The net unrealized losses in most bank’s securities portfolios increased in 3Q as interest rates rose because the Federal Reserve continued to raise their Fed funds target. Some banks, such as the Bank of America (BAC), had very significant increased losses in their HTM portfolio. While some investors still assert that these unrealized losses don’t really mean much, bank regulators think they do according to Federal Reserve Bank studies and according to statements in their new proposed capital requirements. This is a quarterly update for the third quarter to my prior articles on bank unrealized losses in the securities portfolios.

As Interest Rates Increase So Do Unrealized Losses

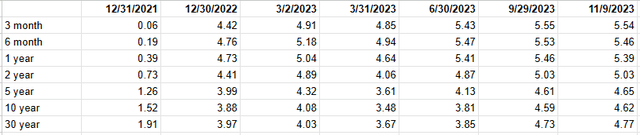

Long-term interest rates increased significantly this past quarter. Rates rose sharply after the end of the quarter then dropped back down to be about the same as the end of 3Q. The shorter end of yield did not really have significant changes. Those banks that hold long-dated securities, such as MBS, saw the most impact from rising rates.

U.S. Treasury Yields

home.treasury.gov

(Note: 3/2/2023 was the start of the bank crisis)

Rates on Deposits Higher Than Amount Earned on Securities

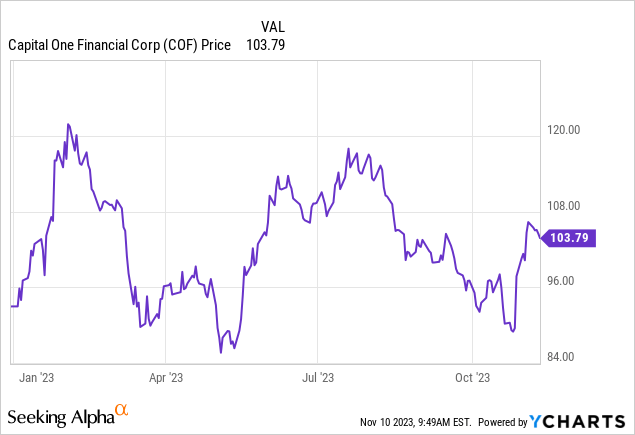

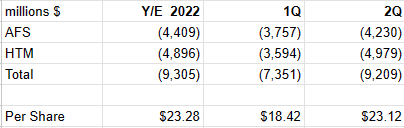

An interesting issue that I saw for a few banks is that they paid a higher average interest rate on interest-bearing deposits than they received on their securities portfolio. Capital One Financial (COF), for example, paid an average 3.30% on interest-bearing deposits and received an average of 2.86% on their securities portfolio. Capital One holds all their securities in an AFS portfolio so I do not understand why they hold securities that are effectively being financed by cash that is more expensive than what they are getting on the securities – on average. It even looks worse considering in 3Q 2022, they paid an average 1.00% on interest-bearing deposits and received an average 2.25% on their securities portfolio. The same with the Bank of New York Mellon (BK) that paid an average 3.62% and received an average 3.24% in 3Q compared to an average paid in 3Q 2022 of 0.95% and received an average 1.87% on their investment securities.

Unrealized Losses Are Important

As I covered in my sell Citigroup (C) article, the study by the Kansas Federal Reserve Bank concluded that unrealized securities losses do have a significant impact on banks and the proposed new banking regulations includes extensive mention of unrealized securities losses as one of the reasons that the new regulations are needed. (Note: use this link to read the proposed regulations because the original link in the Citi article no longer exists.)

Some have asserted that because of hedging these unrealized losses are not really that critical. I strongly disagree. The reality is that if a bank is forced to immediately sell these securities because of liquidity issues to raise cash they can’t unwind the hedges in tandem with the securities sales. In addition, there are risks that the party to the other side of the hedge is in financial trouble, which was a serious problem in 2008. These interest rate hedges are not just specific to their debt securities portfolios – they are usually hedges against all the assets, including loans held on their balance sheet. (This is an interesting study from last April on interest rate hedging by banks.)

As I covered in my prior 2Q loss article, the only “qualified” securities can be used under BTFP to borrow money from the Fed. Many banks hold a lot of securities that are not qualified and, therefore, could be forced to sell those securities at a loss if they need to raise cash immediately.

Others have also asserted that because the market value of the long-term debt the bank issued has declined as interest rates rose this offsets their unrealized securities losses. That is a typical theory asserted by a professor in some graduate school Econ class. Nice in theory but ignores reality. Bank regulations look at the face value – the actual amount of their legal liability – not the market value of that liability.

AFS and HTM Unrealized Losses on Debt Securities

This a quarterly update to my prior articles on unrealized securities losses. The details behind the tables below of prior period losses are included in my 2Q article. Most banks hold their debt securities in two different portfolio accounts. The available-for-sale – AFS securities are those that might be sold and are reported at fair value on the balance sheets. Any unrealized losses/gains are reported via accumulated other comprehensive income -AOCI – in the shareholder equity area of the balance sheet. Held-to-maturity – HTM securities are debt securities that are expected to be held until their maturity and are reported on the balance sheet at cost. HTM unrealized losses/gains are not directly reported on the balance sheet. Some banks, such as Capital One, hold all their debt securities in AFS accounts and don’t have HTM accounts. Any actual gains/losses on security sales are reported on the income statement. I used the end of the quarter numbers and not the average numbers for the quarter. I also used the latest reported number of shares outstanding.

3Q Quarter Results

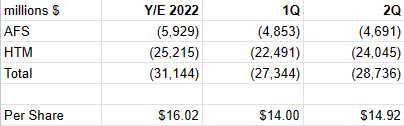

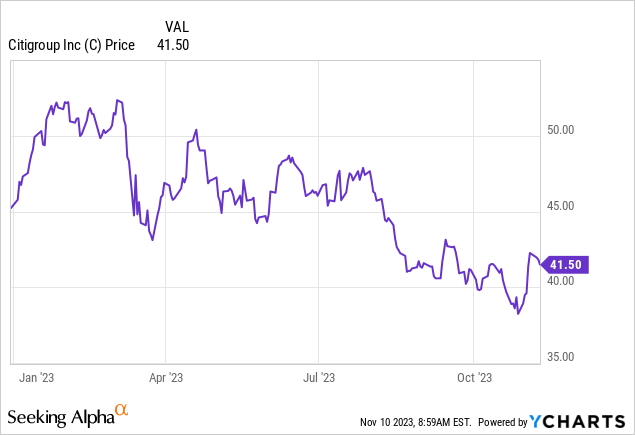

Citigroup (C)

September 30, 2023

Loss per share $16.42

Loss as percentage of current stock price 40%

AFS $246,763 million cost – $241,783million fair value = $4,980 million loss

HTM $259,456 million cost – $231,002 million fair value = $28,454 million loss

Total unrealized loss $31,434 million

10-Q (sec.gov)

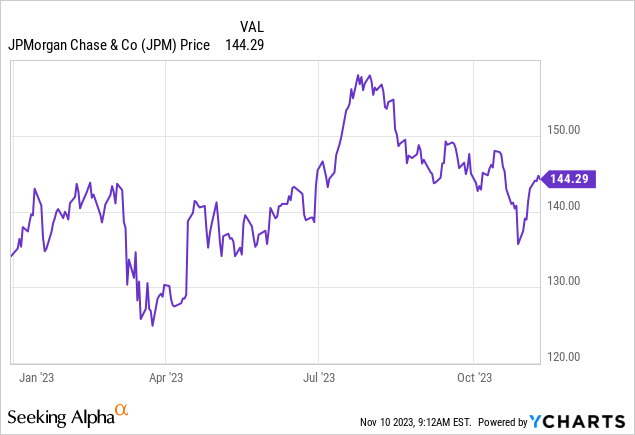

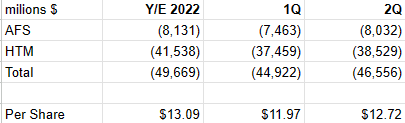

JPMorgan Chase (JPM)

Loss per share $20.17

Loss as percentage of current stock price 14%

AFS $206,500 million cost – $197,119 million fair value = $9,381 million loss

HTM $594,761 million cost – $545,820 million fair value = $48,941 million loss

Total unrealized loss $58,322 million

10-Q (sec.gov)

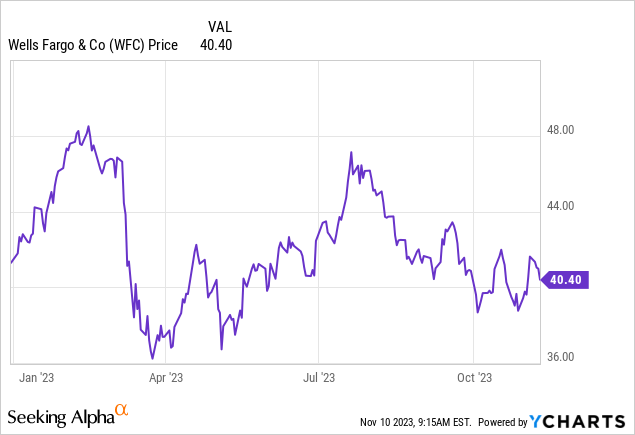

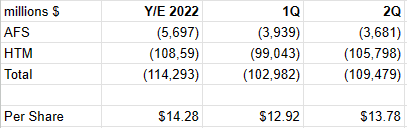

Wells Fargo (WFC)

September 30, 2023

Loss per share $18.48

Loss as percentage of current stock price 46%

AFS $137,265 million cost – $126,437 million fair value = $10,828 million loss

HTM $267,214 million cost – $216,927 million fair value = $50,287 million loss

Total unrealized loss $67,115 million

10-Q (sec.gov)

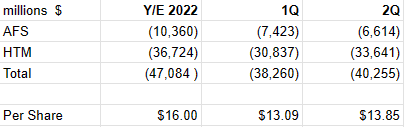

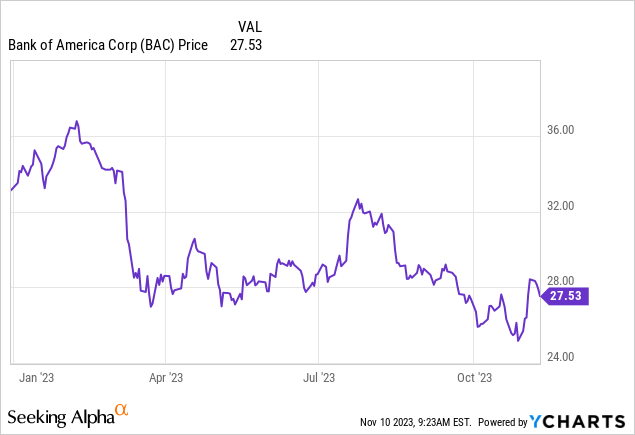

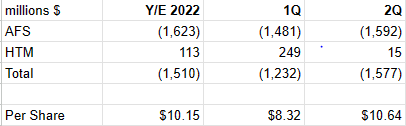

Bank of America (BAC)

September 30, 2023

Loss per share $17.20

Loss as percentage of current stock price 62%

AFS $170,125 million cost – $165,610 million fair value = $4,515 million loss

HTM $603,365 million cost – $471,761 million fair value = $131,604 million loss

Total unrealized loss $136,119 million

10-Q (sec.gov)

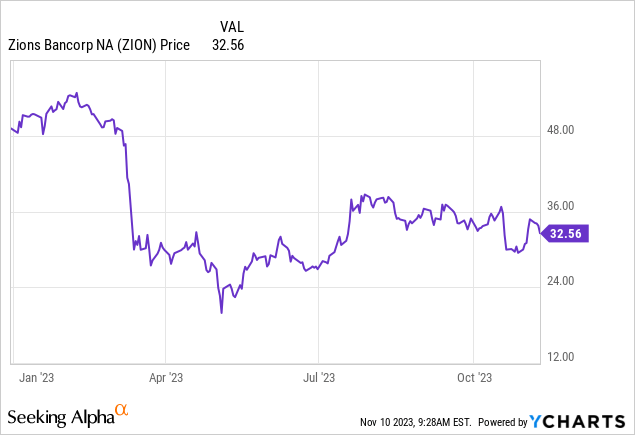

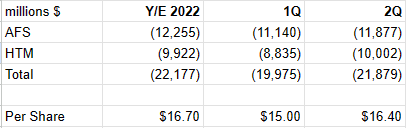

Zions Bancorporation (ZION)

September 30, 2023

Loss per share $16.48

Loss as percentage of current stock price 51%

AFS $12,078 million cost – $10,148 million fair value = $1,930 million loss

HTM $10,559 million cost – $10,049 million fair value = $510 million loss

Total unrealized loss $2,440 million

10-Q (sec.gov)

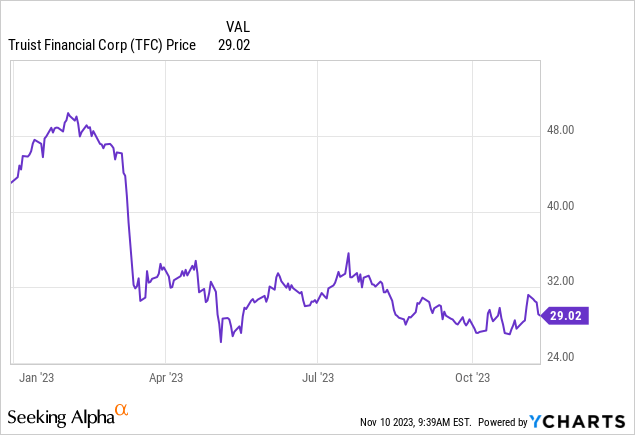

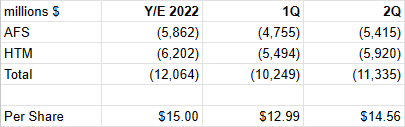

Truist Financial (TFC)

September 30, 2023

Loss per share $20.21

Loss as percentage of current stock price 70%

AFS $79,627 million cost – $65,117 million fair value = $14,517 million loss

HTM $54,942 million cost – $42,501 million fair value = $12,441 million loss

Total unrealized loss $26,958 million

10-Q (sec.gov)

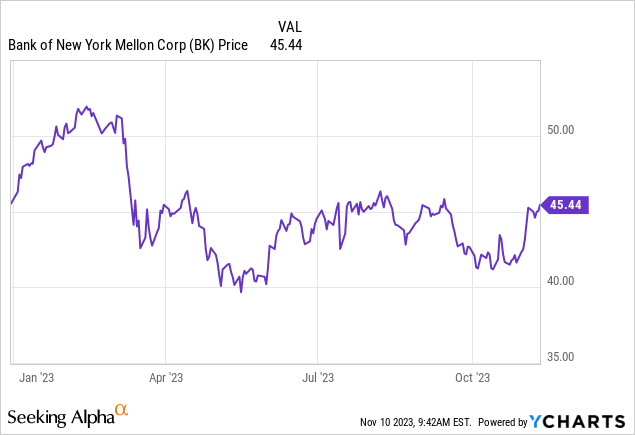

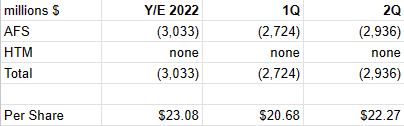

Bank of New York Mellon (BK)

September 30, 2023

Loss per share $16.45

Loss as percentage of current stock price 36%

AFS $83,074 million cost – $77,218 million fair value = $5,856 million loss

HTM $51,007 million cost – $44,211 million fair value = $6,796 million loss

Total unrealized loss $12,652 million

10-Q (sec.gov)

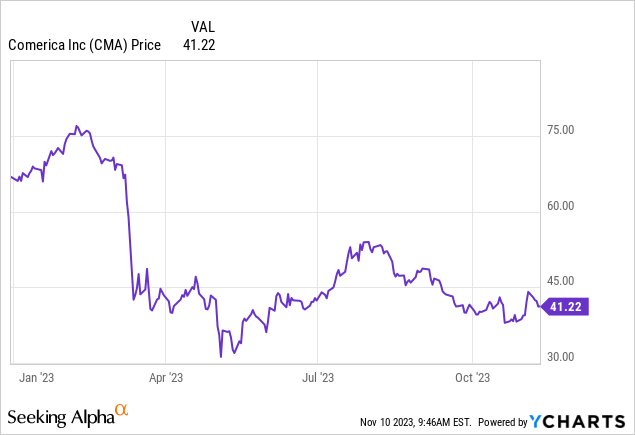

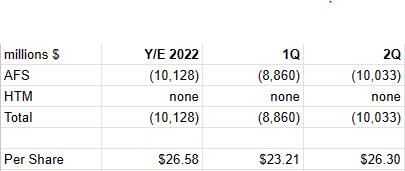

Comerica (CMA)

September 30, 2023

Loss per share $27.64

Loss as percentage of current stock price 67%

AFS $19,969 million cost – $16,323 million fair value = $3,646 million loss

HTM None

Total unrealized loss $3,646 million

10-Q (sec.gov)

Capital One Financial Group (COF)

September 30, 2023

Loss per share $33.64

Loss as percentage of current stock price 32%

AFS $87,650 million cost – $74,837 million fair value = $12,813 million loss

HTM none

Total unrealized loss $12,813 million

10-Q (sec.gov)

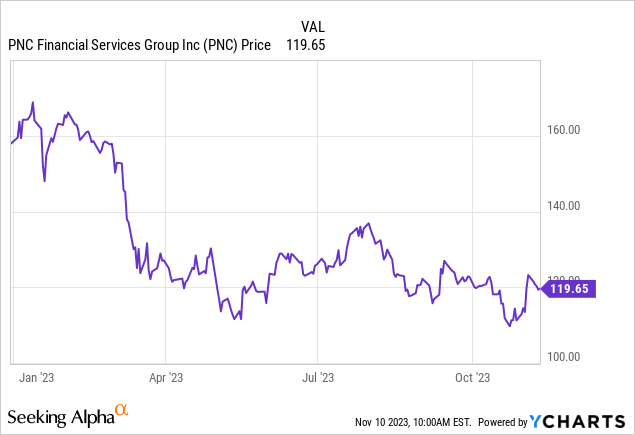

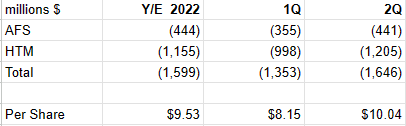

PNC Financial Services Group (PNC)

September 30, 2023

Loss per share $32.01

Loss as percentage of current stock price 27%

AFS $45,990 million cost – $40,590 million fair value = $5,400 million loss

HTM $91,797 million cost – $84,447 million fair value = $7,350 million loss

Total unrealized loss $12,750 million

10-Q (sec.gov)

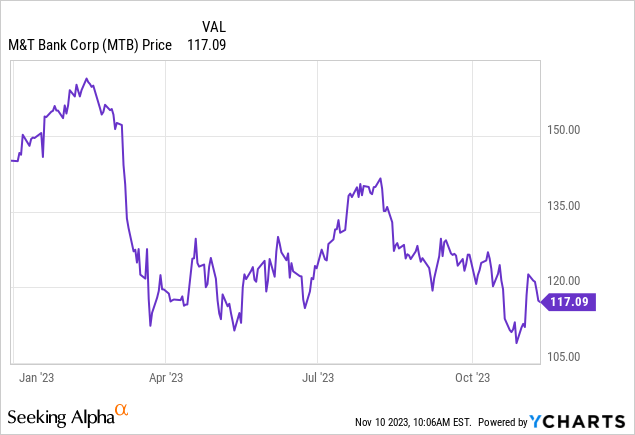

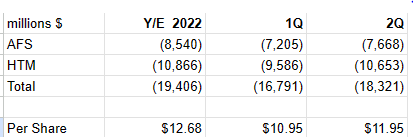

M&T Bank Corp. (MTB)

September 30, 2023

Loss per share $21.89

Loss as percentage of current stock price 19%

AFS $11,039 million cost – $10,592 million fair value = $437 million loss

HTM $15,571 million cost – $12,375 million fair value = $3,196 million loss

Total unrealized loss $3,633 million

10-Q (sec.gov)

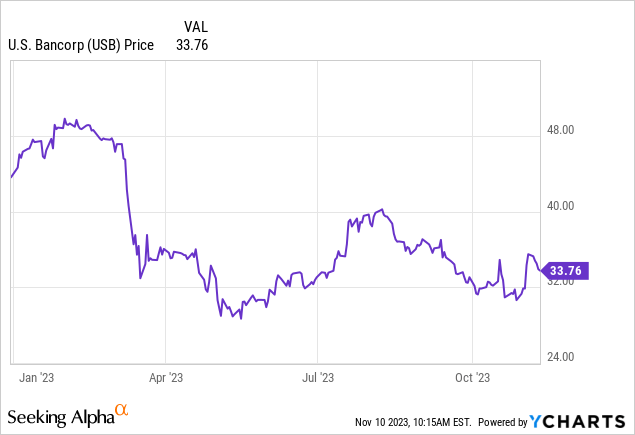

U.S. Bancorp (USB)

September 30, 2023

Loss per share $15.82

Loss as percentage of current stock price 47%

AFS $76,850 million cost – $67,207 million fair value = $9,643 million loss

HTM $85,342 million cost – $70,359 million fair value = $14,983 million loss

Total unrealized loss $24,626 million

10-Q (sec.gov)

Conclusion

Interest rates are currently at about the same level as the end of 3Q after dropping from two weeks ago. It is debatable if rates have already peaked, which would mean that the unrealized losses on securities have also peaked. The next major issue could be massive losses on commercial real estate loans. The combination of continued very large losses on unrealized losses on securities and these developing massive losses on loans could put some banks in very serious trouble. Some of these banks already have balance sheet issues from these unrealized losses on securities, which got much worse in 3Q.

The numbers in the report should be used only as part of a trader’s decision to invest in a specific bank. If one thinks that long-term interest rates are headed sharply lower, some of the banks with the largest losses might be worth a second look because the losses would be reduced as rates decline. I, however, feel that rates will remain relatively high and that there could be some serious troubles in the near future with commercial real estate loans. Combined with the potential for stricter capital requirements, bank stocks may remain in the doldrums for some time.

Read the full article here

Leave a Reply