Investors are confronted with plenty of choice these days, and that’s not a bad problem to have. For one thing, U.S. Treasury bonds are now yielding between 4.5% to 5%, giving savers a much more meaningful yield than what they had been accustomed in the prior 15 years.

However, plenty of excellent dividend payers have yielded higher, too, due to the recent downturn in REITs, and for those who prize durable income with potential for growth, that may be a better option.

This brings me to Public Storage (NYSE:PSA), which I last covered here with a ‘Buy’ rating, noting its high profitability compared to smaller peers and impressive NOI growth. PSA hasn’t been immune to investor jitters around higher interest rates, as its share price has ticked down by 9.2% since my last piece, underperforming the 3.5% decline in the S&P 500 (SPY) over the same timeframe.

In this piece, I revisit the stock and discuss why value and income investors ought to pick this stock for its high quality attributes while it’s trading solidly in the bottom half of its 52-week price range, so let’s get started!

PSA Stock (Seeking Alpha)

Why PSA?

Public Storage is the second largest self-storage REIT on the market today, after peer Extra Space Storage (EXR) acquired Life Storage to become the #1 player in terms of asset size. PSA is also one of the oldest REITs around, having been in operation for 51 years.

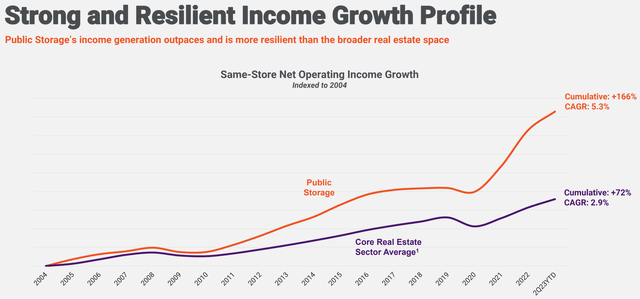

At present, it owns 3,266 properties, just behind EXR’s 3,500+ locations, across 40 U.S. states serving 1.9 million customers. Notably, it’s expanded its portfolio by one-third since 2019 through $10.7 billion worth of acquisitions over the past 4 years. Importantly, PSA has been able to grow in a highly accretive manner due to its efficient scale and balance sheet strength. This is reflected by PSA’s industry leading same-store NOI growth over the past 2 decades with a 5.3% CAGR, sitting above the 2.9% CAGR for the sector average, as shown below.

Investor Presentation

As with other industries, size also matters in the self-storage space. In the case of PSA, it’s able to spread corporate overhead over a wider asset base, resulting higher profitability. This is reflected by PSA’s operating margin (with depreciation addback) of 72.5% over the trailing 12 months, comparing favorably to that of the smaller peer, CubeSmart (CUBE), which carries a 66.4% op margin over the same time period.

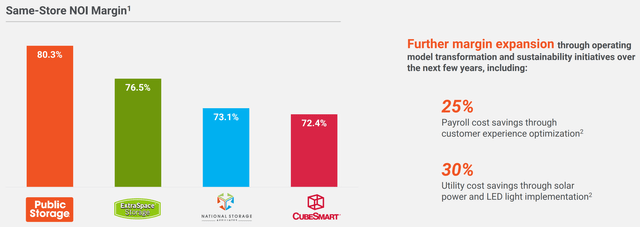

Importantly in this inflationary environment, PSA has demonstrated positive operating leverage, as demonstrated by 80.3% same store direct net operating income margin during the second quarter. This marks a 140 basis point improvement since Q1, and 180 bps improvement since the end of last year. This contributed to a very healthy 6.2% rise in SS NOI and 7.3% rise in FFO/share over the prior year period. As shown below, PSA leads its peers in SS NOI margin.

Investor Presentation

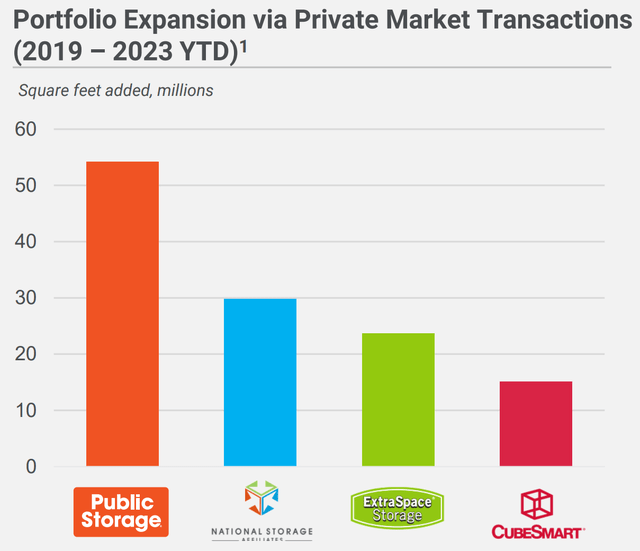

Those who follow the self-storage industry may know that this sector has gotten more competitive over the years, as much of the low-hanging acquisition fruit has been picked off. That’s where PSA has an advantage through its proprietary big data and analytics platform to scope out opportunities and lease-up opportunities, the latter of which is the bread and butter of internal valuation creation for REITs. As shown below, PSA has led its peers in terms of private market transactions over the past 4 years, adding 54 million square feet of rentable space.

Investor Presentation

The latest material acquisition is Simply Self Storage for $2.2 billion, which PSA announced a couple months ago. Management expects this acquisition to be accretive with a 6.5% nominal yield on investment by year 3.

This is also supported by PSA’s industry-leading balance sheet as the only player in the self-storage sector with a A2/A credit ratings from Moody’s and S&P. PSA’s net debt + Preferred Equity to EBITDA ratio stands at a low 3.9x, and its cost of debt and preferred equity stands at 3.4%, making acquisitions such as the one above accretive to the bottom line.

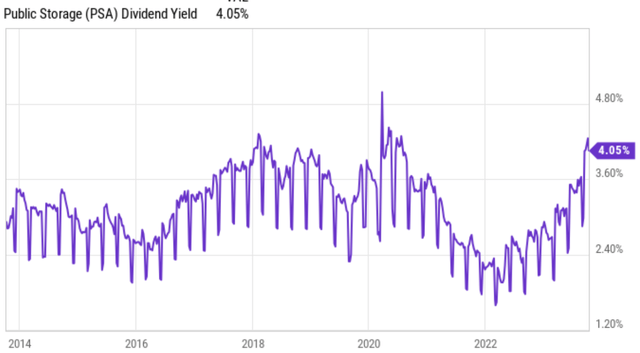

Meanwhile, PSA pays an attractive 4.4% dividend yield that’s well-covered by a 72% payout ratio, and comes with a 6.6% 5-year CAGR. PSA’s yield also sits at the highest point over the past decade, outside of the spike in early 2020 during the pandemic.

(Note: The following table shows TTM dividend yield. Forward yield is 4.4%)

YCharts

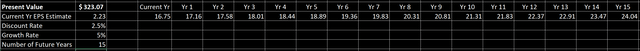

Lastly, I see solid value in PSA at the current price of $271.49 with a forward P/FFO of 16.8, sitting below its normal P/FFO of 20.3. Based on my valuation analysis, I arrive at a fair value of $323. This is based on current year FFO/share of $16.75, a modest long-term growth rate of 5% and a conservative 2.5% discount rate, which is slightly higher than the long-term inflation target of 2%.

NPV Analysis (Produced by Author)

Risks to the thesis include materially higher interest rates, which create yield competition for investment dollars and could therefore drive PSA’s price down. In addition, the economy could have a hard landing due to higher rates, which could impact even self-storage REITs, which are more recession-resilient than other REIT segments. Lastly, higher competition for acquisitions could drive down investment yields.

Investor Takeaway

While there’s no shortage of REIT opportunities in today’s market, PSA stands out with its high profitability driven by scale, healthy NOI growth, and substantial shareholder wealth creation through internal and external value creation. Meanwhile, it pays an attractive 4.4% dividend yield that unlike a Treasury bond, is likely to grow over time with the support of its strong balance sheet. As such, investors seeking a meaningful yield and strong long-term growth potential may want to consider PSA at present. Reiterate ‘Buy’ rating.

Read the full article here

Leave a Reply