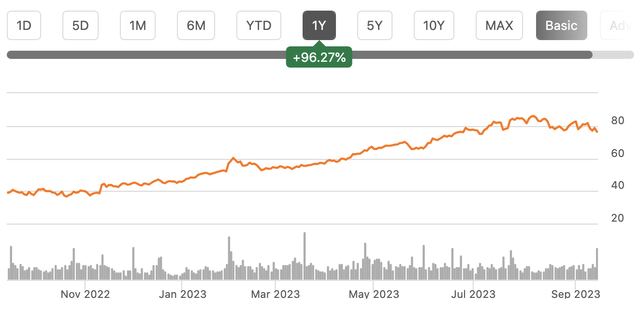

Shares of PulteGroup (NYSE:PHM) have been a very strong performer over the past year, nearly doubling. This has happened even as mortgages rates have risen dramatically, causing some cooling in the housing market and concerns of an even deeper downturn. Pulte has been a standout, actually growing its business over the past year. With its strong balance sheet and capital returns, I view shares as still attractive, particularly given my view the housing market is likely to remain firm.

Seeking Alpha

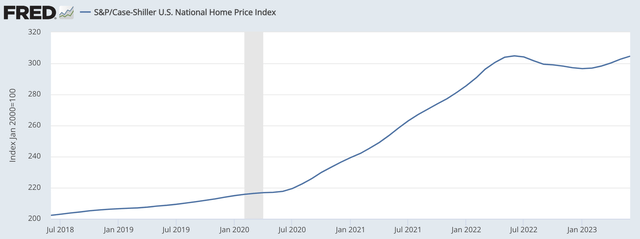

In the company’s second quarter, it generated adjusted EPS of $3.00, $0.50 ahead of consensus, and 9% higher than a year ago. Revenue rose 8% due to 5% more closings and a 3% higher sales price of $540k. Home prices were down slightly year over year, according to the Case-Shiller index, so this was a strong outcome. In particular, management noted that the pricing environment for spec homes improved sequentially. While slightly lower than a year ago, we have seen national home prices rise in recent months, a positive sign. I will discuss the macro environment in more depth below.

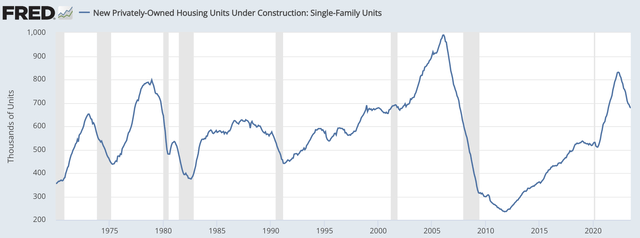

St. Louis Federal Reserve

As the market has cooled a bit, gross margins declined 170bp from last year to 29.6%, but they were up 50bp sequentially due to the improved pricing noted earlier. Bottlenecks around supply chains and construction times have been improving, and this relief on cost pressure should help to maintain margins around current levels.

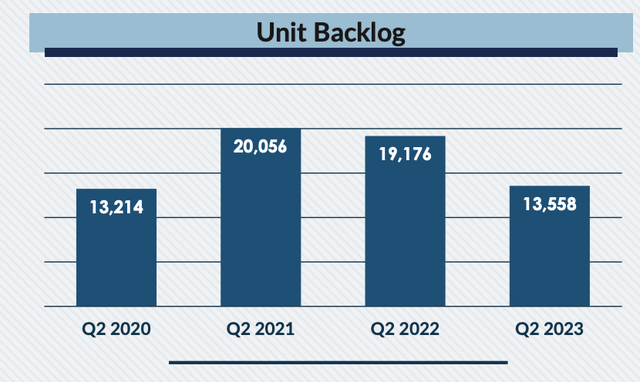

Closings of 7,518 were up from last year as it has been easier to complete homes on schedule. That said, I do expect to see closings slow over the next year. PHM has been eating into its backlog of signed but not completed houses over the past year to maintain the current rate of construction. Its backlog is down by nearly 30% over the past year to 13,558 units. I would note this is still a historically solid level, covering nearly 6 months of completions—it is not however as strong as levels seen in 2021 and 2022 when builders simply could not keep up with demand.

Fortunately, during the quarter, net new orders were 7,947, or about 400 units higher than closings, suggesting the pace of backlog decline seen below should begin to moderate. During last summer and over the winter as rates surged, we saw prospective homebuyers take a step back, likely shocked at how much mortgage payments would be. This caused new orders to slow, and so Pulte began delivering on its backlog.

Pulte

The backlog essentially did exactly what it was supposed to do—allow the company to continue operating and posting strong results even as buyers took a pause. It functions to some degree as a “shock absorber” for Pulte. It is encouraging to see orders exceed closings during the quarter, as a sign that this process is finishing. That said, one quarter does not make a trend. While I do expect to see orders prove to be resilient, my central case is for deliveries to slow modestly over the next year as management will not want to see the backlog continue to draw down at the same pace.

Just as the backlog provides stability to the business, Pulte has a fortress balance sheet that will enable the company to weather downturns well. Debt to capital is just 17.3%, a 140bp improvement this year, and a very strong level. It also has $1.8 billion of cash on hand, up $700 million year to date, even as it has returned $472 million to shareholders via dividends and buybacks. This strong balance sheet gives the company significant flexibility to not only ride-out downturns but buy land from distressed sellers, should opportunities arise. It also can continue to aggressively return capital, something it has done well. Indeed over the past decade, it has reduced its share count by over 40% thanks to this buyback program. Share count reduction of this magnitude can help EPS grow much faster than net income. With shares near an all-time high, these repurchases were done at prices well below the current share price on average.

Seeking Alpha

Ultimately, Pulte has navigated through this period of dramatically higher rates quite well. It has a pristine balance sheet, solid buyback, and it has actually grown earnings, thanks to management of its backlog. This combination has helped propel its stock to new highs. With margins and pricing stabilizing but closings likely to fall low single-digits as it stabilizes the backlog, this is a company with $11.50-$12.00 in earnings power, for just a 6.5x earnings multiple, indicating market concerns that earnings will not be sustained at this level for long.

Now, this was also the concern last year when shares similarly had a single-digit P/E, but even after one of the fastest rate hike cycles in history, earnings have held in. The US housing market has proven to be quite durable, and even with rates at these levels, I expect that to stay the case. As shown in the chart above, home prices have begun to tick back up in recent months as buyers normalize expectations for the current rate environment. Given the first 500bp of rate hikes did not kill the housing market, one does have to question why the market would roll over the next year or two?

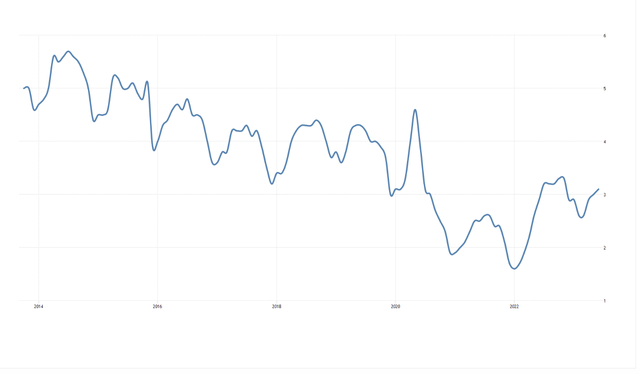

Now, I am not dismissing the challenges higher rates cause. On a $300,000 30-year mortgage at 3%, the monthly payment is about $1,265. At 7%, it is $1,995. That extra $9,000 per year certainly has pushed some buyers out of the market, but it also has reduced supply. If you own your home with a low-rate mortgage, unless you absolutely have to move, you are likely to stay put rather than move and face that higher mortgage payment. Higher rates do not just impact demand—they also impact supply. Months’ supply of homes for sale remains well below normal levels, and that lack of supply helps to support prices.

Trading Economics

As seen by how Pulte manages its balance sheet, the homebuilders are cautious with management deeply scarred by the depths of the 2008 downturn. As such when rates began rising, we saw a meaningful pullback in new home construction, in case buying demand really did dry up for a prolonged period. Combined with the lack of existing homes for sale, declining new home activity is exacerbating the supply shortage and supporting pricing.

St. Louis Federal Reserve

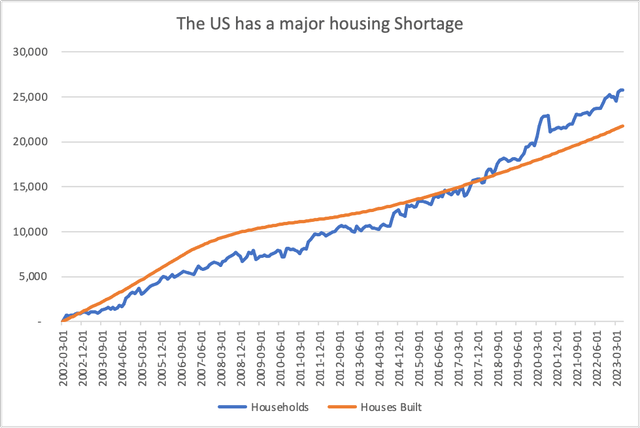

Ironically, this comes at a time when the US housing market is deeply and structurally under-supplied. By my estimates, using Census data, we have created 4 million more households than housing units over the past 20 years as construction entered a deep downturn following the financial crisis. This shortage comes as millennials are entering their 30s, the prime time to buy a first home.

Census Bureau, My Own Calculations

With construction activity subdued, it will take years to bring the market into balance. This in my view is why housing demand and home prices have held in so well. The pool of potential buyers is just structurally larger than the stock of available housing. While rate spikes can cause buyers to pause, hoping for a reversion, at some point life events necessity making a purchase or move.

Selling into an under-supplied market is a strong position to be in, as it means you maintain strong pricing power over time. We as investors want to find companies that operate in markets like that, which is why I am bullish on the homebuilders. I see Pulte as particularly strong given its balance sheet and adept management. Its ability to continue to reduce the share count aggressively also means that even if earnings are peaking, EPS can continue to rise over time. In fact, the low multiple means it can buy back more shares, making the program even more accretive over time.

A year from now, I expect we will have a similar story to the past year. Earnings prove more resilient than expected, the balance sheet is even stronger, and share count is lower. At less than 7x earnings, that means we are once again likely to see meaningful share price upside. As markets increasingly realize the secular tailwind of the US housing market being under-supplied, I think shares could conservatively reach even a 10x multiple, for a $115-$120 share price, pointing to another 50% of upside. Investors should buy Pulte.

Read the full article here

Leave a Reply