Shares of Prudential Financial (NYSE:PRU) have rebounded from their March lows but have spent the past few months stuck between $90 and $100. Last October, I argued Prudential shares were a “hold,” offering limited upside but a secure dividend, and in fact, shares have been flat since that recommendation. With a year having passed and the company taking action to reduce its exposure to market volatility, I view now as an opportune time to re-evaluate PRU’s prospects.

Seeking Alpha

In the company’s second quarter, Prudential reported adjusted operating income of $2.94, up from $2.34 last year. That excludes an after-tax $329 million charge due to revised assumptions. Each year, insurance companies revise actuarial assumptions underlying their outstanding policies, which can shift profitability. After all, when you sell an insurance policy to a 40-year-old, you will not know exactly how profitable that policy is until he or she passes away, which could be, 30, 40, 50 years from now.

Based on the assumed remaining lifespan of policyholders (among other long-term assumptions), some profit or loss is booked each year on each policy. Then, as it sees actual data on how its policies are performing, these assumptions are fine-tuned. Sometimes, these changes can be dramatic, and other times not as much. For a company of Prudential’s size, this was a fairly minor assumptions update, but still a modest negative. I note this up-front as one-time costs are something that has weighed on shares and will be discussed further.

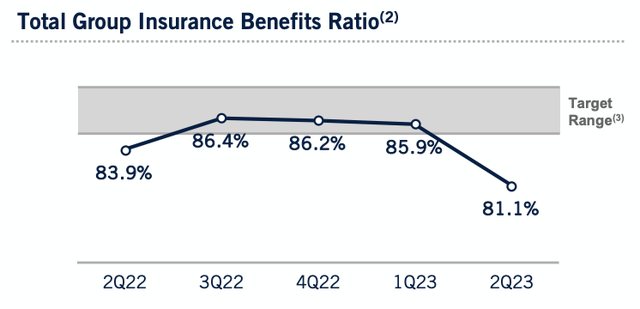

Looking first though at core operations, results have been pretty solid. Its US insurance operation saw income rise to $956 million from $573 million, aided by improved spread income. Fixed annuities are now up to 33% of individual sales, amid strong overall retirement sales. Higher interest rates have increased the appeal of fixed annuities. Fixed annuities, by offering a fixed payout tied to today’s prevailing interest rates, rather than variable annuities, which are tied to future market performance, are less sensitive to the performance of the market. This makes them easier for insurance companies to manage and hedge against, meaning their profitability should be more predictable. This increased sales-share is consistent with PRU’s strategy. PRU also saw strong underwriting results last quarter, with a payout ratio well below its 85+% target. This aided quarterly profit, but I would be cautious to assume this rate persists until we see several more quarters.

Prudential

Thanks to strength in EM, international income rose over 10% to $784 million. Its international business also includes a large business from Japan, which continues to perform solidly. The Bank of Japan slowly backing away from yield curve control may also help support increased investment income and retirement sales over time.

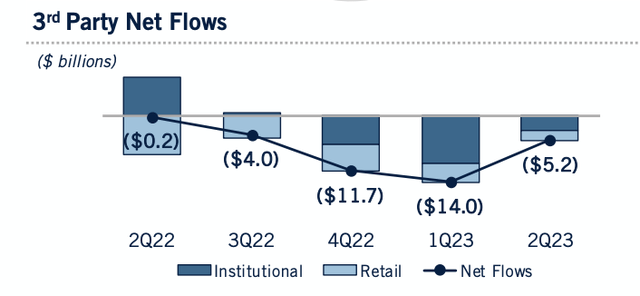

Finally, Prudential manages third-party assets through its investment manager, PGIM. In the quarter, PGIM saw net income of $179 million from $206 million last, even as assets were up 1%, due to fee pressure and a mix-shift away from equities. This is the one part of the recurring business seeing headwinds. Like many asset managers, PGIM has seen outflows out of equities and a shift to passive funds, but management expects a return to positive flows over time.

It is important to note that 71% of funds are outperforming over the past three years; 95% over the past decade. I would be more concerned about outflows if most funds were underperforming, as its investors would likely be seeking out other managers. Instead, this looks to be less of a “PGIM” issue and more of a macro asset allocation shift which has weighed on PGIM. Notably, we did see flows improve in Q2 from the previous two quarters. While fee pressure is likely to persist, PGIM remains a strong franchise.

Prudential

PRU, through the premiums it collects from policyholders, has a $368 billion investment portfolio. Investment yields, ex-Japan, up 60bp from last year to 4.69%, which is in keeping with the rise in interest rates we have seen. Note though that the policies it sells at a given point in time are priced based on the prevailing rate environment (i.e., a fixed annuity sold when rates are 4% has a higher monthly payment, all else equal, than one sold when rates were 2.5%), so the fair value of its liabilities also move in sync with interest rates. As such, little of this 60bp increase feeds down to the bottom line.

I would flag as a risk that $50 billion is invested in commercial mortgages – that is 13% of its portfolio. However, just 2% of its total portfolio is in office-the most challenged sector. Multifamily and industrial are its biggest components, which are healthier. 75% of its office exposure is “Class A,” and just $2 billion of its mortgage portfolio has a loan to value above 70%. While commercial real estate is clearly challenged, PRU appears to have a conservative positioning in the sector, which should limit losses.

Alongside these results, the parent company (the entity that pays dividends and makes buybacks) has $4.5 billion of liquidity – at the high-end of its $3-5 billion target. In addition to its ~5% dividend yield, PRU did $463 million of repurchases last quarter. Accordingly, the share count is down 3% over the past year.

Risk-based capital was about 375%, which is lower than the 400+% last year, but there are 26% of pending actions, due to regulatory changes on accounting of unrealized interest rate-related losses. Adjusting for this, capital is essentially flat at just over 400%, a solid level, which will enable continued dividends up to the parent, through which capital can be returned to shareholders.

While ongoing results have been solid and Prudential has a strong balance sheet, it has been plagued by one-time costs, like the assumptions update last quarter. In the third quarter of last year, Prudential reported a loss, in part due to negative revisions in market experience assumptions, impairments, and losses in discontinued operations. In the fourth quarter of last year, it was forced to take a $713 million impairment, leading to a loss. I note this because when it reported Q2 2022 earnings last year, it reported adjusted book value of $104.19. Due to revisions and subsequent activity, Q2 2022 book value is now reported at $97.91.

So while today’s book value of $97.38 is essentially unchanged year over year, it is about 6% lower than an investor last year thought PRU’s book value was. Because of the long-term nature of annuities and life insurance policies, the wisdom of today’s underwriting decision is not really known for many years, and the value of its liabilities and its book value are really just the very best estimates. This is the case for all insurance companies, but it is more pronounced in the life sector, as their policies last the longest. A reason shares of PRU have struggled to move above book value, in my view, is the risk investors see of continued one-time items and adjustments.

Recognizing this, management has taken action. As noted above, it is shifting towards fixed annuities, which are simpler to manage with more predictable profits as their payouts are not tied to future market performance. Further, in September, it announced a plan with Warburg Pincus to launch a reinsurer to take on $10 billion of its annuity contracts to free up reserves. The entity will have $1 billion in capital, with PRU contributing $200 million for a 20% stake. This will remove some of the most market-sensitive liabilities off of its balance sheet with the support of $800 million in external capital.

Of course, the reinsurer is not taking on this risk for free. This transaction will reduce earnings by $55 million annually but release $650 million in capital ($200 million of which is invested in the new entity). On the net $450 million of capital that can be distributed to shareholders via buybacks and dividends, PRU is essentially transacting at an ~8x multiple, essentially in line with where shares trade. Considering this is among its less favorable liabilities to get the same multiple as the overall shares are trading, it is a good valuation in my view.

Now, a $10 billion transaction for an insurance company with several hundred billion in liabilities does not entirely transform the company, but it is a solid step and in-keeping with management’s strategy. Indeed, again given the long-term nature of the life business, pivots take time and are incremental. Prudential in my view remains a “show-me” story, but management is starting to execute on this path.

Assuming some normalization in group insurance payouts and variable investment income, PRU should continue to generate about $2.75-$3 in core earnings, or $11.50-$12 over the next year, giving shares a ~8x earnings multiple. That does at first appear quite cheap. However, I would note some of these earnings do remain in the insurance company operating entities as capital to support policies. PRU targets 65% free cash flow conversion.

This means it has “distributable” earnings of $7.50-$8. That provides healthy coverage of its $5 dividend, and leaves room for a buyback that can reduce share count by about 2.5-3% annually. Over the next year, we will likely see buybacks a bit higher than that, as the parent company can work down liquidity, which sits toward the high end of the target.

Ultimately, with a ~8% sustained payout ratio and trading around book value, shares continue to look fairly valued to me. The Warburg Pincus transaction is encouraging, but we will need to see several clean quarters to be sure further book value attrition is not coming. Investors can continue to hold PRU to enjoy solid and secure dividend income but should expect shares to remain within ~5% of book value as fair value.

Read the full article here

Leave a Reply