Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of October.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

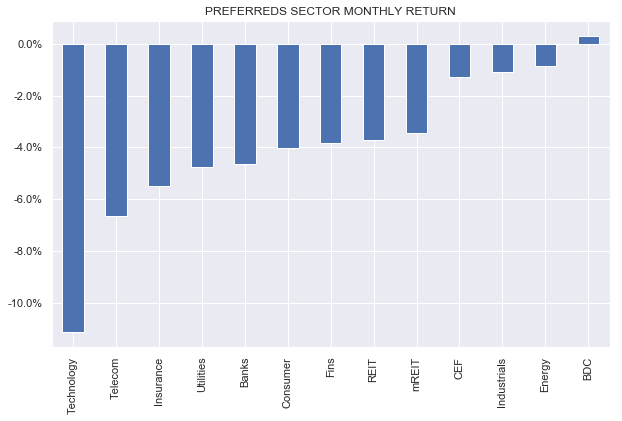

Although preferreds fell this week, largely as a result of rising Treasury yields, they performed comparatively well against higher-beta segments like REITs, BDCs and Convertibles as well as longer-duration segments like investment-grade corporate bonds and Munis.

Month-to-date, the lower-beta CEF segment, among others, has done relatively well alongside Energy preferreds which have enjoyed the rise in the oil price.

Systematic Income

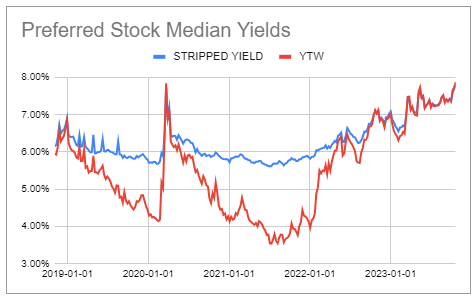

Exchange-traded preferreds yields have moved above their recent peak and towards 8% – a very attractive level for income investors.

Systematic Income Preferreds Tool

Market Themes

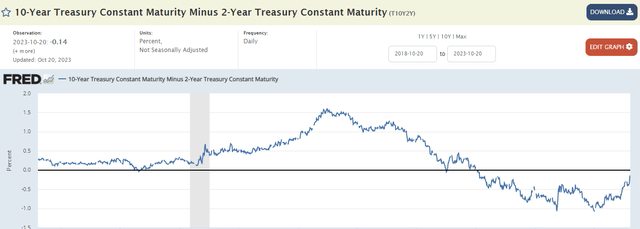

The rise in long-end rates has been pretty fast – 10Y Treasury yields have risen around 0.9% since the end of August and around 0.6% just in the last month. This has resulted in the 2s10s Treasury yield curve almost fully disinverting.

FRED

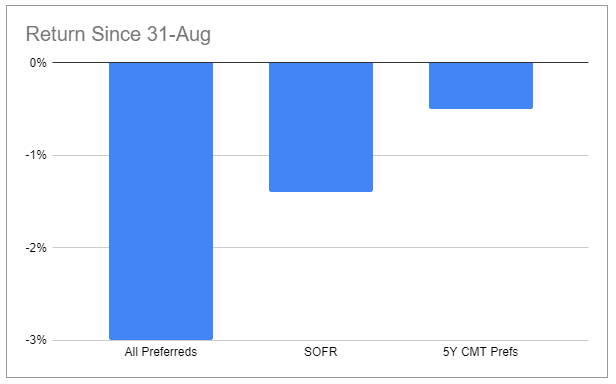

We have discussed a likely yield curve disinversion several times in our updates, though admittedly we expected this process to take longer and be, at least, accompanied by the drop in short-term rates. The outcome, however, is much the same as we thought – preferreds linked to 5Y Treasury yields (i.e. 5Y CMT) have outperformed.

We can see this in the chart below which shows the average total return of various types of preferreds since the end of August.

Systematic Income

5Y CMT-linked preferreds reset every five years to a coupon linked to the 5Y Treasury yield. This means the higher the 5Y Treasury yield and the nearer the reset date, the higher the price of the preferred should rise.

For example, the Enbridge stock EBGEF with a reset in a few months rallied 11% over the past month on the back of this yield jump. Other CMT preferreds have not reacted as strongly as their reset is further in the future.

The fact that the average CMT-linked preferreds has actually fallen offers an attractive opportunity to add to this sub-segment, particularly for investors who worry about even higher longer-term yields and/or those patient to wait for the big yield increase payoff.

The added advantage of CMT-linked preferreds is that there is no fix-for-life risk as Treasuries, unlike Libor, are not going away anytime soon.

Market Commentary

The CLO Equity CEF CCIF priced its preferred (CCIA) at a coupon of 8.75% – slightly below the yield trading range of the sector. This might be due to the brand name of the manager – Carlyle is a very well-known entity, much more so than the other CLO Equity CEF managers (Eagle Point, Oxford Square, Prospect Capital and OFS).

It’s also, arguably, because asset coverage of the new preferred will be relatively high – around 2.8x and because there is no debt ahead of the preferred. Of course, nothing prevents CCIF from issuing additional debt or new preferreds.

Overall, we would expect CCIA to open weak given you can buy CLO Equity CEF bonds at a higher yield than 8.75% (in fact 4 of the 5 bonds in the sector are trading at a yield at or above the 8.75% coupon). OXLC bonds look most attractive in the segment given their high asset coverage levels (and above those of ECC bonds) with yields in the range of 8.6-9%.

Stance And Takeaways

As highlighted above, we continue to see value in 5Y CMT-linked preferreds with current holdings of both AGNCL and SPNT.PR.B in our Income Portfolios. This week we topped up our AGNCL allocation and added additional CMT preferred holdings. In a sense, these preferreds have negative duration as they stand to benefit from a rise in longer-term yields, unlike short-term anchored preferreds and particularly fixed-rate preferreds. These make them attractive diversified in income portfolios which are typically highly sensitive to rising yields.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply