven by content growth with AAPL. We now expect it’ll be more difficult for the company to expand margins; management is already guiding for non-GAAP gross margin to decline to the range of 43-44% driven by higher costs inventory that was made during a low fab utilization phase. Additionally, we expect QRVO to see increased competition in the 5G market from both Qualcomm and Huawei after the latter releases the 5G Mate 60 Pro. Ironically, Huawei used to account for 13% and 8% of QRVO’s FY19 and FY18 revenue, respectively, which changed post-2019. We think the company will now face increased competition from Huawei’s ability to manufacture chips in sourcing from China.

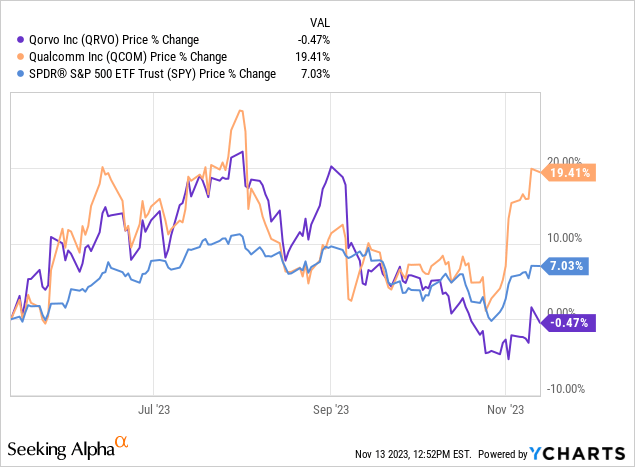

We’re already seeing the stock price react to the weaker outlook for 4Q24; the stock is down roughly 9% since our downgrade to a hold back in mid-August, underperforming the S&P 500 by 9%. QRVO stock underperforms the S&P 500 and QCOM over the past 6M, roughly flat, underperforming the S&P 500 by 7% and QCOM by 19%. We now think a lot of the macro weakness has been priced into the stock price and outlook, but recommend investors stay on the sidelines as we see QRVO being an in-line performer through 1H24.

The following graph outlines QRVO stock versus S&P 500 and QCOM.

YCharts

Valuation

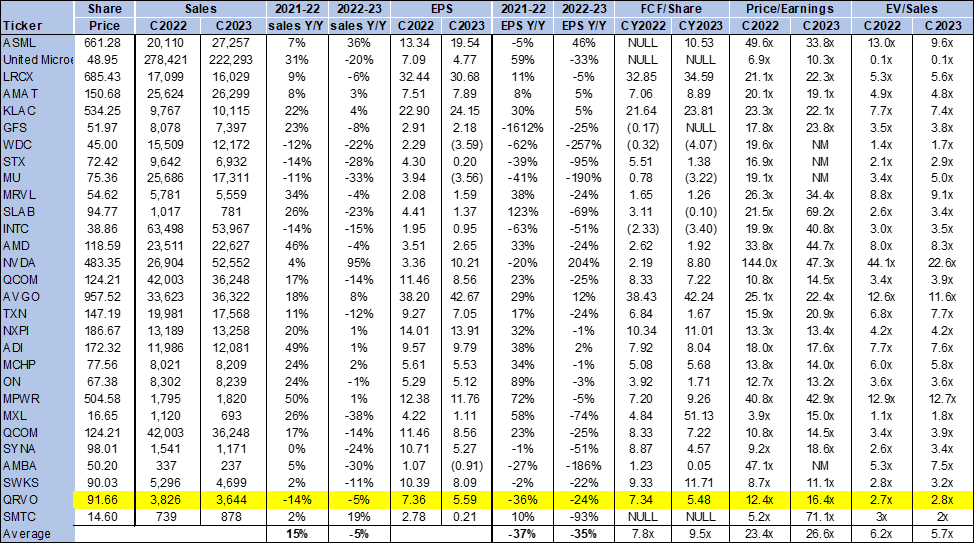

The stock is trading below the peer group and is undervalued at current levels. On a P/E basis, the stock is trading at 16.4x C2023 EPS $5.59 compared to the peer group average of 26.6x. The stock is trading at 2.8x EV/C2023 Sales versus the peer group average of 5.7x. We understand the attractive valuation at play here, especially for a company in bed with AAPL, but we recommend investors don’t buy the stock on weakness. We don’t see any near-term catalyst offsetting the macro headwinds.

The following chart outlines QRVO’s valuation table against the peer group.

TSP

Word on Wall Street

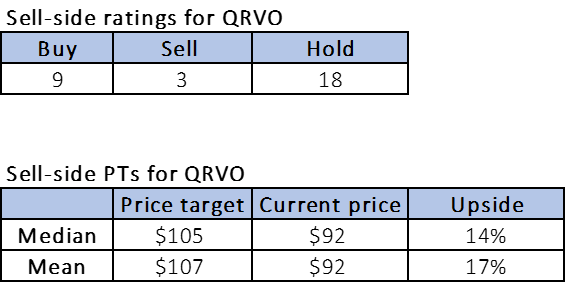

Wall Street shares our neutral stance on the stock. Of the 30 analysts covering the stock, nine are buy-rated, 18 are hold-rated, and the remaining are sell-rated. The stock is currently priced at $92 per share. The median sell-side price target is $105, while the mean is $107, with a potential 14-17% upside.

The following charts outline QRVO’s sell-side ratings and price-targets.

TSP

What to do with the stock

We’re less optimistic about QRVO’s financial performance in 2024 and recommend investors stay on the sidelines of the stock for the near-term. We think QRVO is at a higher risk of gross margin headwinds and slower sales growth as the smartphone TAM growth for next year remains muted. Additionally, we see the company facing increased competition with both QCOM and Huawei in 2024. We do believe the stock could see a near-term upside if smartphone 2024 TAM expands substantially but we don’t see evidence that this is likely. We think QRVO will be an in-line performer through 1H24.

Read the full article here

Leave a Reply