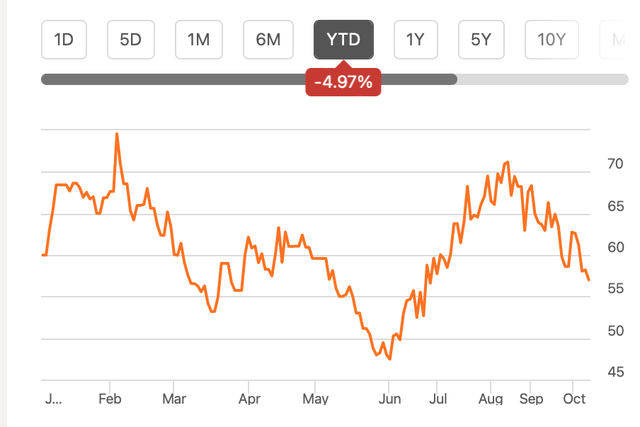

The stock for consumer goods giant Procter & Gamble (NYSE:PG) hasn’t had much of a year, with a 6.5% decline in share price year-to-date. The decline has been an even sharper 8.2% since the last time I wrote about it in August.

Price Chart (Source: Seeking Alpha)

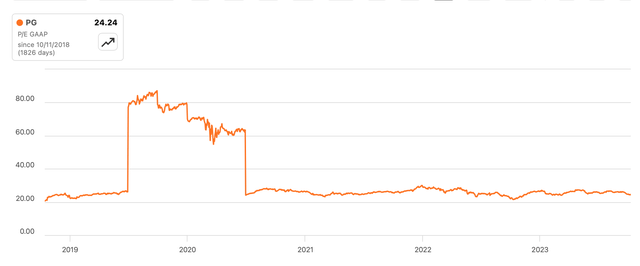

At the time, the stock already looked fairly valued with both the forward GAAP price-to-earnings (P/E) ratio and the forward non-GAAP P/E a shade higher than PG’s own five-year average. Even with a price decline, however, its forward ratios don’t look very different from a couple of months ago.

But there’s a potential price catalyst on the horizon. The company’s first quarter (Q1 FY24) earnings report is due next week. Here I explore what they could have in store and whether they could result in a share price uptick.

The story so far

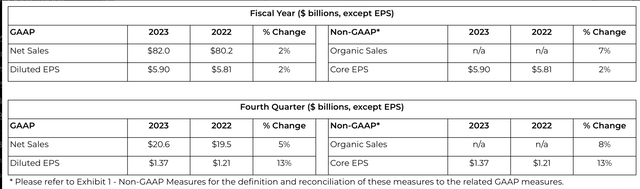

But first, a quick look back. When I last checked on PG, it was fresh from its full-year results (for its year ending June 30, 2023). There were three key takeaways from these numbers.

FY23 results

One, reported sales came in the guidance range at 2%, while organic sales growth exceeded expectations of 3-5%, growing by 7% instead. Two, margins were also largely sustained during the year, with the operating margin at 22.1% in FY23. And three, supported by sales growth and stable margins, the diluted earnings per share rose by 13% year-on-year (YoY).

Key Financials (Source: Procter & Gamble)

FY24 Outlook

PG also provided its projections for this financial year. The highlights are as follows:

- GAAP sales are expected to come in at 3%-4%, on more favorable currency trends, from the 2% seen in FY23, even as organic sales are seen slowing down to 4%-5%.

- The diluted EPS, however, is seen growing by 6%-9%, close to halving the growth rate at the mid-point of the range, from the last financial.

Projections for Q1 FY24: The bad and the good

The company’s FY24 outlook is helpful in assessing what to expect in Q1 FY24. From a stock perspective, the goal of this exercise is really to get to what PG’s TTM P/E could be after the numbers are released.

Conservative estimates

To get there, I assumed sales in the quarter grew at the midpoint of the guidance range for GAAP sales of 3.5%. Next, the net margin is conservatively assumed to stay constant at 17.52% from FY23 considering there are factors both supporting it and pulling it back.

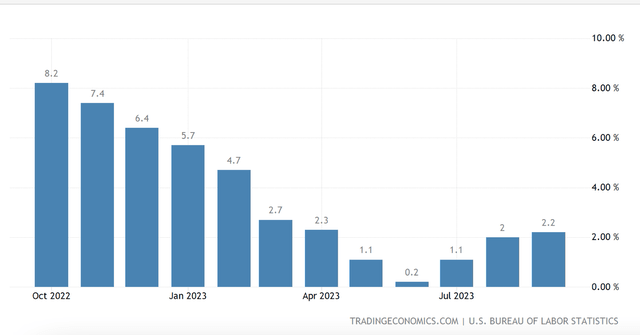

Supporting it is the likelihood of lower cost inflation, as producer prices [PPI] in its big US market have seen low inflation from a historical standpoint this year, a trend also seen in other markets. This also suggests that the pass-through of costs would be limited, though, which can cap the extent of margin rise.

US Producer Price Index, Inflation, %, YoY (Source: Trading Economics)

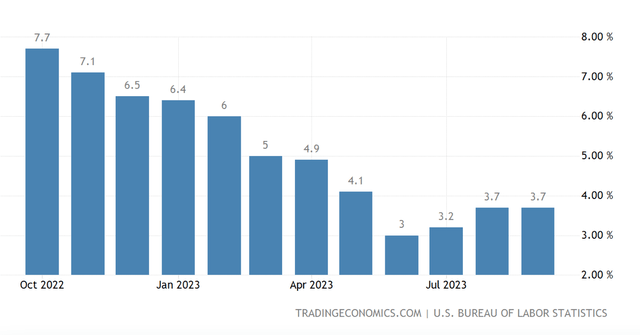

There is a possibility that the margin could rise more, going by higher consumer price inflation compared to PPI. For context, the latest CPI inflation rate is at 3.7% for September, while PPI inflation is at 2.2%. But let’s go with the conservative assumption for now.

US Consumer Price Index, Inflation, %, YoY (Source: Trading Economics)

This yields a basic EPS of USD 1.5 for the quarter. I have shaved off USD 0.025 from this to get to the diluted EPS, in keeping with the average quarterly difference seen in FY23. The diluted EPS for the quarter is estimated at USD 1.52, which is actually 3.5% below the Q1 FY23 level. This in turn gives a TTM P/E, assuming no change in price when the numbers are released, at 24.4x. This isn’t very different from the 24.2x it’s at now.

Optimistic estimates

However, my estimates are pessimistic compared to those of other analysts. The average EPS expectation of 20 analysts is USD 1.72 for the quarter, based on higher revenue expectations of 4.9%.

Not only are these numbers significantly higher than my estimates, but they actually show a 9.5% YoY rise, in contrast with the decline suggested by mine. That said, the TTM P/E to expect next week doesn’t change much at 23.6x from the current level either.

The upshot

The key takeaway from this discussion on Q1 FY24 is that no matter how we look at the upcoming earnings report, PG doesn’t look attractive as a stock. In fact, considering even the company’s own top end of the EPS range of USD 6.4 for the full year FY24 continues to indicate that it’s largely fairly valued, with a forward P/E of 22.2x, higher than the median for the consumer staples sector at 17.9x.

The slowdown risk and opportunity

The forecasts for the full year FY24 are subject to change of course, both for the better and the worse. Stock upside could come in if the long forecast slowdown actually materializes and impacts the stock markets. Here’s why.

Some consumer goods companies already have started seeing softening in markets like the US and Europe. The last time we were in an uncertain economy, during the pandemic, the stock rallied through 2020 after the initial shock. Its P/E ratio was also the highest during the year than it has been in the past five years (see chart below).

PG, Historical GAAP TTM P/E (Source: Seeking Alpha)

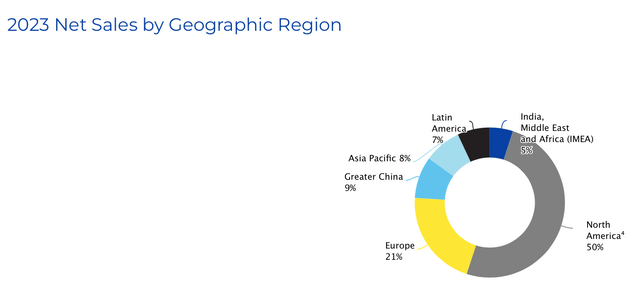

However, on the downside, its financials could be impacted. Because unlike the pandemic, with no lockdown around, this slowdown is unlikely to result in increased dependence on consumer staples. In the recession that started from the financial crisis in 2008, for instance, the company subsequently did see a correction in both revenues and net income. This is worth considering keeping in mind that North America and Europe account for over 70% of its sales.

Sales by geography (Source: Procter & Gamble)

What next?

How the future plays out remains to be seen. In the meantime, PG continues to look fairly valued. There could be small fluctuations to its share price next week, depending on whether the earnings surprise on the upside or not.

But going by its market valuations, there really appears little room for them to be a significant price catalyst. In fact, going by the trend seen since August, it appears that there’s more downside than not for it as its multiples look elevated compared to the consumer staples sector as such.

There’s no reason to sell it, considering that it’s a good defensive stock at what could be an uncertain time going forward. But there’s little reason to buy it either. I’m retaining a Hold rating on Procter & Gamble.

Read the full article here

Leave a Reply